Fee Acquisition: How to Maximize Profits and Dominate the Market

Fee acquisition refers to the process of obtaining ownership or control of a fee interest in real estate or other assets, often through purchase or transfer. In this process, the buyer gains full rights and privileges associated with the property or asset in exchange for payment.

Fee acquisition allows individuals or entities to establish legal ownership, use, and enjoyment of the property or asset as they see fit, subject to any applicable laws or restrictions. This article explores the key aspects of fee acquisition and its significance in various industries.

It discusses the importance of conducting due diligence, negotiating terms, and completing the necessary legal documentation to ensure a successful fee acquisition process.

Setting The Stage

In the world of business, fee acquisition is a crucial aspect that contributes to the growth and success of a company. It involves strategically acquiring fees from clients or customers for the products or services provided, ultimately resulting in increased revenue and profitability. To fully understand and appreciate the significance of fee acquisition, it is important to delve into the various factors that come into play. This blog post aims to provide you with valuable insights into the realm of fee acquisition, delving into its importance, market overview, and crucial considerations that can help you formulate effective strategies.

The Importance Of Fee Acquisition

In any business, fee acquisition is imperative for sustainable growth and profitability. Efficiently acquiring fees ensures that your business remains financially sound, enabling you to invest in further development and expansion. By strategically acquiring fees, you can strengthen your financial position, increase market share, and establish a competitive advantage over your rivals.

Market Overview

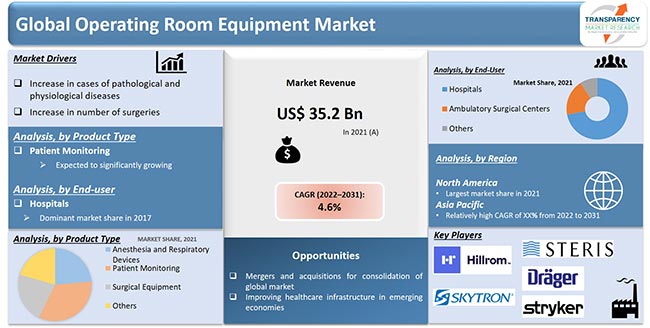

To successfully acquire fees, it is essential to have a comprehensive understanding of the market in which your business operates. A market overview provides you with valuable insights into the demand for your products or services, the pricing strategies adopted by competitors, and the potential customer base you can target.

Credit: www.transparencymarketresearch.com

Developing A Solid Strategy

Developing a solid strategy for fee acquisition is crucial for achieving success in business growth. By implementing effective tactics and analyzing market trends, businesses can attract and acquire new customers while maximizing revenue opportunities. This comprehensive approach ensures long-term success and sustainability.

Developing a Solid Strategy When it comes to fee acquisition, developing a solid strategy is essential for success. Without a well-thought-out plan, it’s easy to make mistakes that can hinder your growth and profitability. In this blog post, we will explore three key elements of a solid fee acquisition strategy: identifying target markets, evaluating potential acquisitions, and creating a competitive advantage.Identifying Target Markets

Identifying the right target markets is the first crucial step in fee acquisition. It involves understanding your industry, analyzing market trends, and identifying the areas where your services are most in demand. By conducting thorough research, you can pinpoint the most promising target markets and focus your efforts on acquiring fees in those areas.Evaluating Potential Acquisitions

Once you have identified your target markets, it’s time to evaluate potential acquisitions. This involves assessing the financial viability, cultural fit, and growth potential of each potential acquisition candidate. By conducting due diligence and analyzing the synergies between your company and the target acquisition, you can determine whether it’s a good fit for your fee acquisition strategy. Remember, not all acquisitions are equal, and it’s imperative to choose ones that align with your long-term goals.Creating A Competitive Advantage

In a saturated market, creating a competitive advantage is crucial for fee acquisition success. This involves understanding your strengths and unique selling proposition, as well as analyzing your competitors’ weaknesses. By strategically positioning your company and highlighting the benefits you offer, you can attract potential clients and stand out from the competition. By consistently focusing on innovation, quality, and customer satisfaction, you can build a competitive advantage that will drive the success of your fee acquisition strategy. To summarize, developing a solid fee acquisition strategy requires identifying target markets, evaluating potential acquisitions, and creating a competitive advantage. By following these steps, you can position your company for growth and ensure long-term success in fee acquisition.Executing The Acquisition

Executing the acquisition of a fee requires careful planning and meticulous attention to detail. This phase of the process involves several key steps, including valuation and negotiation, due diligence and risk assessment, and navigating legal and regulatory challenges. By following these steps and adhering to best practices, businesses can optimize their chances of successfully acquiring the desired fee and achieving their strategic goals.

Valuation And Negotiation

Valuation and negotiation play a central role in the acquisition process. Before entering into negotiations, it is essential for businesses to accurately determine the monetary value of the fee they wish to acquire. This evaluation involves carefully examining various factors such as market trends, potential revenue streams, and the overall financial health of the fee-owning entity.

Once the valuation is complete, businesses can proceed with negotiating the terms of the acquisition. Effective negotiation requires a combination of tact, strategic thinking, and open communication. It is crucial for businesses to clearly articulate their objectives and understand the motivations and interests of the fee-owning party. By finding common ground and reaching mutually beneficial agreements, businesses can secure a successful acquisition while maintaining positive relationships.

Due Diligence And Risk Assessment

Diligence and making well-informed decisions are of utmost importance when executing an acquisition. Conducting due diligence helps businesses identify any potential risks or red flags associated with the fee they intend to acquire. This process involves conducting thorough research, reviewing financial records, assessing legal obligations, and scrutinizing the fee’s operational history.

By performing a comprehensive risk assessment, businesses can evaluate the potential impact of any identified risks and determine whether they can be mitigated or managed effectively. This step enables businesses to make informed decisions about the feasibility and desirability of the acquisition, helping to minimize potential liabilities in the long run.

Navigating Legal And Regulatory Challenges

Acquiring a fee is a complex process that often involves navigating through various legal and regulatory challenges. These challenges can range from adhering to specific licensing requirements to complying with industry-specific guidelines and regulations.

Understanding the legal and regulatory landscape is crucial, as it helps businesses ensure compliance and avoid any legal pitfalls. Seeking legal expertise early in the acquisition process can provide valuable guidance and help mitigate potential risks. By working closely with legal professionals who specialize in fee acquisitions, businesses can navigate through the legal complexities with confidence, ensuring a smoother and more successful acquisition process.

:max_bytes(150000):strip_icc()/Timesrevenuemethod_update-220e696b22bf40a5a71a9dda204d3c08.png)

Credit: www.investopedia.com

Post-acquisition Integration

Post-acquisition integration is a critical phase in the fee acquisition process, where the acquired company merges its operations with the acquiring firm. This stage requires careful planning and execution to ensure a smooth transition and achieve the desired synergies. Streamlining operations, retaining key personnel, and maximizing synergies and cost savings are key focus areas during the post-acquisition integration phase.

Streamlining Operations

Streamlining operations is vital to eliminate redundancies and enhance efficiency after the acquisition. By evaluating and aligning processes, systems, and resources, the acquiring firm can optimize workflow and eliminate any inefficiencies. This includes identifying redundant roles and responsibilities, merging duplicate departments, and standardizing procedures across the newly integrated organization. A structured approach to streamlining operations ensures seamless cooperation and improves overall production.

Retaining Key Personnel

Retaining key personnel is crucial to maintain the acquired company’s talent pool and leverage their expertise for continued success. A dedicated effort should be made to understand the motivations and aspirations of key individuals and develop retention strategies accordingly. This could involve offering incentives, career advancement opportunities, or creating a conducive work environment. By retaining key personnel, the acquiring company can preserve valuable institutional knowledge and sustain the acquired company’s growth trajectory.

Maximizing Synergies And Cost Savings

Maximizing synergies and cost savings is a primary objective of post-acquisition integration. This involves identifying potential areas of overlap and leveraging shared resources to achieve economies of scale. By combining purchasing power, consolidating suppliers, and streamlining distribution channels, the acquiring firm can optimize cost structures and enhance profitability. Additionally, synergies can also be realized through cross-selling opportunities, utilizing complementary capabilities, and implementing best practices across the integrated organization.

Sustaining Market Dominance

To sustain market dominance, fee acquisition firms must continuously evaluate opportunities, expand their market share, and build and leverage relationships. By actively engaging in these strategies, fee acquisition firms can maintain their position as leaders in the market.

Continuously Evaluating Opportunities

By continuously evaluating opportunities, fee acquisition firms can stay ahead of the competition and identify potential areas for growth. This involves regularly reviewing market trends, analyzing customer needs, and exploring new avenues for expansion. Through meticulous assessment and timely decision-making, fee acquisition firms can seize opportunities to enhance their market dominance.

Expanding Market Share

Expanding market share is key to sustaining market dominance. Fee acquisition firms need to actively pursue strategies that allow them to reach new customers and increase their presence in the market. This can be achieved through a combination of targeted marketing campaigns, innovative product offerings, and strategic partnerships. By continuously expanding their market share, fee acquisition firms can solidify their position as market leaders.

Building And Leveraging Relationships

Building and leveraging relationships is essential for fee acquisition firms to maintain their market dominance. This involves establishing strong connections with customers, partners, and stakeholders in the industry. By nurturing these relationships, fee acquisition firms can gain valuable insights, access new opportunities, and strengthen their market position. Through effective relationship management, fee acquisition firms can stay ahead of the competition and sustain their market dominance.

Credit: rotateagency.net

Frequently Asked Questions Of Fee Acquisition

How Does Fee Acquisition Work?

Fee acquisition is the process of obtaining fees or charges from customers for the products or services provided. It involves setting prices, billing customers, and collecting payments. This helps businesses generate revenue and cover their expenses.

What Are The Benefits Of Fee Acquisition?

Fee acquisition offers several benefits to businesses. It provides a steady stream of revenue, which helps with financial stability and growth. It also helps businesses cover their costs and invest in further development. Additionally, fee acquisition can help improve the overall customer experience by providing value-added services.

What Strategies Can Be Used For Successful Fee Acquisition?

Successful fee acquisition requires effective strategies. Businesses can consider implementing pricing strategies such as value-based pricing or cost-plus pricing. They can also offer flexible payment options and leverage technology for efficient billing and payment processes. It is important to analyze market trends, competition, and customer preferences to tailor the fee acquisition strategies.

How Can Businesses Improve Their Fee Acquisition Process?

Businesses can improve their fee acquisition process by focusing on customer satisfaction and continuous improvement. They can streamline their billing and payment processes, provide clear pricing information, and offer excellent customer support. Collecting feedback, analyzing data, and adapting to market changes can also contribute to an improved fee acquisition process.

Conclusion

Fee acquisition is a vital element for businesses to not only generate revenue but also enhance their overall growth and success. By adopting strategic approaches, businesses can effectively acquire fees, establish client relationships, and strengthen their position in the market.

A well-executed fee acquisition strategy can lead to increased profitability, improved brand reputation, and increased client satisfaction. So, it’s crucial for businesses to prioritize fee acquisition and constantly evolve their strategies to stay ahead in a competitive landscape.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “How does fee acquisition work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Fee acquisition is the process of obtaining fees or charges from customers for the products or services provided. It involves setting prices, billing customers, and collecting payments. This helps businesses generate revenue and cover their expenses.” } } , { “@type”: “Question”, “name”: “What are the benefits of fee acquisition?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Fee acquisition offers several benefits to businesses. It provides a steady stream of revenue, which helps with financial stability and growth. It also helps businesses cover their costs and invest in further development. Additionally, fee acquisition can help improve the overall customer experience by providing value-added services.” } } , { “@type”: “Question”, “name”: “What strategies can be used for successful fee acquisition?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Successful fee acquisition requires effective strategies. Businesses can consider implementing pricing strategies such as value-based pricing or cost-plus pricing. They can also offer flexible payment options and leverage technology for efficient billing and payment processes. It is important to analyze market trends, competition, and customer preferences to tailor the fee acquisition strategies.” } } , { “@type”: “Question”, “name”: “How can businesses improve their fee acquisition process?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Businesses can improve their fee acquisition process by focusing on customer satisfaction and continuous improvement. They can streamline their billing and payment processes, provide clear pricing information, and offer excellent customer support. Collecting feedback, analyzing data, and adapting to market changes can also contribute to an improved fee acquisition process.” } } ] }