What Does Amortization Mean in a Loan? Explore the Power of Scheduled Repayments

Amortization in a loan refers to the process of gradually paying off the loan amount over a set period of time through regular installments that include both principal and interest. It involves breaking down the total loan amount into smaller, equal payments spread out over the loan term.

This method ensures that the borrower pays off the debt gradually while also covering the interest charges. As the loan progresses, the loan balance gradually decreases as each payment is made, resulting in the loan being fully paid off by the end of the term.

This approach is commonly used in mortgages, car loans, and personal loans to make repayments more manageable for borrowers.

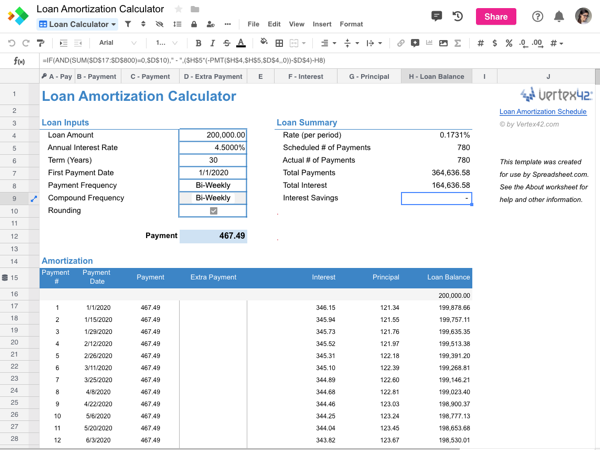

Credit: www.boe.ca.gov

The Basics Of Amortization

Amortization in a loan refers to the process of paying off a debt through regular installments, which cover both the principal amount and interest. This method allows borrowers to gradually reduce their outstanding balance over time, ensuring a systematic approach to debt repayment.

Definition Of Amortization

Amortization is a financial term that refers to the process of gradually reducing a loan balance over time through regular payments. It involves both the principal amount borrowed and the interest charged on the loan.

Purpose Of Amortization

The purpose of amortization is twofold: to ensure that the loan is repaid in full by the end of its term and to distribute the cost of the loan evenly over its duration. By making regular payments that include both principal and interest, borrowers can steadily reduce their outstanding loan balance and eventually become debt-free.

Amortization is commonly used for various types of loans, including mortgages, car loans, and personal loans. It is an essential component of these loans as it allows borrowers to effectively manage their debt obligations and plan their finances.

Key Elements Of An Amortized Loan

When it comes to loans, understanding the key elements of an amortized loan is crucial. Amortization refers to the process of paying off a debt, such as a loan, through regular payments over a specified period. This method ensures that both the principal amount and the interest are gradually paid off over time. To grasp the concept of amortization fully, it’s essential to familiarize yourself with the three key elements: the principal amount, interest rate, and loan term.

Principal Amount

The principal amount is the initial sum borrowed from the lender. It serves as the foundation of the loan and determines the total amount that the borrower will eventually repay. The principal amount is often influenced by various factors, including the borrower’s creditworthiness, income, and the purpose of the loan. When obtaining a loan, it is crucial to carefully consider the principal amount, as it directly affects the overall cost of the loan and the monthly payments.

Interest Rate

The interest rate in an amortized loan refers to the cost of borrowing. Expressed as a percentage, the interest rate is applied to the outstanding balance of the loan. It represents the additional amount the borrower has to pay above the principal amount. The interest rate affects the overall cost of the loan and determines the portion of each payment that goes toward interest. When applying for a loan, it is essential to compare interest rates offered by different lenders to find the most competitive option that suits your financial situation.

Loan Term

The loan term represents the duration or length of time over which the loan will be repaid. It is typically specified in months or years. The loan term plays a significant role in determining the amount of each monthly payment. Generally, longer loan terms result in lower monthly payments but higher overall interest costs, while shorter loan terms require higher monthly payments but lower overall interest costs. It is crucial to consider your financial goals and ability to afford the monthly payments when selecting the appropriate loan term.

Understanding Scheduled Repayments

Understanding scheduled repayments in a loan is essential for borrowers to manage their debt effectively. Amortization plays a crucial role in determining the monthly repayment amount and understanding how it affects the interest and principal can help individuals make informed financial decisions.

How Amortization Affects Monthly Payments

Amortization impacts monthly payments by allocating a larger portion towards interest at the beginning of a loan term, gradually shifting towards paying off more principal over time. As a result, borrowers experience higher interest payments initially, while the principal gradually decreases, leading to a reduction in the monthly payment amount over the loan term.

Impact On Interest And Principal

Amortization impacts the allocation of each monthly payment towards interest and principal. At the start of the loan, a greater portion of the payment goes towards interest, with a smaller portion reducing the principal balance. Over time, the allocation shifts, with more of the payment going towards reducing the principal, effectively decreasing the overall interest paid over the loan term.

Credit: fastercapital.com

The Power Of Amortization

When borrowing money for a big purchase like a home or a car, it’s essential to understand the concept of amortization. Amortization refers to the process of spreading out your loan payments over time, which can have a significant impact on your financial situation. By breaking down your loan into smaller, regular payments, amortization allows you to budget your finances more effectively and build equity over time. Understanding the power of amortization is crucial to making informed decisions about your borrowing needs.

Building Equity Over Time

One of the most significant advantages of an amortized loan is that it enables you to build equity over time. Equity is the value of your asset, such as a home or a car, minus any outstanding loan balance. With each payment you make towards an amortized loan, a portion goes towards the principal (the original amount borrowed) and another portion goes towards the interest charged by the lender. As you continue making regular payments, more money goes towards reducing the principal, which in turn increases your equity. Over time, the balance between principal and interest shifts, allowing you to build equity and eventually own your asset outright.

This gradual increase in equity is particularly beneficial for homeowners. As the amount you owe decreases, the value of your home may appreciate due to market fluctuations or improvements you make. This combination of paying down your mortgage and potential appreciation can result in significant gains in your overall net worth. So, by making timely payments on an amortized loan, you not only pay off your debt but also build wealth and financial security for the future.

Comparing Amortized Loans With Other Loan Structures

When considering various loan options, it’s essential to compare amortized loans with other loan structures to determine which best suits your needs. Unlike other loan structures, such as interest-only loans or balloon loans, amortized loans enable you to pay off both the principal and interest gradually over time. This repayment structure provides stability and predictability, as you know exactly how much you need to pay each month and when your loan will be fully paid off.

Additionally, amortized loans often come with lower interest rates compared to other loan structures, making them more cost-effective in the long run. The fixed monthly payments and lower interest rates allow you to allocate your funds towards other financial goals, such as saving for retirement or paying off other debts.

To further illustrate the benefits of amortized loans, let’s compare it with an interest-only loan. While an interest-only loan requires you to pay only the interest for a set period, such as five years, an amortized loan requires you to make monthly payments that include both principal and interest. Over time, the interest-only loan may result in a larger final payment or higher monthly payments once the interest-only period ends. On the other hand, with an amortized loan, you steadily reduce the principal, ensuring a more manageable debt load and a clear path towards full repayment.

In conclusion, the power of amortization lies in its ability to help you build equity, accumulate wealth, and make progress towards a debt-free future. By understanding how your loan payments are structured, you can make informed choices that align with your financial goals. So, whether you’re buying a home, financing a car, or taking on any significant loan, consider the benefits of an amortized loan and the power it holds to shape your financial future.

Strategies For Managing Amortized Loans

When it comes to managing an amortized loan, having a solid repayment plan in place is crucial. By understanding the concept of amortization and employing effective strategies, you can take control of your loan and save money in the long run. In this article, we will explore two key strategies that can help you manage your amortized loan effectively. These strategies include making extra payments and taking advantage of refinancing opportunities.

Making Extra Payments

Making extra payments on your amortized loan is an excellent way to reduce the overall interest you pay and shorten the length of your loan term. By allocating additional funds towards your loan principal, you effectively decrease the outstanding balance. As a result, your monthly interest charges decrease, allowing you to save money in the long run.

To make extra payments, it’s essential to develop a budget that allows for this additional expenditure. Consider cutting back on unnecessary expenses or increasing your income to free up extra funds. Additionally, it’s vital to communicate with your lender and understand their policies regarding extra payments. Some lenders may have specific guidelines on how to apply these payments to ensure they are reducing the principal balance effectively.

By making extra payments consistently, you not only reduce your loan term but also improve your credit score. Paying your loan off faster demonstrates financial responsibility and can boost your creditworthiness, improving your chances of securing future loans on favorable terms.

Refinancing Opportunities

Another strategy for managing an amortized loan is taking advantage of refinancing opportunities. Refinancing involves replacing your existing loan with a new one, usually with more favorable terms. This allows you to lower your interest rate, decrease your monthly payments, or adjust the length of your loan.

If interest rates have dropped since you initially took out the loan, refinancing can save you a significant amount of money over time. To determine if refinancing is a viable option for you, it’s important to consider the costs associated with refinancing, such as closing costs and fees. Compare these costs to the potential savings from the new loan to ensure it makes financial sense.

Refinancing can also be a smart strategy if your credit score has improved since obtaining the loan. With a higher credit score, you may qualify for a lower interest rate, which can result in substantial savings over the life of your loan.

Before pursuing refinancing, it’s advisable to shop around and compare offers from different lenders. This allows you to find the most competitive rates and terms that align with your financial goals.

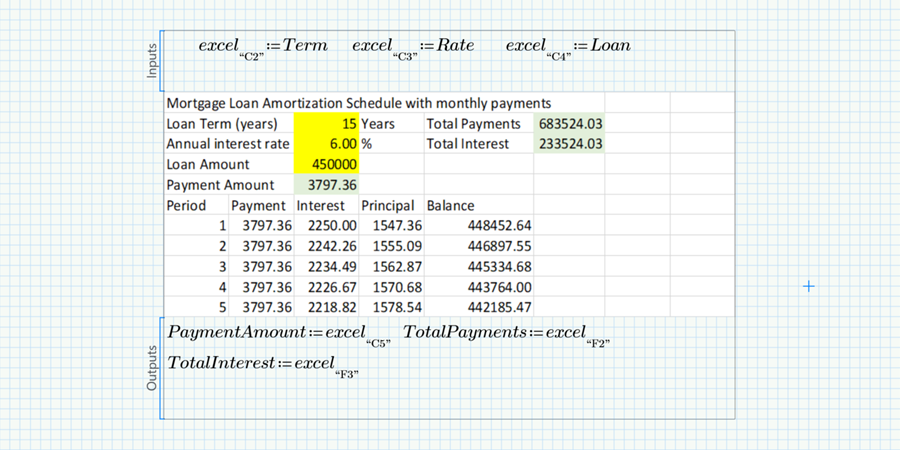

Credit: www.mathcad.com

Frequently Asked Questions Of What Does Amortization Mean In A Loan?

What Is The Definition Of Amortization In A Loan?

Amortization in a loan refers to the process of paying off a debt over time through regularly scheduled payments. It includes both the principal amount borrowed and the interest charged. Amortization ensures that borrowers gradually reduce their debts while also paying interest to the lender.

How Does Amortization Work In A Loan?

Amortization works by dividing the total loan amount into equal installments over a set period. Each payment consists of both principal and interest components, with the proportion of each varying over time. In the early stages of the loan, most of the payment goes towards the interest, while in later stages, more is applied to the principal.

What Are The Benefits Of Amortization In A Loan?

Amortization provides several benefits for borrowers. Firstly, it allows for manageable monthly payments, making it easier to budget and plan for the loan repayment. Secondly, it enables borrowers to gradually reduce their debt over time, building equity in the process.

Lastly, by paying off the principal, it helps improve the borrower’s creditworthiness.

Conclusion

Understanding amortization is crucial when applying for a loan. By grasping the concept, you can make informed financial decisions. It’s important to consider the impact of interest payments and how they affect your overall loan. With this knowledge, you can confidently navigate the loan process and manage your finances effectively.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is the definition of amortization in a loan?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Amortization in a loan refers to the process of paying off a debt over time through regularly scheduled payments. It includes both the principal amount borrowed and the interest charged. Amortization ensures that borrowers gradually reduce their debts while also paying interest to the lender.” } } , { “@type”: “Question”, “name”: “How does amortization work in a loan?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Amortization works by dividing the total loan amount into equal installments over a set period. Each payment consists of both principal and interest components, with the proportion of each varying over time. In the early stages of the loan, most of the payment goes towards the interest, while in later stages, more is applied to the principal.” } } , { “@type”: “Question”, “name”: “What are the benefits of amortization in a loan?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Amortization provides several benefits for borrowers. Firstly, it allows for manageable monthly payments, making it easier to budget and plan for the loan repayment. Secondly, it enables borrowers to gradually reduce their debt over time, building equity in the process. Lastly, by paying off the principal, it helps improve the borrower’s creditworthiness.” } } ] }