Conduit Ira : Unlock the Power of Your Retirement Investments

Conduit IRA combines the benefits of a traditional IRA with the flexibility of a Roth IRA. It allows you to convert your traditional IRA into a Roth IRA while maintaining control over your investments.

When planning your retirement strategy, it’s important to consider the various options available to you. One such option is the Conduit IRA, which offers the best of both worlds by combining the advantages of a traditional IRA and a Roth IRA.

With a Conduit IRA, you have the ability to convert your traditional IRA into a Roth IRA, thus enjoying tax-free withdrawals in retirement. This unique feature sets the Conduit IRA apart from other retirement savings vehicles and makes it an attractive choice for individuals looking to maximize their retirement savings. We will explore the benefits and considerations of a Conduit IRA, helping you make an informed decision about your retirement strategy.

What Is A Conduit Ira?

A Conduit IRA allows you to transfer funds from one retirement account to another without tax consequences. It acts as a tax-free intermediary, enabling you to maintain the tax advantages of your investments.

Definition Of A Conduit Ira

A Conduit IRA, also known as a self-directed IRA or an inherited IRA, is a special type of individual retirement account that allows you to transfer assets from an existing IRA or retirement plan into a new account. It serves as a tax-efficient method for passing wealth to future generations.

Benefits Of A Conduit Ira

A Conduit IRA offers several valuable benefits for individuals looking to maximize their retirement savings and preserve wealth for their beneficiaries:

- Tax-deferred growth: With a Conduit IRA, the assets you transfer from your existing retirement account continue to grow tax-deferred. This means you don’t have to pay taxes on the investment gains until you start taking withdrawals during retirement.

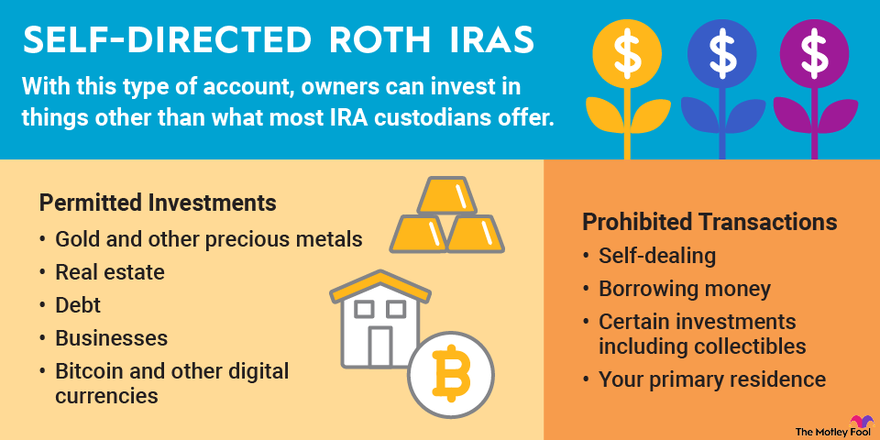

- Flexibility in investments: Unlike traditional retirement accounts that limit your investment options to stocks, bonds, and mutual funds, a Conduit IRA allows you to invest in a wide range of assets, including real estate, precious metals, private equity, and more. This means you can diversify your portfolio and potentially earn higher returns.

- Control over distribution: By setting up a Conduit IRA, you retain control over how and when the assets will be distributed to your beneficiaries. This allows you to customize the distribution plan based on your family’s specific needs, ensuring that your wealth is distributed in a way that aligns with your wishes.

- Asset protection: In some cases, a Conduit IRA can provide protection from creditors. By placing your assets in an IRA, they may be shielded from certain legal claims and judgments, providing an extra layer of security for your wealth.

Overall, a Conduit IRA offers a powerful tool for individuals who want to take control of their retirement savings and ensure a smooth transfer of wealth to future generations. Understanding the definition and benefits of a Conduit IRA can help you make informed decisions about your retirement and legacy planning.

Credit: ultimateestateplanner.com

How Does A Conduit Ira Work?

A Conduit IRA allows you to transfer retirement funds from an old employer’s plan into an IRA without triggering taxes or penalties. It serves as a temporary holding account, facilitating a tax-free rollover into another retirement plan in the future.

Rolling Over Traditional Ira Into A Conduit Ira

In order to understand how a Conduit IRA works, it’s important to first grasp the concept of rolling over a traditional IRA into a Conduit IRA. The process is relatively straightforward and involves transferring funds from an existing traditional IRA into a Conduit IRA. This can be done without incurring any taxes or penalties, as long as the transfer is handled correctly. By rolling over your traditional IRA into a Conduit IRA, you can take advantage of the potential tax benefits and flexibility that a Conduit IRA offers.Investing Your Conduit Ira Funds

Once you have successfully rolled over your traditional IRA into a Conduit IRA, you can begin investing the funds. A Conduit IRA allows you to invest in a variety of assets, such as stocks, bonds, mutual funds, real estate, and more. The flexibility of the Conduit IRA allows you to choose the investments that align with your financial goals and risk tolerance. It’s important to carefully consider your investment options and consult with a financial advisor to ensure that you are making informed decisions and maximizing the potential growth of your Conduit IRA funds.Tax Implications Of A Conduit Ira

One of the key advantages of a Conduit IRA is its potential tax benefits. When you invest with a Conduit IRA, your earnings grow tax-deferred, meaning you won’t have to pay taxes on the gains until you start taking withdrawals. This can provide you with more growth potential over time as your investments compound. Additionally, if you meet certain criteria, you may also be eligible for tax deductions when you make contributions to your Conduit IRA. However, it’s important to note that when you start taking withdrawals from your Conduit IRA, they are subject to ordinary income tax rates. Therefore, it’s crucial to plan your withdrawals strategically to minimize your tax liability and maximize the value of your Conduit IRA. In conclusion, understanding how a Conduit IRA works is essential for optimizing your retirement savings strategy. By rolling over a traditional IRA into a Conduit IRA, you can take advantage of potential tax benefits and flexibility in investing. Remember to carefully consider your investment options and consult with a financial advisor to make informed decisions. With proper planning and strategic withdrawals, a Conduit IRA can provide you with a valuable tool for achieving your retirement goals.Maximizing Retirement Savings With A Conduit Ira

Maximize retirement savings by utilizing a conduit IRA, a tax-efficient strategy that allows for seamless rollovers into another retirement savings account. Secure your financial future by taking advantage of this smart investment option.

Exploring Investment Options

A Conduit IRA offers a unique opportunity to maximize your retirement savings by exploring a wide range of investment options. Unlike traditional retirement accounts, a Conduit IRA allows you to diversify your portfolio beyond the limitations of typical investment vehicles. With the flexibility to invest in stocks, bonds, mutual funds, real estate, and more, you can tailor your investment strategy to achieve your long-term financial goals.

Diversifying Your Portfolio

Diversification is a key aspect of maximizing your retirement savings, as it helps reduce risk and increase potential returns. With a Conduit IRA, you have the freedom to allocate your funds across different asset classes, industries, and geographical regions. By spreading your investments, you minimize the impact of market volatility and position yourself for long-term growth. Whether you choose to invest in domestic or international markets, diversifying your portfolio through a Conduit IRA can potentially enhance your retirement savings.

Optimizing Long-term Growth

One of the primary benefits of a Conduit IRA is its potential for long-term growth. By strategically selecting investment options that align with your risk tolerance and time horizon, you can optimize the growth potential of your retirement savings. Whether you prefer a conservative approach or are willing to take on more risk for higher returns, a Conduit IRA offers the flexibility to tailor your investment strategy accordingly.

Potential Risks And Considerations

Before investing in a Conduit Individual Retirement Account (IRA), it’s important to understand the potential risks and considerations involved. From withdrawal rules to tax consequences and investment performance, being aware of these factors will help you make informed decisions. Read on to explore each aspect in detail.

Understanding Withdrawal Rules

Withdrawals from a Conduit IRA must adhere to specific rules set by the Internal Revenue Service (IRS). It’s crucial to be familiar with these rules to avoid penalties and maximize your financial benefits. Here are a few key points to consider:

- Minimum age for penalty-free withdrawals: The general rule is that withdrawals made before the age of 59 ½ may be subject to a 10% early withdrawal penalty.

- Required Minimum Distributions (RMDs): Starting at age 72, you must begin taking RMDs from your Conduit IRA, and failure to do so may result in substantial tax penalties.

- Exceptions to the early withdrawal penalty: Certain circumstances, such as disability or qualified higher education expenses, may qualify for penalty-free withdrawals. However, it’s crucial to consult with a financial advisor or tax professional to ensure eligibility.

Tax Consequences Of Early Withdrawals

Early withdrawals from a Conduit IRA may have significant tax implications. Understanding the potential tax consequences will help you strategize your withdrawals effectively. Consider the following:

- Income tax: Withdrawals from a Conduit IRA are generally subject to income tax unless they qualify for an exception. Taxes will be assessed based on your current tax bracket, so it’s essential to plan withdrawals accordingly.

- Penalties: In addition to income tax, early withdrawals made before the age of 59 ½ may incur a 10% penalty. This penalty can significantly erode the value of your savings, so careful consideration is advised.

- Withholding requirements: Depending on the amount of your withdrawal, your traditional Conduit IRA may require mandatory tax withholding. It’s important to understand the withholding percentages to prevent surprises come tax time.

Monitoring Investment Performance

Just like any investment, monitoring the performance of your Conduit IRA is crucial for long-term financial success. Consider the following tips to stay informed:

- Review investment options: Regularly assess the performance and suitability of the investment options within your Conduit IRA. Diversification and risk management are key factors to consider when evaluating the performance of your investments.

- Stay up to date with market trends: Keep yourself informed about market trends, economic changes, and industry developments that could impact your Conduit IRA. Understanding how these factors affect your investments will help you make informed decisions.

- Consult a financial professional: Consider working with a financial advisor who specializes in retirement planning. They can provide personalized insights and guidance tailored to your specific goals and risk tolerance.

Is A Conduit Ira Right For You?

When considering your retirement options, it’s important to explore all avenues that can help you reach your financial goals. One such option to consider is a Conduit IRA. But how do you know if it’s the right choice for you? In this post, we will discuss the key factors to consider when assessing whether a Conduit IRA is the best fit for your unique retirement needs.

Assessing Your Retirement Goals

Before determining if a Conduit IRA is suitable for you, it’s essential to have a clear understanding of your retirement goals. Are you aiming for early retirement, or are you planning to work for a more extended period? Do you want to maintain your current lifestyle or have plans to travel and explore new hobbies? Consider all aspects of your retirement dreams and write them down to gain a comprehensive view of what you want to achieve.

Creating a table outlining your short-term and long-term goals, income requirements, and potential expenses can be a helpful visual aid. This table can provide clarity and help determine whether a Conduit IRA aligns with your retirement objectives. Taking this step can assist you in making an informed decision, ensuring that your financial strategy fits seamlessly into your retirement plans.

Determining Your Risk Tolerance

Another vital factor in deciding if a Conduit IRA is right for you is evaluating your risk tolerance. Everyone has a different level of comfort when it comes to investment risk. Some individuals may prefer low-risk options to protect their retirement savings, while others might be more open to higher-risk investments with the potential for greater returns.

Consider your investment experiences, financial stability, and overall attitudes toward risk. A helpful exercise is to create a list of potential investment scenarios and rate them based on your comfort level with risk. This will allow you to gauge whether a Conduit IRA, with its specific investment options, is compatible with your risk tolerance level.

Consulting With A Financial Advisor

Seeking the guidance of a qualified financial advisor is an essential step in determining if a Conduit IRA is the right fit for your retirement strategy. An experienced advisor can provide valuable insights tailored to your unique financial situation, helping you weigh the pros and cons of a Conduit IRA.

This professional can discuss the tax benefits, withdrawal limitations, and investment possibilities associated with a Conduit IRA. They can analyze your retirement goals, risk tolerance, and present alternative options that may better align with your needs. With their expertise, you can make an informed decision that maximizes your retirement potential in a way that matches your preferences and objectives.

In conclusion, when deciding if a Conduit IRA is right for you, it’s crucial to assess your retirement goals, determine your risk tolerance, and consult with a financial advisor. By considering these factors, you can ensure that your chosen retirement plan aligns with your unique needs, setting you on the path towards a secure and fulfilling retirement.

Credit: www.youtube.com

Credit: www.visionretirement.com

Frequently Asked Questions On Conduit Ira

What Is A Conduit Ira?

A Conduit IRA, also known as a rollover IRA, allows you to transfer funds from your former employer’s retirement plan into an individual retirement account. This gives you more control over your retirement savings and allows for potential tax advantages.

How Does A Conduit Ira Work?

A Conduit IRA works by receiving funds from a former employer’s retirement plan and holding them in an individual retirement account. This allows you to maintain the tax-deferred status of the funds while providing more flexibility and investment options.

What Are The Benefits Of A Conduit Ira?

A Conduit IRA offers several benefits, including tax advantages, flexibility in investment choices, and the ability to consolidate retirement funds from multiple employers. It also allows for potential future rollovers into new employer plans, if eligible.

Can I Contribute To A Conduit Ira?

No, a Conduit IRA is designed to hold funds transferred from a former employer’s retirement plan. Contributions are not allowed, but you can continue to manage and invest the existing funds within the Conduit IRA.

Conclusion

Overall, a Conduit IRA can be a valuable tool for effectively managing retirement funds. By allowing individuals to invest in alternative assets, such as real estate or private companies, this type of IRA offers the potential for greater diversification and potentially higher returns.

Additionally, with the ability to control investments and make decisions in real-time, individuals can have a more hands-on approach to their retirement savings. As you consider your retirement plan options, don’t overlook the potential benefits of a Conduit IRA. Start exploring this option today and discover the possibilities for your future financial security.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a Conduit IRA?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A Conduit IRA, also known as a rollover IRA, allows you to transfer funds from your former employer’s retirement plan into an individual retirement account. This gives you more control over your retirement savings and allows for potential tax advantages.” } } , { “@type”: “Question”, “name”: “How does a Conduit IRA work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A Conduit IRA works by receiving funds from a former employer’s retirement plan and holding them in an individual retirement account. This allows you to maintain the tax-deferred status of the funds while providing more flexibility and investment options.” } } , { “@type”: “Question”, “name”: “What are the benefits of a Conduit IRA?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A Conduit IRA offers several benefits, including tax advantages, flexibility in investment choices, and the ability to consolidate retirement funds from multiple employers. It also allows for potential future rollovers into new employer plans, if eligible.” } } , { “@type”: “Question”, “name”: “Can I contribute to a Conduit IRA?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “No, a Conduit IRA is designed to hold funds transferred from a former employer’s retirement plan. Contributions are not allowed, but you can continue to manage and invest the existing funds within the Conduit IRA.” } } ] }