Financial Planning Jobs: Unlock Lucrative Opportunities

Financial planning jobs involve helping individuals and businesses manage their finances, create budgets, and make investment decisions for the future. With a strong understanding of financial markets and economic trends, financial planners provide advice and guidance to clients, ensuring their financial goals are met.

These professionals typically work with banks, investment firms, or establish their own consulting businesses. Financial planning jobs require strong analytical and mathematical skills, as well as excellent communication and interpersonal abilities to build trust and rapport with clients. Individuals pursuing a career in financial planning can expect to work closely with clients, assessing their financial situations, developing customized plans, and optimizing investment strategies to secure their financial well-being.

The Growing Demand For Financial Planning Jobs

Financial planning is a critical aspect of personal and business success, and the increasing complexity of the financial landscape has created a significant demand for skilled professionals in this field. As individuals and organizations strive to maximize their financial outcomes, the need for expert advice and guidance has never been greater. This blog post explores the growing demand for financial planning jobs and the factors contributing to this trend.

Meeting The Increasing Need For Financial Planning

Companies and individuals are increasingly recognizing the value of financial planning to navigate the challenges and opportunities that arise in the ever-changing economic landscape. As a result, the demand for financial planners has been steadily increasing.

Financial planners play a crucial role in helping individuals and businesses achieve their financial goals. They assess their clients’ current financial situation, analyze their financial data, and develop customized strategies to help them reach their objectives. This could include creating investment portfolios, managing debt, optimizing tax planning, and retirement planning.

One of the key reasons for the growing demand for financial planning jobs is the complexity of financial products and services available today. Individuals and businesses require knowledgeable professionals who can guide them through the maze of investment options, insurance products, and retirement plans to make informed decisions.

The Impact Of Legislative Changes On Financial Planning Jobs

Another factor contributing to the increasing demand for financial planning jobs is the impact of legislative changes. Governments around the world continue to introduce new regulations and reforms aimed at ensuring financial transparency and consumer protection. These changes have resulted in a greater need for financial planners who can help individuals and businesses navigate the evolving regulatory landscape.

Legislative changes often bring about new opportunities and challenges for financial planning professionals. They must stay up-to-date with the latest regulations and adapt their strategies accordingly. This requires a deep understanding of the legal framework and the ability to provide timely advice to clients that complies with regulatory requirements.

In addition, legislative changes can also create additional demand for financial planners in specific areas. For example, the implementation of new tax laws may drive the need for tax planning experts who can guide clients through the complexities of the revised tax code.

Overall, the growing demand for financial planning jobs is a reflection of the increasing awareness of the importance of financial planning and the need for specialized expertise in this field. As individuals and businesses strive for financial success in today’s complex environment, the role of financial planners becomes even more critical.

Credit: www.opalesque.com

Key Skills And Qualifications

Key skills and qualifications for financial planning jobs include expertise in financial analysis, investment strategies, risk management, and strong knowledge of tax and estate planning. Additionally, proficiency in financial software, excellent communication skills, and the ability to work in a fast-paced environment are essential.

Technical Knowledge And Expertise

Whether you’re just starting out or looking to advance in your financial planning career, having strong technical knowledge and expertise is crucial. Financial planning jobs involve analyzing complex financial data, building investment portfolios, and providing strategic advice to clients. To excel in these roles, proficiency in various technical areas is essential. Let’s explore some of the key technical skills and knowledge required: 1. An in-depth understanding of financial markets and investment products is fundamental. Financial planners need to stay up-to-date on market trends, economic indicators, and the performance of different asset classes. This knowledge allows them to make informed decisions and recommendations for their clients’ investment portfolios. 2. Proficiency in financial analysis tools and software is also important. Financial planners often rely on sophisticated software to model scenarios, evaluate risk, and determine the optimal allocation of assets. Being proficient in tools such as Excel, financial planning software, and portfolio management systems is highly beneficial. 3. Tax planning knowledge is crucial for financial planners. Understanding the tax implications of various financial decisions, such as investment strategies and retirement planning, allows planners to minimize tax burdens and maximize returns for their clients. 4. Compliance and regulatory knowledge is necessary to navigate the legal framework in which financial planners operate. Staying informed about industry regulations and requirements ensures that planners provide advice that is legally sound and compliant with ethical standards.Effective Communication And Interpersonal Skills

In addition to technical expertise, effective communication and interpersonal skills play a vital role in financial planning jobs. As a financial planner, you’ll be working closely with clients, colleagues, and other professionals, making it essential to possess excellent communication skills. Here are some crucial skills in this area: 1. Strong verbal communication skills are necessary to explain complex financial concepts in a clear and concise manner. Being able to articulate strategies, risks, and potential outcomes allows clients to make informed decisions regarding their financial goals. 2. Active listening skills are equally important. Truly understanding a client’s needs and aspirations requires active listening, empathy, and the ability to ask relevant questions. This enables financial planners to customize their advice and solutions to meet each client’s unique circumstances. 3. Written communication skills are crucial for preparing reports, investment proposals, and other client-facing documents. Financial planners must convey complex information effectively, ensuring that clients can understand their recommendations and make informed decisions. 4. Relationship building and interpersonal skills are essential for establishing trust and rapport with clients. Financial planners often deal with sensitive financial information and must create a safe and confidential environment for their clients. Building lasting relationships allows planners to better understand clients’ long-term goals and adjust strategies accordingly. By developing a strong combination of technical knowledge and expertise, along with effective communication and interpersonal skills, you’ll be well-equipped for success in the challenging yet rewarding field of financial planning.Career Paths In Financial Planning

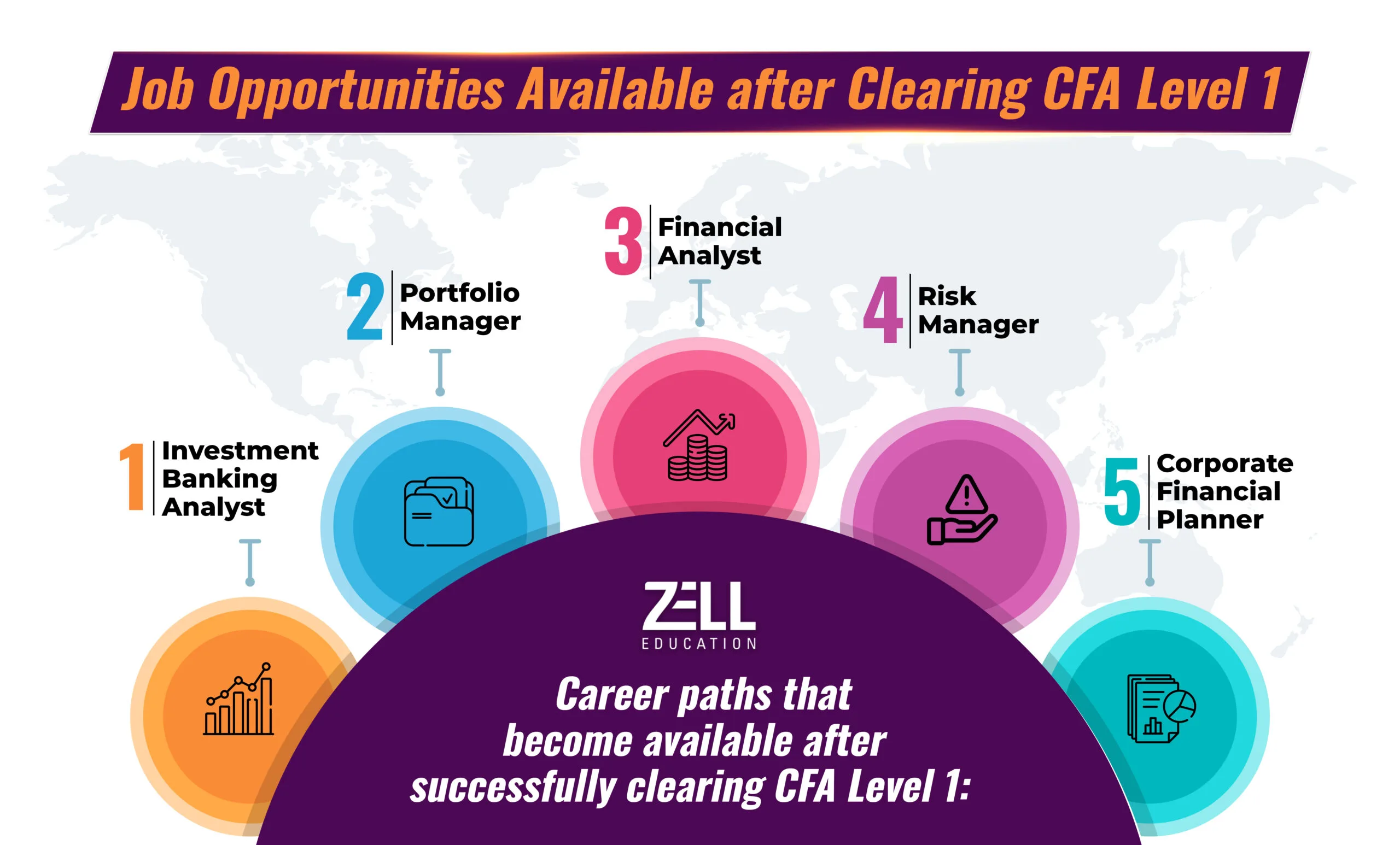

Financial planning jobs offer diverse career paths, including roles such as financial advisor, investment analyst, and wealth manager. These positions involve providing expert advice on managing finances, investment strategies, and long-term financial goals. Success in this field requires strong analytical skills, excellent communication, and a passion for helping clients achieve financial success.

Wealth Management And Investment Planning

Financial planning offers various career paths that professionals can specialize in. One popular area is wealth management and investment planning. As a wealth manager, your primary focus is on helping individuals and organizations grow, protect, and manage their financial assets. You would work closely with clients to understand their financial goals and develop personalized investment strategies.Retirement Planning And Pension Advising

Retirement planning and pension advising is another crucial career path in financial planning. As a retirement planner, you would assist individuals in preparing financially for their retirement. This involves assessing their current financial situation, estimating future expenses, and developing strategies to ensure a comfortable retirement. Pension advising focuses on helping clients understand and maximize their pension benefits, ensuring they make informed decisions throughout their retirement years. Financial planning jobs offer a diverse range of opportunities, allowing professionals to specialize in areas that align with their interests and expertise. While some may choose to focus on wealth management and investment planning, others may find their passion in retirement planning and pension advising. It is important to evaluate your own skills, interests, and goals to choose the career path that is the best fit for you. By doing so, you can build a successful and fulfilling career in the field of financial planning.Salary And Compensation

Financial planning jobs offer promising earning potential, making it an attractive career choice for many professionals. The compensation in this field is influenced by various factors, including experience, education, and the specific industry in which one works. Understanding the earning potential in financial planning jobs and the factors that affect salary growth can help individuals plan their career paths effectively.

Earning Potential In Financial Planning Jobs

Earning potential in financial planning jobs can vary depending on several factors. A financial planner’s base salary typically starts at around $50,000 per year. However, with experience and expertise, professionals in this field can earn substantially higher salaries. The highest-earning financial planners can make six-figure incomes or even more.

The financial planning industry provides ample opportunities for individuals to increase their income. Financial planners can generate additional income through commissions and bonuses by successfully managing their clients’ investments and meeting their financial goals. Additionally, some financial planners choose to work on a fee-based model, where they charge a percentage fee based on the assets they manage for their clients.

Factors Affecting Salary Growth

Several factors can influence the salary growth of financial planners:

- Experience: As with many professions, financial planners with more experience often command higher salaries. Experience brings a wealth of knowledge and expertise, allowing seasoned professionals to demonstrate their value to clients and employers.

- Education: Higher levels of education, such as advanced degrees or specialized certifications, can significantly impact salary growth in financial planning. Continuing education and acquiring relevant certifications can enhance one’s professional credibility and open doors to higher-paying opportunities.

- Industry specialization: Financial planners who specialize in specific industries, such as healthcare or technology, may earn higher salaries due to their specialized knowledge and understanding of unique financial needs within those sectors.

- Location: The location in which a financial planner practices can also impact salary. Major metropolitan areas or regions with a higher cost of living may offer higher salaries to compensate. However, it’s essential to consider the potential offsetting factors such as living expenses.

- Client portfolio: Another significant factor affecting salary growth is the size and quality of a financial planner’s client portfolio. Financial planners who work with high-net-worth individuals or have a substantial number of clients can often command higher compensation.

By considering these factors and strategically managing their careers, financial planners can work towards significant salary growth and enjoy a rewarding and prosperous professional journey in the field of financial planning.

How To Prepare For A Career In Financial Planning

Looking to launch a career in financial planning? Here’s how to prepare for financial planning jobs. Develop a strong foundation in finance and economics, obtain the necessary certifications, and gain practical experience through internships or entry-level positions. Start a successful career in financial planning through these key steps.

Education And Certification Requirements

Before pursuing a career in financial planning, it is important to understand the education and certification requirements. To become a financial planner, it is highly recommended to obtain a degree in finance, economics, or a related field. This educational foundation will provide you with a solid knowledge base to understand the complexities of the financial industry.

Additionally, pursuing certifications such as the Certified Financial Planner (CFP) designation can greatly enhance your credibility and job prospects. The CFP certification requires completing a specific coursework on financial planning topics, passing a comprehensive exam, and fulfilling experience requirements.

Developing A Strong Network And Professional Relationships

Building a strong network and fostering professional relationships is essential for a successful career in financial planning. Creating connections within the industry can provide invaluable opportunities for mentorship, job referrals, and staying up-to-date with the latest industry trends.

One way to expand your network is by attending industry conferences, workshops, and seminars. These events offer an opportunity to meet professionals in the field and learn from their experiences. Another effective way to develop your network is by joining financial planning associations or organizations, where you can connect with like-minded individuals and participate in networking events.

Furthermore, maintaining strong relationships with clients and colleagues is crucial in establishing trust and credibility. Providing excellent service, demonstrating integrity, and delivering on your promises will help you build a reputation as a reliable and trustworthy financial planner.

Credit: www.facebook.com

Credit: www.upwork.com

Frequently Asked Questions For Financial Planning Jobs

What Are The Different Types Of Jobs In Financial Planning?

Financial planning jobs include financial advisors, wealth managers, investment analysts, retirement planners, and tax consultants. Each role requires specialized skills and knowledge in areas such as budgeting, investment strategy, risk assessment, and retirement planning.

What Qualifications Do I Need For A Career In Financial Planning?

To pursue a career in financial planning, you typically need a bachelor’s degree in finance, economics, or a related field. Additionally, obtaining relevant certifications such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst) can enhance your job prospects and credibility in the industry.

How Much Can I Earn As A Financial Planner?

The earning potential as a financial planner can vary depending on factors such as experience, location, and the type of clients you serve. On average, financial planners earn a median annual salary of around $88,890 according to the Bureau of Labor Statistics.

However, top performers in the field can earn significantly higher incomes.

What Skills Are Important For A Successful Career In Financial Planning?

Key skills for a successful career in financial planning include strong analytical abilities, attention to detail, excellent communication and interpersonal skills, problem-solving capabilities, knowledge of financial software and tools, and the ability to stay updated with industry trends and regulations.

Conclusion

Financial planning jobs offer a lucrative career path for individuals with a passion for numbers and helping others secure their financial future. As the demand for financial guidance continues to grow, this profession presents numerous opportunities for growth and advancement.

By combining financial expertise with effective communication skills, professionals in this field can make a meaningful impact on their clients’ lives. So, if you have an interest in finance and a desire to make a difference, consider a career in financial planning.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What are the different types of jobs in financial planning?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Financial planning jobs include financial advisors, wealth managers, investment analysts, retirement planners, and tax consultants. Each role requires specialized skills and knowledge in areas such as budgeting, investment strategy, risk assessment, and retirement planning.” } } , { “@type”: “Question”, “name”: “What qualifications do I need for a career in financial planning?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To pursue a career in financial planning, you typically need a bachelor’s degree in finance, economics, or a related field. Additionally, obtaining relevant certifications such as CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst) can enhance your job prospects and credibility in the industry.” } } , { “@type”: “Question”, “name”: “How much can I earn as a financial planner?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The earning potential as a financial planner can vary depending on factors such as experience, location, and the type of clients you serve. On average, financial planners earn a median annual salary of around $88,890 according to the Bureau of Labor Statistics. However, top performers in the field can earn significantly higher incomes.” } } , { “@type”: “Question”, “name”: “What skills are important for a successful career in financial planning?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Key skills for a successful career in financial planning include strong analytical abilities, attention to detail, excellent communication and interpersonal skills, problem-solving capabilities, knowledge of financial software and tools, and the ability to stay updated with industry trends and regulations.” } } ] }