How Do I Create a Payment Agreement That Works?

To make a payment agreement with someone, discuss the terms and conditions of the agreement and document them in a written agreement or contract. Now, I will provide a well-rounded introduction on how to create a payment agreement that protects both parties involved.

Creating a payment agreement with someone is essential when engaging in financial transactions or loaning money. It serves as a legally binding document that outlines the terms and conditions of the agreement, ensuring clarity and accountability for both parties. Whether it’s for a personal loan, rental agreement, or business transaction, a payment agreement provides a framework for repayments, interest rates (if applicable), due dates, and consequences for late or missed payments.

By following a few simple steps, you can establish a payment agreement that protects your interests and promotes a smooth transaction process.

Understanding Payment Agreements

To establish a payment agreement with someone, both parties must mutually agree on the terms and conditions, including the amount, payment schedule, and late fees. It’s important to document the agreement in writing and ensure both parties understand and acknowledge the terms to avoid any misunderstandings or disputes in the future.

Understanding Payment Agreements A payment agreement is a legally binding contract between two parties that outlines the terms and conditions for making payments for goods or services rendered. Whether you’re a business owner collecting payments or an individual lending money to a friend, having a payment agreement in place is crucial. It helps establish clear expectations and protects both parties from any misunderstandings or disputes that may arise in the future. Key Elements of a Payment Agreement A payment agreement typically includes several key elements to ensure clarity and enforceability. These elements outline the responsibilities and obligations of both parties involved. Here are some essential components to include in your payment agreement: 1. Parties Involved: Clearly state the names and contact information of both parties entering into the agreement. This helps establish who is responsible for making or receiving payments. 2. Payment Terms: Specify the amount of the payment, whether it is a lump sum or installment payments, the due dates, and the approved methods of payment. This ensures that both parties are on the same page with regards to the payment schedule. 3. Late Payment Penalties: It’s essential to address what will happen in case of late or missed payments. State the consequences and any penalties that may be imposed, such as additional fees or interest charges. This helps incentivize timely payments. 4. Dispute Resolution: Include a section outlining how any payment-related disputes will be resolved. This could involve mediation, arbitration, or legal action. Clarifying the process for resolving conflicts can save both parties time and money down the line. Benefits of Having a Payment Agreement Having a payment agreement in place offers various benefits for both parties involved. Here are a few key advantages: 1. Clarity and Protection: A payment agreement provides clarity on payment terms, expectations, and consequences, ensuring that both parties are protected from any misunderstandings or disputes. 2. Legal Enforceability: By putting the agreement in writing, it becomes a legally binding contract. This means that if either party fails to fulfill their obligations, the other party can seek legal remedies to enforce the payment agreement. 3. Peace of Mind: Having a payment agreement gives both parties peace of mind, knowing that the terms and conditions have been agreed upon and documented. It provides a sense of security and reduces the risk of potential conflicts. 4. Better Relationships: A payment agreement helps maintain healthy relationships between parties involved in financial transactions. By having clear expectations and consequences in place, it fosters trust and transparency. In conclusion, understanding payment agreements is crucial when it comes to protecting your interests and establishing clear expectations when exchanging goods or services for payment. By including key elements and taking advantage of the benefits, you can ensure a smooth and fair payment process. Remember, always consult with a legal professional to ensure your payment agreement adheres to the specific laws and regulations of your jurisdiction.

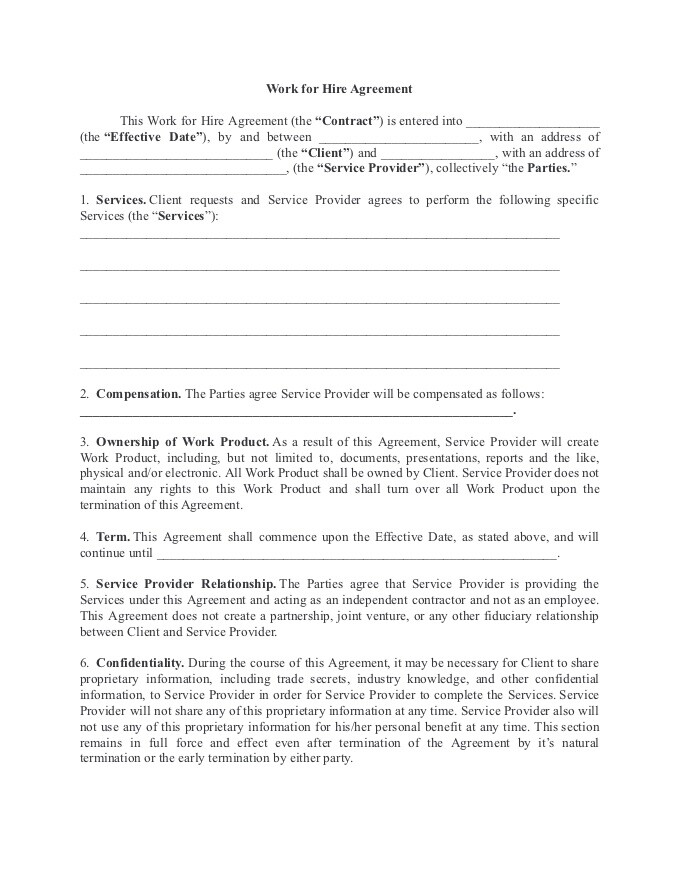

Credit: www.gonitro.com

Crafting A Successful Payment Agreement

When entering into a payment agreement with someone, it’s crucial to craft a comprehensive and well-structured document to ensure both parties are protected. A successful payment agreement outlines the terms, legal and financial considerations, and helps to establish trust and avoid future misunderstandings. In this section, we will explore how to determine payment terms and incorporate legal and financial considerations in your payment agreement, ensuring a smooth and fair financial arrangement.

Determining Payment Terms

Setting clear and precise payment terms is essential for a successful payment agreement. Not only does it ensure that both parties are on the same page, but it also helps to avoid any confusion or conflicts in the future. When determining payment terms:

- Specify the amount: Clearly state the exact amount that is due, whether it is a lump sum payment or installments.

- Define the due date: Set a specific due date or provide a timeline for making payments, ensuring that it aligns with the agreed payment frequency.

- Outline the payment method: Specify the acceptable methods of payment, such as cash, check, bank transfer, or online payment platforms.

- Include late payment consequences: To encourage timely payments, include any penalties or late fees that may apply if the payment is not made by the agreed-upon due date.

Incorporating Legal And Financial Considerations

While crafting a payment agreement, it’s crucial to address the legal and financial aspects to protect both parties involved. Here are some important considerations:

Legal Considerations:

- Identify the parties involved: Clearly state the names and contact information of all parties participating in the payment agreement to establish their legal identities.

- Include dispute resolution clause: Incorporate a clause that outlines how any disputes or disagreements will be resolved, such as through mediation or arbitration.

- Mention governing law: Specify the applicable law governing the payment agreement to ensure a clear understanding of legal rights and obligations.

- Include a termination clause: Outline the circumstances under which either party can terminate the agreement, safeguarding their interests in case of unforeseen events.

Financial Considerations:

Financial considerations within a payment agreement can provide security and clarity. Consider the following:

| Financial Consideration | Importance |

|---|---|

| Interest rates and penalties | Clarify the consequences of late or missed payments |

| Security deposits or guarantees | Provide added assurance for the party receiving payment |

| Payment schedules and milestones | Outline the agreed-upon payment schedule and milestones for larger projects |

| Document retention | Specify the period for which payment-related documentation should be retained |

By incorporating these legal and financial considerations in your payment agreement, you can ensure that the terms, obligations, and protection for both parties are defined explicitly. This, in turn, fosters trust, clarity, and a positive business relationship.

Ensuring Clarity And Compliance

Setting up a payment agreement with someone requires clear communication and strict adherence to laws and regulations. It’s essential to make sure that both parties understand the terms and conditions of the agreement and comply with legal requirements.

Communicating Expectations Clearly

When creating a payment agreement, it’s crucial to communicate the expectations clearly. Use simple and understandable language to outline the payment schedule, amount, and any additional terms. Clarify the consequences of late payments or breaches of the agreement to ensure both parties are on the same page.

Adhering To Applicable Laws And Regulations

Adhering to applicable laws and regulations is non-negotiable in payment agreements. Ensure that the agreement complies with local, state, and federal laws regarding payment terms, interest rates, and consumer protection. Seek legal advice if necessary to guarantee full compliance and avoid potential legal issues.

Credit: www.approveme.com

Addressing Potential Challenges

When entering into a payment agreement with someone, there are potential challenges that may arise along the way. It’s essential to be prepared and have a plan in place for handling these challenges.

Handling Late Payments

One of the common challenges in a payment agreement is dealing with late payments. Late payments can disrupt the agreed-upon schedule and pose a financial burden on both parties. To effectively handle late payments, consider the following steps:

- Set Clear Terms: Clearly outline the payment due dates, penalties for late payments, and any grace periods in your payment agreement. Having these terms explicitly stated can help prevent confusion and encourage timely payments.

- Reminders: Send friendly reminders to the other party a few days before the payment due date. These reminders can be in the form of emails, text messages, or automated payment reminders.

- Communicate: If the other party consistently makes late payments, it’s important to communicate openly and address the issue. Reach out to discuss the reasons behind the late payments and find a mutually agreeable solution.

- Consider Late Fees: Including late fees in your payment agreement can incentivize timely payments. Clearly state the amount of the late fee and how it will be applied.

Resolving Disputes And Non-compliance

In some cases, disputes or non-compliance with the payment agreement may arise. It’s crucial to address these issues promptly to maintain a healthy agreement. Here are some steps to resolve disputes and non-compliance:

- Review the Agreement: Thoroughly review the payment agreement to ensure that both parties are fulfilling their obligations. Identify any potential areas of disagreement or non-compliance.

- Open Communication: Reach out to the other party to discuss the issue and seek a resolution. Maintain a calm, professional demeanor during these conversations to encourage productive communication.

- Mediation: If direct communication fails to resolve the dispute, consider involving a neutral third party, such as a mediator. A mediator can help facilitate discussions and find a compromise that both parties can agree upon.

- Legal Action: If all attempts at resolution fail, it may be necessary to take legal action. Consult with an attorney who specializes in contract law to understand your options and take appropriate steps.

By addressing potential challenges head-on and being prepared with strategies for handling late payments and resolving disputes, you can navigate the payment agreement process with confidence and maintain a positive relationship with the other party.

Building Long-term Relationships

Crafting a solid payment agreement is crucial for building long-term relationships with individuals. Discover the essential steps to establish a fair and effective arrangement that benefits everyone involved.

Nurturing Trust And Transparency

Building a strong and lasting relationship with someone requires a foundation of trust and transparency. When it comes to making a payment agreement, it is vital to establish this trust from the very beginning. Open and honest communication is key. Clearly explain the terms and conditions of the agreement, including payment amounts, due dates, and any penalties for late payments. By being transparent about these details, you can ensure that both parties have a clear understanding of their responsibilities.

Furthermore, it is essential to foster trust in the payment process itself. Offering multiple payment options and providing secure payment channels will give the other party confidence in your organization. Implementing proper encryption and security measures demonstrates your commitment to protecting their sensitive information, strengthening the trust between both parties.

Adapting The Agreement To Changing Circumstances

As life is unpredictable, circumstances can change that may affect the original payment agreement. To build a long-term relationship, it is crucial to be flexible and willing to adapt the agreement to these changes. For instance, if the other party experiences financial difficulties, it may be necessary to reevaluate the payment schedule or explore alternative payment arrangements. By showing empathy and understanding, you can demonstrate your commitment to finding solutions that work for both parties.

Regularly reviewing the payment agreement is also essential to ensure it remains relevant. As time goes on, circumstances may change, and updating the agreement accordingly can help prevent any potential disputes or misunderstandings. By keeping the agreement up to date, you can maintain a positive and productive relationship based on mutual respect and understanding.

Credit: www.rocketlawyer.com

Frequently Asked Questions Of How Do | Make A Payment Agreement With Someone?

How Can I Create A Payment Agreement With Someone?

To create a payment agreement, start by clearly defining the terms and conditions, including the payment amount, due dates, and any penalties for late payments. Put everything in writing, sign the agreement, and make sure both parties have a copy for future reference and clarity.

What Should I Include In A Payment Agreement?

To ensure a comprehensive payment agreement, include important details such as the names and contact information of both parties, the payment amount and frequency, due dates, accepted payment methods, and any consequences for non-payment. It’s also wise to include clauses for late payments, refunds, and a dispute resolution process.

Is A Payment Agreement Legally Binding?

Yes, a payment agreement is legally binding as long as it meets certain requirements, such as clear and agreed-upon terms, consideration (e. g. , payment), and the intent to create a legal relationship. It’s crucial to consult with a legal professional to ensure your payment agreement adheres to local laws and regulations.

Conclusion

Creating a payment agreement is crucial for smooth transactions. By clearly outlining terms and conditions, both parties can avoid misunderstandings and disputes. Remember to document every detail and ensure mutual understanding to create a legally binding and secure payment agreement.

With these tips, you can confidently navigate the process and protect your financial interests.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “How can I create a payment agreement with someone?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To create a payment agreement, start by clearly defining the terms and conditions, including the payment amount, due dates, and any penalties for late payments. Put everything in writing, sign the agreement, and make sure both parties have a copy for future reference and clarity.” } } , { “@type”: “Question”, “name”: “What should I include in a payment agreement?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To ensure a comprehensive payment agreement, include important details such as the names and contact information of both parties, the payment amount and frequency, due dates, accepted payment methods, and any consequences for non-payment. It’s also wise to include clauses for late payments, refunds, and a dispute resolution process.” } } , { “@type”: “Question”, “name”: “Is a payment agreement legally binding?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, a payment agreement is legally binding as long as it meets certain requirements, such as clear and agreed-upon terms, consideration (e.g., payment), and the intent to create a legal relationship. It’s crucial to consult with a legal professional to ensure your payment agreement adheres to local laws and regulations.” } } ] }