Foundation Stocks : Building Your Portfolio with Reliable Investments

Foundation stocks are stable, reliable investments in well-established companies with a history of consistent growth and dividend payments. These stocks form the base of a solid investment portfolio, providing stability and steady returns over the long term.

Foundation stocks are an essential component of a balanced investment strategy, offering investors a low-risk option for building wealth. By selecting companies with strong financials, a competitive advantage, and a history of profitability, foundation stocks can offer a steady stream of income and the potential for capital appreciation.

As a result, these stocks are often favored by conservative investors seeking to minimize risk while achieving sustainable long-term growth. With their stable performance and history of dividend payments, foundation stocks can provide a reliable source of income and serve as a solid anchor for a diversified investment portfolio.

The Basics Of Foundation Stocks

Foundation stocks are an essential part of any healthy and thriving investment portfolio. These stocks, also known as core holdings, serve as the building blocks upon which your portfolio is constructed. Understanding the basics of foundation stocks is crucial to making informed investment decisions and achieving long-term financial success.

Defining Foundation Stocks

Foundation stocks, simply put, are the bedrock of your investment strategy. These are the stocks that form the foundation of your portfolio, providing stability and serving as a reliable base for your investment journey. These stocks are typically large, well-established companies that have a proven track record of delivering consistent returns over time.

Characteristics Of Foundation Stocks

Foundation stocks possess certain characteristics that set them apart from other types of investments. By considering these characteristics, you can identify and select the most suitable foundation stocks for your portfolio.

| Characteristics | Description |

|---|---|

| Liquidity | Foundation stocks are highly liquid, meaning they can be easily bought or sold without significantly impacting their market value. |

| Stability | These stocks tend to exhibit stability even during market downturns, allowing investors to weather turbulent times with confidence. |

| Dividends | Many foundation stocks offer regular dividend payments, providing investors with consistent income streams. |

| Growth Potential | While foundation stocks prioritize stability, they also have the potential for gradual growth over time, allowing your portfolio to appreciate steadily. |

By incorporating foundation stocks into your investment strategy, you can achieve a well-balanced portfolio that withstands market fluctuations and maximizes long-term returns. It is important to conduct thorough research and assess the characteristics of potential foundation stocks to determine their suitability for your investment goals and risk tolerance.

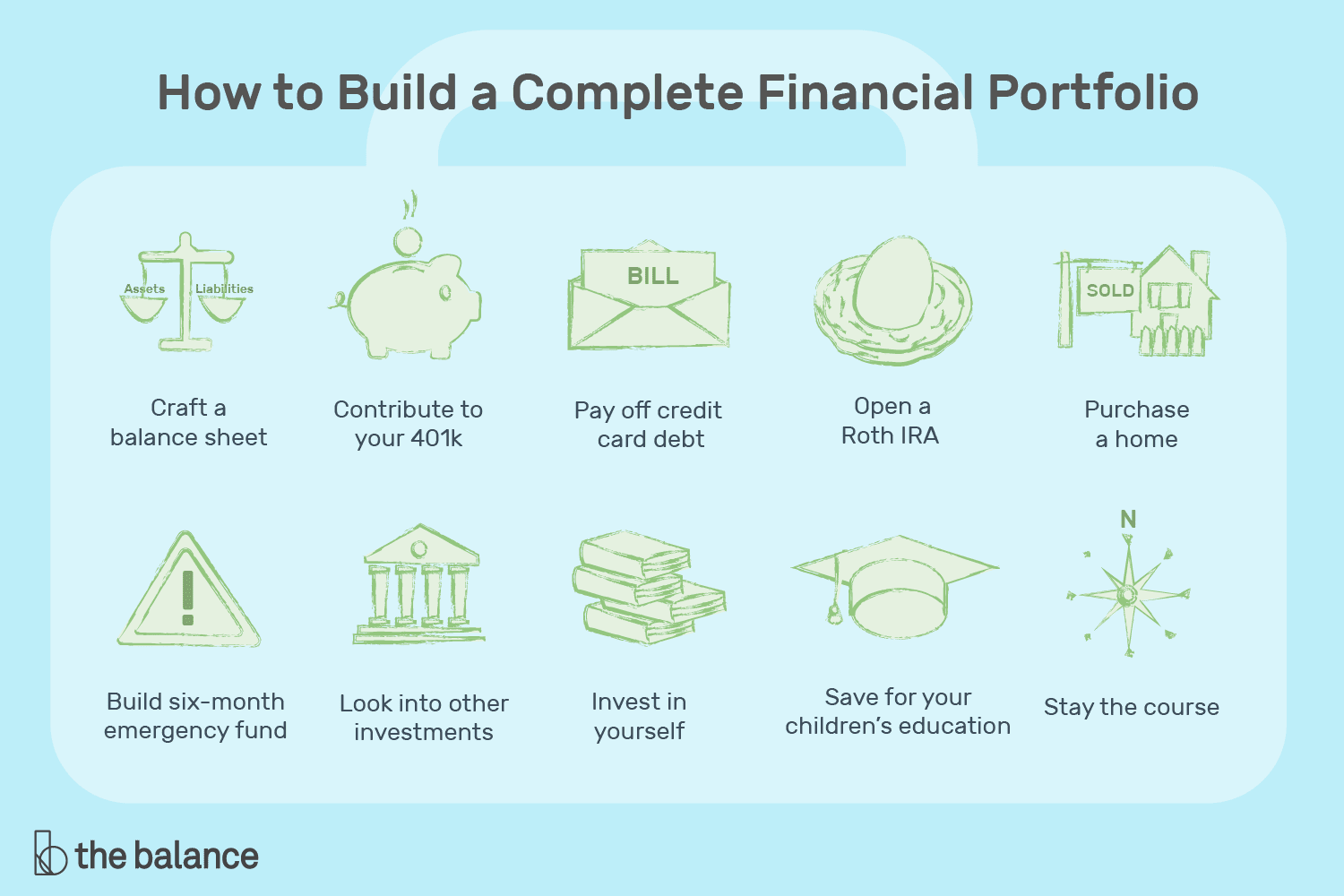

:max_bytes(150000):strip_icc()/FourStepstoBuildingaProfitablePortfolio-171c087dc41f40269547e95a0b60eab5.png)

Credit: www.investopedia.com

Benefits Of Incorporating Foundation Stocks

Incorporating foundation stocks offers numerous benefits, such as building a strong base for future growth, ensuring genetic diversity, and improving overall plant health. By using foundation stocks, businesses can establish a solid foundation for success in the long run.

Incorporating foundation stocks into your investment strategy offers various benefits, including stability and consistency, as well as long-term growth potential. By understanding these advantages, you can make informed decisions that can contribute to your financial success.

Stability And Consistency

Foundation stocks provide a stable and consistent base for your investment portfolio. These stocks typically belong to well-established companies that have a history of steady performance, making them less susceptible to dramatic price fluctuations. With foundation stocks, you can enjoy a smoother investment journey, reducing the risks associated with volatile market conditions.

Furthermore, these stocks often offer reliable dividends, generating a steady stream of income over time. As a result, you can maintain a consistent cash flow, which can be particularly beneficial if you are relying on your investments to support your day-to-day expenses or future financial goals.

Long-term Growth Potential

Beyond stability, incorporating foundation stocks into your investment portfolio can help you tap into their long-term growth potential. These stocks are typically associated with large and well-established companies that have a solid track record in their respective industries. This solid foundation allows these companies to weather economic downturns, adapt to changing market conditions, and continue to grow over time.

Moreover, foundation stocks often benefit from sustained market demand for their products or services. This demand provides a solid foundation for growth, allowing these stocks to appreciate in value gradually. By including foundation stocks in your portfolio, you can position yourself for long-term capital appreciation, ultimately boosting your overall investment returns.

Selecting The Right Foundation Stocks

When it comes to building a strong investment portfolio, selecting the right foundation stocks is key. These stable and reliable stocks provide the basis for long-term growth and stability in an investment portfolio. Foundation stocks are often well-established companies with a history of strong performance, consistent dividends, and a stable share price. Selecting the right foundation stocks requires careful consideration of various factors such as industry analysis and financial health assessment.

Industry Analysis

An important aspect of selecting the right foundation stocks is conducting a thorough industry analysis. This involves evaluating the prospects and performance of the industry in which the companies operate. Understanding the dynamics of the industry can help in identifying companies that are well-positioned for long-term growth and success. Factors to consider in industry analysis include market trends, competition, regulatory environment, and future growth potential.

Financial Health Assessment

Assessing the financial health of a company is crucial when choosing foundation stocks. This involves analyzing key financial metrics such as revenue growth, profitability, debt levels, and cash flow. Companies with strong financial health are better positioned to weather economic downturns and continue to provide consistent returns to investors. Additionally, evaluating the company’s balance sheet and cash reserves can provide insights into its ability to withstand financial challenges.

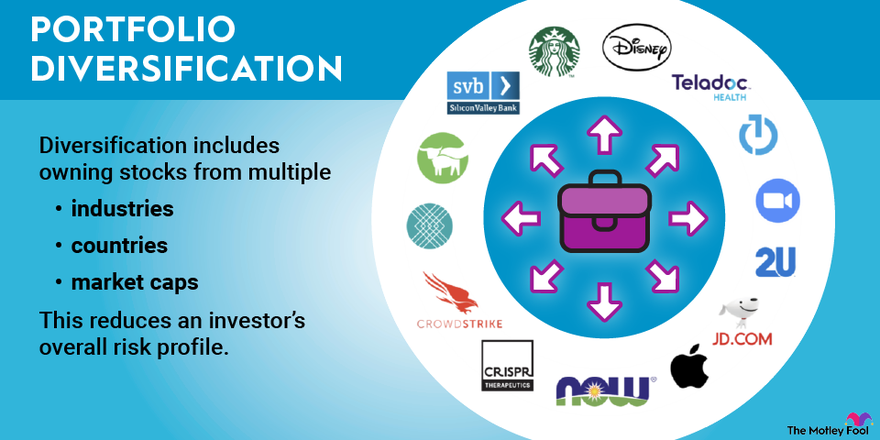

Credit: www.fool.com

Building A Diversified Portfolio With Foundation Stocks

When it comes to building a diversified portfolio, foundation stocks play a crucial role in balancing risk and return while incorporating different sectors. These stocks are the bedrock of a well-structured investment strategy, providing stability and growth potential over the long term.

Balancing Risk And Return

Foundation stocks help in balancing risk and return by offering steady, reliable performance even during market downturns. With a focus on companies with a strong track record of stability and growth, these stocks provide a solid foundation for an investor’s portfolio.

Incorporating Different Sectors

Foundation stocks contribute to portfolio diversification by incorporating different sectors such as technology, healthcare, consumer goods, and industrials. This ensures that the portfolio is not overly reliant on the performance of a single industry, reducing the overall risk exposure.

Strategies For Monitoring And Managing Foundation Stocks

To effectively manage foundation stocks, it is vital to implement robust monitoring strategies. Regular assessments can help identify any fluctuations in stock levels and inform proactive management decisions. By closely monitoring foundation stocks, organizations can ensure sustainable and stable resources for the future.

Monitoring and managing foundation stocks is crucial for maintaining a healthy and profitable investment portfolio. By regularly reviewing their performance and implementing appropriate rebalancing techniques, investors can ensure that their foundation stocks are optimized for long-term success. Here are some key strategies to consider:

Regular Performance Review

To ensure your foundation stocks remain on track, it’s essential to conduct regular performance reviews. By analyzing key performance factors such as annual returns, dividend yields, and price-to-earnings ratios, you can gain insights into the performance of each stock and determine if any adjustments are necessary.

Consider creating a simple and easy-to-understand table to track the performance of your foundation stocks. Include important metrics like the stock symbol, purchase date, purchase price, current price, and overall return. This table will provide a visual representation of the stock’s performance, allowing you to make informed decisions based on real-time data.

Rebalancing Techniques

As the market fluctuates, the allocation of your investment portfolio can deviate from your desired asset mix. This is where rebalancing comes into play. Rebalancing involves adjusting the weightings of your foundation stocks to maintain the original asset allocation.

There are multiple effective rebalancing techniques to consider:

- Percentage-based rebalancing: This technique involves determining a target percentage for each foundation stock in your portfolio. If a stock’s value exceeds or falls below the desired threshold, you can sell or buy shares to restore the original allocation.

- Threshold-based rebalancing: With this technique, you set a specific tolerance range within which your foundation stock’s allocation should remain. If a stock’s weightage exceeds the upper or lower threshold, you can rebalance by buying or selling shares accordingly.

- Time-based rebalancing: This technique involves rebalancing your portfolio at regular intervals, regardless of the market conditions. For example, you may decide to rebalance every quarter or annually, ensuring your foundation stocks are consistently adjusted.

Implementing a suitable rebalancing technique depends on various factors such as risk tolerance, investment goals, and market conditions. It’s essential to choose a technique that aligns with your investment strategy and objectives.

Regularly monitoring and managing foundation stocks through performance reviews and rebalancing techniques can help investors achieve stability and maximize long-term returns. By staying proactive and adaptive to market changes, you can ensure your foundation stocks remain aligned with your investment goals.

Credit: www.morningstar.com

Frequently Asked Questions For Foundation Stocks

What Are Foundation Stocks?

Foundation stocks refer to the initial set of stocks held by a company. These stocks are used to establish ownership and control, as well as to provide capital for the company’s operations and growth. They are typically held by the founders, early investors, and key stakeholders.

How Do Foundation Stocks Affect Shareholders?

Foundation stocks can have a significant impact on shareholders. They often come with special rights and privileges, such as voting power and priority in dividend distribution. This can give foundation stockholders greater influence and control over company decisions, potentially affecting the value and returns for other shareholders.

Can Foundation Stocks Be Diluted?

Yes, foundation stocks can be diluted. Dilution occurs when a company issues additional shares, which reduces the percentage ownership of existing shareholders, including foundation stockholders. This can happen through stock offerings, employee stock options, or convertible debt. Dilution can impact the voting power and economic interests of foundation stockholders.

Conclusion

Foundation stocks play a crucial role in any investment portfolio. With their ability to provide a stable base for long-term growth, they offer investors a sense of security. By diversifying across industries and consistently monitoring performance, investors can take advantage of the benefits that foundation stocks offer.

As the foundation of your investment strategy, these stocks can help you navigate the uncertainties of the market and pave the way for a successful financial future.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What are foundation stocks?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Foundation stocks refer to the initial set of stocks held by a company. These stocks are used to establish ownership and control, as well as to provide capital for the company’s operations and growth. They are typically held by the founders, early investors, and key stakeholders.” } } , { “@type”: “Question”, “name”: “How do foundation stocks affect shareholders?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Foundation stocks can have a significant impact on shareholders. They often come with special rights and privileges, such as voting power and priority in dividend distribution. This can give foundation stockholders greater influence and control over company decisions, potentially affecting the value and returns for other shareholders.” } } , { “@type”: “Question”, “name”: “Can foundation stocks be diluted?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, foundation stocks can be diluted. Dilution occurs when a company issues additional shares, which reduces the percentage ownership of existing shareholders, including foundation stockholders. This can happen through stock offerings, employee stock options, or convertible debt. Dilution can impact the voting power and economic interests of foundation stockholders.” } } ] }