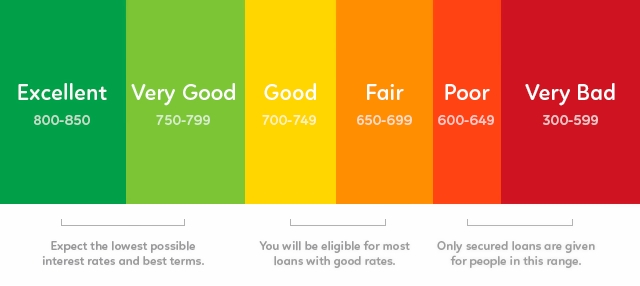

Transform Your Credit Score: How Fast Can You Go from 600 to 700?

It is difficult to determine how fast you can go from a 600 to 700 credit score as it depends on various factors such as your credit history, current financial situation, and how proactive you are in improving your credit score. However, by consistently paying your bills on time, reducing credit card balances, and addressing any negative items on your credit report, you can gradually raise your credit score over time.

Factors Affecting Credit Score Improvement

Improving your credit score from 600 to 700 depends on various factors. These include timely bill payments, reducing debt, and minimizing credit inquiries. Additionally, it’s important to regularly check your credit report for errors and maintain a good mix of credit types.

Factors Affecting Credit Score Improvement Improving your credit score is an important step towards achieving financial stability. Whether you want to qualify for a mortgage, get approved for a car loan, or simply have better access to credit, increasing your credit score from 600 to 700 can make a significant difference. However, it’s essential to understand the factors that affect credit score improvement. By focusing on these key aspects, you can effectively boost your credit score and reach your financial goals.Payment History

One of the most influential factors impacting your credit score is your payment history. Lenders want reassurance that you are a reliable borrower who can meet their repayment obligations. By making timely payments on your credit accounts, such as loans and credit cards, you can demonstrate responsibility and build a positive payment history. Even a single late payment can negatively impact your credit score, so it’s vital to prioritize meeting all payment deadlines.Credit Utilization

Credit utilization refers to the amount of credit you are currently using compared to your available credit limit. Keeping your credit utilization ratio low is crucial as it can significantly impact your credit score. Ideally, you should aim to use less than 30% of your available credit. For example, if you have a credit limit of $5,000, it’s advisable to keep your outstanding balances below $1,500. By maintaining a low credit utilization ratio, you can demonstrate responsible credit management, which is positively reflected in your credit score.Length Of Credit History

The length of your credit history is another crucial factor that affects your credit score. Lenders often view a longer credit history as an indicator of financial stability and responsibility. If you’re looking to improve your credit score, it’s essential to establish a solid credit history by opening accounts and maintaining them over time. Avoid closing old credit accounts, especially those with a positive payment history, as they contribute to the length of your credit history. In conclusion, improving your credit score from 600 to 700 requires focusing on multiple factors that impact your creditworthiness. By maintaining a positive payment history, keeping your credit utilization low, and building a solid credit history over time, you can gradually increase your credit score. Remember, it may take some time and consistency, but the effort is well worth it when it comes to achieving your financial aspirations.

Credit: time.com

Strategies For Rapid Credit Score Enhancement

If you are aiming to improve your credit score quickly, there are several strategies you can incorporate into your financial habits. By implementing these strategies consistently, you can go from a 600 to a 700 credit score in no time. Below are three key strategies that can help you achieve rapid credit score enhancement.

Timely Payments

Paying your bills on time is crucial when it comes to improving your credit score. Late payments can have a significant negative impact on your creditworthiness. To avoid this, set up automatic payments for your recurring bills or use reminders to ensure that you never miss a due date. By consistently making timely payments, you are demonstrating to creditors that you are responsible and can be trusted with credit.

Reducing Credit Card Balances

High credit card balances can hurt your credit score. Aim to keep your credit card balances as low as possible, ideally below 30% of your credit limit. Paying down your credit card debt can have a positive impact on your credit utilization ratio, which is a key factor in credit scoring models. Consider creating a budget and allocating extra funds towards paying off your balances. By gradually reducing your credit card debt, you can improve your credit score significantly.

Diversifying Credit Mix

The types of credit you have can also impact your credit score. Lenders like to see a variety of credit accounts on your credit report, such as credit cards, installment loans, and a mortgage. If you only have credit card debt, consider diversifying your credit mix by applying for different types of credit that suit your financial situation. However, it is important to avoid taking on too much debt in an attempt to diversify your credit mix, as this can have a negative impact on your credit score.

By incorporating these strategies into your financial routine, you can accelerate your journey from a 600 to a 700 credit score. Remember, consistency and discipline are key when it comes to rapid credit score enhancement. With the right approach, you can make significant progress towards achieving a healthier credit profile.

Avoiding Common Pitfalls

When working to improve your credit score from 600 to 700, it’s important to be aware of common pitfalls that can hinder your progress. Avoiding these pitfalls will help you reach your goal more efficiently and effectively.

Opening Too Many New Accounts

Opening too many new accounts at once can negatively impact your credit score. Each new account creates a hard inquiry on your credit report, which can lower your score temporarily. It’s essential to carefully consider the necessity of each new account and space out applications to minimize the impact on your score.

Closing Old Accounts Too Soon

Closing old accounts too soon can also harm your credit score. The length of your credit history contributes to your score, and closing old accounts can reduce the average age of your accounts. This can potentially lower your score, so it’s crucial to evaluate the impact on your credit history before closing any accounts.

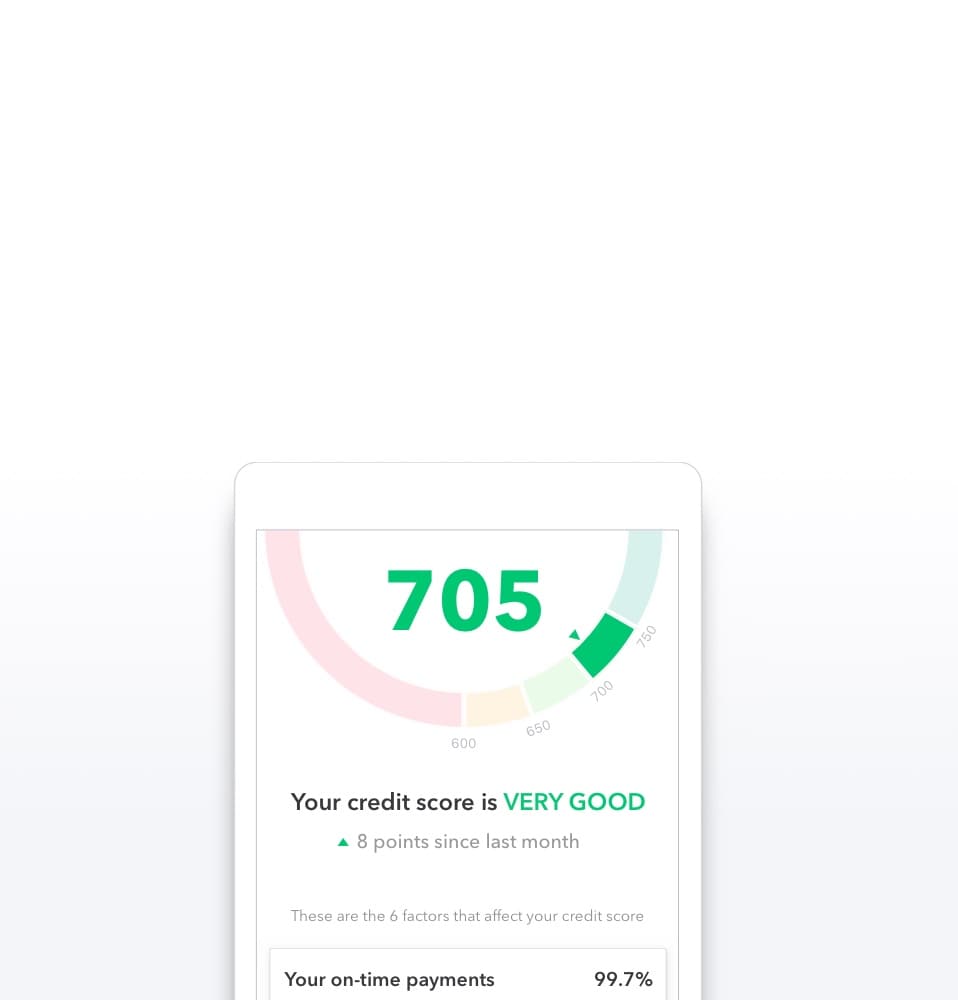

Credit: mint.intuit.com

Monitoring And Maintaining Progress

Your journey to a 700 credit score doesn’t end once you reach the 600 mark. It’s essential to keep a close eye on your credit reports and continually manage your credit behavior. Monitoring and maintaining progress are crucial steps in ensuring long-term financial stability.

Regularly Checking Credit Reports

One of the most important things you can do to monitor your credit progress is to regularly check your credit reports. This means obtaining copies of your reports from the three major credit bureaus – Equifax, Experian, and TransUnion.

To make this process easier, you can request a free copy of your credit report from each bureau once a year through AnnualCreditReport.com. By reviewing your reports, you can check for any errors, inaccuracies, or fraudulent activity that might be negatively impacting your credit score.

Continuously Managing Credit Behavior

To maintain and improve your credit score, it’s important to continuously manage your credit behavior. This means being responsible with credit by making payments on time, paying off debts, and keeping credit utilization low.

Avoiding excessive credit applications and taking on unnecessary debt can also help in maintaining a healthy credit score. It’s important to understand that your credit behavior has a significant impact on your overall score, so it’s crucial to make wise financial decisions.

To keep yourself on track, consider setting up reminders and automating payments for bills and credit card balances. This will help you avoid missing due dates and minimize the risk of late payments, which can adversely affect your credit score.

| Best practices for managing credit behavior: |

|---|

|

Remember, building credit takes time and effort. Monitoring your credit reports and managing your credit behavior are ongoing processes that require commitment and diligence. By making positive financial choices and staying proactive, you can steadily move towards improving your credit score from 600 to 700 and beyond.

Seeking Professional Advice

If you’re looking to improve your credit score from 600 to 700, seeking professional advice can be a smart move. Financial advisors and credit counseling services can provide you with valuable guidance and strategies to help you climb the credit ladder faster. Let’s explore the options available to you:

Consulting With Financial Advisors

Enlisting the help of a financial advisor can be a game-changer when it comes to credit score improvement. These professionals possess expert knowledge of the credit industry and can provide personalized advice tailored to your unique financial situation. They can assess your current credit status, identify areas for improvement, and recommend specific actions that will enable you to see results faster. With their guidance, you’ll be equipped with the right strategies and resources to accelerate your credit score growth.

Considering Credit Counseling Services

Credit counseling services can also offer invaluable assistance in your journey towards a higher credit score. Certified credit counselors are well-versed in credit repair techniques and can help you develop a comprehensive plan to achieve your credit goals. They can negotiate with creditors on your behalf, consolidate your debts into a more manageable payment plan, and provide you with educational resources to enhance your money management skills. With the support of credit counseling services, your credit score can experience a noteworthy transformation in a relatively short amount of time.

In conclusion, seeking professional advice when aiming to improve your credit score from 600 to 700 is a wise decision. Financial advisors and credit counseling services can provide you with the expertise, guidance, and tools necessary to expedite the credit score growth process. Consult with these professionals, implement their recommendations, and watch as your credit score steadily rises towards your desired target.

Credit: www.nitrocollege.com

Frequently Asked Questions For How Fast Can You Go From 600 To 700 Credit Score?

How Long Does It Take To Go From 600 To 700 Credit Score?

It can take several months to a few years to go from a 600 to a 700 credit score. The exact timeframe depends on factors like how you manage your credit, payment history, and existing debt. Consistently paying bills on time, reducing debt, and using credit responsibly can help improve your score faster.

How Long Does It Take To Go From 500 To 700?

It typically takes around 6 to 12 months to go from a credit score of 500 to 700, depending on various factors like timely payments, reducing debt, and maintaining a good credit utilization ratio. Setting a budget and consistently following it can help speed up the process.

How To Get A 700 Credit Score In 6 Months?

To achieve a 700 credit score in 6 months, pay bills on time, reduce credit card balances, and check credit reports for errors. Open new accounts sparingly to avoid potential negative impacts on the credit score. Regularly monitor progress to stay on track.

How To Increase Credit Score By 100 Points In 30 Days?

To increase your credit score by 100 points in 30 days, follow these steps: 1. Pay your bills on time and avoid late payments. 2. Keep your credit card balances low and aim to use less than 30% of your available credit.

3. Check your credit report for errors and dispute any inaccuracies. 4. Avoid closing old credit accounts and consider opening new ones. 5. Limit credit inquiries and avoid applying for new credit. By taking these actions, you can improve your credit score quickly.

Conclusion

In a nutshell, improving your credit score from 600 to 700 is achievable with dedication and discipline. By implementing healthy financial habits and consistently paying bills on time, you can see gradual, but steady progress. Keep monitoring your credit report, and seek professional advice if needed.

With patience and persistence, reaching a 700 credit score is well within reach.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “How long does it take to go from 600 to 700 credit score?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “It can take several months to a few years to go from a 600 to a 700 credit score. The exact timeframe depends on factors like how you manage your credit, payment history, and existing debt. Consistently paying bills on time, reducing debt, and using credit responsibly can help improve your score faster.” } } , { “@type”: “Question”, “name”: “How long does it take to go from 500 to 700?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “It typically takes around 6 to 12 months to go from a credit score of 500 to 700, depending on various factors like timely payments, reducing debt, and maintaining a good credit utilization ratio. Setting a budget and consistently following it can help speed up the process.” } } , { “@type”: “Question”, “name”: “How to get a 700 credit score in 6 months?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To achieve a 700 credit score in 6 months, pay bills on time, reduce credit card balances, and check credit reports for errors. Open new accounts sparingly to avoid potential negative impacts on the credit score. Regularly monitor progress to stay on track.” } } , { “@type”: “Question”, “name”: “How to increase credit score by 100 points in 30 days?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To increase your credit score by 100 points in 30 days, follow these steps: 1. Pay your bills on time and avoid late payments. 2. Keep your credit card balances low and aim to use less than 30% of your available credit. 3. Check your credit report for errors and dispute any inaccuracies. 4. Avoid closing old credit accounts and consider opening new ones. 5. Limit credit inquiries and avoid applying for new credit. By taking these actions, you can improve your credit score quickly.” } } ] }