Cm Accounting: Unlock Your Financial Success with Expert Strategies

Cm Accounting provides accurate and professional accounting services for businesses of all sizes. With years of experience, their team ensures efficient financial management and compliance.

They offer services such as bookkeeping, tax planning, and financial statement preparation. Cm Accounting strives to help businesses make informed financial decisions and achieve their financial goals. Their expertise and commitment to client satisfaction make them a reliable choice for accounting needs.

From startups to established companies, Cm Accounting offers tailored solutions to meet each client’s unique requirements. Trust them to handle your accounting needs and focus on growing your business.

Benefits Of Cm Accounting

Cm Accounting offers a range of benefits for businesses, including comprehensive financial management, accurate bookkeeping, and strategic tax planning. The expert team ensures streamlined operations and helps clients optimize their financial performance.

Cm Accounting offers a range of benefits that can significantly improve the financial health and decision-making processes of businesses. From maximizing tax savings to enhanced financial planning and decision making, Cm Accounting provides the expertise and resources necessary for businesses to thrive. In this blog post, we will explore these benefits in detail to highlight the value of Cm Accounting for businesses of all sizes.Maximizing Tax Savings:

One of the primary advantages of Cm Accounting is the ability to maximize tax savings for businesses. Through careful analysis of financial records and expert knowledge of tax regulations, Cm Accounting helps businesses identify deductions, exemptions, and credits that can reduce their tax liability. By staying up-to-date with ever-changing tax laws, Cm Accounting ensures that businesses comply with regulations while taking full advantage of available tax-saving opportunities.Improved Financial Planning:

Effective financial planning is crucial for the success of any business. Cm Accounting assists businesses in developing comprehensive financial plans that align with their goals and objectives. By analyzing past performance, current financial data, and market trends, Cm Accounting enables businesses to make informed decisions to optimize their financial resources. With the help of Cm Accounting, businesses can create realistic budgets, set achievable targets, and monitor their financial progress to stay on track and achieve long-term success.Enhanced Decision Making:

In today’s fast-paced business environment, making informed and timely decisions is vital. With Cm Accounting’s expertise, businesses can make precise decisions based on accurate financial information. By providing real-time financial reports, Cm Accounting gives businesses a clear and comprehensive view of their financial health. This helps business owners and managers make informed decisions regarding resource allocation, investments, growth strategies, and cost reduction. With accurate and up-to-date financial information, businesses can make smarter decisions that drive their success. In conclusion, the benefits of Cm Accounting are far-reaching and integral to the success of businesses. Through their expertise in maximizing tax savings, improved financial planning, and enhanced decision-making, Cm Accounting provides businesses with the tools they need to thrive in today’s competitive landscape. By partnering with Cm Accounting, businesses can gain a significant advantage, ensuring their long-term financial stability and growth.

Credit: www.facebook.com

Key Strategies For Financial Success

When it comes to achieving financial success, implementing effective strategies is crucial. By adopting key strategies for financial management, businesses can drive their growth and profitability. In this blog post, we will explore three fundamental strategies that can pave the way for financial success: efficient cash flow management, optimizing budgeting and cost control, and effective risk management.

Efficient Cash Flow Management

Managing cash flow is a vital aspect of financial success for any business. By ensuring a steady and healthy cash flow, organizations can meet their financial commitments, seize growth opportunities, and navigate unforeseen challenges. Here are some key considerations for efficient cash flow management:

- Monitor and project cash flow regularly to anticipate and address potential shortfalls or surpluses.

- Streamline accounts receivable processes to improve cash collection, minimizing late payments and bad debt.

- Optimize accounts payable procedures to negotiate favorable payment terms with suppliers while maintaining good relationships.

- Consider implementing automated payment systems for smoother and faster cash flow transactions.

By implementing these strategies, businesses can ensure a healthy flow of cash, enabling them to better allocate resources and invest in future growth.

Optimizing Budgeting And Cost Control

The effective allocation and control of financial resources are critical for achieving financial success. Optimized budgeting and cost control practices empower businesses to make informed decisions, increase operational efficiency, and enhance profitability. Here are some strategies to optimize budgeting and cost control:

- Regularly review and update budgets based on financial goals, market trends, and performance metrics.

- Identify and eliminate unnecessary expenses through rigorous cost analysis and monitoring.

- Negotiate favorable pricing and terms with suppliers by leveraging your purchasing power.

- Implement cost-saving initiatives such as energy efficiency measures, paperless processes, and remote work arrangements.

By optimizing budgeting and cost control, businesses can maximize their financial resources, minimize waste, and invest more strategically in their growth initiatives.

Effective Risk Management

Risks are an inherent part of business operations, and effectively managing them is vital to achieving long-term financial success. By identifying, evaluating, and mitigating risks, businesses can protect their financial stability and minimize potential losses. Here are some strategies for effective risk management:

- Conduct thorough risk assessments to identify potential threats to your business, such as market volatility, natural disasters, and cyber attacks.

- Develop and implement risk mitigation strategies, including insurance coverage and contingency plans.

- Regularly review and update risk management policies and procedures to adapt to evolving business environments.

- Cultivate a risk-aware culture within your organization, promoting proactive identification and reporting of potential risks.

By prioritizing effective risk management, businesses can safeguard their financial health, reputation, and long-term success.

Leveraging Technology In Cm Accounting

The use of technology in Cm Accounting has revolutionized the way businesses manage their financial processes. By leveraging the power of automation, streamlined reporting and analysis, and enhanced data security, Cm Accounting offers a range of benefits for businesses looking to streamline their accounting operations. In this blog post, we will explore how Cm Accounting utilizes technology to optimize accounting processes and enhance overall efficiency.

Automation Of Routine Tasks

In today’s fast-paced business environment, time is of the essence, and there is no room for manual data entry and repetitive tasks. Cm Accounting understands this need for efficiency and employs automation to handle routine tasks.

- Automated data entry simplifies the process of capturing financial information, ensuring accuracy and reducing the chance of human error.

- Scheduled reporting and invoicing eliminate the need for manual intervention, allowing accounting professionals to focus on more strategic aspects of their work.

- Automated bank feeds facilitate seamless reconciliation, saving valuable time and reducing the risk of discrepancies.

Moving from traditional manual methods to automated processes improves the overall efficiency and productivity of accounting operations, enabling businesses to allocate resources more effectively.

Streamlined Reporting And Analysis

One of the key advantages of leveraging technology in Cm Accounting is the ability to generate real-time reports and perform in-depth analysis. Cm Accounting ensures seamless data integration and provides advanced reporting and analysis capabilities to support informed decision-making.

- Interactive dashboards offer an intuitive view of financial data, allowing users to drill down into the details and gain insights into business performance.

- The ability to customize reports and tailor them to specific business needs enables accounting professionals to present key financial information effectively.

- Automated ratio and trend analysis provide valuable insights into a business’s financial health, helping to identify areas for improvement and make informed financial decisions.

| Benefits of Streamlined Reporting and Analysis: |

|---|

| Improved decision-making based on accurate and up-to-date information. |

| Enhanced financial transparency and accountability throughout the organization. |

| Ability to identify financial trends and patterns, allowing for proactive decision-making. |

Enhanced Data Security

Data security is a top priority for businesses, especially when it comes to sensitive financial information. Cm Accounting recognizes the importance of data protection and employs robust security measures to ensure the confidentiality and integrity of financial data.

- Advanced encryption techniques safeguard data during transmission and storage, minimizing the risk of unauthorized access.

- Automatic backups and disaster recovery plans ensure business continuity and minimize the impact of unforeseen events.

- Role-based access controls restrict data access based on predefined user roles, providing an extra layer of security.

With Cm Accounting, businesses can rest assured that their financial data is secure and protected from potential threats.

In conclusion, by leveraging technology, Cm Accounting revolutionizes the way businesses manage their accounting processes. Through automation, streamlined reporting and analysis, and enhanced data security, Cm Accounting offers a comprehensive solution for businesses looking to optimize their financial operations. Embracing technology in accounting enables businesses to save time, make informed decisions, and protect sensitive financial data.

Credit: www.udemy.com

Choosing The Right Cm Accounting Service

Finding the right CM Accounting service is crucial for your business’s financial success. The expertise and reliability of CM Accounting will ensure accurate financial records and effective management of your accounts.

Factors To Consider

When it comes to managing the financial aspects of your business, choosing the right accounting service is crucial. The right CM accounting service can offer you much more than just number-crunching. It can provide valuable insights and strategic advice to help you make informed business decisions. But with so many options available, how do you determine which CM accounting service is the right fit for your business? Here are some important factors to consider: 1. Expertise: Look for a CM accounting service that specializes in your industry or has experience working with businesses similar to yours. This ensures they have a deep understanding of the unique challenges and requirements of your business. 2. Range of Services: Consider the specific services you need for your business. Some CM accounting services offer basic bookkeeping and tax services, while others provide a comprehensive range of financial services including budgeting, forecasting, and financial reporting. Determine your specific needs and find a service that can meet them. 3. Technology and Automation: In today’s digital age, it’s important to choose a CM accounting service that utilizes modern technology and automation tools. This can streamline your financial processes and provide real-time access to your financial data. Look for services that offer cloud-based accounting software and automation tools to save you time and improve accuracy. 4. Communication and Support: Regular and effective communication is essential when working with a CM accounting service. Ensure that they have clear lines of communication, responsive customer support, and are willing to provide timely reports and updates.Comparing Service Providers

When comparing CM accounting service providers, it’s important to do your due diligence. Here are some key considerations to keep in mind: – Cost: While cost shouldn’t be the sole determining factor, it’s important to compare pricing structures and ensure you’re getting value for your money. Look for CM accounting services that offer transparent pricing and clearly outline what services are included in their packages. – Reputation: Research each CM accounting service provider’s reputation by reading client reviews and testimonials. This can provide valuable insights into their level of expertise, reliability, and customer satisfaction. – Accreditation and Certifications: Check if the CM accounting service provider is accredited by relevant professional bodies. This ensures they adhere to high standards of professionalism and ethical conduct. – Scalability: Consider your future growth plans and whether the CM accounting service can accommodate your evolving needs. Find out if they have experience working with businesses of similar size and scale.Client Success Stories

Nothing speaks volumes about the quality and effectiveness of a CM accounting service than the success stories of their clients. Look for case studies or testimonials from businesses similar to yours that highlight how the CM accounting service has helped them achieve their financial goals. This can provide valuable reassurance and help you make an informed decision about which service provider to choose. In conclusion, choosing the right CM accounting service requires careful consideration of various factors including expertise, range of services, technology, communication, pricing, reputation, and client success stories. By taking the time to evaluate these factors, you can find a CM accounting service that aligns with your business goals and can provide the financial support you need.

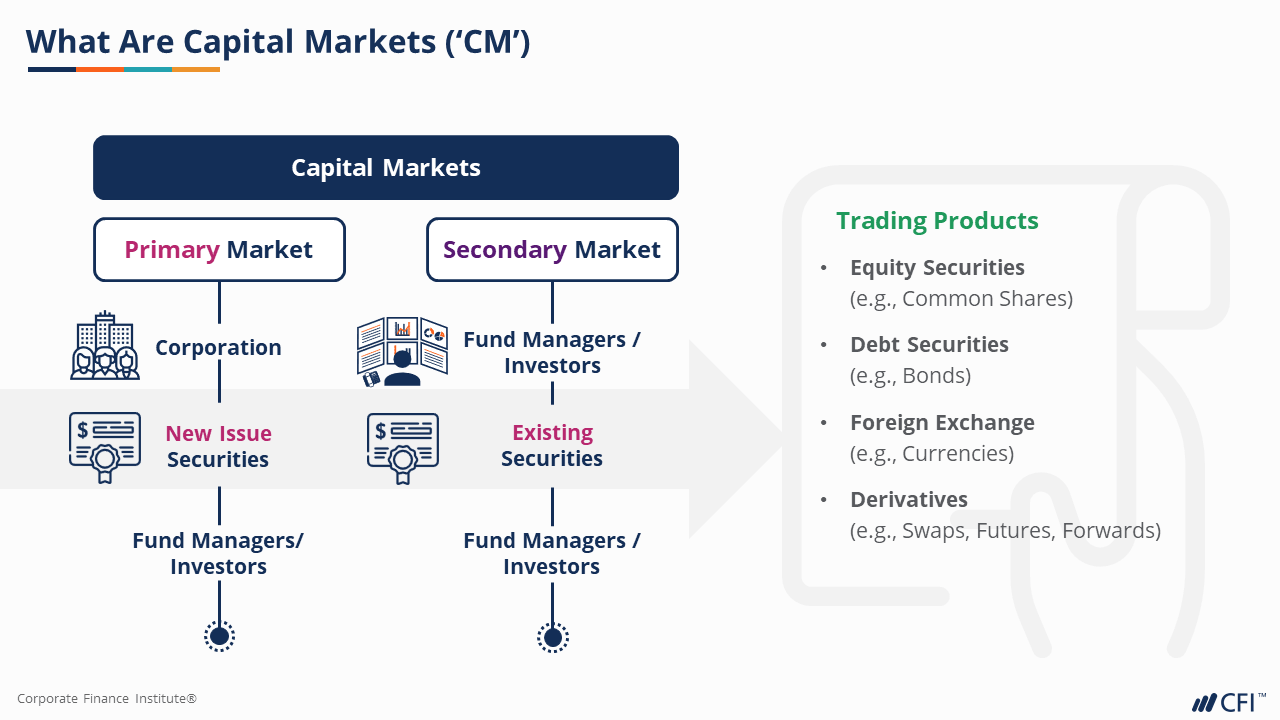

Credit: corporatefinanceinstitute.com

Frequently Asked Questions Of Cm Accounting

What Services Does Cm Accounting Provide?

CM Accounting provides a wide range of services including bookkeeping, tax preparation, financial statement preparation, payroll processing, and business consulting. Their experienced team ensures accurate and timely financial information to help businesses make informed decisions and stay compliant with regulations.

How Can Cm Accounting Help My Business With Tax Planning?

CM Accounting can help your business with tax planning by analyzing your financial situation and identifying potential deductions, credits, and strategies to minimize your tax liability. They stay up-to-date with the latest tax laws and regulations to ensure you are taking advantage of all available opportunities.

Can Cm Accounting Assist With Setting Up A Budget For My Business?

Absolutely! CM Accounting can help you set up a budget for your business by analyzing your expenses, revenue, and financial goals. They will work with you to develop a customized budget plan that allows you to effectively manage your finances and achieve your business objectives.

What Industries Does Cm Accounting Specialize In?

CM Accounting has experience working with a wide range of industries including retail, manufacturing, professional services, healthcare, and more. Their expertise allows them to understand the unique financial challenges and opportunities that businesses in different industries face.

Conclusion

Cm Accounting offers comprehensive accounting services that are tailored to meet the unique needs of businesses. With their team of experienced professionals, they provide accurate financial reporting, tax planning, and bookkeeping solutions. Whether you are a small startup or an established corporation, Cm Accounting is committed to ensuring your financial success.

Trust them to handle your accounting needs efficiently and effectively, allowing you to focus on growing your business.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What services does CM Accounting provide?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “CM Accounting provides a wide range of services including bookkeeping, tax preparation, financial statement preparation, payroll processing, and business consulting. Their experienced team ensures accurate and timely financial information to help businesses make informed decisions and stay compliant with regulations.” } } , { “@type”: “Question”, “name”: “How can CM Accounting help my business with tax planning?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “CM Accounting can help your business with tax planning by analyzing your financial situation and identifying potential deductions, credits, and strategies to minimize your tax liability. They stay up-to-date with the latest tax laws and regulations to ensure you are taking advantage of all available opportunities.” } } , { “@type”: “Question”, “name”: “Can CM Accounting assist with setting up a budget for my business?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Absolutely! CM Accounting can help you set up a budget for your business by analyzing your expenses, revenue, and financial goals. They will work with you to develop a customized budget plan that allows you to effectively manage your finances and achieve your business objectives.” } } , { “@type”: “Question”, “name”: “What industries does CM Accounting specialize in?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “CM Accounting has experience working with a wide range of industries including retail, manufacturing, professional services, healthcare, and more. Their expertise allows them to understand the unique financial challenges and opportunities that businesses in different industries face.” } } ] }