How Do You Terminate a Promissory Note? Discover the Expert Techniques

To terminate a promissory note, you can mutually agree with the lender to pay off the debt or a legal way.

Credit: store.ceb.com

The Basics Of A Promissory Note Termination

In this section, we will explore the fundamental aspects of terminating a promissory note. Understanding the promissory note and identifying termination conditions are crucial steps in this process.

Understanding The Promissory Note

A promissory note is a legal document that details a borrower’s promise to repay a loan to a lender. It sets out the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any collateral or security provided.

When terminating a promissory note, it is essential to have a clear understanding of its contents, including the rights and responsibilities of both parties involved.

Identifying Termination Conditions

Terminating a promissory note typically requires the satisfaction of certain conditions. These conditions may be explicitly stated within the note or subject to negotiation between the borrower and lender.

Here are some common termination conditions you need to consider:

1. Full Repayment of the Principal Amount

The borrower must repay the entire principal amount borrowed, including any accrued interest, before terminating the promissory note. This ensures that the lender receives full compensation as agreed upon.

2. Adherence to Repayment Schedule

The borrower must adhere to the agreed-upon repayment schedule, making all payments in a timely manner. Regular, consistent payments demonstrate the borrower’s commitment to fulfilling their obligations.

3. Release of Collateral or Security

If the promissory note is secured by collateral or other forms of security, the borrower may need to release or provide alternative security before terminating the note. This helps protect the lender’s interests and ensures they are adequately compensated.

4. Mutual Agreement

In some cases, both the borrower and lender may agree to terminate the promissory note before the loan is fully repaid. This could be due to changing circumstances or the need for a new arrangement. It is crucial that both parties consent to the termination in writing.

In Summary

Terminating a promissory note requires a thorough understanding of the note’s contents and the fulfillment of specific termination conditions. It is essential to consult with legal professionals or financial advisors to ensure compliance with applicable laws and to protect your interests.

Legal Considerations And Requirements

When it comes to terminating a promissory note, understanding the legal implications and complying with contractual obligations is crucial. Failing to meet these requirements can lead to potential legal consequences. To ensure a smooth termination process, it is important to be aware of the legal considerations and follow the necessary steps.

Understanding Legal Implications

Before terminating a promissory note, it is essential to understand the legal implications involved. A promissory note is a legally binding financial agreement between two parties, typically a borrower and a lender. Terminating the note prematurely or in violation of its terms can result in serious legal repercussions.

Therefore, it is crucial to review the terms of the promissory note and determine the conditions under which termination is allowed. Some promissory notes may have specific clauses or provisions that outline the process for termination, including any penalties or consequences.

In order to avoid legal complications, it is advisable to consult with a legal professional who specializes in contract law.

Complying With Contractual Obligations

When terminating a promissory note, it is important to comply with all contractual obligations. This includes adhering to the agreed-upon repayment terms, interest rates, and any other conditions outlined in the note.

One key aspect to consider is whether there are any prepayment penalties or fees associated with early termination. Some promissory notes may impose additional costs for terminating the agreement before the agreed-upon maturity date. Understanding and fulfilling these contractual obligations can help mitigate any potential legal disputes that may arise.

It is crucial to carefully review the terms of the promissory note and ensure compliance with all contractual obligations before proceeding with termination.

Termination Methods And Procedures

When terminating a promissory note, it’s essential to follow specific methods and procedures to ensure a clear and legally binding termination. The termination of a promissory note involves various steps and documentation to ensure that the agreement is concluded appropriately.

Negotiation And Agreement

Negotiation and agreement between the parties involved is a common method for terminating a promissory note. This process involves open communication and discussion to reach a mutual understanding regarding the termination of the note. Both the lender and the borrower need to come to an agreement on the terms and conditions of the termination, final payment, and any other related matters, ensuring that all parties are satisfied with the conclusion of the promissory note.

Formal Termination Documentation

Formal termination documentation plays a crucial role in the proper conclusion of a promissory note. This involves drafting and executing specific legal documents that officially terminate the agreement. The documentation should include clear details of the termination, including the date of termination, final payment amount, and any other relevant terms and conditions. This formal documentation serves as a record of the termination and helps to ensure that both parties fulfill their obligations and abide by the terms of the agreement.

Credit: collegeaidpro.com

Consequences And Impact Of Termination

To terminate a promissory note, you must carefully consider the consequences and impact. It is essential to follow the legal procedures, as failing to do so can lead to legal ramifications. Seek legal advice to ensure a smooth and proper termination process.

Financial Ramifications

When it comes to terminating a promissory note, there are several financial ramifications to consider. One of the major factors is the impact it has on the borrower’s finances.Expert Tips For Successful Promissory Note Termination

When it comes to terminating a promissory note, it’s important to follow the correct procedures to ensure a smooth and successful process. Consulting legal advice, as well as employing effective communication strategies, can greatly contribute to a successful termination. In this article, we will explore these expert tips for terminating a promissory note.

Consulting Legal Advice

One of the most crucial steps in terminating a promissory note is seeking legal advice. A legal expert can provide valuable guidance and ensure that the terms of the note are properly understood. They can review the agreement, identify any potential legal issues, and guide you through the termination process.

Effective Communication Strategies

Effective communication is vital when it comes to terminating a promissory note. It is important to clearly and concisely communicate your intentions to the other party involved in the agreement. Open and honest communication can help establish trust and cooperation, making the termination process smoother.

Here are some strategies to facilitate effective communication when terminating a promissory note:

- 1. Express your intentions: Clearly communicate your decision to terminate the promissory note to the other party. Ensure that they fully understand your reasoning and the timeline you have set for the termination process.

- 2. Maintain open lines of communication: Keep the communication channels open throughout the termination process. Promptly respond to any queries or concerns raised by the other party to avoid misunderstandings.

- 3. Put agreements in writing: Document all communication and agreements made during the termination process in writing. This can help avoid future disputes or misunderstandings.

- 4. Stay professional: Maintain a professional and respectful tone during all communications. This can help preserve relationships and facilitate a smoother termination.

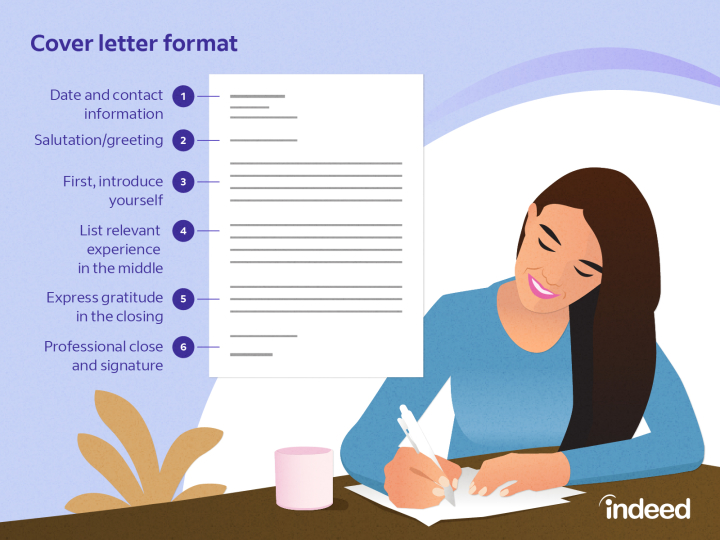

Credit: www.indeed.com

Frequently Asked Questions On How Do You Terminate A Promissory Note?

How Do You Terminate A Promissory Note?

To terminate a promissory note, the lender and borrower must agree in writing to cancel the debt. Both parties should sign a termination agreement stating their consent. It’s crucial to ensure the agreement is legally binding and properly executed to avoid any future disputes.

Can I Terminate A Promissory Note Early?

Yes, you can terminate a promissory note early if both the lender and borrower agree to it. In such cases, a written agreement should be made, clearly stating the terms and conditions of the early termination. It’s important to consult legal counsel to ensure all the necessary steps are taken and both parties are protected.

What Happens If A Promissory Note Is Not Terminated?

If a promissory note is not terminated, it will remain in effect until the debt is fully repaid. The borrower will be legally obligated to make payments according to the terms specified in the note. Failure to repay the debt as agreed can result in legal consequences such as damage to credit score, collection efforts, or even litigation.

It’s essential to fulfill the obligations stated in the promissory note.

Conclusion

Terminating a promissory note is a crucial process that requires careful attention to legal details. By following the required steps and seeking legal advice if necessary, you can ensure a smooth and effective termination. Understanding the legal implications and fulfilling all obligations is essential for both parties involved.

Always prioritize clear communication and documentation.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “How do you terminate a promissory note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To terminate a promissory note, the lender and borrower must agree in writing to cancel the debt. Both parties should sign a termination agreement stating their consent. It’s crucial to ensure the agreement is legally binding and properly executed to avoid any future disputes.” } } , { “@type”: “Question”, “name”: “Can I terminate a promissory note early?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, you can terminate a promissory note early if both the lender and borrower agree to it. In such cases, a written agreement should be made, clearly stating the terms and conditions of the early termination. It’s important to consult legal counsel to ensure all the necessary steps are taken and both parties are protected.” } } , { “@type”: “Question”, “name”: “What happens if a promissory note is not terminated?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “If a promissory note is not terminated, it will remain in effect until the debt is fully repaid. The borrower will be legally obligated to make payments according to the terms specified in the note. Failure to repay the debt as agreed can result in legal consequences such as damage to credit score, collection efforts, or even litigation. It’s essential to fulfill the obligations stated in the promissory note.” } } ] }