How to Skyrocket Your Credit Score: From 600 to 750!

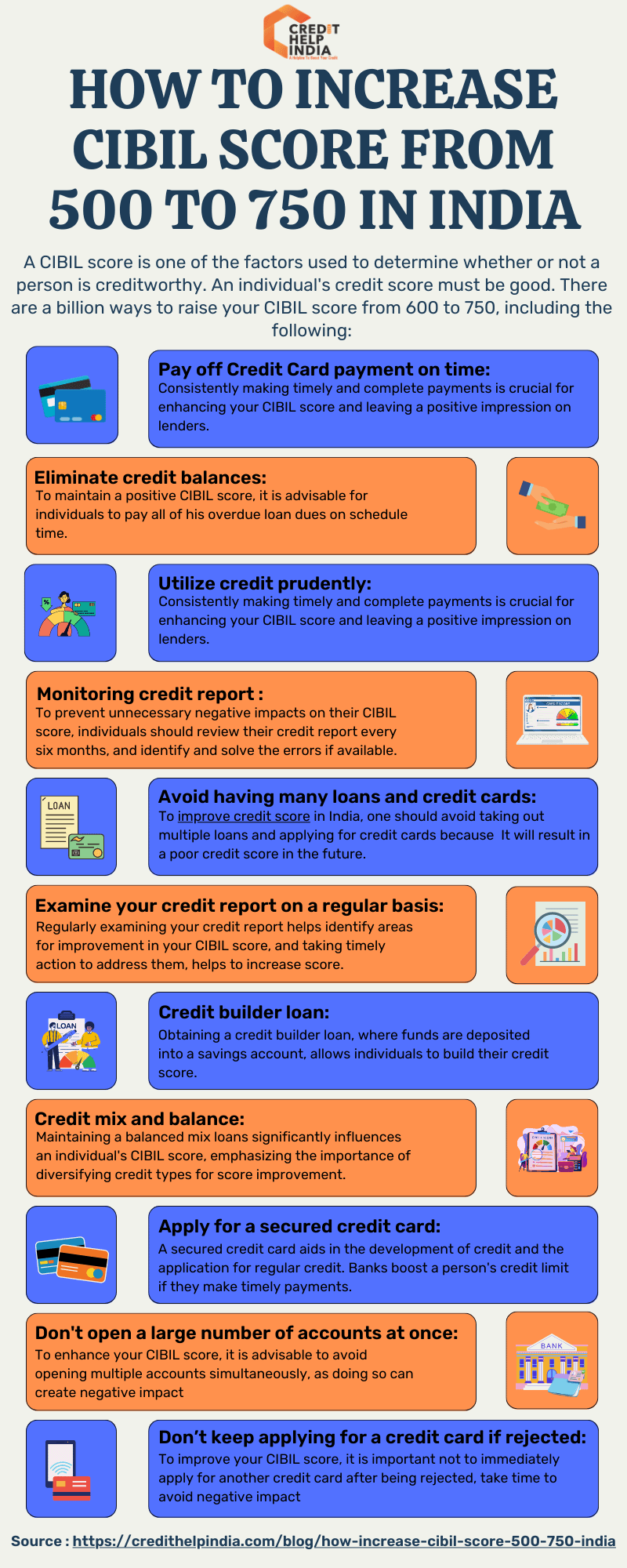

To go from a 600 to a 750 credit score, focus on paying bills on time and reducing credit card balances. A combination of timely payments and credit utilization improvements will help raise your credit score.

Introducing an excellent credit score can open a world of financial opportunities, such as securing lower interest rates on loans, acquiring better credit card offers, and even increasing your employment prospects. If you currently have a credit score of 600 and aspire to reach the coveted 750 mark, there are specific strategies you can employ to accomplish this goal.

We will discuss actionable steps you can take to improve your credit score, focusing on two key areas: making timely payments and reducing your credit card balances. By implementing these strategies, you can set yourself on the path to achieving a credit score of 750 or higher.

Credit: www.audible.com

Understanding Credit Scores

Learn how to boost your credit score from 600 to 750 with smart financial management. Understand the factors that influence credit scores and take steps to improve them. By paying bills on time, keeping credit card balances low, and checking your credit report regularly, you can build a healthier credit profile.

Understanding your credit score is essential when it comes to improving it. Your credit score is a numerical representation of your creditworthiness, indicating how likely you are to repay your debts. Lenders, landlords, and even potential employers use this score to assess your financial reliability.

What Is A Credit Score?

A credit score is a three-digit number that is calculated based on several factors, providing a snapshot of your creditworthiness. The most commonly used credit score model is the FICO score, which ranges from 300 to 850. A score above 670 is generally considered good, and a score above 740 is considered excellent.

Factors That Affect Your Credit Score

Several factors contribute to your credit score, and understanding them is crucial for improving it. Here are the key factors:

- Payment History: This is the most influential factor, accounting for 35% of your credit score. It considers your past payment behavior, highlighting if you have paid your bills on time.

- Amounts Owed: This factor accounts for 30% of your credit score. It considers the total amount you owe in relation to your credit limits, also known as your credit utilization ratio.

- Length of Credit History: This factor accounts for 15% of your credit score. It considers the age of your oldest account, average account age, and the time since specific account activities.

- New Credit: This factor accounts for 10% of your credit score. It looks at the number of recently opened accounts and the number of credit inquiries

- Credit Mix: This factor accounts for 10% of your credit score. It considers the different types of credit accounts you have, such as credit cards, mortgage loans, and car loans.

By understanding these key factors, you can take proactive steps to improve your credit score. Whether it’s consistently making on-time payments, reducing your credit card balances, or diversifying your credit mix, each factor plays a crucial role in boosting your score. With a plan in place and a commitment to financial responsibility, you can go from a 600 credit score to an impressive 750 and enjoy the benefits that come with it.

Credit: jprentals.com

Knowing Where You Stand

Learn how to boost your credit score from 600 to 750 with “Knowing Where You Stand. ” Discover practical strategies and tips to improve your creditworthiness and secure better financial opportunities. Start taking control of your credit score today.

If you want to raise your credit score from 600 to 750, the first step is knowing where you stand. Before you can implement any strategies to improve your credit, you need to obtain your credit report and analyze it carefully. In this section, we will discuss how to obtain your credit report and how to analyze it effectively.

Obtaining Your Credit Report

Obtaining your credit report is a crucial first step in understanding your current credit situation. You can request a free copy of your credit report from each of the three major credit bureaus, TransUnion, Equifax, and Experian. To expedite the process, here’s a simple guide:

- Visit the official websites of the credit bureaus.

- Look for the “Request your credit report” option.

- Fill out the necessary information, including your name, address, social security number, and date of birth.

- Choose the type of report you want (individual or joint).

- Verify your identity by answering a few security questions.

- Submit your request and wait for your credit report to arrive via mail or download it online.

Analyzing Your Credit Report

Once you have your credit report in hand, it’s time to analyze it carefully. This step is important because it allows you to identify any negative items or errors that may be pulling your credit score down. Here’s a simple process for analyzing your credit report:

- Review your personal information: Check if your name, address, and other personal details are accurate and up-to-date. Any errors in this section should be reported and corrected.

- Examine your accounts: Go through your open and closed accounts, making sure they are all accounted for. Look for any discrepancies, such as accounts that do not belong to you or duplicate accounts.

- Check your payment history: Your payment history has a significant impact on your credit score. Look for any missed or late payments that may be negatively affecting your score.

- Inspect your credit utilization: Credit utilization refers to the percentage of your available credit that you are currently using. Aim to keep this ratio below 30% to maintain a healthy credit score.

- Identify any negative items: Look for any negative items on your report, such as bankruptcies, foreclosures, or accounts in collections. These items can significantly lower your credit score and may need to be addressed.

By carefully examining your credit report, you can pinpoint areas that need improvement and take the necessary steps to boost your credit score. Remember, improving your credit score takes time and effort, but with a proactive approach and a solid plan, you can achieve your goal of raising your credit score from 600 to 750.

Taking Immediate Action

When it comes to improving your credit score from 600 to 750, taking immediate action is crucial. By implementing the right strategies, you can make tangible progress in a short time.

Paying Bills On Time

Prioritize paying bills on time to demonstrate responsible financial behavior. Setting up automatic payments or creating calendar reminders can help you stay on track.

Reducing Credit Card Balances

Focus on reducing credit card balances to decrease your credit utilization ratio. Keeping your balances below 30% of your credit limit can positively impact your credit score.

Building A Solid Credit History

Building a solid credit history is crucial to improving your credit score. It shows lenders that you are a responsible borrower and can be trusted with credit. By following a few key strategies, you can gradually work towards a higher credit score.

Opening New Credit Accounts Wisely

When it comes to opening new credit accounts, it’s important to proceed with caution. While having a mix of credit types can positively impact your credit score, it’s crucial to open new accounts wisely. Here are a few tips to keep in mind:

- Research and compare different credit card offers to find the best fit for your needs.

- Apply for new credit accounts sparingly to avoid multiple hard inquiries that can temporarily lower your credit score.

- Avoid opening too many new accounts within a short period as it may be viewed as a sign of financial instability.

- Ensure that you can comfortably manage the new credit account, including its fees and interest rates.

Managing Different Types Of Credit

A diverse credit mix can demonstrate your ability to handle different types of credit responsibly. Here’s how you can manage different types of credit effectively:

- Continue making timely payments on your existing credit accounts.

- Maintain a low credit utilization ratio by keeping your credit card balances relatively low compared to your credit limit.

- Consider diversifying your credit mix by adding installment loans, such as auto loans or personal loans, to your credit profile.

- Keep unused credit accounts open to show a longer credit history and lower your credit utilization ratio.

Remember, building a solid credit history takes time and patience. By responsibly managing your credit accounts and following these strategies, you can gradually elevate your credit score from 600 to 750 and beyond. Stay consistent and focused on your financial goals, and you’ll see progress over time.

Long-term Strategies For A Stellar Score

Boosting a credit score from 600 to 750 requires long-term strategies. Focus on paying bills consistently, reducing debt, and keeping credit utilization low. Building a strong payment history and being patient will help achieve a stellar credit score.

Monitoring Your Credit Regularly

Regularly monitoring your credit is crucial for improving your credit score in the long term. By keeping a close eye on your credit reports, you can stay informed about any errors or fraudulent activity that may be negatively impacting your score. Make it a habit to check your credit reports at least once a year, if not more frequently. This can be easily done by requesting your reports from each of the major credit bureaus – Experian, Equifax, and TransUnion.

Understanding Credit Utilization

Understanding credit utilization is essential in your journey towards a better credit score. Credit utilization refers to the percentage of your available credit that you are currently using. It plays a significant role in determining your creditworthiness. To maintain a stellar credit score, aim to keep your credit utilization ratio below 30%. For example, if you have a credit card with a $10,000 limit, try to keep your outstanding credit card balance below $3,000. By keeping your credit utilization in check, you demonstrate responsible borrowing habits and enhance your creditworthiness.

One effective strategy to improve credit utilization is to pay down your existing debts. By reducing your outstanding balances, you can lower your credit utilization ratio and demonstrate to lenders that you are managing your debt responsibly. Additionally, avoid maxing out your credit cards, as this signals potential financial strain to lenders and can negatively impact your credit score.

Credit: www.upwork.com

Frequently Asked Questions For How To Go From 600 To 750 Credit Score?

How To Get Credit Score From 600 To 750?

To improve your credit score from 600 to 750, pay bills on time, reduce credit card balances, avoid new debt, and monitor your credit report regularly. Also, consider using a secured credit card and diversifying your credit mix.

How Fast Can You Go From 600 To 700 Credit Score?

Improving your credit score from 600 to 700 can vary based on individual circumstances. Factors like payment history, credit utilization, and credit length can impact the speed of improvement. Consistently paying bills on time, reducing debt, and maintaining a low credit utilization ratio can help increase your score over time.

How Long Does It Take To Build Credit Score To 750?

It typically takes time and consistent financial behavior to build a credit score of 750. By making timely payments, keeping credit utilization low, and maintaining a mix of credit accounts, you can improve your score gradually. Regularly monitor your credit report for accuracy and avoid any negative actions that may hurt your score.

How To Get A Credit Score Of 700 In 6 Months?

To achieve a credit score of 700 in 6 months, pay bills on time, reduce debt, and limit new credit applications. Regularly check your credit report for errors and consider credit-building products like secured cards or credit-builder loans.

Conclusion

In boosting your credit score, consistency and discipline are key. By practicing good financial habits, you can steadily improve your credit score over time. It’s essential to monitor your credit report regularly to track your progress and address any errors.

Remember, a higher credit score opens up new opportunities for better financial products and lower interest rates, leading to a more secure financial future.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “How to get credit score from 600 to 750?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To improve your credit score from 600 to 750, pay bills on time, reduce credit card balances, avoid new debt, and monitor your credit report regularly. Also, consider using a secured credit card and diversifying your credit mix.” } } , { “@type”: “Question”, “name”: “How fast can you go from 600 to 700 credit score?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Improving your credit score from 600 to 700 can vary based on individual circumstances. Factors like payment history, credit utilization, and credit length can impact the speed of improvement. Consistently paying bills on time, reducing debt, and maintaining a low credit utilization ratio can help increase your score over time.” } } , { “@type”: “Question”, “name”: “How long does it take to build credit score to 750?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “It typically takes time and consistent financial behavior to build a credit score of 750. By making timely payments, keeping credit utilization low, and maintaining a mix of credit accounts, you can improve your score gradually. Regularly monitor your credit report for accuracy and avoid any negative actions that may hurt your score.” } } , { “@type”: “Question”, “name”: “How to get a credit score of 700 in 6 months?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To achieve a credit score of 700 in 6 months, pay bills on time, reduce debt, and limit new credit applications. Regularly check your credit report for errors and consider credit-building products like secured cards or credit-builder loans.” } } ] }