Is It Illegal to Be Denied Credit? Protect Your Rights with These Legal Strategies!

It is not illegal to be denied credit, as lenders have the right to reject credit applications based on their own criteria. However, it is illegal for lenders to deny credit based on discriminatory factors such as race, religion, or gender.

In the United States, the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA) protect consumers from credit discrimination. These laws prohibit creditors from discriminating against applicants based on race, color, religion, national origin, sex, marital status, age, or receiving public assistance.

If an individual feels they have been unfairly denied credit, they can file a complaint with the Consumer Financial Protection Bureau or seek legal advice. Understanding one’s rights and the laws that protect against credit discrimination is important for consumers seeking fair and equal access to credit.

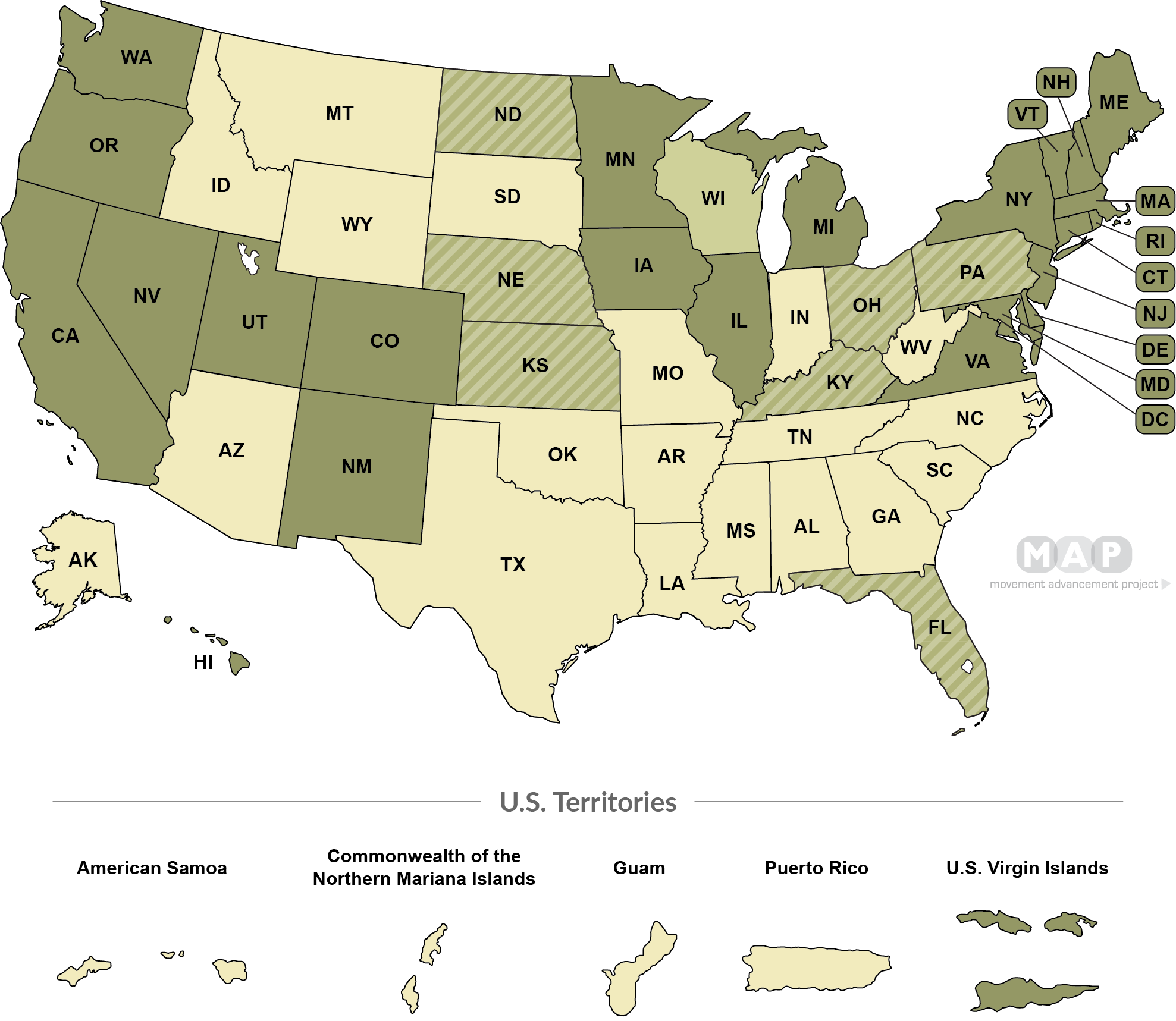

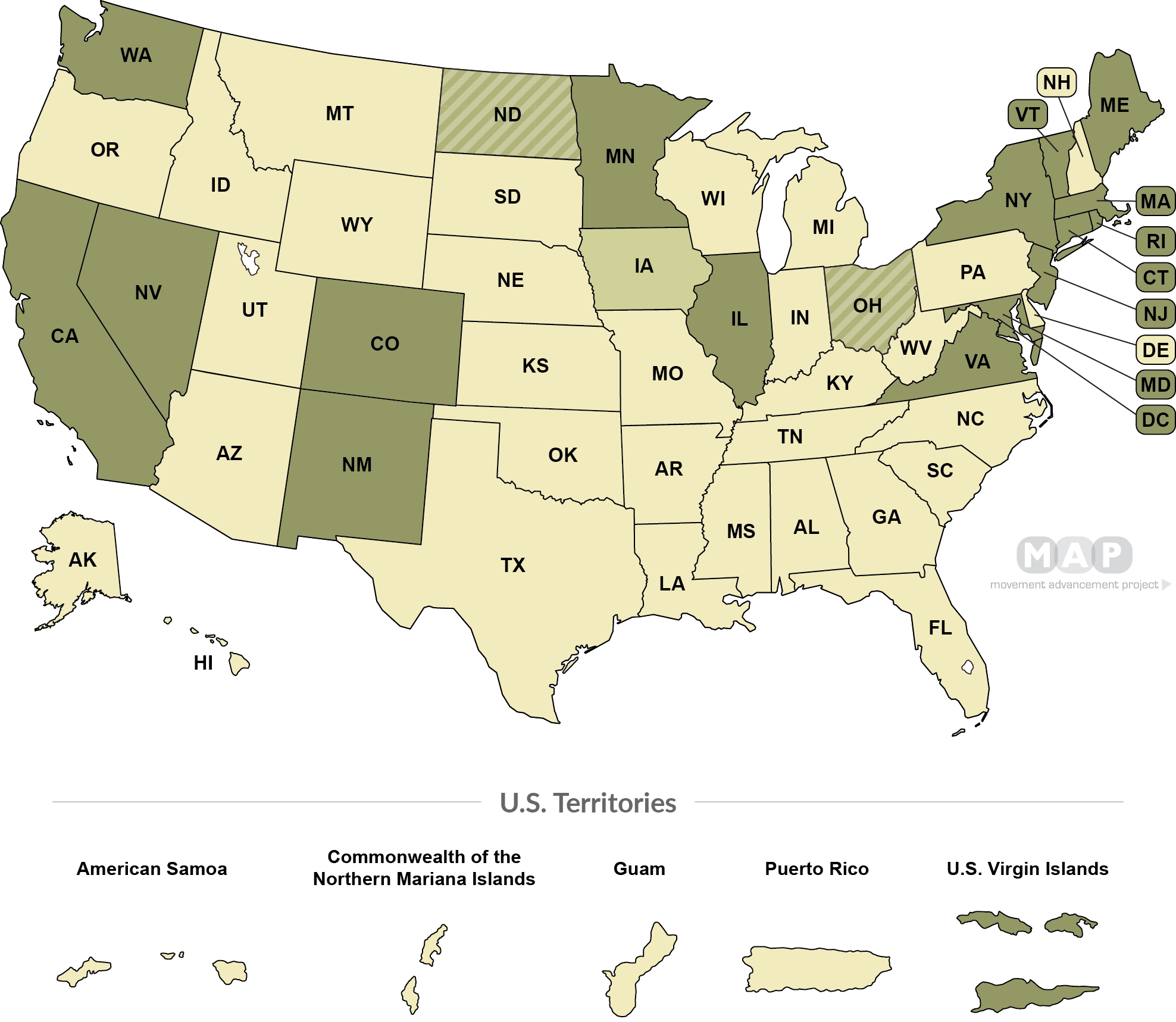

Credit: www.lgbtmap.org

Understanding Credit Denial

What Is Credit Denial

Credit denial occurs when a lender, such as a bank or credit card company, refuses to extend credit to an individual. This can have a significant impact on a person’s financial well-being, as credit denial can hinder their ability to make large purchases or even rent an apartment.

Common Reasons For Credit Denial

There are several common reasons why an individual may be denied credit, including a low credit score, a history of late payments, and high levels of existing debt. These factors can signal to lenders that the individual may be a risky borrower, leading to the denial of credit.

The Legal Framework

When it comes to credit denial, it’s essential to understand the legal framework that governs credit access. Several laws exist to protect consumers from unfair treatment by creditors. These laws ensure that every individual has the right to access credit without facing discrimination or unfair denials. Let’s take a closer look at the legal protections provided under the Fair Credit Reporting Act and the Equal Credit Opportunity Act.

The Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection, dissemination, and use of consumer credit information. Enforced by the Federal Trade Commission (FTC), the FCRA aims to promote accuracy, fairness, and privacy of consumer information contained in the files of consumer reporting agencies.

The Equal Credit Opportunity Act

The Equal Credit Opportunity Act (ECOA) prohibits creditors from discriminating against credit applicants based on race, color, religion, national origin, sex, marital status, age, or dependency on public assistance. The ECOA ensures that all individuals have an equal opportunity to access credit and prohibits practices that may discourage or restrict applicants on the basis of these protected characteristics.

Steps To Take When Denied Credit

When denied credit, it’s important to know that it is not illegal for lenders to deny credit. However, there are steps you can take to address the situation and improve your chances of being approved in the future.

If you ever find yourself being denied credit, it can feel disheartening and overwhelming. However, there are steps you can take to address the situation and improve your chances of being approved in the future. It’s important to stay calm and approach the issue proactively. Here are some key steps you should take:Review Your Credit Report

One of the first things you should do when denied credit is to review your credit report. Your credit report contains crucial information about your financial history and is often the basis for lenders’ decisions. Request a free copy of your credit report from the three major credit bureaus – TransUnion, Equifax, and Experian. Carefully scrutinize every detail to ensure accuracy.Correct Any Errors

After obtaining your credit report, carefully check for any errors or inaccuracies. Common mistakes can include incorrect personal information, outdated accounts, or fraudulent activity. It’s essential to dispute these errors by contacting the credit reporting agencies directly. Provide them with the necessary documentation and evidence to support your claim.Communicate With The Lender

Once you have reviewed your credit report and corrected any errors, it’s time to communicate with the lender who denied you credit. Reach out to them and inquire about the specific reason for the denial. Understanding the cause can give you insight into how to rectify the situation and be better prepared for your next credit application. Additionally, it is crucial to maintain clear and effective communication throughout the process. In conclusion, being denied credit can feel discouraging, but it doesn’t have to be a permanent setback. By following these steps – reviewing your credit report, correcting errors, and communicating with lenders – you can improve your chances of obtaining credit in the future. Remember, patience and persistence are key to achieving your financial goals.

Credit: www.politico.com

Legal Strategies For Challenging Credit Denial

Being denied credit can be frustrating and confusing, especially when you believe it’s unjustified. Fortunately, there are legal strategies you can employ to challenge credit denial. By understanding your rights and taking proactive steps, you can potentially reverse a credit decision and obtain the credit you deserve. Here are three effective strategies:

1. File A Dispute With The Credit Bureau

If you firmly believe your credit denial was unjustified, it’s crucial to begin by filing a dispute with the credit bureau. This step is important because credit bureaus are responsible for collecting and reporting your credit history to lenders. To file a dispute, follow these steps:

- Obtain a copy of your credit report from the credit bureau that issued the denial.

- Review the report carefully for any inaccuracies, errors, or fraudulent activity.

- Compose a clear and concise letter explaining the reasons why you believe the credit denial was incorrect.

- Include any supporting documentation, such as payment receipts, documentation of resolved disputes, or other relevant information.

- Send the dispute letter and documentation via certified mail with a return receipt requested to ensure its delivery and to create a paper trail.

By taking this step, you initiate a formal investigation into the accuracy of the credit information that led to the denial. The credit bureau is required to investigate your claim within a reasonable timeframe and provide a response.

2. Submit A Complaint To The Consumer Financial Protection Bureau

If you’re not satisfied with the outcome of the credit bureau’s investigation, you can escalate your case by submitting a complaint to the Consumer Financial Protection Bureau (CFPB). The CFPB is a government agency that oversees consumer financial protection laws and has the authority to investigate credit reporting agencies and lenders.

To submit a complaint to the CFPB, follow these steps:

- Visit the CFPB website and navigate to the “Submit a Complaint” section.

- Provide accurate and detailed information about your credit denial case, including the name of the credit reporting agency, relevant dates, and any supporting evidence or documentation.

- Submit your complaint online through the CFPB’s secure portal.

- Keep all communication and correspondence regarding your complaint organized and easily accessible.

By lodging a complaint with the CFPB, you bring your case to the attention of a regulatory authority that has the power to investigate and take action against unlawful credit practices.

3. Consult With An Attorney

If you’ve exhausted the previous options and still haven’t achieved the desired result, consulting with an attorney who specializes in credit and consumer law may be your best course of action. An attorney can provide expert advice tailored to your specific situation and guide you through the legal processes involved in challenging credit denial.

When selecting an attorney, ensure they have experience handling credit-related cases and a strong track record of success. Tap into their knowledge and expertise to navigate the complex landscape of credit laws, regulations, and potential legal strategies that will increase your chances of obtaining credit.

In conclusion, if you’ve been denied credit and believe it was unjustified, don’t lose hope. By utilizing these legal strategies, you can actively challenge the credit denial and work towards achieving the credit you deserve.

Know Your Rights: Getting Compensation

When you are denied credit, it’s important to know that you have rights and options for seeking compensation. Understanding these options can help you navigate through the process and ensure that you are treated fairly. In this section, we will discuss the different ways you can seek compensation if you have been illegally denied credit.

Understanding Compensation Options

There are various compensation options available to individuals who have been unlawfully denied credit. These options can help you recover any damages you may have suffered due to the denial. It’s crucial to be familiar with these options so that you can make an informed decision about the course of action to take:

- Mandatory damages: In some cases, the law requires the creditor to pay you a certain amount of money if they have violated your rights. These mandatory damages are set by law and can help compensate you for the harm caused by the denial.

- Actual damages: If you can prove that the denial of credit has caused you financial losses, you may be entitled to receive compensation for these actual damages. This can include expenses incurred in trying to secure credit elsewhere or any harm caused to your credit score.

- Punitive damages: In situations where the creditor’s denial of credit was willful or reckless, you may be eligible to receive punitive damages. These damages are meant to punish the creditor for their actions and deter them from engaging in similar behavior in the future.

- Attorney’s fees and costs: If you decide to pursue legal action, you may also be able to recover your attorney’s fees and other costs associated with the lawsuit. This can help alleviate the financial burden of seeking compensation.

Filing A Lawsuit

If you believe your rights have been violated and you are unable to resolve the issue through other means, filing a lawsuit may be an option. To initiate a lawsuit, you will need to follow specific procedures, which can vary depending on your jurisdiction. Here are some steps to consider:

- Gather evidence: Collect any documentation, correspondence, or records that support your claim. This evidence can be crucial in establishing the validity of your case.

- Consult with an attorney: It’s highly recommended to seek legal advice from an experienced attorney specializing in credit denial cases. They can guide you through the legal process, provide expert analysis of your situation, and advocate for your rights.

- File a complaint: Comply with the necessary legal requirements to initiate your lawsuit. This typically involves submitting a formal complaint to the appropriate court, outlining the details of your case and the relief you are seeking.

- Attend court proceedings: Throughout the litigation process, you will need to attend court hearings, present evidence, and potentially testify in support of your claim. Your attorney will guide you through these proceedings.

- Consider settlement: It’s important to be open to settlement negotiations with the creditor. In some cases, reaching a settlement agreement can be advantageous, as it avoids the time and expense of a full trial.

Obtaining Legal Representation

Having skilled legal representation is crucial in maximizing your chances of obtaining compensation for a denied credit. An attorney with experience in credit denial cases can help you navigate the complex legal landscape, ensure your rights are protected, and advocate for fair compensation. Here are a few ways to find and select the right legal representation for your case:

- Research: Conduct thorough research to identify attorneys or law firms that specialize in credit denial cases. Look for their experience, track record of success, and any reviews or testimonials from previous clients.

- Free consultations: Many attorneys offer free initial consultations to assess your case and determine if they are a good fit for your needs. Take advantage of these consultations to discuss your situation, ask questions, and evaluate the attorney’s expertise.

- Fee structures: Inquire about the attorney’s fee structure and payment arrangements. Some attorneys work on a contingency basis, which means they only get paid if they win your case. Others may charge hourly rates or flat fees.

- Communication: Ensure that the attorney you choose maintains open and clear communication throughout your case. You should feel comfortable asking questions and receiving updates on the progress of your claim.

- Trust your instincts: Ultimately, trust your instincts when selecting legal representation. Choose an attorney you feel confident in, who understands your situation, and who you believe will diligently fight for your rights.

:max_bytes(150000):strip_icc()/dotdash-the-history-of-lending-discrimination-5076948-Final-93e5c7733a534ae18fd5d08bcd7d08fe.jpg)

Credit: www.investopedia.com

Frequently Asked Questions On Is It Illegal To Be Denied Credit?

What Are Your Rights If You Are Denied Credit?

If you’re denied credit, you have the right to a free credit report. You can dispute any errors and request the reasons for denial. Additionally, you can ask the creditor for an explanation. If the denial is due to your credit report, you can work on resolving issues.

Is Denial Of Credit Illegal?

Denial of credit based on protected factors such as race, religion, or gender is illegal. It violates the Equal Credit Opportunity Act.

On What Grounds Would It Be Illegal To Deny Credit?

It is illegal to deny credit based on grounds such as race, religion, national origin, sex, marital status, age, or receiving public assistance.

What If Consumers Are Denied The Right To Credit?

Consumers’ denial of credit rights can prevent them from accessing financial opportunities. Limited credit may hinder their ability to make purchases or secure loans for important needs. It is essential to address such issues and advocate for fair credit practices to ensure equal financial opportunities for all consumers.

Conclusion

Being denied credit is not necessarily illegal, but it can still be both frustrating and impactful on an individual’s financial standing. Understanding the reasons behind a credit denial, such as a low credit score or insufficient income, can help in improving one’s creditworthiness.

Taking proactive measures to manage and build credit can also lead to better opportunities for obtaining credit in the future. Remember, staying informed and informed about your legal rights and options is essential when it comes to credit.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What are your rights if you are denied credit?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “If you’re denied credit, you have the right to a free credit report. You can dispute any errors and request the reasons for denial. Additionally, you can ask the creditor for an explanation. If the denial is due to your credit report, you can work on resolving issues.” } } , { “@type”: “Question”, “name”: “Is denial of credit illegal?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Denial of credit based on protected factors such as race, religion, or gender is illegal. It violates the Equal Credit Opportunity Act.” } } , { “@type”: “Question”, “name”: “On what grounds would it be illegal to deny credit?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “It is illegal to deny credit based on grounds such as race, religion, national origin, sex, marital status, age, or receiving public assistance.” } } , { “@type”: “Question”, “name”: “What if consumers are denied the right to credit?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Consumers’ denial of credit rights can prevent them from accessing financial opportunities. Limited credit may hinder their ability to make purchases or secure loans for important needs. It is essential to address such issues and advocate for fair credit practices to ensure equal financial opportunities for all consumers.” } } ] }