How to Ensure a Legally Binding Payment Agreement

To make a payment agreement legally binding, it is crucial to include all terms and conditions in writing and have both parties sign the document. This ensures mutual understanding and enforcement of the agreement.

Are you in the process of creating a payment agreement with another party? Making a payment agreement legally binding is essential to protect the interests of both parties involved. A legally binding agreement gives you the assurance that the terms and conditions of the agreement will be upheld and enforced.

By following a few key steps, you can ensure that your payment agreement holds legal validity and provides a strong foundation for your business relationship. We will guide you through the process of making a payment agreement legally binding.

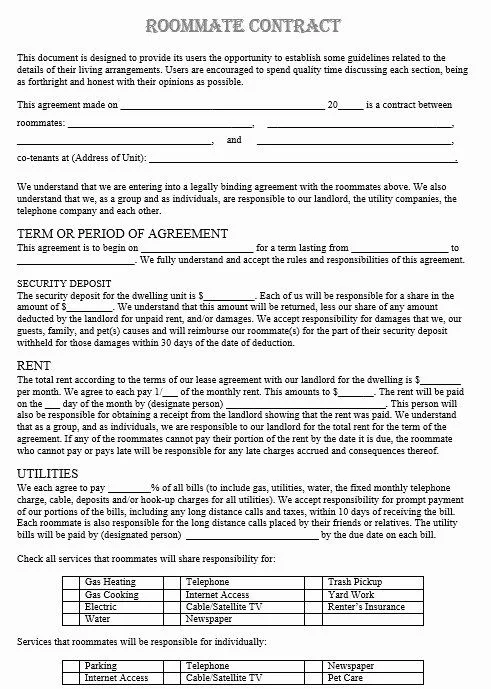

Credit: www.powerwashbros.org

Understanding Payment Agreements

When it comes to financial transactions, it’s essential to ensure that both parties involved are on the same page. This is where payment agreements come into play. A payment agreement is a legally binding document that outlines the terms and conditions of a financial arrangement between two parties. It provides clarity, protects both parties’ interests, and helps avoid any misunderstandings or disputes in the future.

Key Elements Of A Payment Agreement

A payment agreement typically includes several key elements that make it comprehensive and legally enforceable. These elements include:

- Identification of the parties involved: Clearly stating the names and contact information of both the payee and the payer.

- Description of the transaction: Providing a detailed description of the goods, services, or loan involved in the agreement.

- Payment terms: Outlining the amount, frequency, and method of payment agreed upon by both parties.

- Due dates and late fees: Specifying the due dates for payments and any penalties for late or missed payments.

- Interest rates (if applicable): If interest will be charged on the outstanding balance, this should be clearly stated along with the agreed-upon rate.

- Conditions for termination: Defining the circumstances under which the agreement can be terminated by either party and the consequences of such termination.

- Dispute resolution: Including a provision for resolving disputes, such as mediation or arbitration, to avoid costly litigation.

Importance Of A Legally Binding Agreement

A payment agreement is not just a piece of paper; it serves as a legally binding contract between the parties involved. Having a legally binding agreement provides numerous benefits, such as:

- Clarity and understanding: A payment agreement ensures that both parties have a clear understanding of their rights, responsibilities, and obligations in the financial arrangement.

- Enforceability: A legally binding agreement gives the parties involved the ability to seek legal remedies if the other party fails to fulfill their obligations.

- Protection against disputes: By clearly documenting the terms and conditions, a payment agreement helps prevent disagreements and disputes that can lead to costly litigation.

- Professionalism: Using a legally binding agreement demonstrates professionalism and seriousness in the business relationship, fostering trust and credibility.

- Financial security: A payment agreement provides financial security by ensuring that both parties are protected and have recourse if the agreed-upon terms are not met.

- Evidence in court: In the unfortunate event of a legal dispute, a legally binding payment agreement serves as valuable evidence in court, supporting your claims and protecting your interests.

By understanding the key elements of a payment agreement and the importance of having a legally binding contract, you can ensure a smooth and secure financial transaction. Whether you are lending money, paying for services, or entering into any other financial arrangement, a well-drafted and legally binding payment agreement is your best ally.

Creating A Solid Payment Agreement

To make a payment agreement legally binding, ensure it is in writing, includes all terms and conditions, and is signed by both parties. Additionally, consider including a clause outlining the consequences for non-payment to strengthen the agreement’s legality.

Creating a Solid Payment Agreement Clear Terms and Conditions When it comes to making a payment agreement legally binding, one of the most critical aspects is to ensure that the terms and conditions are clear and concise. By using clear language that is easily understood by all parties involved, you can avoid confusion and minimize the chances of disputes in the future. When drafting your payment agreement, be sure to include specific details such as the names of the parties involved, the agreed-upon payment amount, and the payment schedule. This level of clarity will provide a strong foundation for a legally binding agreement. Inclusion of Necessary Details The inclusion of necessary details is another key factor in creating a solid payment agreement. To make sure your agreement is legally binding, it is important to include all the essential information that will protect both parties involved. This includes the dates on which payments are due, late payment penalties, and any additional fees or charges that may arise. By outlining these details in the agreement, you can ensure that both parties have a clear understanding of their obligations and responsibilities. To make the necessary details easily readable, you can consider presenting the information in a table format, like the one shown below: | Key Details | |———————————–| | Parties involved | | Payment amount | | Payment schedule | | Due dates | | Late payment penalties | | Additional fees or charges | By organizing the information in a table, you create a visually appealing format that is easy to understand at a glance. This aids in readability and makes it simpler for both parties to refer back to the agreement when needed. In summary, when creating a solid payment agreement that is legally binding, it is crucial to have clear terms and conditions in place. By using language that is easily understood, all parties can have a mutual understanding of their obligations. Additionally, the inclusion of necessary details such as payment amounts, schedules, due dates, and penalties will provide a strong foundation for the agreement. With these components in place, you can ensure a legally binding payment agreement that is fair and protects the interests of everyone involved.Legal Requirements For Enforceability

When creating a payment agreement, it is essential to ensure its legal enforceability. To achieve this, it is crucial to understand the legal requirements for enforceability. By complying with these requirements, you can create a payment agreement that holds up in a court of law.

Valid Consideration

A payment agreement must contain valid consideration to be legally binding. Consideration refers to something of value exchanged between the parties, such as money, goods, or services. Both parties must provide consideration for the agreement to be enforceable. Without valid consideration, an agreement may be deemed unenforceable in a court of law.

Compliance With Applicable Laws

Another important aspect of creating a legally binding payment agreement is ensuring compliance with applicable laws. This includes adhering to contract laws, consumer protection laws, and any specific regulations related to the type of payment agreement being created. Failure to comply with relevant laws and regulations can render the agreement unenforceable.

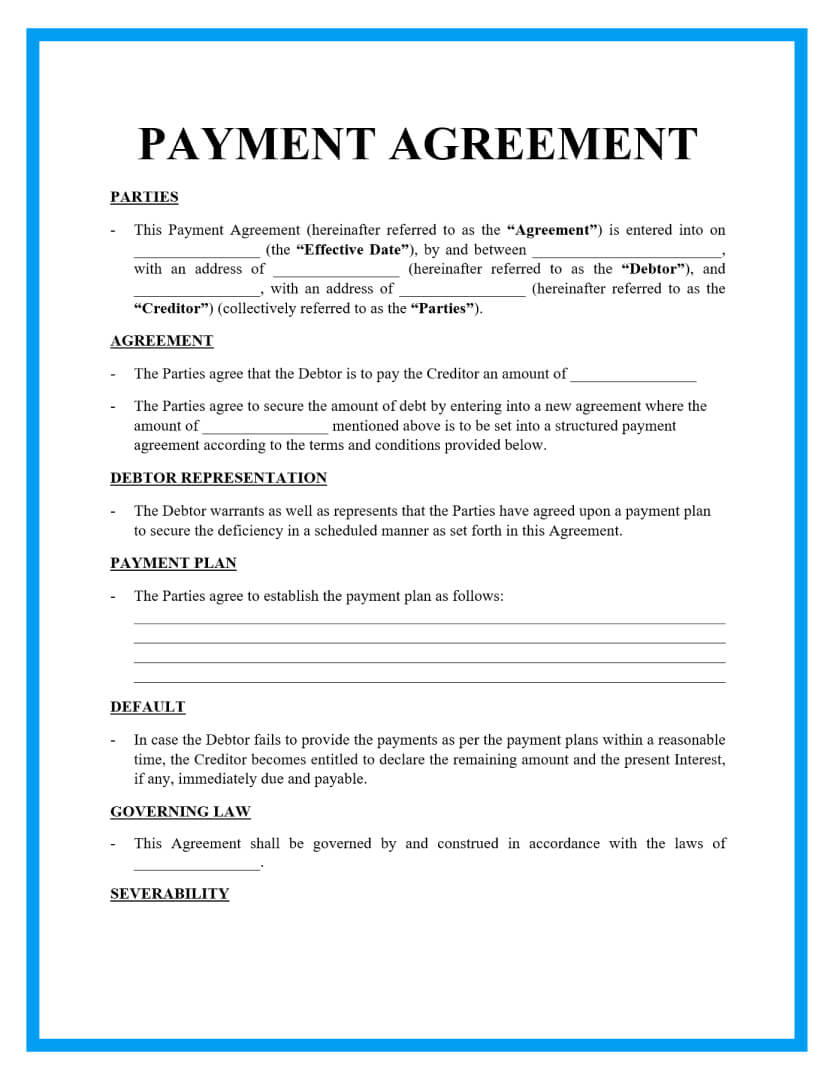

Credit: www.pinterest.com

Documenting The Agreement

To make a payment agreement legally binding, it is important to document the terms and conditions in writing. This includes including all relevant information, such as the payment amount, due date, and consequences for non-payment. By having a written agreement, both parties are protected and can refer back to it if any issues arise.

When making a payment agreement, it’s important to document it properly to ensure its legal binding. Documenting the agreement provides clarity and serves as evidence of the agreed terms and conditions. In this section, we will explore two key aspects of documenting the agreement: written vs. oral agreements and the role of witnesses or notarization.

Written Vs. Oral Agreements

Creating a written agreement is generally the preferred method as it provides a clear and comprehensive record of the agreed terms. A written agreement should include all essential details, such as the parties involved, payment terms, due dates, consequences of non-payment, and any other relevant information. Having a written agreement reduces the chances of misunderstandings or disputes.

An oral agreement, on the other hand, is an agreement made verbally without a written record. While oral agreements can be legally binding in some cases, they can be challenging to prove. Without a written document, it becomes a matter of one party’s word against the other’s if a dispute arises. Therefore, it is advisable to always opt for a written agreement to ensure clarity and enforceability.

The Role Of Witnesses Or Notarization

Adding witnesses or seeking notarization can add an extra layer of legal protection to your payment agreement. Witnesses, who are impartial individuals not involved in the agreement, can attest to the signing and understanding of the agreement by both parties. Their presence and signature provide additional evidence in case of any future disputes.

Notarization involves the involvement of a notary public, who is a licensed official authorized to certify the authenticity of documents. Notarizing the payment agreement involves signing the document in the presence of the notary public, who then adds their own signature and seal. This process further validates the agreement and makes it more legally enforceable.

While not always required, witnesses and notarization can significantly strengthen the legal binding of your payment agreement and protect your interests.

Enforcing And Resolving Disputes

Once you have a legally binding payment agreement in place, it’s important to understand how to enforce it and resolve any potential disputes that may arise. By knowing your options for enforcement and exploring methods of resolving disputes amicably, you can ensure that your payment agreement remains effective and in good standing.

Options For Enforcement

When it comes to enforcing a payment agreement, there are several options available to you:

- 1. Filing a Lawsuit: If the other party refuses to comply with the terms of the agreement, you can take legal action by filing a lawsuit. This can often lead to a court judgment in your favor, which can be used to collect the owed amount.

- 2. Seeking Mediation: Mediation involves hiring a neutral third party who will help facilitate negotiations and discussions between both parties. This can be a cost-effective and efficient way to resolve disputes without going to court.

- 3. Utilizing Arbitration: Arbitration is another alternative to litigation where a neutral arbitrator is appointed to make a binding decision on the dispute. This process can be more streamlined and less formal than a court proceeding.

Resolving Disputes Amicably

Resolving disputes amicably is often the preferred approach, as it can help maintain a positive relationship between both parties. Here are some methods to consider:

- 1. Open Communication: Start by discussing the issue with the other party in a calm and open manner. Misunderstandings can often be resolved through clear communication.

- 2. Negotiation: Try to find a mutually beneficial solution through negotiation. This may involve compromising on certain aspects of the agreement to reach a resolution.

- 3. Written Agreement: If you are able to reach an agreement, it’s important to document it in writing. This can help ensure that both parties understand and agree to the terms moving forward.

- 4. Alternative Dispute Resolution: Consider alternative dispute resolution methods such as mediation or arbitration, as mentioned earlier. These processes can provide a structured framework for resolving disputes outside of the courtroom.

Credit: signaturely.com

Frequently Asked Questions For How Do I Make A Payment Agreement Legally Binding?

How Can I Make A Payment Agreement Legally Binding?

To make a payment agreement legally binding, both parties should sign a written contract outlining the terms and conditions of the agreement. It’s important to include all relevant details such as payment amount, due date, and consequences for non-payment. Consulting with a lawyer can ensure the agreement meets legal requirements.

What Happens If A Payment Agreement Is Not Legally Binding?

If a payment agreement is not legally binding, it may be difficult to enforce its terms. In case of non-payment, you may not have legal recourse or protection. It’s crucial to ensure that the agreement satisfies all legal requirements and is enforceable to protect your rights and interests.

Can A Verbal Payment Agreement Be Legally Binding?

In some cases, a verbal payment agreement can be legally binding. However, it is more challenging to prove the terms of the agreement without a written contract. Having a written agreement minimizes misunderstandings and provides solid evidence in case legal action is required.

How Can I Protect Myself When Creating A Payment Agreement?

To protect yourself when creating a payment agreement, clearly define the terms and conditions, including payment amounts, due dates, and any consequences for non-payment. Consult with a lawyer to ensure the agreement is enforceable and complies with all legal requirements.

Keep thorough records of payments and communication related to the agreement.

Conclusion

In establishing a legally binding payment agreement, attention to detail is crucial. By adhering to the necessary legal elements and ensuring mutual understanding, you can create a solid foundation for a payment agreement. Remember to seek legal advice whenever necessary to protect your interests.

With these steps, you can confidently secure a legally binding payment agreement.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “How can I make a payment agreement legally binding?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To make a payment agreement legally binding, both parties should sign a written contract outlining the terms and conditions of the agreement. It’s important to include all relevant details such as payment amount, due date, and consequences for non-payment. Consulting with a lawyer can ensure the agreement meets legal requirements.” } } , { “@type”: “Question”, “name”: “What happens if a payment agreement is not legally binding?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “If a payment agreement is not legally binding, it may be difficult to enforce its terms. In case of non-payment, you may not have legal recourse or protection. It’s crucial to ensure that the agreement satisfies all legal requirements and is enforceable to protect your rights and interests.” } } , { “@type”: “Question”, “name”: “Can a verbal payment agreement be legally binding?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “In some cases, a verbal payment agreement can be legally binding. However, it is more challenging to prove the terms of the agreement without a written contract. Having a written agreement minimizes misunderstandings and provides solid evidence in case legal action is required.” } } , { “@type”: “Question”, “name”: “How can I protect myself when creating a payment agreement?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To protect yourself when creating a payment agreement, clearly define the terms and conditions, including payment amounts, due dates, and any consequences for non-payment. Consult with a lawyer to ensure the agreement is enforceable and complies with all legal requirements. Keep thorough records of payments and communication related to the agreement.” } } ] }