What are the Three Types of Amortization? Discover the Power of Principal, Interest, and Loan Term.

The three types of amortization are straight-line amortization, declining balance amortization, and sinking fund amortization. Straight-line amortization involves a constant amount of amortization expense over a period.

Declining balance amortization utilizes a decreasing percentage of the asset’s carrying value each period. Lastly, sinking fund amortization involves setting aside funds in a separate account to repay the principal of a debt at a future date. Understanding these types of amortization is crucial for financial planning and analyzing the impact of loan repayments or asset depreciation.

Whether it’s spreading out costs evenly, using a declining balance method, or creating a sinking fund, each type of amortization offers a unique solution for managing expenses and handling debt.

The Basics Of Amortization

Principal amortization refers to the process of gradually paying off the principal amount of a loan over a set period of time. When you make monthly mortgage payments, a portion of the payment goes towards repaying the principal balance. This helps to reduce the total amount owed on the loan. As you continue to make regular payments, the amount going towards the principal gradually increases, while the amount going towards interest decreases.

Interest amortization involves the gradual reduction of the interest portion of a loan payment over time. At the beginning of the loan term, a larger portion of the monthly payment goes towards covering the interest charged on the loan. However, as you continue to make payments, the principal balance decreases, resulting in lower interest charges. This means that over time, more of your monthly payment will go towards reducing the principal balance rather than paying interest.

Loan term amortization refers to the repayment schedule of a loan over a specified period, such as 15 or 30 years for a mortgage. Each payment made during the loan term includes both principal and interest, with the goal of fully amortizing the loan by the end of the term. This means that by the time the loan term is completed, the entire loan amount, including principal and interest, will have been paid off.

In summary, the three types of amortization include:- Principal amortization involves reducing the principal balance of a loan over time.

- Interest amortization entails gradually reducing the interest portion of the loan payment.

- Loan term amortization refers to the repayment schedule of the loan over a specified period.

Understanding these types of amortization can help you make informed decisions about your loans and manage your finances effectively.

Principal Amortization

Principal amortization refers to the process of paying down the initial loan amount. The three main types of amortization include straight-line, declining balance, and annuity. Each method has its own unique way of distributing repayment over the loan term.

Definition And Importance

The principal amortization is an essential component of the three types of amortization. It refers to the gradual reduction of the principal amount of a loan or debt over time through regular payments. This means that with each payment made, a portion goes towards paying off the principal balance of the loan.

Principal amortization is crucial because it determines how quickly the borrower can pay off the debt. By allocating funds towards the principal, the borrower can reduce the outstanding balance, ultimately leading to complete repayment of the loan. Let’s delve deeper into this concept and understand its significance.

Examples And Scenarios

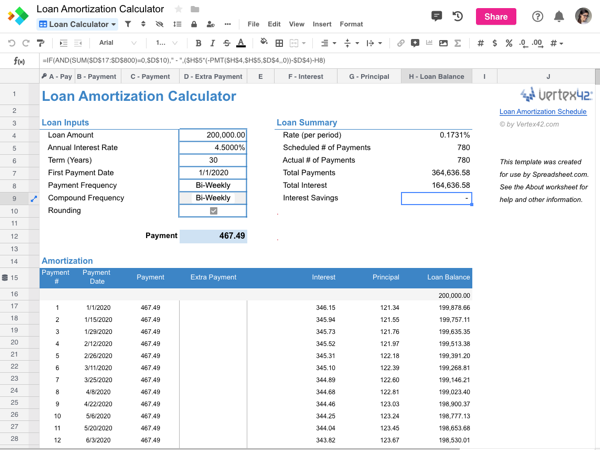

To illustrate the importance of principal amortization, let’s consider a scenario where a person takes out a mortgage of $200,000 to buy a house. The loan is structured over a period of 30 years with an interest rate of 4%.

With each monthly payment made, a portion of it will be dedicated to the principal balance. In the early years of the mortgage, the majority of the payment will go towards interest, while a smaller percentage will contribute to the principal. However, as time passes, the proportion allocated to the principal increases, gradually reducing the outstanding balance.

For example, after 10 years of making regular payments, the homeowner may find that the outstanding balance has reduced to $150,000. This reduction is a result of the principal amortization process. Through disciplined repayment, the borrower decreases the debt burden and increases equity in the property.

Another scenario to consider is for businesses that have taken out loans to finance their operations or expansion plans. Properly managing the principal amortization on these loans can significantly impact the financial health of the company. By reducing the principal over time, businesses can improve their balance sheets, enhance their creditworthiness, and pave the way for future growth opportunities.

In conclusion, principal amortization is a vital element of loan repayment. It allows borrowers to steadily reduce their debt and eventually become debt-free. Whether it’s an individual purchasing a home or a business seeking growth, understanding and effectively managing principal amortization is essential for financial stability and success.

Interest Amortization

Interest amortization is a key concept in loan repayment, as it determines how the interest on a loan is allocated over time. There are three types of amortization, with interest amortization being a critical factor in understanding the dynamics of loan repayment. Let’s dive into the first aspect of interest amortization: understanding interest allocation.

Understanding Interest Allocation

In interest amortization, understanding how interest is allocated over the payment period is crucial. The allocation of interest varies during the life of a loan, with a higher portion of each payment initially allocated to interest. It gradually shifts towards the principal amount as the loan matures. This process is determined by the type of amortization schedule used for the loan.

Impact On Loan Repayment

The allocation of interest has a significant impact on the overall loan repayment. At the beginning of the loan, a larger portion of the monthly payment goes toward paying off the interest, which means the principal balance reduces slowly. As time progresses, the portion of the payment allocated to the principal increases while the interest portion decreases. This shift has a direct effect on the total interest paid and the time required to pay off the loan.

:max_bytes(150000):strip_icc()/dotdash-TheBalance-calculate-mortgage-315668-final-fd8c0ed392cd40118439cd1c23317e99.jpg)

Credit: www.thebalancemoney.com

Loan Term Amortization

Loan term amortization refers to the process of spreading out loan payments over a period of time. There are three types of amortization: straight-line, declining balance, and annuity. Each type has its own unique characteristics, allowing borrowers to choose the best option for their financial needs.

Exploring Loan Duration

Loan term amortization refers to the process of repaying a loan over a specific period of time. It is important to understand the various aspects of loan term amortization to make informed financial decisions. One crucial aspect to consider is loan duration. Loan duration, or loan term, refers to the length of time over which a loan is scheduled to be repaid. It is usually expressed in months or years. Exploring loan duration can help you gain a better understanding of how it affects your monthly payments and the total interest you will end up paying over the course of the loan.Effect On Total Interest Paid

The duration of your loan term has a direct impact on the total interest paid over the life of the loan. Generally, the longer the loan term, the more interest you will end up paying. This is because, with longer loan terms, the interest has more time to accumulate. Conversely, shorter loan terms typically result in lower total interest paid. For example, let’s consider a loan with a $10,000 principal amount and an annual interest rate of 5%. If this loan has a term of 5 years (60 months), the total interest paid would be approximately $1,591. However, if the loan term is reduced to 3 years (36 months), the total interest paid would decrease to approximately $954. This significant reduction in total interest paid is due to the shorter time period in which interest can accumulate. When deciding on the duration of your loan term, it is important to consider your financial goals, current income, and monthly budget. While longer loan terms may result in lower monthly payments, they also lead to higher total interest paid. On the other hand, shorter loan terms may require larger monthly payments, but they can save you money in the long run by reducing the overall interest burden. In conclusion, understanding loan duration is crucial when it comes to loan term amortization. Exploring loan duration can help you determine how it affects your total interest paid and make informed decisions about the length of your loan term. Remember to consider your financial goals and monthly budget when deciding on a loan duration that best suits your needs.Comparing The Three Types Of Amortization

Amortization can be categorized into three types: straight-line, declining balance, and annuity. Each type has its own unique features and benefits, allowing borrowers to choose the most suitable option for their financial needs. Understanding the differences among these types of amortization can help individuals make informed decisions when it comes to managing their loan payments.

When it comes to paying off a loan, understanding the different types of amortization methods can be crucial in choosing the right strategy for your financial goals. In this section, we will analyze the combined impact, as well as the process of choosing the right amortization strategy for your needs.

Analyzing Combined Impact

Comparing the three types of amortization – straight-line, declining balance, and annuity – allows us to see how they differ in terms of payment structure and interest allocation. Here is a breakdown of the combined impact:

| Amortization Type | Payment Structure | Interest Allocation |

|---|---|---|

| Straight-line | Equal payments throughout the loan term | Higher interest allocation in the beginning, decreasing over time |

| Declining balance | Decreasing payments over time | Higher interest allocation in the beginning, decreasing over time |

| Annuity | Equal payments throughout the loan term | Lower interest allocation in the beginning, increasing over time |

As demonstrated in the table above, each amortization method has a unique impact on both the payment structure and interest allocation. Understanding these differences can help you determine which method aligns best with your financial objectives.

Choosing The Right Strategy

When selecting an amortization strategy, there are several factors to consider. Here are some key aspects to keep in mind:

- Loan Purpose: Determine if your loan is for a long-term investment or short-term expense.

- Cash Flow: Assess your current and future cash flow to ensure the chosen strategy is sustainable.

- Interest Savings: Calculate the interest savings potential of each amortization method to make an informed decision.

- Financial Goals: Consider your short and long-term financial goals, and choose an amortization strategy that aligns with them.

By carefully analyzing the combined impact and considering the factors listed above, you can choose the right amortization strategy that suits your specific needs. As always, consulting with a financial advisor or loan expert can provide valuable guidance in making this important decision.

:max_bytes(150000):strip_icc()/compoundinterest_final-5c67da5662ba458f8d9d229ab4ca4292.png)

Credit: www.investopedia.com

:max_bytes(150000):strip_icc()/principal.asp-final-80855b2caf65451db5843ac098d0994e.png)

Credit: www.investopedia.com

Frequently Asked Questions On What Are The Three Types Of Amortization?

What Is Amortization In Real Estate?

Amortization in real estate refers to the gradual repayment of a loan over a set period of time, typically through monthly installments. It allows borrowers to build equity in their property while steadily reducing their debt. This process ensures a systematic and predictable way to pay off a mortgage or loan while balancing interest and principal payments.

What Are The Benefits Of Amortization?

Amortization offers several benefits for borrowers. Firstly, it allows for affordable monthly payments, spreading out the cost of a large purchase over time. Additionally, as each payment is made, a portion goes towards reducing the principal, resulting in increased equity in the property.

Lastly, amortization helps borrowers qualify for tax advantages related to mortgage interest deductions.

What Are The Three Types Of Amortization?

The three types of amortization are:

1. Straight-Line: This method involves equal monthly payments throughout the loan term, with a consistent reduction in principal each month. 2. Balloon Payment: This type features smaller monthly payments for a set period followed by a large payment of the remaining balance. 3. Negative Amortization: In negative amortization, the monthly payments are lower than the interest owed, resulting in an increase in the loan balance.

How Does Amortization Affect Interest Payments?

Amortization affects interest payments by gradually decreasing the outstanding loan balance. As the principal diminishes, the interest is calculated based on the remaining balance. This means that over time, a larger portion of the monthly payment goes towards reducing the principal, resulting in decreased interest expenses.

Conclusion

Understanding the three types of amortization – straight-line, declining balance, and annuity – can be crucial for managing finances and making informed decisions. Each method has its unique characteristics and applications, offering flexibility to accommodate various financial scenarios. With this knowledge, individuals and businesses can better navigate loan repayments and financial planning.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is Amortization in Real Estate?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Amortization in real estate refers to the gradual repayment of a loan over a set period of time, typically through monthly installments. It allows borrowers to build equity in their property while steadily reducing their debt. This process ensures a systematic and predictable way to pay off a mortgage or loan while balancing interest and principal payments.” } } , { “@type”: “Question”, “name”: “What are the Benefits of Amortization?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Amortization offers several benefits for borrowers. Firstly, it allows for affordable monthly payments, spreading out the cost of a large purchase over time. Additionally, as each payment is made, a portion goes towards reducing the principal, resulting in increased equity in the property. Lastly, amortization helps borrowers qualify for tax advantages related to mortgage interest deductions.” } } , { “@type”: “Question”, “name”: “What are the Three Types of Amortization?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The three types of amortization are:1. Straight-Line: This method involves equal monthly payments throughout the loan term, with a consistent reduction in principal each month. 2. Balloon Payment: This type features smaller monthly payments for a set period followed by a large payment of the remaining balance. 3. Negative Amortization: In negative amortization, the monthly payments are lower than the interest owed, resulting in an increase in the loan balance.” } } , { “@type”: “Question”, “name”: “How does Amortization Affect Interest Payments?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Amortization affects interest payments by gradually decreasing the outstanding loan balance. As the principal diminishes, the interest is calculated based on the remaining balance. This means that over time, a larger portion of the monthly payment goes towards reducing the principal, resulting in decreased interest expenses.” } } ] }