Do You Have to Pay Back a Promissory Note? : Uncovering the Obligation

Yes, a promissory note is a legally binding agreement that requires the borrower to repay the borrowed funds. When you sign a promissory note, you commit to repaying the loan within a specified period and according to agreed-upon terms.

Credit: fastercapital.com

What Is A Promissory Note?

A promissory note is a legal document requiring the borrower to repay a specified amount to the lender. The borrower is obligated to pay back the promissory note according to the agreed terms and conditions, failing which legal action can be taken.

A promissory note is a legally binding document that serves as a written promise to repay a debt. It is a common financial instrument used in various personal and business transactions. When someone borrows money, the promissory note establishes the terms and conditions of the loan, including the amount borrowed, the interest rate, and the repayment schedule. In essence, it acts as an IOU between the borrower and the lender.Definition

A promissory note is an enforceable written agreement that outlines the borrower’s commitment to repay a loan. It serves as evidence of the debt owed to the lender and contains specific details about the loan, such as the principal amount, interest rate, and repayment terms. Think of it as a written contract that outlines the borrower’s promise to repay the borrowed amount within a specified period.Key Elements

A promissory note typically includes several key elements that define the terms of the loan and clarify the responsibilities of both parties involved. These elements include: 1. Parties: The note identifies the borrower, also known as the maker, and the lender, who is often referred to as the payee or holder of the note. 2. Principal Amount: This is the initial amount of money borrowed by the borrower, which is to be repaid to the lender. 3. Interest Rate: The promissory note specifies the rate at which interest will accrue on the outstanding loan balance. 4. Repayment Schedule: The note outlines how the loan will be repaid, whether through regular installments or in a lump sum at a specific date. 5. Due Date: This is the date by which the borrower must repay the loan in full. 6. Default and Remedies: The promissory note details the consequences of defaulting on the loan, including any penalties or legal actions that the lender may pursue. 7. Collateral: In some cases, the note may include information about any collateral offered by the borrower to secure the loan. Overall, a promissory note provides a clear and legally binding framework for loan repayment, ensuring that both parties are aware of their rights and obligations. It establishes a sense of trust and accountability between the borrower and lender, helping to minimize misunderstandings and potential conflicts. If you have borrowed money or are considering lending funds, understanding the basics of a promissory note is essential to protect your interests and ensure a smooth repayment process.Note: This blog post section is about understanding the definition and key elements of a promissory note. In subsequent sections, we will explore the repayment aspect of promissory notes and discuss whether they need to be repaid. Stay tuned!

Credit: legaltemplates.net

The Legal Obligations

When it comes to promissory notes, understanding the legal obligations is crucial. A promissory note is a legally binding document that outlines a borrower’s promise to repay a loan to a lender. It is important to know the enforceability of a promissory note and the consequences of non-payment. In this section, we will delve into these aspects to provide you with a comprehensive understanding of your legal obligations.

Enforceability

Enforceability refers to the ability to legally compel the borrower to honor the terms of the promissory note. In order for a promissory note to be enforceable, it must meet certain requirements:

- Written Form: A promissory note must be in writing to be enforceable. Verbal promises or agreements hold no legal weight.

- Signatures: The promissory note must be signed by both the borrower and the lender. This signifies their agreement to the terms and conditions outlined in the document.

- Clear Terms: The terms of the loan, including the amount borrowed, repayment schedule, and interest rate, must be clearly stated in the promissory note. This clarity ensures that both parties are aware of their obligations.

Example: A properly executed and clearly worded promissory note will have a higher chance of enforceability in a court of law.

Consequences Of Non-payment

Non-payment of a promissory note can have significant consequences for the borrower. These consequences may include:

- Legal Action: If a borrower fails to repay the loan as agreed, the lender has the right to take legal action to recover the amount owed. This may result in a lawsuit and potential court-ordered garnishment of wages or seizure of assets.

- Negative Credit Impact: Non-payment of a promissory note can severely impact the borrower’s credit score. This can make it difficult to obtain future loans or credit cards and may result in higher interest rates for any future credit.

- Strained Relationships: Failing to repay a promissory note can strain relationships between the borrower and the lender, especially if they have a personal or familial connection. It is crucial to communicate and address any financial difficulties honestly and transparently.

Understanding the legal obligations associated with a promissory note is vital for both borrowers and lenders. Enforceability and the consequences of non-payment should not be taken lightly. By adhering to the terms outlined in the promissory note, borrowers can ensure a smooth repayment process and maintain positive financial relationships.

In summary: A promissory note is a legally binding document, and non-payment can lead to legal action, negative credit impact, and strained relationships. It is crucial to fulfill your obligations and adhere to the terms outlined in the promissory note.Exceptions And Situations

While a promissory note is a legally binding agreement to repay a debt, there are certain exceptions and situations where the obligation to pay back the note may be altered or eliminated. These exceptions can vary depending on specific circumstances and legal factors. It is crucial to understand these exceptions and situations to know your rights and obligations regarding the promissory note.

Bankruptcy

One significant exception is when the promisor declares bankruptcy. In a bankruptcy case, the debtor’s financial liabilities undergo a legal process. Depending on the type of bankruptcy filing, the promissory note debt may be discharged or restructured as part of the overall bankruptcy proceedings. It is important to consult with a bankruptcy attorney to understand how your promissory note will be affected in the event of bankruptcy.

Death Of The Promisor

Another situation that can affect the repayment of a promissory note is the death of the promisor. If the promisor passes away before fulfilling the debt obligation, the responsibility to repay the note may be transferred to the promisor’s estate. The executor or administrator of the estate will handle the repayment, ensuring that the debt is settled from the assets of the deceased.

However, it’s worth noting that if the promissory note is unsecured and the deceased promisor has no significant assets, the creditors may not be able to recover the debt fully. In such cases, the creditor may need to seek legal advice to determine the best course of action.

In conclusion, while a promissory note creates a legal obligation to repay a debt, there are exceptions and situations where repayment may be altered or eliminated. Bankruptcy and the death of the promisor are two such situations that can affect the repayment of a promissory note. Understanding these exceptions is crucial for both creditors and debtors to navigate their rights and responsibilities.

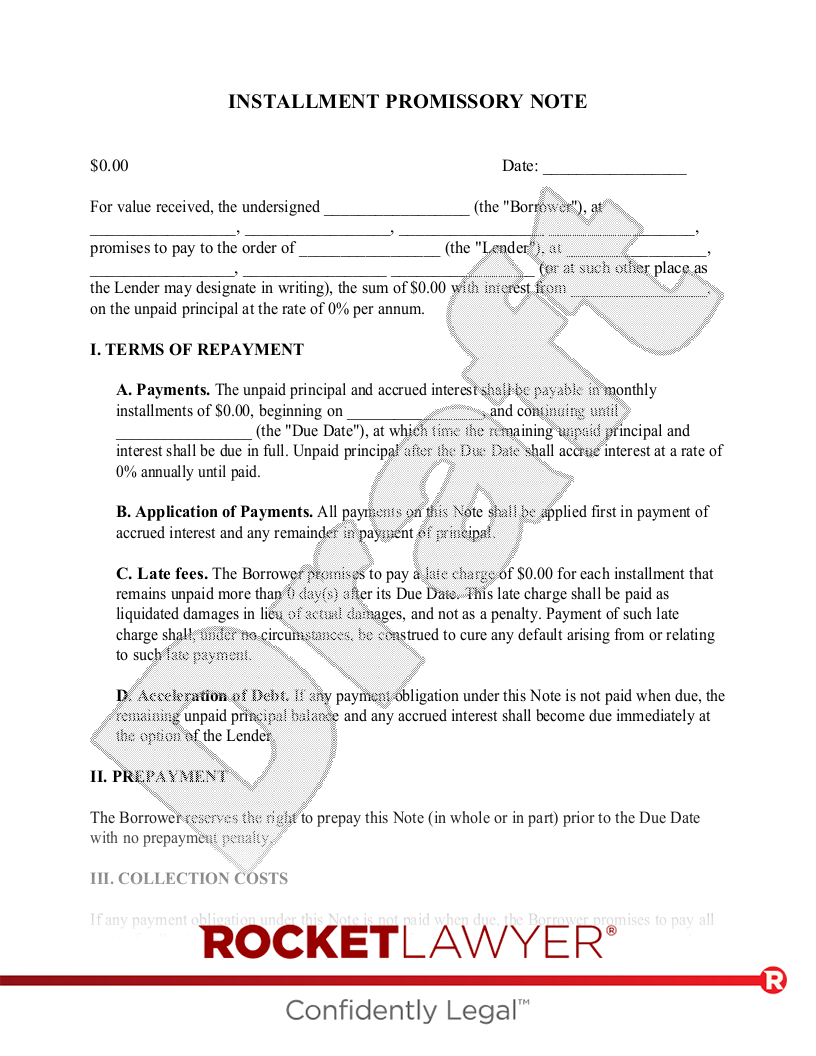

Credit: www.rocketlawyer.com

Options For Resolving The Debt

Resolving the debt can be approached through various options, including repayment plans, debt consolidation, negotiation, or seeking legal advice if necessary. When it comes to promissory notes, it is generally expected that you repay the debt as promised, but exploring available alternatives can help you find the best solution.

Negotiation

If you find yourself facing the daunting task of repaying a promissory note, don’t panic just yet. There are options available to help you resolve the debt. One of the first steps you can take is negotiating with the lender. This allows you to discuss the terms of repayment and potentially reach a mutually beneficial agreement. Negotiation can be a valuable tool in resolving your debt, so it’s important to approach it with a clear understanding of your financial situation.

When negotiating, it’s crucial to be prepared. Take the time to gather all relevant financial information, such as your income and expenses. This will allow you to present a realistic repayment plan to the lender. Be open and honest about your financial hardships and the challenges you are facing. Showing your willingness to work towards finding a solution can help establish a sense of trust between you and the lender.

During the negotiation process, be prepared to discuss potential modifications to the original promissory note. This could include adjusting the interest rate, extending the repayment period, or even settling for a lower amount. Keep in mind that the lender may also have their own suggestions or requirements. It’s important to approach these conversations with a sense of flexibility and a willingness to compromise.

Remember, negotiation requires effective communication skills. Be respectful and professional in your interactions with the lender. Clearly articulate your position and be prepared to provide supporting documents or evidence if necessary. By approaching negotiation with a positive attitude and a willingness to find common ground, you increase the chances of reaching a satisfactory resolution to your debt.

Legal Action

If negotiation doesn’t lead to a satisfactory outcome, you may have to consider legal action as a way to resolve the debt. This option should be taken seriously, as it typically involves hiring an attorney and potentially going to court. Before pursuing legal action, it’s important to consult with a legal professional to determine if this is the best course of action for your specific situation.

Before taking legal action, it’s important to gather all relevant documentation and evidence related to the promissory note. This may include the original agreement, any modifications or correspondence between you and the lender, and proof of any payments made. Having a strong case will increase your chances of success.

If you do decide to proceed with legal action, it’s important to understand the potential consequences. This can include legal fees, court costs, and potential damage to your credit score. However, in some cases, pursuing legal action may be the only way to ensure that your rights are protected and that the debt is resolved in a fair manner.

Legal action should always be considered as a last resort after all other options have been exhausted. It’s important to weigh the potential benefits against the potential costs and risks before proceeding. Consulting with a legal professional who specializes in debt resolution can provide you with the guidance and advice needed to make an informed decision.

Frequently Asked Questions Of Do You Have To Pay Back A Promissory Note?

What Is A Promissory Note?

A promissory note is a legal document that outlines the terms of a loan or debt agreement between two parties. It includes details such as the amount borrowed, interest rate, repayment schedule, and consequences for non-payment. It serves as evidence of the borrower’s promise to repay the loan.

Is A Promissory Note Legally Binding?

Yes, a promissory note is a legally binding document. It outlines the borrower’s obligation to repay the loan according to the terms specified. If the borrower fails to repay the loan as agreed, the lender has legal recourse and can pursue various actions, such as filing a lawsuit or seeking collection efforts.

What Happens If You Don’t Pay A Promissory Note?

If you fail to pay a promissory note, the consequences can be severe. The lender can take legal action to collect the debt, including filing a lawsuit and seeking a judgment against you. This can result in wage garnishment, asset seizure, or a negative impact on your credit score.

It is important to fulfill your obligations outlined in the promissory note.

Conclusion

In short, it’s crucial to understand the implications of a promissory note and the potential legal ramifications if not repaid. Whether you’re the borrower or lender, knowing your rights and responsibilities is vital. Always seek professional advice to navigate any disputes and protect your financial interests.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a promissory note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A promissory note is a legal document that outlines the terms of a loan or debt agreement between two parties. It includes details such as the amount borrowed, interest rate, repayment schedule, and consequences for non-payment. It serves as evidence of the borrower’s promise to repay the loan.” } } , { “@type”: “Question”, “name”: “Is a promissory note legally binding?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, a promissory note is a legally binding document. It outlines the borrower’s obligation to repay the loan according to the terms specified. If the borrower fails to repay the loan as agreed, the lender has legal recourse and can pursue various actions, such as filing a lawsuit or seeking collection efforts.” } } , { “@type”: “Question”, “name”: “What happens if you don’t pay a promissory note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “If you fail to pay a promissory note, the consequences can be severe. The lender can take legal action to collect the debt, including filing a lawsuit and seeking a judgment against you. This can result in wage garnishment, asset seizure, or a negative impact on your credit score. It is important to fulfill your obligations outlined in the promissory note.” } } ] }