American Emergency Fund Reviews: Unlocking Financial Security

American Emergency Fund has received positive reviews for its quick and reliable financial assistance during emergency situations. Many users have praised the fund for its easy application process and fast approval.

In a time of crisis, having access to financial resources is crucial. American Emergency Fund has garnered positive feedback from users who have found the funds to be a valuable resource during times of need. The efficiency and ease of the application process have been particularly appreciated, allowing individuals to secure assistance quickly.

As the demand for reliable emergency funding options continues to rise, it is important to consider the experiences of those who have utilized such services. In this review, we will explore the feedback and experiences of users with American Emergency Fund to provide insight into the effectiveness of this financial resource.

Credit: www.bankrate.com

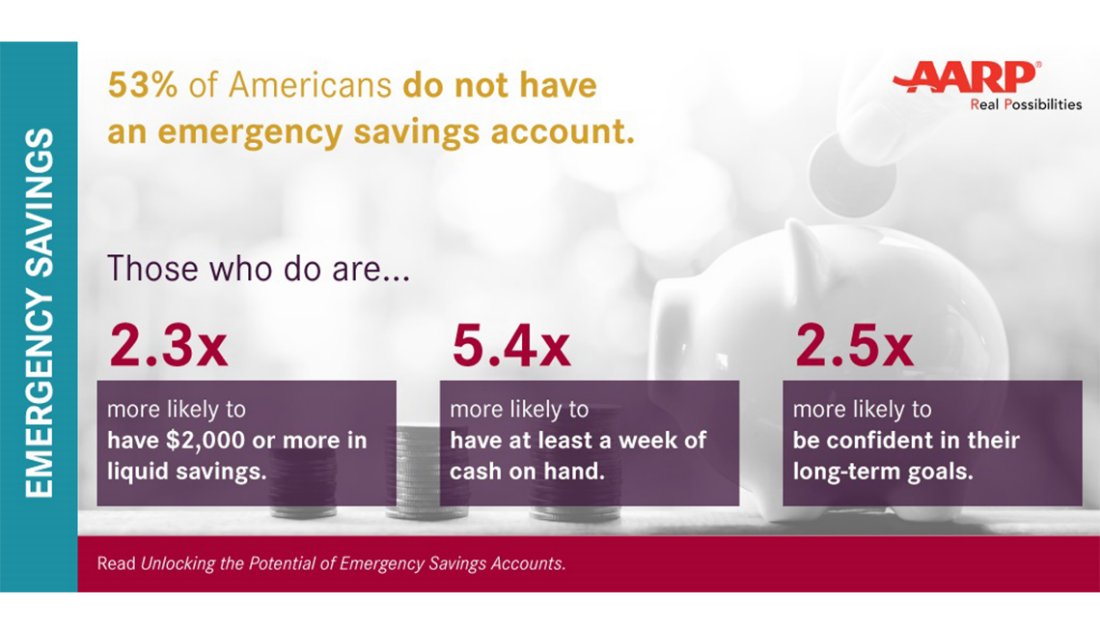

The Importance Of Emergency Funds

American Emergency Fund Reviews highlight the significance of having emergency funds as a crucial financial safety net. These reviews emphasize the importance of being prepared for unexpected expenses and unforeseen circumstances.

An emergency fund is like a safety net that provides financial security and stability during unexpected circumstances. Having such funds readily available enables individuals to navigate through unexpected events and emergencies without having to worry about financial strain.

Preparing For The Unexpected

Life is unpredictable, and emergencies can strike at any time. From medical emergencies and sudden job loss to car repairs and home repairs, unexpected expenses can have a tremendous impact on our finances.

By setting up an emergency fund, you are proactively preparing yourself for such situations. It acts as a financial cushion, allowing you to cover necessary expenses without dipping into your savings or getting into debt.

Peace Of Mind

One of the greatest benefits of having an emergency fund is the peace of mind it brings. Knowing that you have a financial safety net in place can alleviate stress and anxiety during challenging times.

With an emergency fund, you no longer have to worry about how you will pay for unexpected expenses or how you will make ends meet if you face a sudden loss of income.

In addition, having an emergency fund gives you a sense of control over your finances. It allows you to feel confident in your ability to manage unexpected situations without relying on external assistance.

Furthermore, setting up an emergency fund can also reduce the temptation to use credit cards or take out loans in times of crisis. This can save you from accumulating unnecessary debt and the high interest rates that come with it.

Having the financial stability provided by an emergency fund enables you to tackle emergencies with ease and focus on finding solutions rather than worrying about the financial fallout.

Overall, an emergency fund is an essential financial tool that can provide security, stability, and peace of mind during uncertain times. By being proactive and setting up your emergency fund today, you are safeguarding your financial future and ensuring that you are prepared for whatever unexpected events may come your way.

Credit: www.aarp.org

Challenges In Building And Maintaining Emergency Funds

Building and maintaining emergency funds is crucial for financial stability. However, it is not without its challenges. Financial instability and temptations to dip into savings are two of the major obstacles that individuals face when trying to establish and preserve their emergency funds.

Financial Instability

Financial instability poses a significant hurdle in the journey of building emergency funds. Unpredictable events, such as job loss, unexpected medical expenses, or home repairs, can derail the progress made towards establishing a solid financial cushion. These unforeseen circumstances can strain one’s budget and leave individuals struggling to make ends meet.

Temptations To Dip Into Savings

Another challenge that individuals encounter is the temptation to dip into their hard-earned savings. It is common to face unexpected expenses or emergencies that require immediate attention, making it tempting to use emergency funds. However, without a strict commitment to leave the funds untouched, the purpose of having an emergency fund can be compromised.

There are several reasons why individuals may be tempted to dip into their emergency funds:

- Impulse purchases: The desire for instant gratification can lead individuals to splurge on non-essential items, draining their emergency funds.

- Unplanned vacations: The allure of vacations can be hard to resist, even when it means sacrificing emergency savings. This temporary pleasure can have long-term consequences.

- Emergencies not covered by insurance: While insurance often covers a range of unforeseen events, some emergencies may not fall under its protection. In such cases, individuals may be compelled to use their emergency funds.

- Dependency on emergency funds: If individuals rely heavily on their emergency funds to compensate for poor financial management or overspending, the funds can quickly deplete, leaving them vulnerable in times of real emergencies.

It is important to recognize these temptations and develop strategies to avoid or overcome them. By being conscious of one’s spending habits and having a clear understanding of the purpose and importance of emergency funds, individuals can protect themselves from the allure of dipping into their savings unnecessarily.

Evaluation Of American Emergency Fund Options

When it comes to preparing for unexpected financial emergencies, having an American Emergency Fund can provide peace of mind and a sense of security. However, with various options available, it’s essential to evaluate the features and benefits of different American Emergency Fund choices to make an informed decision.

Types Of Emergency Funds

Emergency funds come in various forms, including traditional savings accounts, money market accounts, and high-yield savings accounts. Each type has its own set of advantages in terms of liquidity, interest rates, and accessibility.

Comparative Analysis

Conducting a comparative analysis of American Emergency Fund options allows individuals to assess factors such as minimum balance requirements, interest rates, fees, and ease of withdrawals. This evaluation helps in selecting the most suitable emergency fund option based on one’s financial situation and objectives.

Credit: m.facebook.com

Real-life Impact Of American Emergency Funds

Testimonials

Testimonials are powerful real-life stories that demonstrate the impact of American Emergency Funds. These stories portray how individuals and families have been able to overcome financial crises and emergencies with the support of this fund.

Success Stories

Inspiring success stories highlight the positive outcomes that individuals and communities have experienced through the assistance of American Emergency Funds. These stories showcase how access to timely financial support has made a tangible difference in people’s lives.

Tips For Optimizing Emergency Fund Benefits

Learn how to maximize the benefits of your emergency fund with actionable tips. Get expert insights on American Emergency Fund reviews and make the most of your financial safety net.

Having an emergency fund is crucial for anyone looking to secure their financial future. It provides a safety net and peace of mind during unforeseen circumstances. However, simply having an emergency fund is not enough – optimizing its benefits is equally important. In this section, we will explore some practical tips to make the most of your emergency fund.

Budgeting Strategies

Creating a budget is the first step towards optimizing your emergency fund benefits. A budget helps you track your income and expenses, allowing you to identify areas where you can save more. By cutting back on unnecessary expenses and allocating more funds towards your emergency fund, you can accelerate its growth and be better prepared for any unexpected financial emergencies.

Creating A Safety Net

When it comes to emergency funds, it’s important to aim for at least three to six months’ worth of living expenses. This safety net provides a buffer during times of financial hardship, such as job loss or a medical emergency. To achieve this goal, focus on consistently contributing to your emergency fund and avoid dipping into it for non-emergency expenses. This way, you’ll have a substantial reserve to rely on when needed.

Another effective strategy is automating your emergency fund contributions. By setting up automatic transfers from your paycheck or bank account, you ensure that a portion of your income goes directly into your emergency fund without the temptation to spend it elsewhere. This not only helps you stay disciplined but also makes saving for emergencies a priority.

In addition, consider keeping your emergency fund in a separate high-yield savings account. This not only protects the funds from being mixed with your regular savings but also allows them to grow through higher interest rates. Research and compare different financial institutions to find the one that offers the best rates for your emergency fund.

Remember, an emergency fund should be easily accessible in times of need. Although investing part of your emergency fund may seem tempting, it’s crucial to prioritize liquidity over potential returns. Choose a savings account or money market account which allows you to withdraw funds quickly without incurring penalties or fees.

To sum up, optimizing your emergency fund benefits requires proper budgeting strategies and creating a solid safety net. By having a realistic budget in place and consistently contributing to your fund, you can be better prepared for any unexpected financial challenges that come your way. Take advantage of automation and higher interest rates to maximize the growth of your emergency fund, while ensuring it remains easily accessible when you need it the most.

Frequently Asked Questions For American Emergency Fund Reviews

Is American Emergency Fund Loans Legit?

Yes, American emergency fund loans are legitimate. Always research and verify before applying.

What Is American Emergency Fund?

The American emergency fund is a savings account for unexpected expenses like medical bills or car repairs. It helps individuals and families be financially prepared for unforeseen events. Saving in this fund ensures a safety net during times of crisis.

What Is The Best Account For Emergency Fund?

The best account for an emergency fund is a high-yield savings account. It provides easy access to your money while earning a competitive interest rate, helping it grow over time.

What Should An Emergency Fund Not Be Used For?

An emergency fund should not be used for non-essential expenses like shopping, dining out, or luxury items. It’s important to save it for true emergencies like medical bills, car repairs, or sudden job loss. Using it for everyday spending can leave you unprepared when a real emergency arises.

Conclusion

To sum up, the reviews of American Emergency Fund showcase its effectiveness in providing necessary financial assistance in times of crisis. With its easy application process and quick funding, individuals facing emergencies can rely on this fund for timely help.

The positive feedback and testimonials highlight the trust and reliability associated with this emergency fund. So, consider American Emergency Fund as your reliable partner in ensuring financial stability during unexpected situations.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Is American emergency fund loans legit?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, American emergency fund loans are legitimate. Always research and verify before applying.” } } , { “@type”: “Question”, “name”: “What is American emergency fund?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The American emergency fund is a savings account for unexpected expenses like medical bills or car repairs. It helps individuals and families be financially prepared for unforeseen events. Saving in this fund ensures a safety net during times of crisis.” } } , { “@type”: “Question”, “name”: “What is the best account for emergency fund?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The best account for an emergency fund is a high-yield savings account. It provides easy access to your money while earning a competitive interest rate, helping it grow over time.” } } , { “@type”: “Question”, “name”: “What should an emergency fund not be used for?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “An emergency fund should not be used for non-essential expenses like shopping, dining out, or luxury items. It’s important to save it for true emergencies like medical bills, car repairs, or sudden job loss. Using it for everyday spending can leave you unprepared when a real emergency arises.” } } ] }