What is an Example of Amortize in a Sentence?: Unlock the Magic of Amortization

Amortize refers to the process of gradually paying off a debt over a specific period. Amortize is a financial term that describes the gradual repayment of a debt over a defined period.

For example, when buying a house, the mortgage payments are amortized, meaning they are spread out over many years rather than paid in a lump sum. This allows the borrower to make smaller, manageable payments over time. Amortization is commonly used in loans and mortgages to ensure the borrower can pay off the debt without experiencing financial strain.

By paying off the principal amount and the interest together, the borrower effectively reduces the outstanding balance. Overall, the amortization process helps individuals and businesses handle long-term financial obligations efficiently.

The Concept Of Amortization

Amortization is a financial term that refers to the process of spreading out or distributing the cost of an asset over its useful life. Through amortization, businesses can account for the expense of an asset gradually, rather than in one lump sum. This concept is particularly useful for large purchases, such as houses or vehicles, where the cost is substantial and would be difficult to pay all at once.

Definition Of Amortization

Amortization can be defined as a systematic approach used by businesses to allocate the cost of an asset over its useful life, resulting in a reduction of the asset’s value over time.

| Asset Examples | Usage |

|---|---|

| Real estate properties | Purchased by individuals or investors for long-term use or rental income |

| Automobiles | Acquired for personal or business use |

| Intangible assets (patents, copyrights) | Held by companies for exclusive rights or future earnings |

Importance Of Amortization

- Accurate financial reporting: By spreading the cost over time, amortization allows for more accurate representation of the asset’s value on the balance sheet.

- Matched expenses with revenues: Amortization aligns the expenses associated with an asset with the revenues it generates over time, providing a more realistic depiction of profitability.

- Budgeting and planning: The gradual allocation of costs through amortization helps businesses budget and plan for future expenses, ensuring financial stability.

- Tax benefits: Depending on the applicable tax laws, businesses may be able to deduct a portion of the amortized expense, reducing their tax liability.

In conclusion, amortization is a crucial financial concept that allows businesses to evenly distribute the cost of assets over time, resulting in accurate financial reporting and improved budgeting capabilities.

Credit: www.ramseysolutions.com

Examples Of Amortization

Sure, here is a short description: An example of amortization in a sentence is “The loan will amortize over 25 years, with monthly payments gradually paying off the principal and interest. ” In this case, the loan is being repaid over time through regular installments, including both principal and interest.

Amortization is a financial term that refers to the process of gradually paying off a debt over a specified period of time. It involves making regular payments, which are typically composed of both principal and interest. This helps borrowers to manage their repayment obligations and allows lenders to receive a steady flow of income. In this section, we will explore some real-life examples of amortization.

Real-life Examples

Amortization is commonly used in various aspects of personal finance, including mortgages, car loans, and student loans. Let’s take a look at some specific examples:

Mortgages:

A homeowner takes out a $250,000 mortgage loan with a fixed interest rate of 4% for a term of 30 years. The monthly repayment amount is calculated using an amortization schedule, which breaks down the payment into portions for interest and principal. Over time, the borrower gradually pays off the principal debt, reducing the outstanding balance and accruing less interest.

Car Loans:

An individual decides to buy a car worth $20,000 and obtains a car loan for the same amount with an interest rate of 6%. The loan term is set at 5 years, and monthly payments are made to cover both the principal and interest. As the borrower continues to make regular payments, the principal debt decreases, resulting in lower interest charges over time.

Student Loans:

A college graduate has accumulated $50,000 in student loan debt with an interest rate of 5%. The loan provider establishes an amortization schedule, which outlines the regular payments to be made over a specified period, typically 10 or 20 years. By adhering to this repayment schedule, the borrower progressively reduces the principal amount owed, managing the debt in a structured manner.

It is important to note that the specific terms and conditions of amortization may vary depending on the individual’s financial situation and the terms offered by the lender. However, the concept remains consistent across various financial instruments.

Amortization In Various Industries

Amortization is a financial concept that impacts various industries, including real estate and business loans. Let’s take a closer look at how amortization is applied in different sectors and understand its significance.

Real Estate

In the real estate industry, amortization plays a crucial role in mortgage payments. Homebuyers can see the impact of amortization in their monthly payments, where a portion goes towards paying off the mortgage principal while the rest covers interest.

For example, “The homebuyer will amortize the mortgage over 30 years.”

Business Loans

Amortization in business loans refers to the spread-out repayment of a loan over a specific time period. This enables businesses to manage their cash flow effectively, as they can budget for consistent payments. Entrepreneurs often opt for amortized loans to ensure a predictable repayment schedule.

For instance, “The business will amortize the loan over five years.”

Credit: study.com

Key Calculations In Amortization

In the world of finance, understanding key calculations in amortization is crucial. Two important aspects to be aware of are the principal and interest, as well as the amortization schedule. Let’s take a closer look at these concepts:

Principal And Interest

When borrowing money, the principal refers to the original loan amount. Interest, on the other hand, represents the additional cost incurred for borrowing that money. Both principal and interest are important factors in the amortization process.

An example sentence that showcases the use of “amortize” in relation to principal and interest is:

“The monthly payments I make on my mortgage help amortize the principal while also covering the interest.”

This sentence highlights that the borrower’s monthly payments contribute to reducing the principal loan amount over time, while also covering the interest charges.

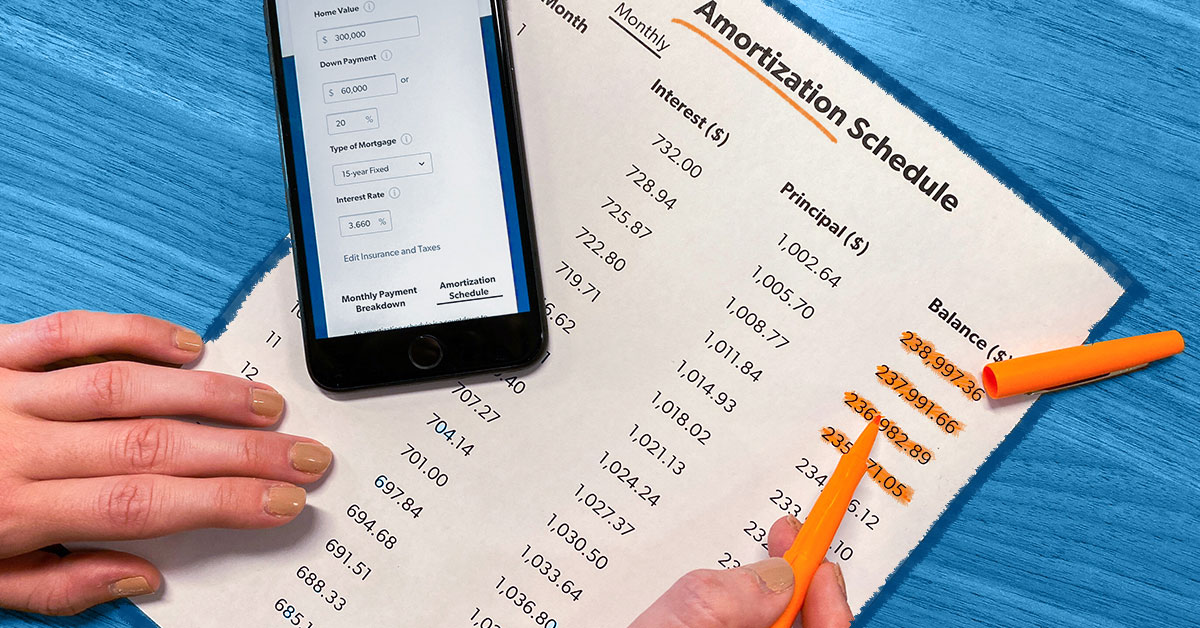

Amortization Schedule

An amortization schedule is a detailed table that outlines the repayment plan for a loan, including the breakdown of principal and interest payments over the loan term. This schedule is typically provided by lenders to borrowers.

Here’s an example of an amortization schedule for a $10,000 loan with a 5% interest rate and a 5-year term:

| Payment Number | Payment Amount | Principal Portion | Interest Portion | Remaining Balance |

|---|---|---|---|---|

| 1 | $188.71 | $157.72 | $30.99 | $9,842.28 |

| 2 | $188.71 | $159.94 | $28.77 | $9,682.34 |

| 3 | $188.71 | $162.18 | $26.53 | $9,520.16 |

This table demonstrates the payment amounts, principal and interest portions, as well as the remaining balance after each payment. It allows the borrower to visually track the progress of their loan repayment.

Understanding the key calculations in amortization provides clarity on the overall cost of borrowing and how payments contribute towards reducing the loan amount. By grasping the concepts of principal and interest, as well as referring to an amortization schedule, borrowers can make informed financial decisions.

Strategies For Effective Amortization

When it comes to managing your finances and paying off loans, having a clear understanding of amortization can be a game-changer. Amortization refers to the process of gradually paying off a debt over time through regular payments that are divided into both principal and interest. By effectively incorporating strategies for amortization, you can save money, pay off your debts faster, and achieve financial freedom sooner rather than later.

Accelerated Amortization

Accelerated amortization is a powerful strategy that allows you to pay off your debt faster by increasing your monthly or periodic payments. By doing so, you can reduce the total interest paid over the life of the loan and ultimately save money. For example, if you have a mortgage, increasing your monthly payment by even a small amount can make a significant impact in the long run. Consider using an online loan repayment calculator to see how accelerating your payments can affect the amortization schedule.

Refinancing Options

Refinancing can be another effective strategy for amortization, especially if you can secure a lower interest rate. When you refinance a loan, you essentially take out a new loan to pay off the existing one. By doing this, you may be able to lower your monthly payments, reduce the interest paid over time, or even shorten the loan term. However, it’s important to carefully consider the costs associated with refinancing, such as closing fees or penalties, to ensure it is a financially sound decision.

Additionally, you should also explore the possibility of refinancing your loan to a shorter term. While this may increase your monthly payments, it can result in substantial long-term savings by reducing the overall interest paid. Even shaving a few years off the loan term can make a significant difference.

In conclusion, by implementing these strategies for effective amortization, you can take control of your financial future and work towards paying off your debts efficiently. Consider accelerating your amortization through increased payments or exploring refinancing options to save money, reduce interest, and achieve financial freedom faster. Remember, every step you take towards effective amortization brings you one step closer to a debt-free life.

Credit: www.linkedin.com

Frequently Asked Questions On What Is An Example Of Amortize In A Sentence?

What Does It Mean To Amortize A Loan?

Amortizing a loan means paying off the debt over time, typically in regular installments. It allows borrowers to gradually reduce the principal amount while also paying interest. This helps borrowers manage their debt and ensures a predictable repayment schedule.

How Is Amortization Calculated?

Amortization is calculated using a formula that takes into account the loan amount, interest rate, and loan term. It determines the monthly payment by dividing the loan amount by the number of months in the term and adding interest. As the loan progresses, the principal portion of the payment increases while the interest portion decreases.

Why Do People Amortize Loans?

People choose to amortize loans because it allows them to spread out their debt payments over time, making it more manageable and affordable. By making regular monthly payments, borrowers can steadily reduce their loan balance, build equity, and avoid the burden of a lump-sum repayment.

Amortization also helps lenders mitigate the risk of non-payment.

Conclusion

Understanding how to use “amortize” in a sentence can enhance your communication. By incorporating this financial term into your vocabulary, you can effectively explain the gradual repayment of a debt or the spreading out of costs. This knowledge adds depth and clarity to your language, improving both written and verbal communication.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What does it mean to amortize a loan?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Amortizing a loan means paying off the debt over time, typically in regular installments. It allows borrowers to gradually reduce the principal amount while also paying interest. This helps borrowers manage their debt and ensures a predictable repayment schedule.” } } , { “@type”: “Question”, “name”: “How is amortization calculated?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Amortization is calculated using a formula that takes into account the loan amount, interest rate, and loan term. It determines the monthly payment by dividing the loan amount by the number of months in the term and adding interest. As the loan progresses, the principal portion of the payment increases while the interest portion decreases.” } } , { “@type”: “Question”, “name”: “Why do people amortize loans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “People choose to amortize loans because it allows them to spread out their debt payments over time, making it more manageable and affordable. By making regular monthly payments, borrowers can steadily reduce their loan balance, build equity, and avoid the burden of a lump-sum repayment. Amortization also helps lenders mitigate the risk of non-payment.” } } ] }