Are You Legally Obligated to Return Money Paid in Error? Discover the Definitive Answer

Yes, you are legally obligated to return money paid in error.

Credit: www.rentecdirect.com

Legal Obligation To Return Money

When it comes to financial matters, a payment error can cause confusion and raise questions about legal responsibilities. If you find yourself on the receiving end of money that was mistakenly paid to you, you might wonder whether you are legally obligated to return it. In this blog post, we will explore the nature of payment errors and the legal implications surrounding them. Understanding your rights and responsibilities in such situations is essential for ensuring transparency, fairness, and ethical conduct.

Payment errors can occur due to various reasons, such as technical glitches, human error, or oversights in financial transactions. These errors can result in individuals, businesses, or organizations unintentionally receiving funds they are not entitled to. Whether it is a bank deposit mistakenly made to your account, an overpayment from a client, or an incorrect refund, it is important to examine the nature of the payment error to determine the appropriate course of action. Understanding how the error occurred is crucial for assessing your legal obligations in returning the money.

When it comes to a payment made in error, there can be legal implications that need to be considered. While laws may vary between jurisdictions, common principles of fairness and restitution typically apply. In general, individuals who receive money in error are legally obligated to return it to the rightful owner or sender. This obligation arises from the fundamental legal principle that one should not unjustly benefit from another’s mistake or misfortune.

In addition to the moral obligation to return the funds, failing to do so could lead to potential legal consequences. It could be seen as an act of unjust enrichment if you consciously keep money that doesn’t belong to you. Legal actions, such as lawsuits or criminal charges, may be taken against you to recover the mistakenly paid funds.

However, it is important to note that legal obligations can vary depending on the specific circumstances of the payment error. Factors such as good faith, mistake of fact, and the effort made to rectify the error can influence the outcome of the legal situation. Consulting with legal professionals familiar with the laws in your jurisdiction is essential to navigate the intricacies of your case and understand your legal obligations more accurately.

:max_bytes(150000):strip_icc()/demand-letter.asp_final-a34601ef53cb43da82e3f8c1b550310d.png)

Credit: www.investopedia.com

Refusal To Return Incorrect Payment

Introduction:

If you’ve ever been on the receiving end of an incorrect payment, you may have wondered about your legal obligations regarding its return. After all, it’s not your mistake, right? Unfortunately, the situation is not always so straightforward, and understanding the consequences of refusing to return an incorrect payment is crucial. In this article, we will delve into the potential legal actions and their ramifications when you refuse to return an incorrect payment.

Consequences

When you make the decision to refuse the return of an incorrect payment, several consequences may arise. It’s important to be aware of these potential outcomes to make an informed choice.

- Debt Collection: By refusing to return the money, you risk subjecting yourself to debt collection efforts by the rightful owner. They may enlist the help of collection agencies to recoup the funds.

- Negative Reputation: Refusing to return an incorrect payment can harm your reputation, especially if the situation becomes public knowledge. Others may view you as untrustworthy or unethical, which could have long-term consequences for your personal or professional relationships.

- Legal Action: Refusing to correct the mistake may lead the rightful recipient to pursue legal action against you. This can result in costly legal fees, potential fines, or even a court judgment against you.

Potential Legal Action

When you refuse to return an incorrect payment, the rightful owner of the money may choose to pursue legal action to recover their funds. In such cases, you may face serious legal consequences.

It’s crucial to understand that if the rightful owner takes legal action against you, they will generally need to prove that the payment was made in error, and you knowingly and willfully kept the funds. The burden of proof lies with them to establish your refusal to return the money despite their reasonable efforts to rectify the situation.

If the court finds in favor of the rightful owner, you may be ordered to return the funds, plus any additional legal fees and damages awarded. Additionally, depending on the jurisdiction and circumstances, you could face criminal charges, fines, or even imprisonment in extreme cases.

Keep in mind that the consequences may vary depending on your specific jurisdiction and the circumstances surrounding the incorrect payment. It’s always advisable to consult with a legal professional to gain a comprehensive understanding of the potential legal ramifications in your particular situation.

Handling Incorrect Payments

Handling incorrect payments can be a challenging situation for both the payer and the recipient. Whether it’s an overpayment, duplicate payment, or payment made in error, it’s crucial to understand the legal obligations and the appropriate steps to take in resolving such situations.

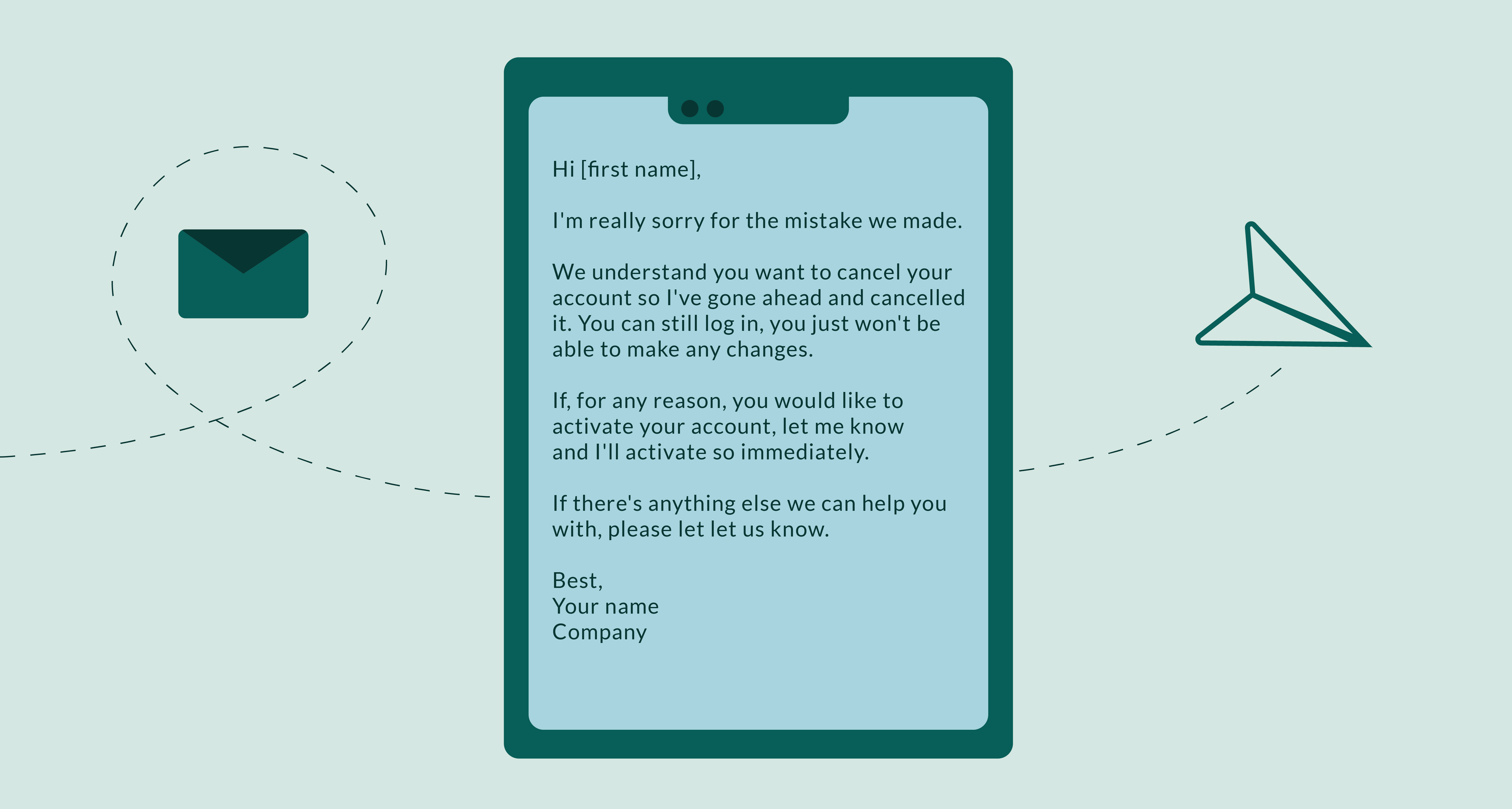

Communication

Open and clear communication is essential when dealing with incorrect payments. The payer should promptly notify the recipient of the error. Transparency and clarity are key in facilitating a smooth resolution process. Documentation of all communication regarding the incorrect payment is also important for record-keeping purposes.

Resolution Process

Once the error is identified, the resolution process should be initiated promptly. This involves thoroughly investigating the nature of the incorrect payment and determining the necessary steps to rectify the situation. Prompt action is essential to avoid further complications or misunderstandings.

Preventing Payment Errors

When it comes to financial transactions, payment errors can happen to anyone. It’s important to have measures in place to prevent such errors and avoid unnecessary complications. By following best practices and implementing security measures, you can greatly minimize the chances of payment errors occurring. In this article, we will explore some effective strategies to protect yourself and your business from payment mishaps.

Best Practices

- Keep accurate records of all transactions: Maintaining detailed records of every payment received and made is essential. This will help you easily spot any discrepancies and rectify them promptly.

- Double-check before processing payments: Before making any payment, it is important to cross-verify the recipient’s information. One small mistake can lead to funds ending up in the wrong hands.

- Use reliable payment systems: Opt for reputable payment platforms that have established security protocols. These platforms often offer additional layers of protection to ensure secure financial transactions.

- Review invoices and bills carefully: Thoroughly examine all invoices and bills before making any payment. Verify the details, amounts, and due dates to avoid making incorrect payments or missing payment deadlines.

- Implement internal controls: If you run a business, establish proper internal controls and procedures to prevent payment errors. This includes having multiple individuals review and approve transactions before processing.

Security Measures

Ensuring the security of your financial transactions is crucial in preventing payment errors. By implementing the following security measures, you can safeguard your funds:

- Strong password protection: Use complex passwords that include a combination of letters, numbers, and special characters. Regularly update your passwords and avoid using the same password for multiple accounts.

- Enable two-factor authentication: Two-factor authentication provides an extra layer of security by requiring a second form of verification, such as a unique code sent to your phone, in addition to your password.

- Encrypt sensitive data: Encrypting sensitive information, such as credit card details and personal data, helps protect it from unauthorized access.

- Regularly update software: Keep your operating system, web browsers, and anti-virus software up to date to ensure you have the latest security patches. Outdated software can be vulnerable to cyber attacks.

- Monitor for suspicious activity: Regularly review your financial statements to identify any unusual or unauthorized transactions. Report any suspicious activity to your bank or payment processor immediately.

By following these best practices and implementing robust security measures, you can greatly reduce the risk of payment errors and protect your finances. Remember, prevention is always better than dealing with the repercussions of a payment mistake.

Case Studies

Real-life Scenarios:

In this section, we will explore a few real-life case studies to better understand the outcomes when individuals are faced with the dilemma of returning money paid in error.

Case Study 1: Jane’s Lucky Day

Jane, a hardworking woman living in a small town, woke up one morning to find an unexpected and substantial sum of money deposited into her bank account. Perplexed by this sudden windfall, Jane wondered whether she was legally obligated to return the funds.

Outcomes:

After conducting some research and seeking legal counsel, Jane discovered that she had no legal entitlement to the funds. The mistake had occurred on the part of a financial institution, and as such, the responsibility for rectifying the error fell on their shoulders.

In this case, Jane was able to keep the money without any legal repercussions.

Case Study 2: Jack’s Ethical Dilemma

Jack, a conscientious individual, discovered a significant overpayment in his monthly paycheck. While tempted to keep the extra funds, Jack had moral concerns about doing so.

Outcomes:

After consulting with his employer and conducting thorough research, Jack learned that he was indeed legally obligated to return the overpayment. To ensure compliance, he promptly returned the funds to his employer, avoiding any potential legal complications.

In this case, Jack chose to uphold his ethical responsibilities and returned the money, preventing any negative consequences.

Case Study 3: Lisa’s Unexpected Withdrawal

Lisa, a diligent saver, noticed an extra withdrawal from her bank account that she hadn’t authorized. Surprised and concerned, Lisa wanted to clarify her rights and responsibilities regarding this error.

Outcomes:

Lisa promptly contacted her bank to report the unauthorized withdrawal and sought clarification on her legal obligation to return the funds. After a thorough investigation, it was determined that the error was on the bank’s part, relieving Lisa of any obligation to return the money.

In this case, Lisa was not legally obligated to return the money as the error was attributed to her bank.

These case studies demonstrate that outcomes can vary depending on the specific circumstances surrounding the error. It is important to seek legal advice and carefully consider one’s ethical obligations to ensure the right course of action is taken.

Credit: www.superoffice.com

Frequently Asked Questions For Are You Legally Obligated To Return Money Paid In Error?

Are You Legally Obligated To Return Money Paid In Error?

No, you are generally not legally obligated to return money paid in error. However, it is considered ethical to return the money and failing to do so could damage your reputation. If the error is discovered, it is advisable to contact the person or organization who made the payment to rectify the situation.

What If I Accidentally Spend Money That Was Paid To Me In Error?

Accidentally spending money that was paid to you in error does not absolve you of the responsibility to return it. Even if it was an honest mistake, you should contact the person or organization who made the payment and take prompt actions to repay the amount.

It is essential to rectify the situation to maintain trust and credibility.

Can The Person Or Organization Who Made The Error Take Legal Action To Recover The Money?

Yes, the person or organization who made the error can take legal action to recover the money. They have the right to pursue legal remedies to reclaim the funds paid in error. It is crucial to handle such situations with integrity and comply with any legal obligations to avoid potential legal consequences.

Conclusion

It’s essential to understand your legal responsibilities when dealing with money paid in error. By following the applicable laws and regulations, you can protect yourself and others from potential legal issues. Remember to communicate openly and honestly with the parties involved and seek professional advice if necessary.

Taking the right steps can save you from unnecessary stress in the long run.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Are you legally obligated to return money paid in error?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “No, you are generally not legally obligated to return money paid in error. However, it is considered ethical to return the money and failing to do so could damage your reputation. If the error is discovered, it is advisable to contact the person or organization who made the payment to rectify the situation.” } } , { “@type”: “Question”, “name”: “What if I accidentally spend money that was paid to me in error?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Accidentally spending money that was paid to you in error does not absolve you of the responsibility to return it. Even if it was an honest mistake, you should contact the person or organization who made the payment and take prompt actions to repay the amount. It is essential to rectify the situation to maintain trust and credibility.” } } , { “@type”: “Question”, “name”: “Can the person or organization who made the error take legal action to recover the money?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, the person or organization who made the error can take legal action to recover the money. They have the right to pursue legal remedies to reclaim the funds paid in error. It is crucial to handle such situations with integrity and comply with any legal obligations to avoid potential legal consequences.” } } ] }