Is It Better to Use Credit Or Debit? Stop Wasting Money!

Using credit or debit depends on your spending habits, financial discipline, and rewards preferences. Credit cards can offer more consumer protections and rewards, but they can lead to debt if not used responsibly.

Debit cards are linked directly to your bank account and can help you avoid debt but may offer fewer rewards and protections. Consider your financial goals and spending habits to determine which option is best for you. When deciding between using credit or debit, it is essential to consider the potential benefits and risks of each.

By understanding your own financial habits and needs, you can make an informed decision that aligns with your goals. Let’s explore the factors to consider when choosing between credit and debit and understand how each option can impact your financial well-being.

The Pros And Cons Of Using Credit Cards

When it comes to managing your finances, the decision to use credit or debit cards is an important one. Understanding the pros and cons of using credit cards can help you make informed choices about your spending habits and financial health.

The Benefits Of Using Credit Cards

- Cash back rewards and points for every purchase can help you save money and earn perks.

- Offers better fraud protection compared to debit cards, limiting your liability for unauthorized charges.

- Ability to build a positive credit history by using and paying off your credit card balance responsibly.

- Provides convenience and flexibility for managing large purchases or emergencies.

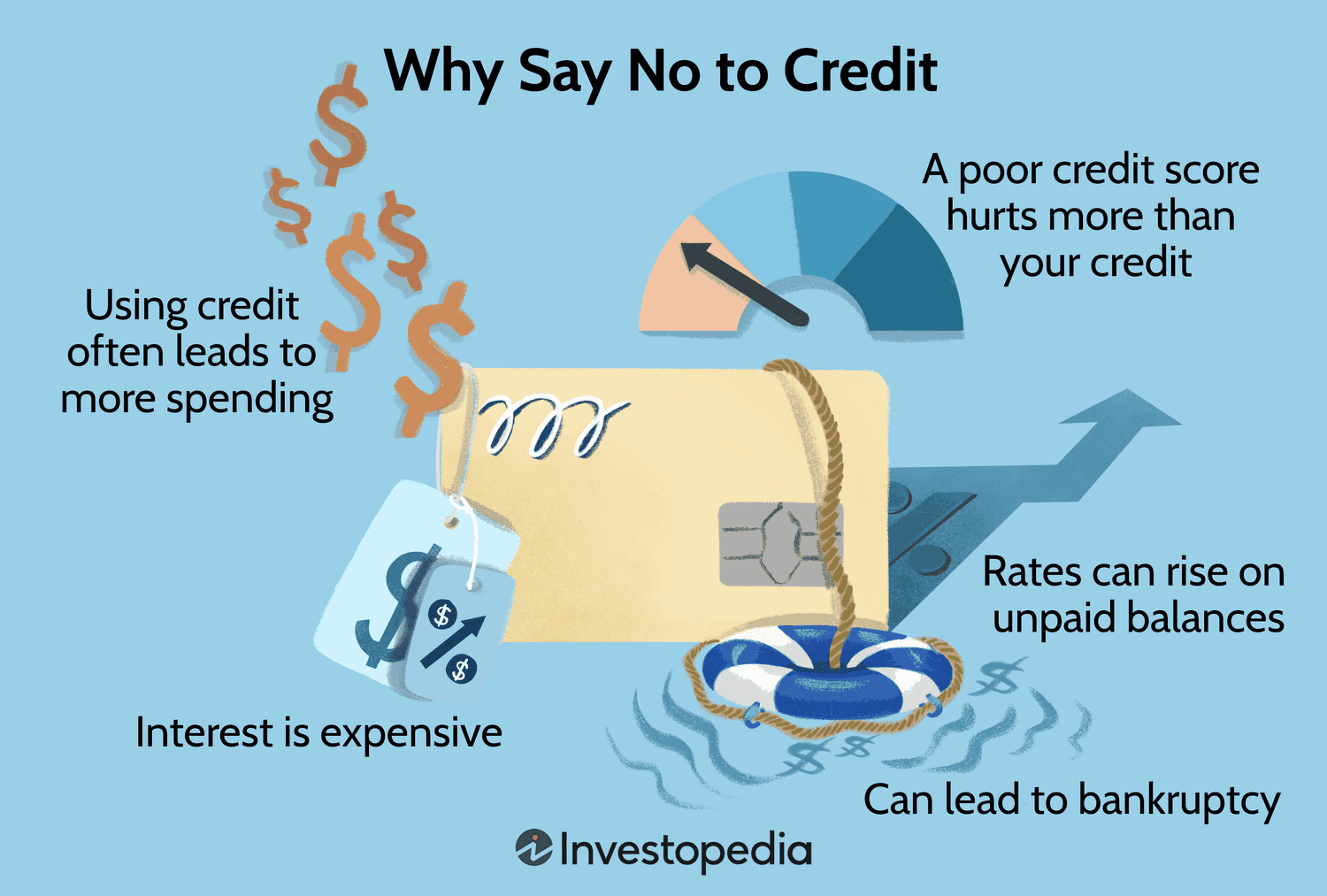

The Drawbacks Of Using Credit Cards

- May lead to accumulating high-interest debt if not paid off in full each month.

- Potential for overspending and falling into a cycle of debt, impacting your financial well-being.

- Annual fees and interest charges can add up and offset any rewards or benefits.

- Impulsive spending and the temptation to make unnecessary purchases due to the ease of using credit.

Credit: www.ramseysolutions.com

The Pros And Cons Of Using Debit Cards

When it comes to the debate of whether to use credit or debit cards, there are various factors to consider. This includes the pros and cons of using debit cards. While debit cards offer convenience and the ability to spend within your means, they also come with certain drawbacks that consumers should take into account.

The Benefits Of Using Debit Cards

Debit cards are an efficient tool for managing personal finances. By using debit cards, consumers can make purchases without acquiring debt, which mitigates the risk of overspending. Furthermore, using a debit card for transactions can help individuals build and maintain a good credit score, as it showcases responsible financial behavior.

The Drawbacks Of Using Debit Cards

However, there are certain drawbacks associated with using debit cards. One primary concern is the lack of fraud protection compared to credit cards. In the event of unauthorized transactions, recovering lost funds from a debit card can be more challenging. Additionally, some debit cards may come with fees for overdrafts, and a compromised debit card can directly impact a consumer’s bank account balance.

Factors To Consider When Choosing Between Credit And Debit

When deciding whether to use credit or debit for your purchases, there are several factors to consider. Each payment method has its own advantages and drawbacks that can impact your financial decisions. To make an informed choice, it’s important to understand these factors.

Financial Discipline

One of the key considerations when choosing between credit and debit is your financial discipline. With a credit card, you have the ability to make purchases and pay for them later. This can be beneficial if you have the discipline to pay off your balance in full each month. By doing so, you can avoid interest charges and potentially improve your credit score.

On the other hand, if you struggle with overspending or paying bills on time, a credit card can be risky. It can lead to high-interest debt and potentially damage your credit history. In this case, using a debit card may be a better option. With a debit card, you can only spend what you have in your bank account, which can help you avoid unnecessary debt and overspending.

Rewards And Cashback

Credit cards often come with rewards and cashback programs, which can be enticing for frequent shoppers. These rewards can range from airline miles and hotel points to cashback on purchases. Depending on your spending habits and goals, utilizing a credit card with attractive rewards can help you save money or earn valuable perks.

Debit cards, on the other hand, usually do not offer the same level of rewards. While some banks may have limited cashback programs, they are generally not as extensive as those offered by credit cards. If rewards and cashback are important to you, using a credit card might be a more suitable choice.

Interest Rates And Fees

Interest rates and fees are significant factors to consider when choosing between credit and debit. Credit cards often come with high-interest rates, especially if you carry a balance from month to month. If you plan to use a credit card, it’s essential to understand the interest rate and any associated fees, such as annual fees or late payment penalties.

On the other hand, debit cards typically do not have interest charges or annual fees. However, some banks may charge fees for specific transactions, such as using an out-of-network ATM. By being aware of these potential fees, you can make an informed decision based on your personal financial situation.

Consumer Protection

When it comes to consumer protection, credit cards often offer more security compared to debit cards. If unauthorized charges occur on your credit card, federal law limits your liability to $50, and most credit card companies have zero-liability policies in place. Additionally, credit card companies can assist with dispute resolution and provide extended warranties and purchase protection.

On the other hand, if unauthorized charges occur on a debit card, your liability depends on how soon you report the theft, and it can be more difficult to recover funds. While debit cards also offer some level of protection, they may not provide the same level of security as credit cards.

Convenience And Accessibility

In terms of convenience and accessibility, both credit and debit cards have their advantages. Credit cards are widely accepted, both online and in physical stores, giving you flexibility when making purchases. They can also provide a buffer in case of emergencies or unexpected expenses, allowing you to access funds even if your bank account balance is low.

Debit cards, on the other hand, offer immediate access to your funds without the need to borrow money or pay back later. They can be used at ATMs to withdraw cash or for direct payments at point-of-sale terminals. Additionally, since debit cards are linked directly to your bank account, you can easily track your spending and manage your finances.

Credit: www.sands-trustee.com

Tips For Making Smart Payment Decisions

When it comes to managing your finances, one of the most important decisions you’ll need to make is whether to use credit or debit. Both options have their pros and cons, so it’s essential to understand how to make smart payment decisions that align with your financial goals and lifestyle. By following these tips, you can ensure that you make wise choices when it comes to using credit or debit.

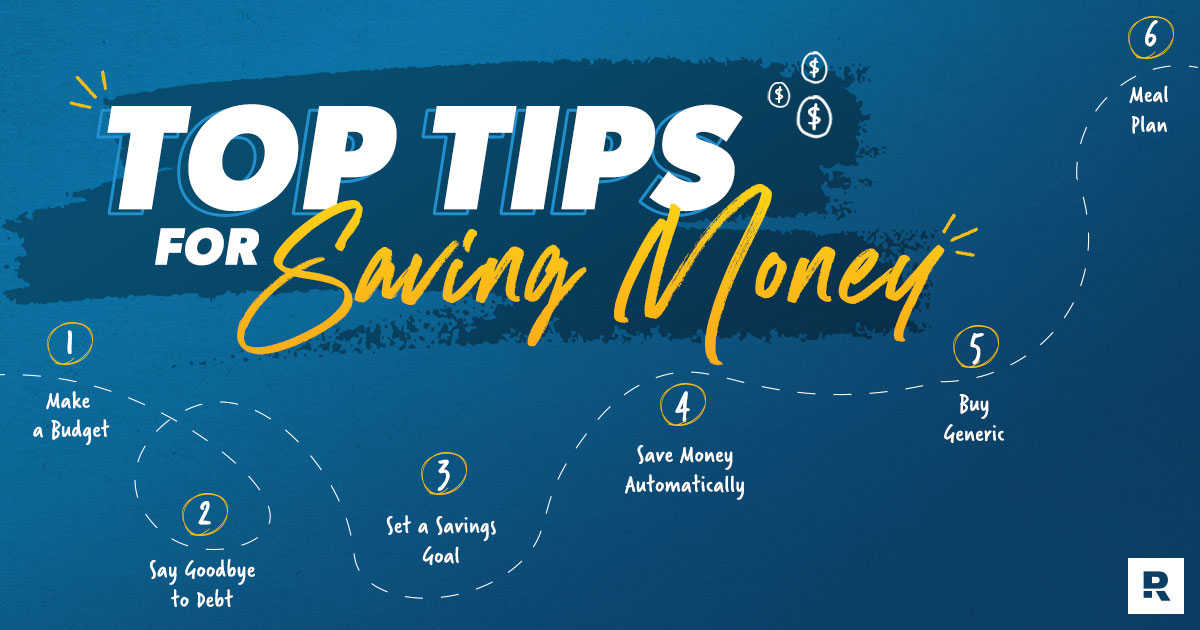

Track Your Spending

One of the first steps in making smart payment decisions is to track your spending. By keeping an eye on where your money is going, you can get a clear picture of your financial habits and identify any areas where you might be overspending. This awareness can help you make more informed decisions about when and how to use your credit or debit cards.

Pay Off Credit Card Balances

If you choose to use credit cards, it’s crucial to pay off your balances in full each month. Carrying a balance not only incurs interest charges but can also lead to a cycle of debt that becomes difficult to escape. By paying off your credit card balances, you can avoid unnecessary interest charges and maintain a healthy credit score.

Avoid Unnecessary Debt

While credit cards can be convenient, it’s essential to use them responsibly. Avoiding unnecessary debt means only charging what you can afford to pay off in full each month. It’s easy to fall into the trap of overspending with credit cards, but exercising restraint and staying within your budget will help you maintain control of your finances and prevent unnecessary debt from accumulating.

Review Terms And Conditions

Before applying for or using a credit or debit card, take the time to thoroughly review the terms and conditions. Pay attention to interest rates, fees, and any potential penalties. Understanding these terms will help you make an informed decision about which card is the best fit for your needs and financial situation.

Plan For Emergencies

Life is full of unexpected events, and it’s crucial to be prepared for emergencies. While using credit cards for emergencies can be a viable option, it’s essential to have a plan in place. Consider setting up an emergency fund to cover unexpected expenses so that you don’t have to rely solely on credit. Having this safety net can provide peace of mind and reduce the dependency on credit cards in times of crisis.

Final Thoughts: Finding The Right Balance

When it comes to managing your finances, finding the right balance between using credit and debit cards is essential. Both options have their own advantages and disadvantages, and it’s important to evaluate your personal financial situation and spending habits before deciding which one is better for you. In this final section, we’ll discuss some key factors to consider when making this decision and help you find the right balance.

Evaluate Your Personal Financial Situation

Before choosing between credit and debit cards, it’s crucial to assess where you stand financially. Consider your income, expenses, and savings goals. Evaluating these factors will help you determine if you can handle the responsibility of a credit card or if a debit card is a safer choice for your current situation.

Consider Your Spending Habits

Your spending habits play a significant role in deciding whether to use a credit or debit card. If you tend to overspend and struggle with impulse purchases, a debit card could be the better option. It allows you to spend only what you have, preventing the accumulation of debt. However, if you are responsible with your spending and can pay off your credit card balance in full each month, using a credit card can bring additional benefits.

Maximize Benefits And Minimize Costs

When it comes to credit and debit cards, it’s crucial to maximize the benefits and minimize the costs. If you choose to use a credit card, look for cards with rewards programs that align with your spending habits. This way, you can earn cash back, travel points, or other incentives for your purchases. On the other hand, with a debit card, focus on finding a bank or financial institution that offers low or no fees for maintaining your account.

In summary, finding the right balance between using credit and debit cards is a personal decision that depends on your individual financial situation and spending habits. By evaluating your current financial standing, considering your spending patterns, and finding ways to maximize benefits while minimizing costs, you can make an informed choice. Whether you choose to use a credit or debit card, remember to always practice responsible financial management and make wise spending decisions.

:max_bytes(150000):strip_icc()/dotdash-050214-credit-vs-debit-cards-which-better-v2-02f37e6f74944e5689f9aa7c1468b62b.jpg)

Credit: www.investopedia.com

Frequently Asked Questions For Is It Better To Use Credit Or Debit?

Is It Better To Use Debit Or Credit For Everyday Purchases?

Using a debit or credit card for everyday purchases depends on personal preferences. Debit cards are ideal for managing expenses, while credit cards offer rewards and protection. Consider your spending habits and financial goals to determine which option is best for you.

Why Do People Use Credit Instead Of Debit?

People use credit for rewards, build credit history, protection, and flexibility in managing finances.

Is It Better To Use Cash Or Debit Or Credit?

Using cash, debit, or credit depends on personal preference, but credit cards offer benefits like rewards and consumer protections, while using cash can help control spending and avoid debt. Consider your financial goals and spending habits to choose which method works best for you.

Which Is Safer To Use Debit Or Credit?

Credit is generally safer to use than debit because it offers more consumer protection against fraud. With credit cards, you’re not responsible for unauthorized charges, and you can dispute them easily. Debit cards, on the other hand, may expose your actual funds to fraudulent activity.

Conclusion

Ultimately, the question of whether it’s better to use credit or debit boils down to personal preference and financial habits. While credit cards can offer rewards and build credit, they also come with the risk of debt and interest charges.

On the other hand, debit cards promote responsible spending but lack the same benefits. Consider your spending habits, financial goals, and the potential risks before making a decision.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Is it better to use debit or credit for everyday purchases?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Using a debit or credit card for everyday purchases depends on personal preferences. Debit cards are ideal for managing expenses, while credit cards offer rewards and protection. Consider your spending habits and financial goals to determine which option is best for you.” } } , { “@type”: “Question”, “name”: “Why do people use credit instead of debit?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “People use credit for rewards, build credit history, protection, and flexibility in managing finances.” } } , { “@type”: “Question”, “name”: “Is it better to use cash or debit or credit?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Using cash, debit, or credit depends on personal preference, but credit cards offer benefits like rewards and consumer protections, while using cash can help control spending and avoid debt. Consider your financial goals and spending habits to choose which method works best for you.” } } , { “@type”: “Question”, “name”: “Which is safer to use debit or credit?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Credit is generally safer to use than debit because it offers more consumer protection against fraud. With credit cards, you’re not responsible for unauthorized charges, and you can dispute them easily. Debit cards, on the other hand, may expose your actual funds to fraudulent activity.” } } ] }