What is Credit Vs Debit? Learn the Key Differences!

Credit refers to money that is borrowed with the expectation of repayment, while debit refers to the direct withdrawal of funds from a bank account for payment. In credit transactions, money is borrowed and owed, while in debit transactions, money is directly withdrawn and spent.

Understanding the difference between credit and debit is crucial for managing personal finances effectively. By knowing how these payment methods work, individuals can make informed decisions about when to use credit and when to choose debit. This article will explore the concept of credit versus debit in more detail, highlighting their key characteristics and providing practical examples.

Additionally, it will discuss the advantages and potential pitfalls of using credit or debit and offer some tips for responsible money management.

Credit: www.indeed.com

The Basics Of Credit And Debit

Credit and debit are different methods of payment. Credit allows you to borrow money, while debit uses funds from your bank account. With credit, you pay later, possibly with interest, whereas debit deducts directly from your account. Understanding the distinction is crucial for managing finances effectively.

Defining Credit And Debit

Before we delve into how credit and debit transactions work, let’s start by understanding what credit and debit actually mean.

Credit: Credit is like borrowing money. When you use a credit card or take out a loan, you are essentially borrowing money with the promise to pay it back later. The credit amount you borrow can vary depending on your approved credit limit. It’s crucial to keep in mind that credit comes with the responsibility of repaying the borrowed amount, often with additional interest.

Debit: On the other hand, debit is like using your own money. When you make a purchase using a debit card or write a check against your bank account, the funds are instantly deducted from your available balance. Debit transactions are directly linked to the money you have in your bank account, allowing you to spend only what you have.

How Credit And Debit Transactions Work

Now that we’re clear on the definitions, let’s take a closer look at how credit and debit transactions work and what sets them apart.

Credit Transactions:

When you make a credit transaction, you are essentially charging the amount to your credit card or establishing a debt. This means the purchase amount gets added to your credit card balance, increasing the amount you owe. At the end of each billing cycle, you will receive a statement outlining your balance and the minimum payment due. It’s important to remember that if you don’t pay off the full balance, you will be charged interest on the remaining debt.

Debit Transactions:

In contrast, when you make a debit transaction, the purchase amount is subtracted directly from the funds available in your bank account. This means you are using your own money to make the purchase, and there is no debt involved. Since debit card transactions are deducted immediately, they provide a real-time reflection of your available balance.

| Credit Transactions | Debit Transactions |

|---|---|

| You are borrowing money | You are using your own money |

| Amount owed accumulates as a debt | Amount spent is subtracted instantly from available funds |

| Requires repayment with added interest | No repayment necessary as you are spending what you have |

Understanding the differences between credit and debit is essential for managing your finances effectively. Whether you choose to use credit or debit for your everyday transactions, it’s crucial to be mindful of your spending and pay close attention to your financial responsibilities.

Key Differences Between Credit And Debit

Understanding the difference between credit and debit is essential for managing personal finances effectively. While both options allow you to make purchases, there are distinct variations in how they work. Let’s explore the key differences between credit and debit to help you make informed decisions about your financial resources.

Source Of Funds

When it comes to the source of funds, credit and debit operate differently. A debit card is linked to your checking account, allowing you to spend the money you already have. It’s like using cash, but in a more convenient form. On the other hand, credit cards provide you with a line of credit that you can borrow against. This means you’re essentially using the bank’s money to make purchases.

Usage And Limits

Usage and limits also differentiate credit and debit. Debit cards have no borrowing limits since they rely on the funds available in your account. However, credit cards come with a specific credit limit based on your creditworthiness and income. This limit determines how much money you can borrow from the bank. It’s important to remember that using your credit card responsibly and staying within your limit is crucial to avoid accumulating excessive debt.

Impact On Finances

The impact on your overall finances is another significant distinction between credit and debit. With debit cards, you are using your own money, so there is no need to pay interest. On the contrary, when you use a credit card, any outstanding balance accrues interest charges until it is paid off. If you consistently carry a balance, this can lead to mounting interest costs that can impact your financial stability negatively.

Furthermore, using credit cards responsibly can build a positive credit history, which can open up opportunities for future loans and better interest rates. Alternatively, mismanaging credit cards and accumulating debt can hurt your credit score and make it harder to secure favorable financial opportunities in the future.

In conclusion, understanding the key differences between credit and debit is essential to make mindful choices about your finances. Debit cards allow you to spend your own money, while credit cards provide a borrowing opportunity. It’s important to use credit responsibly, staying within your limits and paying off any outstanding balances to avoid negative impacts on your financial well-being. Now that we have explored these differences, you can make informed decisions about which payment method suits your needs best.

Pros And Cons Of Credit And Debit

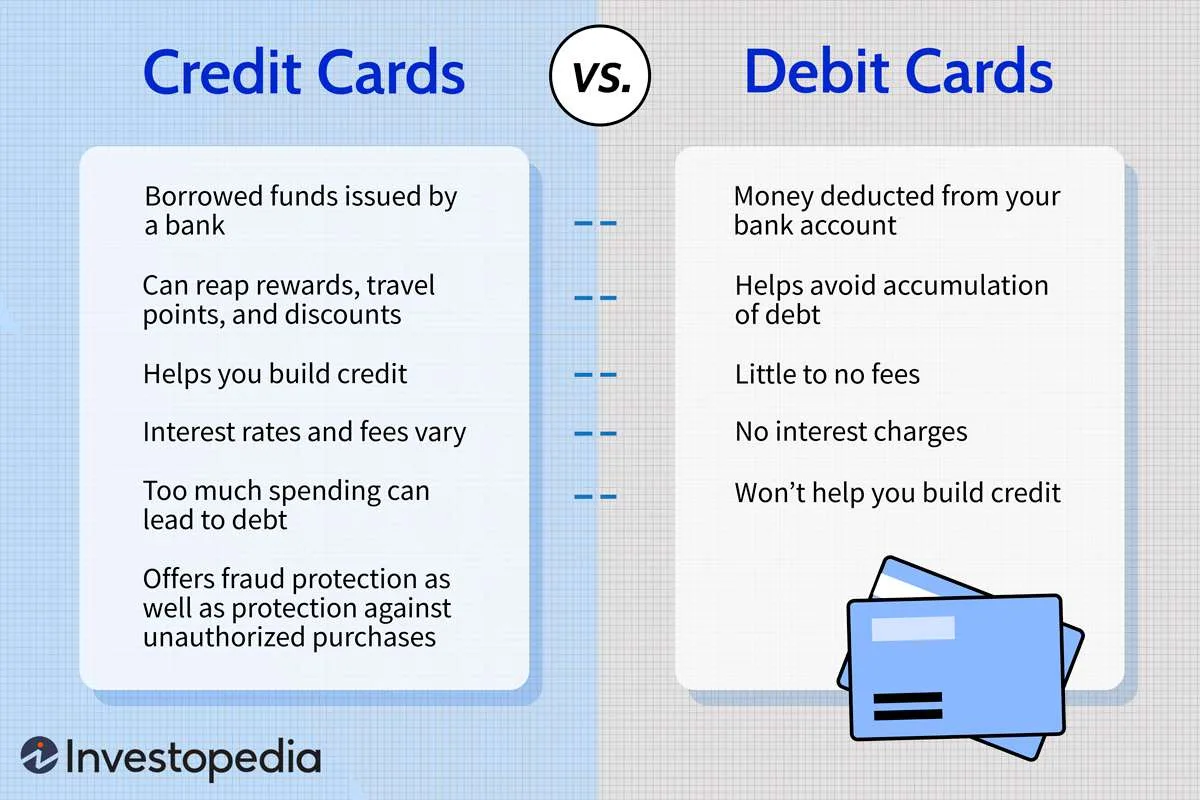

Credit and debit cards are essential tools for managing your finances, but they have distinct advantages and disadvantages. Understanding the pros and cons of using credit and debit cards can help you make informed decisions about which one is right for you. Let’s explore the benefits and drawbacks of both.

Benefits Of Using Credit

- Rewards: Many credit cards offer rewards programs such as cashback, travel points, or discounts.

- Consumer Protection: Credit cards often provide stronger consumer protection, including fraud liability coverage.

- Build Credit: Responsible credit card use can help build a positive credit history, which is important for major purchases like a home or car.

- Emergency Fund: Credit cards can serve as a backup source of funds for emergencies when cash is limited.

Advantages Of Using Debit

- Budget Management: Debit cards allow you to spend only the money you have, helping to avoid debt and overspending.

- No Interest: Since debit card transactions are directly linked to your bank account, there’s no risk of accruing interest charges.

- Accessibility: Debit cards are widely accepted and can be used at ATMs for cash withdrawals.

- Control: Using a debit card means you’re not borrowing money, which can lead to better financial discipline.

Potential Drawbacks

- Overspending: With credit cards, there’s a risk of overspending and accumulating high-interest debt if not managed responsibly.

- Fees and Interest: Credit cards may come with annual fees and high-interest rates on balances carried from month to month.

- Limited Fraud Protection: Debit card fraud protection may not be as extensive as that provided by credit cards.

- No Credit Building: Since debit transactions don’t impact credit scores, they don’t help build credit history.

Managing Credit And Debit Wisely

Credit and debit are two different forms of payment. Credit allows you to borrow money and pay it back later, while debit uses funds directly from your bank account.

Building Credit With Responsible Credit Card Use

Using credit cards responsibly can help you build a solid credit history, which is crucial when applying for loans or mortgages. By following a few simple strategies, you can make the most of your credit card while avoiding unnecessary debt.

First and foremost, it’s important to pay your credit card bills on time and in full. This will help you avoid late fees and interest charges, but more importantly, it shows lenders that you are a responsible borrower. By paying your bills in full each month, you demonstrate that you can manage your credit wisely, which can help improve your credit score.

Another key aspect of responsible credit card use is keeping your credit utilization low. This means using only a small portion of your available credit. Ideally, you should aim to keep your credit card balances below 30% of your credit limit. For example, if your credit limit is $1,000, try to keep your balance below $300. This shows lenders that you are not overly reliant on credit and can help improve your credit score.

Finally, it’s important to regularly review your credit card statements to check for any unauthorized charges or errors. By doing this, you can catch any issues early on and avoid potential headaches down the line. If you notice any discrepancies, be sure to report them to your credit card issuer right away.

Avoiding Overspending With Debit Cards

Debit cards can be a great tool for managing your finances, but it’s important to use them wisely to avoid overspending. Here are a few tips to help you make the most of your debit card:

- Keep track of your transactions: Regularly check your debit card statement or use online/mobile banking to keep track of your spending. This will help you stay within your budget and avoid overdrawing your account.

- Set up alerts: Many banks offer the option to set up alerts for specific transaction amounts or when your balance falls below a certain threshold. These alerts can help you stay on top of your spending and avoid unexpected surprises.

- Avoid impulse purchases: Before making a purchase, take a moment to consider if it is a necessary expense. By avoiding impulse purchases, you can save money and avoid unnecessary debt.

- Use cashback wisely: Some debit cards offer cashback rewards for certain purchases. While these rewards can be enticing, it’s important to use them wisely and not let them tempt you into overspending.

By following these tips, you can manage your credit and debit cards wisely, avoiding unnecessary debt and building a strong financial foundation. Remember, responsible credit card use can help you build credit, while using your debit card wisely can help you stay within your budget and avoid overspending.

Choosing The Right Option For You

Discover the key differences between credit and debit, and learn how to choose the right option for your financial needs. Understand the benefits and potential risks of each payment method to make informed decisions.

When it comes to managing your finances, deciding between using a credit card or a debit card is an important choice. Understanding the differences between credit and debit cards will help you make informed decisions that align with your financial goals. Here are some factors to consider and tips to help you choose the right option for you:

Factors To Consider

Before deciding whether to opt for credit or debit, it’s crucial to take various factors into account:

- Your financial discipline: If you have a solid track record of keeping your spending in check and paying off your balances in full and on time, a credit card may be beneficial. However, if you prefer using your own funds and don’t want to risk accumulating debt, a debit card might be the better option.

- Rewards and benefits: Credit cards often come with perks such as cashback, airline miles, or rewards points. If you enjoy getting something back from your purchases, a credit card might be worth considering. Debit cards generally don’t offer the same level of rewards, so keep this in mind.

- Budgeting: If you have a strict budget and prefer to keep a close eye on your spending, then a debit card may be the better option. With a debit card, you can only spend the money you have available in your account, making it easier to stay within your budget and avoid getting into debt.

- Financial goals: Consider your long-term financial goals. If you’re looking to build credit for major future purchases, such as a car or home, responsibly using a credit card and establishing a good credit history can work in your favor.

- Protection against fraud: Credit cards generally offer more robust fraud protection than debit cards. If you value the added security and peace of mind, a credit card may be a better choice.

- Interest rates and fees: It’s crucial to familiarize yourself with the interest rates and fees associated with credit and debit cards. Credit cards often have higher interest rates, while debit cards might have fewer fees. Understanding these charges will help you make an informed decision.

Tips For Making Informed Decisions

Consider these tips when deciding whether to choose a credit card or a debit card:

- Evaluate your spending habits and financial goals before making a decision.

- Compare the features, benefits, and fees of different credit and debit cards to find the right fit.

- Read the fine print and terms and conditions of each card to fully understand the implications.

- Set a clear budget and track your expenses regularly, regardless of which payment method you choose.

- Monitor your credit score if you opt for a credit card to ensure you’re maintaining a healthy credit history.

- If you have multiple credit cards, manage them responsibly to avoid accumulating excessive debt.

- Stay vigilant against fraudulent activity and report any suspicious transactions promptly.

:max_bytes(150000):strip_icc()/dotdash-050415-what-are-differences-between-debit-cards-and-credit-cards-Final-2c91bad1ac3d43b58f4d2cc98ed3e74f.jpg)

Credit: www.investopedia.com

Credit: www.pnc.com

Frequently Asked Questions For What Is Credit Vs Debit?

What Is The Difference Between Debit And Credit?

Debit decreases your account balance, while credit increases it. Debit is money out, and credit is money in.

What Is The Difference Between Debit And Credit Bills?

Debit bills deduct funds directly from your bank account, while credit bills allow you to borrow money that you must repay later. Debit bills use existing funds, credit bills create a debt.

Is Debit Money In Or Out?

Debit money is out of your account.

What Is An Example Of A Debit And A Credit?

Debit means money leaving the account, like when you buy something. Credit is money coming in, like a deposit.

Conclusion

Understanding the difference between credit and debit cards is crucial for financial management. By knowing the distinctions and benefits of each, you can make informed decisions for your personal or business finances. Whether it’s building credit or controlling spending, both options offer unique advantages.

Ultimately, choosing the right payment method can positively impact your financial health.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is the difference between debit and credit?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Debit decreases your account balance, while credit increases it. Debit is money out, and credit is money in.” } } , { “@type”: “Question”, “name”: “What is the difference between debit and credit bills?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Debit bills deduct funds directly from your bank account, while credit bills allow you to borrow money that you must repay later. Debit bills use existing funds, credit bills create a debt.” } } , { “@type”: “Question”, “name”: “Is debit money in or out?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Debit money is out of your account.” } } , { “@type”: “Question”, “name”: “What is an example of a debit and a credit?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Debit means money leaving the account, like when you buy something. Credit is money coming in, like a deposit.” } } ] }