Automatic Premium Loan Provision: Streamline Your Loan Process and Boost Efficiency

The Automatic Premium Loan Provision is a feature that allows the insurance company to automatically borrow money from the policy’s cash value to cover premium payments if the policyholder fails to pay on time. This provision ensures that the policy remains active and in force, preventing it from lapsing or being canceled.

Life insurance policies provide financial security and peace of mind to individuals and their families. However, managing premium payments can sometimes be challenging, especially when unexpected financial difficulties arise. To address this issue, insurance companies often include an Automatic Premium Loan Provision in their policies.

This provision acts as a safeguard, ensuring that the policy remains active even if the policyholder fails to make timely premium payments. By borrowing from the policy’s cash value, the insurance company can cover the outstanding premium amount, keeping the policy in force and preventing it from lapsing or being canceled. We will explore the Automatic Premium Loan Provision in detail, discussing its benefits and considerations for policyholders.

Credit: www.cloudthat.com

Benefits Of Implementing Automatic Premium Loan Provision

Implementing an Automatic Premium Loan Provision offers several benefits for insurance policyholders. This provision allows policyholders to borrow against their policy’s cash value to cover premium payments, ensuring their policy does not lapse due to non-payment. Let’s explore some of the key benefits of implementing this provision:

Reduced Administrative Burden

The Automatic Premium Loan Provision significantly reduces the administrative burden on policyholders. By automatically borrowing against the policy’s cash value when a premium payment is due, policyholders are relieved from the hassle of remembering payment deadlines and managing invoices.

This feature simplifies the process of premium payment, eliminating the need for manual interventions like writing checks, mailing payments, or contacting customer service for bill reminders. With reduced administrative burden, policyholders can focus on other important aspects of their lives, knowing that their premiums are taken care of by the Automatic Premium Loan Provision.

Improved Loan Processing Speed

One of the crucial advantages of implementing the Automatic Premium Loan Provision is the improved speed of loan processing. When a premium payment is due and the policyholder’s cash value is insufficient, the provision automatically initiates a loan to cover the shortfall. This eliminates the delay associated with traditional loan application processes.

Traditional loan processing can involve extensive paperwork, credit checks, and time-consuming approval processes. However, with the Automatic Premium Loan Provision, policyholders can obtain the necessary funds almost instantly, without requiring additional applications or waiting periods. This efficient loan processing speed ensures that policyholders can avoid policy lapses and maintain uninterrupted coverage.

Overall, the implementation of Automatic Premium Loan Provision offers policyholders the benefits of reduced administrative burden and improved loan processing speed. These advantages provide convenience, peace of mind, and continuity of coverage for policyholders, making it a valuable provision for insurance companies to offer.

Credit: ideausher.com

Key Features Of Automatic Premium Loan Provision

Automatic Premium Loan Provision is a valuable feature in insurance policies that can help policyholders ensure their coverage remains intact, even in times of financial hardship. This provision allows the insurer to automatically initiate a loan payment on behalf of the policyholder if the premium payment is missed. This not only helps policyholders avoid the risk of policy termination due to non-payment but also provides them with the opportunity to maintain their valuable insurance coverage. Here are some key features of this provision:

Automatic Loan Payment Initiation

In case of a missed premium payment, the automatic premium loan provision enables the insurer to initiate a loan payment on behalf of the policyholder. This ensures that the policyholder’s coverage remains active and intact, without the need for any manual intervention. This feature provides peace of mind, as policyholders can rest assured that their insurance coverage will continue without any interruptions, even if they forget or are unable to make the premium payment on time.

Customizable Loan Parameters

The automatic premium loan provision offers flexibility by allowing policyholders to customize various loan parameters according to their specific needs. This customization includes the ability to set a maximum loan amount, which ensures that the policyholder is in control of the loan amount being initiated. Additionally, policyholders can also choose the loan interest rate and repayment period that aligns with their financial situation.

By customizing the loan parameters, policyholders can ensure that the loan repayment is manageable and fits within their budget. This feature adds an extra layer of convenience and control for policyholders, enabling them to tailor the loan arrangement to their individual circumstances.

Considerations For Implementing Automatic Premium Loan Provision

Implementing Automatic Premium Loan (APL) provision can offer numerous benefits to policyholders and insurance companies alike. However, before incorporating this feature into your insurance policies, there are several important considerations to keep in mind. By addressing factors such as data security and privacy, as well as compliance with regulatory requirements, you can ensure a smooth and successful implementation of the APL provision.

Data Security And Privacy

Protecting the confidentiality and integrity of policyholder information is crucial in today’s digital landscape. When implementing the Automatic Premium Loan provision, it is imperative to prioritize data security and privacy. Safeguarding sensitive customer data helps build trust and ensures compliance with data protection regulations. Consider the following measures to strengthen data security:

- Regularly update and patch software systems to safeguard against vulnerabilities.

- Utilize encryption techniques to protect data both at rest and in transit.

- Implement strict access controls and multi-factor authentication to prevent unauthorized access to sensitive information.

- Train employees on data security best practices to minimize the risk of human error or data breaches.

Compliance With Regulatory Requirements

Insurance companies operate in a highly regulated environment, and implementing the Automatic Premium Loan provision requires careful adherence to regulatory requirements. Failure to comply can lead to severe penalties and damage to the company’s reputation. Ensure compliance by:

- Thoroughly researching and understanding the applicable regulations specific to your jurisdiction.

- Seeking legal counsel to ensure your policies and procedures align with regulatory guidelines.

- Maintaining proper documentation and records to demonstrate compliance during audits.

- Regularly reviewing and updating policies and procedures to reflect any changes in regulatory requirements.

Note: It is crucial to consult legal and compliance experts to ensure adherence to specific regulatory requirements in your jurisdiction.

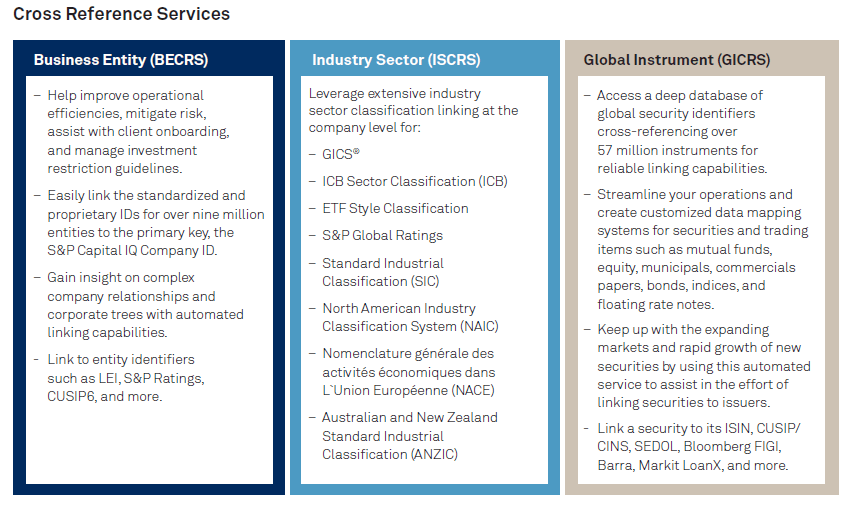

Credit: www.spglobal.com

Frequently Asked Questions On Automatic Premium Loan Provision

What Is An Automatic Premium Loan Provision?

An automatic premium loan provision is a feature that allows insurance policyholders to pay their premiums automatically using the policy’s cash value if they fail to make payments. This provision helps to prevent policy lapse and ensures coverage remains in force.

How Does The Automatic Premium Loan Provision Work?

When a policyholder fails to pay their premium, the automatic premium loan provision kicks in. The insurer will automatically use the cash value of the policy to cover the unpaid premium amount. This loan is secured by the policy’s cash value and accrues interest until the loan is repaid.

What Are The Benefits Of Automatic Premium Loan Provision?

The automatic premium loan provision offers several benefits. It helps policyholders avoid the risk of policy termination due to missed payments. It ensures continuous coverage, even if the policyholder is temporarily unable to pay premiums. Additionally, it eliminates the need for policy reinstatement and allows the policyholder to maintain policy benefits.

Can The Automatic Premium Loan Provision Be Disabled?

Yes, the automatic premium loan provision can usually be disabled if the policyholder prefers not to use it. However, it is essential to understand that by disabling this provision, the policyholder will need to manually pay premiums on time to avoid policy termination.

Conclusion

The Automatic Premium Loan Provision is a beneficial feature that offers convenience and peace of mind to policyholders. By automatically covering overdue premiums, it ensures that policyholders’ coverage remains in force without the need for manual intervention. This provision can provide financial security and prevent policy lapses, ensuring that individuals and their loved ones continue to enjoy the protection and benefits of their insurance policy.

It’s a valuable inclusion in insurance policies that simplifies the premium payment process and offers added protection in times of financial hardships.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is an automatic premium loan provision?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “An automatic premium loan provision is a feature that allows insurance policyholders to pay their premiums automatically using the policy’s cash value if they fail to make payments. This provision helps to prevent policy lapse and ensures coverage remains in force.” } } , { “@type”: “Question”, “name”: “How does the automatic premium loan provision work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “When a policyholder fails to pay their premium, the automatic premium loan provision kicks in. The insurer will automatically use the cash value of the policy to cover the unpaid premium amount. This loan is secured by the policy’s cash value and accrues interest until the loan is repaid.” } } , { “@type”: “Question”, “name”: “What are the benefits of automatic premium loan provision?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The automatic premium loan provision offers several benefits. It helps policyholders avoid the risk of policy termination due to missed payments. It ensures continuous coverage, even if the policyholder is temporarily unable to pay premiums. Additionally, it eliminates the need for policy reinstatement and allows the policyholder to maintain policy benefits.” } } , { “@type”: “Question”, “name”: “Can the automatic premium loan provision be disabled?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, the automatic premium loan provision can usually be disabled if the policyholder prefers not to use it. However, it is essential to understand that by disabling this provision, the policyholder will need to manually pay premiums on time to avoid policy termination.” } } ] }