Discover the Power Behind Accrued Interest Payments: Why Do | Pay?

Accrued interest is paid to compensate the lender for the use of their money over a set period of time. When a borrower takes out a loan or uses credit, they agree to pay interest charges as a cost of borrowing money.

In the finance world, interest payments play a significant role. When a borrower takes out a loan or uses credit, they agree to pay interest charges as compensation for the lender’s money usage over a specific period. The concept of accrued interest is closely related to lending and borrowing, as it represents the financial return the lender earns for their assets being utilized by the borrower.

Accrued interest payments allow borrowers to compensate lenders for the privilege of using their funds and provide an incentive for lenders to lend money, as they will earn additional income through interest charges. Understanding why accrued interest payments are essential helps highlight the mechanics of borrowing and lending in the financial system.

The Basics Of Accrued Interest

Paying accrued interest is essential to compensate the lender for the use of their money over time. It reflects the borrower’s obligation to cover the increase in the loan’s value over time, ensuring fair compensation for the lender. Understanding accrued interest is crucial for managing financial obligations effectively.

What Is Accrued Interest?

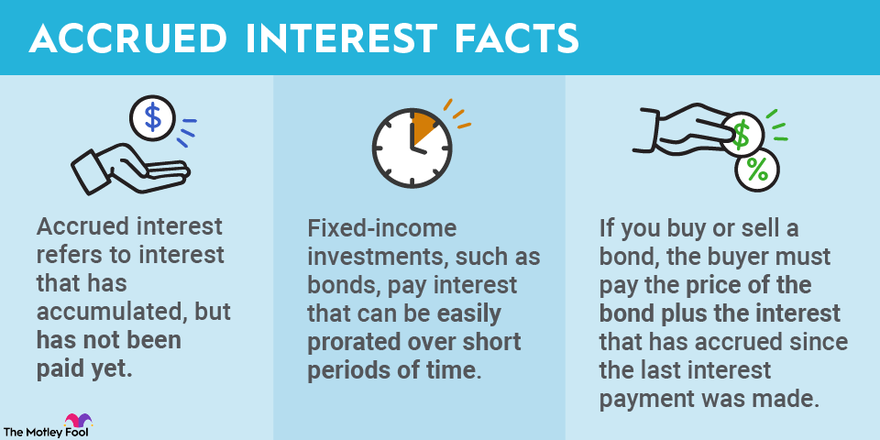

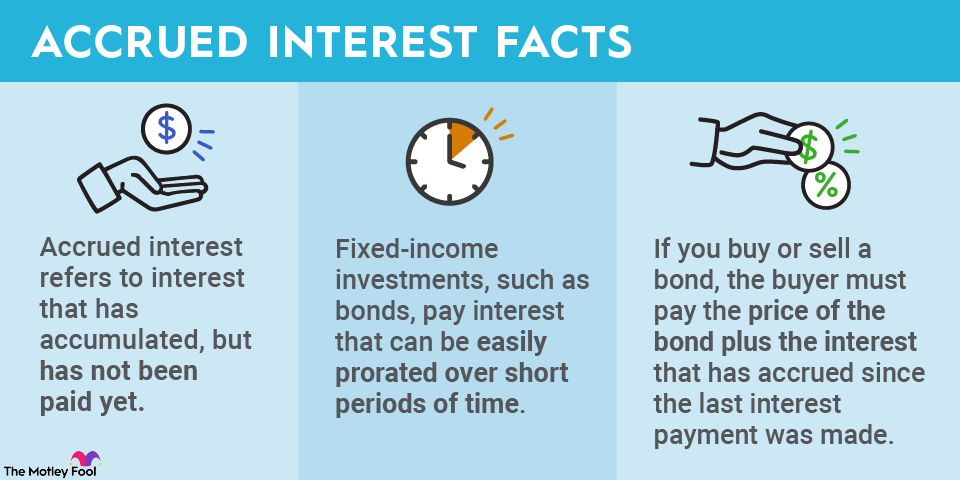

Accrued interest refers to the interest that has been earned but not yet paid or received. When you invest in certain financial instruments such as bonds or loans, you are often entitled to receive periodic interest payments. However, these payments are not always made on a monthly or quarterly basis. Sometimes, the interest payments are accrued, which means that they accumulate over time until they are eventually paid out. Accrued interest is a crucial concept to understand because it can have significant implications for investors and borrowers alike.

How Is Accrued Interest Calculated?

Calculating accrued interest may seem complicated at first, but it can be broken down into a straightforward formula. The formula for calculating accrued interest depends on several factors:

- The principal amount: This is the initial amount of money that was invested or borrowed.

- The interest rate: This is the rate at which the investment or loan accrues interest.

- The time period: This is the duration for which interest has been accruing.

To calculate accrued interest, the following formula is typically used:

Accrued Interest = Principal Amount Interest Rate (Time Period / Total Accrual Period)This formula takes into account the principal amount, the interest rate, and the time period for which interest has been accruing. It divides the time period by the total accrual period to calculate the proportion of interest earned.

For example, let’s say you invest $1,000 in a bond with an annual interest rate of 5%. After six months, you decide to sell the bond. To calculate the accrued interest, you would use the following formula:

Accrued Interest = $1,000 0.05 (6/12) = $25In this example, the accrued interest amounts to $25, which means that you are entitled to an additional $25 on top of your initial investment when you sell the bond.

Understanding how accrued interest is calculated is crucial for investors and borrowers. By knowing how to calculate accrued interest, you can make informed decisions and have a clear understanding of your financial obligations.

Credit: www.synchronybank.com

Significance Of Accrued Interest Payments

Accrued interest payments are an important aspect of any loan or investment. They play a significant role in the financial world, impacting both the borrowers and the lenders. Understanding why these payments matter is essential for anyone involved in borrowing or lending money.

Why Accrued Interest Payments Matter

Accrued interest payments matter because they reflect the cost of borrowing money over time. When a loan or investment earns interest but is not paid immediately, the interest continues to accrue until it is paid in full. This has several implications for both the borrower and the lender.

Impact On Borrowers And Lenders

The impact of accrued interest payments varies for borrowers and lenders. Let’s take a closer look:

Borrowers:

- Accrued interest payments increase the overall cost of borrowing. As interest continues to accrue, the borrower ends up paying more than the initial loan amount.

- Borrowers may face difficulty in making timely payments if they do not account for accrued interest. Neglecting accrued interest can lead to an unexpected financial burden.

- Accrued interest affects creditworthiness. Failing to fulfill accrued interest payments can negatively impact a borrower’s credit score.

Lenders:

- Accrued interest payments are a crucial source of income for lenders. They rely on these payments to generate profits and maintain their business operations.

- The timely receipt of accrued interest payments allows lenders to manage their cash flow effectively and meet their own financial obligations.

- Accrued interest payments provide lenders with a return on their investment or loan. They compensate lenders for the time value of money and the risk associated with lending.

Understanding Accrued Interest In Different Financial Instruments

Accrued interest is a concept relevant to various financial instruments, such as bonds and loans. It represents the accumulation of interest on an investment over time, even if the interest payment hasn’t been made. Each financial instrument handles accrued interest differently, impacting investors and borrowers significantly.

Bonds And Accrued Interest

When investing in bonds, understanding accrued interest is crucial. Bonds accrue interest between coupon payments, and this accrued interest contributes to the bond’s overall value. Investors must take into account the accrued interest when buying or selling bonds, as it adds to the total cost or earnings from the investment.

Loans And Accrued Interest

For borrowers, accrued interest plays a significant role in loan repayment. Loans accumulate interest that is not immediately paid off with each installment. The accrued interest contributes to the total amount owed, affecting the overall cost of the loan. Borrowers must comprehend how accrued interest impacts their repayment schedule and the total amount to be repaid.

:max_bytes(150000):strip_icc()/compoundinterest_final-5c67da5662ba458f8d9d229ab4ca4292.png)

Credit: www.investopedia.com

Challenges And Benefits Of Accrued Interest Payments

Accrued interest payments present both challenges and benefits. While they can be a financial burden for borrowers, they offer the opportunity to earn additional income for lenders. Understanding the reasons behind paying accrued interest is vital for maintaining a balanced financial system.

Challenges In Managing Accrued Interest

Benefits Of Accrued Interest For Investors

Challenges In Managing Accrued Interest

Managing accrued interest can pose several challenges, especially for investors who hold a diverse portfolio of financial instruments. One of the primary challenges is staying on top of the varying interest rates across different investments. Investors need to closely monitor these rates to ensure accurate calculations of accrued interest. Failure to do so can result in financial losses or missed opportunities for maximizing returns. Another challenge is the complexity of calculating accrued interest itself. The calculations can become convoluted, especially when it involves compounding and varying payment frequencies. Investors seeking to accurately determine accrued interest must employ sophisticated financial models or seek the assistance of professionals to navigate these complexities. Furthermore, managing accrued interest requires constant vigilance to changes in interest rates and payment schedules. Investors must be proactive in updating their records and analyzing the impact of these changes on their investment portfolios. Failure to stay informed can lead to inaccuracies in accrued interest calculations and potentially result in financial setbacks.Benefits Of Accrued Interest For Investors

Despite the challenges, there are several benefits to paying accrued interest for investors. These benefits contribute to the overall growth of an investment portfolio and can significantly increase returns over time. One major benefit is the compounding effect of accrued interest. By reinvesting accrued interest back into the investment, investors can generate even greater returns. This compounding effect can accelerate wealth accumulation and lead to substantial long-term gains. Accrued interest payments also serve as an incentive for investors to hold onto their investments until maturity. In situations where investors choose to sell their investments before maturity, accrued interest acts as compensation for the time the investor held the investment. This compensation can mitigate potential losses incurred from premature selling. Moreover, the payment of regular accrued interest can provide investors with a predictable income stream. This income can be especially beneficial for individuals relying on their investment portfolios to supplement their regular income or fund their retirement. The stability of accrued interest payments can provide peace of mind and financial security for investors. In conclusion, while managing accrued interest comes with its challenges, the benefits for investors are substantial. By carefully navigating the complexities of accrued interest calculations and staying informed about changes in interest rates, investors can harness the power of accrued interest to maximize their returns and achieve their financial goals.Strategies For Managing Accrued Interest

Accrued interest is an important aspect of financial management that should not be overlooked. By understanding how to effectively manage accrued interest, you can minimize costs and maximize returns. In this article, we will explore two key strategies for managing accrued interest: minimizing accrued interest costs and maximizing returns through accrued interest.

Minimizing Accrued Interest Costs

When it comes to minimizing accrued interest costs, there are several strategies you can employ:

- Pay accrued interest regularly: By paying off accrued interest on a regular basis, you can prevent it from accumulating and thereby reduce your overall costs.

- Prepay principal: Another effective strategy is to prepay the principal on your debt. By doing so, you can reduce the outstanding balance and consequently lower the amount of interest that accrues.

- Consider debt consolidation: If you have multiple debts with varying interest rates, consolidating them into a single loan with a lower interest rate can help minimize accrued interest costs.

- Explore refinancing options: Refinancing your loans can also be a viable option to reduce accrued interest costs. By securing a loan with a lower interest rate, you can potentially lower your monthly payments and decrease the amount of interest that accrues.

Maximizing Returns Through Accrued Interest

In addition to minimizing costs, you can also maximize returns through accrued interest. Here are some strategies to consider:

- Invest in interest-bearing accounts: By placing your funds in interest-bearing accounts such as savings accounts or certificates of deposit (CDs), you can earn additional income through accrued interest.

- Choose investments with high compounding rates: Investing in assets with high compounding rates can generate substantial returns over time. Examples include stocks, bonds, and mutual funds.

- Reinvest dividends: If you receive dividends from your investments, reinvesting them can further increase your returns through accrued interest.

- Utilize tax-advantaged accounts: Taking advantage of tax-advantaged accounts such as individual retirement accounts (IRAs) or 401(k) plans can help you maximize returns by minimizing tax liabilities on accrued interest.

Credit: www.fool.com

Frequently Asked Questions Of Why Do | Pay Accrued Interest?

Why Do I Have To Pay Accrued Interest?

Accrued interest is the cost of borrowing money over a specific period of time. Lenders charge accrued interest to compensate for the delay in receiving their money back. By paying accrued interest, you fulfill your obligation to compensate the lender for the time you held the borrowed funds.

How Is Accrued Interest Calculated?

Accrued interest is calculated based on the outstanding principal amount and the interest rate. To calculate it, you multiply the principal by the interest rate, and then divide the result by the number of periods in a year. This gives you the amount of interest that has accrued over a specific time period.

When Do I Have To Pay Accrued Interest?

Accrued interest is typically paid when a loan or credit transaction reaches its maturity date, or when there is a prepayment or early termination. The exact timing may vary depending on the terms and conditions of your loan agreement. It’s important to review your loan agreement for specific details on when accrued interest is due.

Can I Avoid Paying Accrued Interest?

In most cases, it is not possible to avoid paying accrued interest as it is a standard component of borrowing money. However, you may be able to minimize the amount of accrued interest you pay by making regular repayments, paying off your debt early, or negotiating lower interest rates with your lender.

Conclusion

Paying accrued interest is vital for fair compensation and maintaining financial stability. It ensures that lenders receive the full return on their investment and borrowers fulfill their financial obligations. Understanding the reasons behind paying accrued interest will empower you to make informed financial decisions and contribute positively to the economy.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Why do I have to pay accrued interest?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Accrued interest is the cost of borrowing money over a specific period of time. Lenders charge accrued interest to compensate for the delay in receiving their money back. By paying accrued interest, you fulfill your obligation to compensate the lender for the time you held the borrowed funds.” } } , { “@type”: “Question”, “name”: “How is accrued interest calculated?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Accrued interest is calculated based on the outstanding principal amount and the interest rate. To calculate it, you multiply the principal by the interest rate, and then divide the result by the number of periods in a year. This gives you the amount of interest that has accrued over a specific time period.” } } , { “@type”: “Question”, “name”: “When do I have to pay accrued interest?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Accrued interest is typically paid when a loan or credit transaction reaches its maturity date, or when there is a prepayment or early termination. The exact timing may vary depending on the terms and conditions of your loan agreement. It’s important to review your loan agreement for specific details on when accrued interest is due.” } } , { “@type”: “Question”, “name”: “Can I avoid paying accrued interest?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “In most cases, it is not possible to avoid paying accrued interest as it is a standard component of borrowing money. However, you may be able to minimize the amount of accrued interest you pay by making regular repayments, paying off your debt early, or negotiating lower interest rates with your lender.” } } ] }