A Guaranteed Renewable Disability Insurance Policy: Protect Your Future

A guaranteed renewable disability insurance policy provides coverage that cannot be canceled by the insurance company as long as premiums continue to be paid, ensuring policyholders have financial protection in the event of a disabling injury or illness. With this type of policy, individuals can have peace of mind knowing their coverage will remain in place, giving them the support they need to replace lost income and meet their financial obligations.

Securing a guaranteed renewable disability insurance policy is crucial for protecting one’s financial stability and ensuring that they can maintain their standard of living if they become disabled. This type of policy provides ongoing coverage, giving policyholders the confidence that they have a safety net in place to protect their financial future.

Credit: www.westernsouthern.com

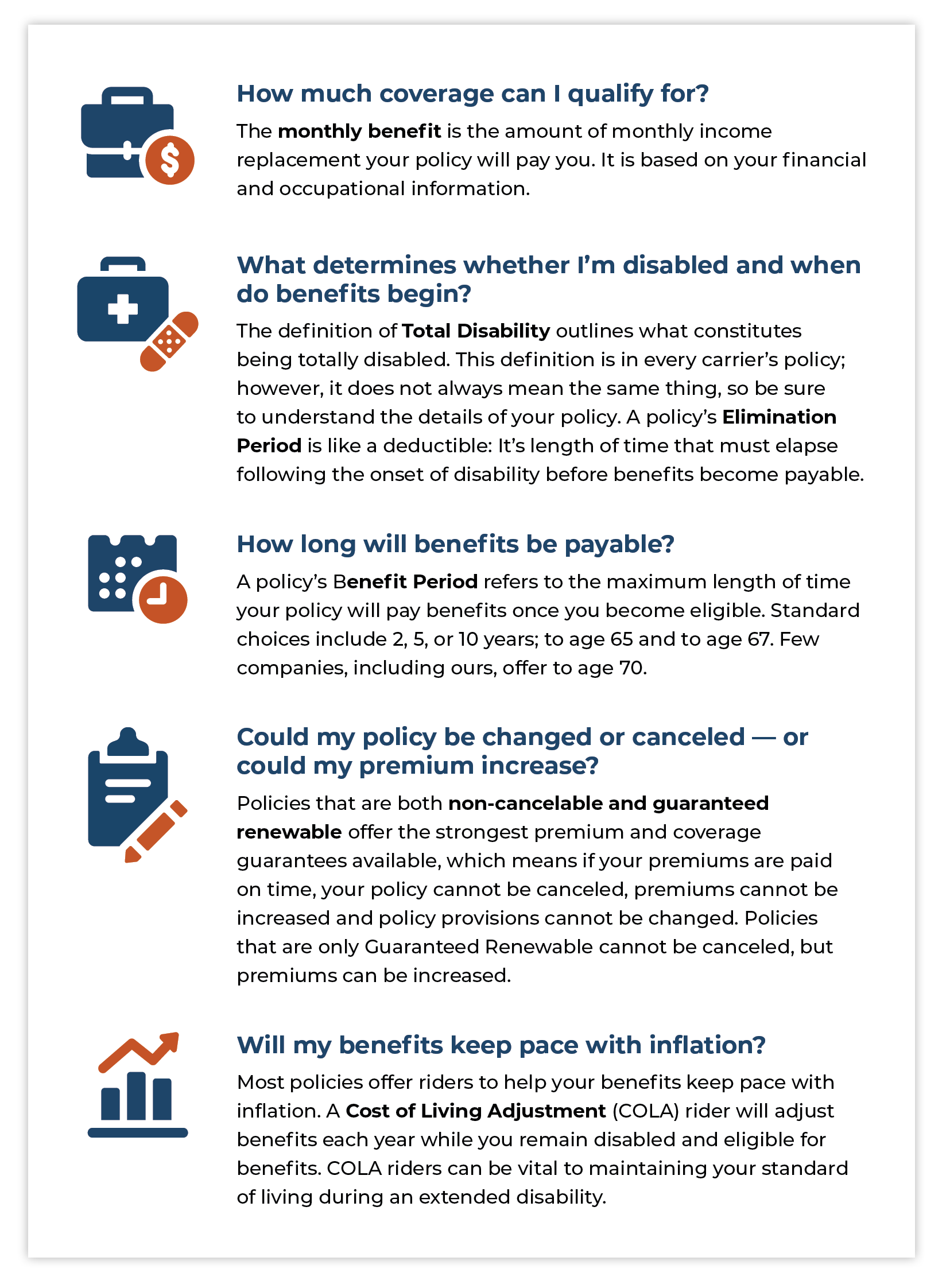

Understanding Disability Insurance

Understand disability insurance with a guaranteed renewable policy that provides long-term coverage. Gain financial protection in the event of a disabling injury or illness. Secure your future with a reliable disability insurance plan.

Understanding Disability Insurance Disability insurance provides essential financial protection in the event that you become disabled due to illness or injury and are unable to work. In this blog post, we will delve deeper into disability insurance, starting with the basic question: What is Disability Insurance?What Is Disability Insurance?

Disability insurance is a type of insurance coverage that offers financial protection to individuals who are unable to work due to a disability. It provides a steady income, typically a percentage of your pre-disability earnings, to help cover your living expenses and maintain your quality of life during your period of disability. Whether it’s a short-term or long-term disability, having an insurance policy in place can offer peace of mind and financial stability.Importance Of Disability Insurance

Being unable to work due to a disability can have significant financial consequences. Without a reliable source of income, you may struggle to pay your bills, medical expenses, or even support your family. This is where disability insurance becomes crucial. By having a disability insurance policy, you ensure that you have a safety net to fall back on if the unexpected happens. It helps you maintain your financial independence and protects your loved ones from the burden of supporting you financially. The importance of disability insurance cannot be overstated, as it provides a lifeline during an incredibly challenging time.Key Benefits Of Disability Insurance

While disability insurance offers financial protection, it also comes with various benefits tailored to your needs. Here are some key advantages of having disability insurance coverage: 1. Income Replacement: Disability insurance replaces a percentage of your lost income, ensuring that you can continue to meet your financial obligations. 2. Guaranteed Renewable: A guaranteed renewable disability insurance policy gives you peace of mind knowing that your coverage will remain intact as long as you pay your premiums. Even if your health condition changes, the insurance company cannot cancel your policy. 3. Tax Benefits: Depending on your country or state, disability insurance premiums may be tax-deductible. Consult with a tax professional for the specific details. 4. No Medical Exam Required: Some disability insurance policies require minimal medical underwriting, making it easier to obtain coverage. 5. Return to Work Support: Many disability insurance providers offer support services to assist you in transitioning back to work after your disability. With these benefits in mind, it is clear that disability insurance is an essential component of financial planning. Protecting your income and ensuring financial security for both you and your loved ones is a wise decision. In conclusion, disability insurance is a vital safeguard against the financial consequences of a disability. By understanding its significance and exploring suitable options, you can protect your income and maintain financial stability during challenging times. Make sure to carefully review different policies and select one that matches your needs and circumstances.

Credit: ccrwealth.com

Renewable Disability Insurance

A guaranteed renewable disability insurance policy provides ongoing coverage and peace of mind for individuals in case of disability. With this policy, you can be assured of continuous protection and support when you need it most.

What Is Renewable Disability Insurance?

Renewable Disability Insurance is a type of insurance policy that provides coverage for individuals who become disabled and are unable to work. Unlike traditional disability insurance policies, which may have limitations on coverage duration, a Guaranteed Renewable Disability Insurance policy ensures that you can continue to receive benefits as long as you meet the policy’s requirements.

How Does Renewable Disability Insurance Work?

In a Guaranteed Renewable Disability Insurance policy, you pay regular premium payments to the insurance provider, and in return, they agree to provide you with benefits in the event of disability. The policy is renewable, meaning that as long as you pay your premiums and fulfill the necessary criteria, you can renew the policy year after year.

Here is a breakdown of how Renewable Disability Insurance works:

Regular Premium Payments:

- You pay a fixed amount of money to the insurance provider at regular intervals, such as monthly or yearly.

- The premium amount may depend on factors like your age, occupation, health condition, and the coverage amount you choose.

Disability Event:

- In the unfortunate event that you become disabled and are unable to work due to an injury or illness, you can file a claim with your insurance provider.

- You may have to provide medical evidence and documentation to support your claim.

Benefit Payments:

- If your claim is approved, the insurance provider will start paying you a predetermined amount of money, known as benefits.

- These benefits are intended to replace a portion of your lost income, helping you meet your financial obligations while you focus on recovering.

Renewal:

- Once you start receiving benefits, you must continue to pay your premiums to keep the policy active and ensure its future renewal.

- The insurance provider may periodically review your disability status to validate ongoing eligibility for benefits.

By choosing a Guaranteed Renewable Disability Insurance policy, you gain peace of mind knowing that even if you become disabled and are unable to work for an extended period, you will continue to receive the financial support you need. It is essential to carefully review the terms and conditions of the policy and consult with an insurance professional to determine the coverage that best suits your needs.

Benefits Of Guaranteed Renewable Disability Insurance

A Guaranteed Renewable Disability Insurance policy offers numerous benefits, providing you with security and peace of mind. With this type of policy, you are guaranteed coverage regardless of changes in your health or occupation, ensuring that you always have financial protection in the event of a disability.

Secure Coverage

When it comes to protecting your financial future, a guaranteed renewable disability insurance policy is a smart choice. One of the key benefits of this type of policy is the assurance of secure coverage. With guaranteed renewability, you have the peace of mind knowing that your policy cannot be canceled by the insurance company as long as you continue to pay your premiums on time.

Unlike non-renewable policies that may leave you vulnerable to unexpected cancellations or changes in coverage, guaranteed renewable disability insurance provides a stable and reliable solution. No matter what may happen in the future, you can rest easy knowing that your disability insurance coverage will remain intact and available when you need it most.

Guaranteed Premiums

Another advantage of guaranteed renewable disability insurance is the assurance of guaranteed premiums. With this type of policy, your premiums are locked in at a fixed rate for the duration of the policy. This means that your monthly payments will never increase, regardless of changes in your health or other factors. This predictability allows you to effectively plan and budget for your insurance expenses, without worrying about unexpected premium hikes.

By choosing a guaranteed renewable disability insurance policy with locked-in premiums, you can avoid the risk of escalating costs and ensure that your coverage remains affordable over time. This provides you with valuable stability and peace of mind, allowing you to focus on your health and recovery instead of financial concerns.

Flexibility In Coverage

In addition to secure coverage and guaranteed premiums, guaranteed renewable disability insurance also offers flexibility in coverage. This means that you have the ability to customize your policy according to your specific needs and circumstances.

| Flexibility in Coverage: |

|---|

| • Choose the amount of monthly benefit you wish to receive in the event of disability. |

| • Decide on the length of waiting period before your benefits begin. |

| • Select the duration of coverage that suits your needs. |

By having control over these variables, you can tailor your disability insurance policy to align with your unique circumstances, ensuring that you receive the right level of protection without paying for unnecessary coverage.

In conclusion, guaranteed renewable disability insurance offers numerous benefits, including secure coverage, guaranteed premiums, and flexibility in coverage. By choosing this type of policy, you can rest easy knowing that your insurance coverage will remain intact, your premiums will remain stable, and your policy can be tailored to your specific needs.

Considerations For Choosing A Guaranteed Renewable Policy

When choosing a guaranteed renewable disability insurance policy, it is important to consider various factors that can greatly impact your coverage and financial security. These considerations will help you make an informed decision that aligns with your needs and budget. Here are some key aspects to evaluate:

Policy Coverage Limits

One of the first things to examine is the policy coverage limits offered by the insurance provider. Ensure that the coverage limits are sufficient to protect your income and lifestyle in the event of a disability. Take into account your current monthly expenses, mortgage or rent payments, and any other financial obligations you have. It is crucial to have a policy that offers comprehensive coverage, allowing you to maintain your standard of living even if you are unable to work.

Waiting Period

The waiting period, also known as an elimination period, refers to the time that must elapse after the onset of a disability before you can start receiving benefits. It is important to carefully consider the waiting period options offered by different insurance policies. Generally, longer waiting periods result in lower premium costs, while shorter waiting periods provide quicker access to benefits. Assess your financial stability and ability to sustain yourself financially during the waiting period, as this will impact your decision.

Exclusions And Limitations

When evaluating a guaranteed renewable disability insurance policy, pay close attention to the exclusions and limitations outlined in the policy documentation. These are conditions or circumstances that may not be covered by the policy. For example, certain pre-existing medical conditions may be excluded or limited in their coverage. Additionally, the policy may have restrictions on the duration of benefits or specific activities that may render you ineligible for coverage. Carefully review these details to ensure the policy aligns with your specific needs and circumstances.

By considering these important factors, you can make an informed decision when selecting a guaranteed renewable disability insurance policy. Assessing policy coverage limits, waiting periods, and exclusions and limitations will help you select a policy that provides comprehensive and suitable coverage for your financial protection.

Credit: www.whitecoatinvestor.com

Frequently Asked Questions On A Guaranteed Renewable Disability Insurance Policy

What Is A Guaranteed Renewable Disability Insurance Policy?

A guaranteed renewable disability insurance policy is a type of coverage that provides long-term disability benefits to policyholders. It guarantees that the policy can be renewed each year, regardless of changes in the insured person’s health or occupation.

How Does A Guaranteed Renewable Disability Insurance Policy Work?

With a guaranteed renewable disability insurance policy, the insurer cannot cancel or refuse to renew the policy as long as the premium payments are made on time. This type of policy provides peace of mind to policyholders, knowing their coverage will continue even if they develop a health condition or change jobs.

What Are The Benefits Of A Guaranteed Renewable Disability Insurance Policy?

A guaranteed renewable disability insurance policy offers several advantages. It provides long-term protection against the risk of a debilitating injury or illness. It also allows policyholders to maintain coverage even with changes in health or occupation, ensuring financial support during a disability.

How Do I Qualify For A Guaranteed Renewable Disability Insurance Policy?

To qualify for a guaranteed renewable disability insurance policy, applicants typically need to meet certain criteria such as age, occupation, and health status. Insurers may request medical records or conduct a medical evaluation to assess the applicant’s eligibility for the policy.

Conclusion

A guaranteed renewable disability insurance policy is a valuable investment that provides financial security in the event of a disability. It offers peace of mind, knowing that your income will be protected and your family’s needs will be met. With its flexibility and long-term coverage, this type of policy ensures stability during uncertain times.

Protect yourself and your loved ones by considering a guaranteed renewable disability insurance policy today.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a guaranteed renewable disability insurance policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A guaranteed renewable disability insurance policy is a type of coverage that provides long-term disability benefits to policyholders. It guarantees that the policy can be renewed each year, regardless of changes in the insured person’s health or occupation.” } } , { “@type”: “Question”, “name”: “How does a guaranteed renewable disability insurance policy work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “With a guaranteed renewable disability insurance policy, the insurer cannot cancel or refuse to renew the policy as long as the premium payments are made on time. This type of policy provides peace of mind to policyholders, knowing their coverage will continue even if they develop a health condition or change jobs.” } } , { “@type”: “Question”, “name”: “What are the benefits of a guaranteed renewable disability insurance policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A guaranteed renewable disability insurance policy offers several advantages. It provides long-term protection against the risk of a debilitating injury or illness. It also allows policyholders to maintain coverage even with changes in health or occupation, ensuring financial support during a disability.” } } , { “@type”: “Question”, “name”: “How do I qualify for a guaranteed renewable disability insurance policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To qualify for a guaranteed renewable disability insurance policy, applicants typically need to meet certain criteria such as age, occupation, and health status. Insurers may request medical records or conduct a medical evaluation to assess the applicant’s eligibility for the policy.” } } ] }