Sandwich Lease : Uncover the Secrets of this Real Estate Strategy

A sandwich lease is a real estate strategy where a tenant becomes a landlord by subleasing a property they are currently leasing. It involves two leases, with the tenant acting as a middleman between the original landlord and a subtenant.

This arrangement allows the tenant to generate rental income while still fulfilling their obligations to the original landlord. In today’s real estate market, individuals and businesses are seeking innovative ways to generate income and maximize the use of their leased properties.

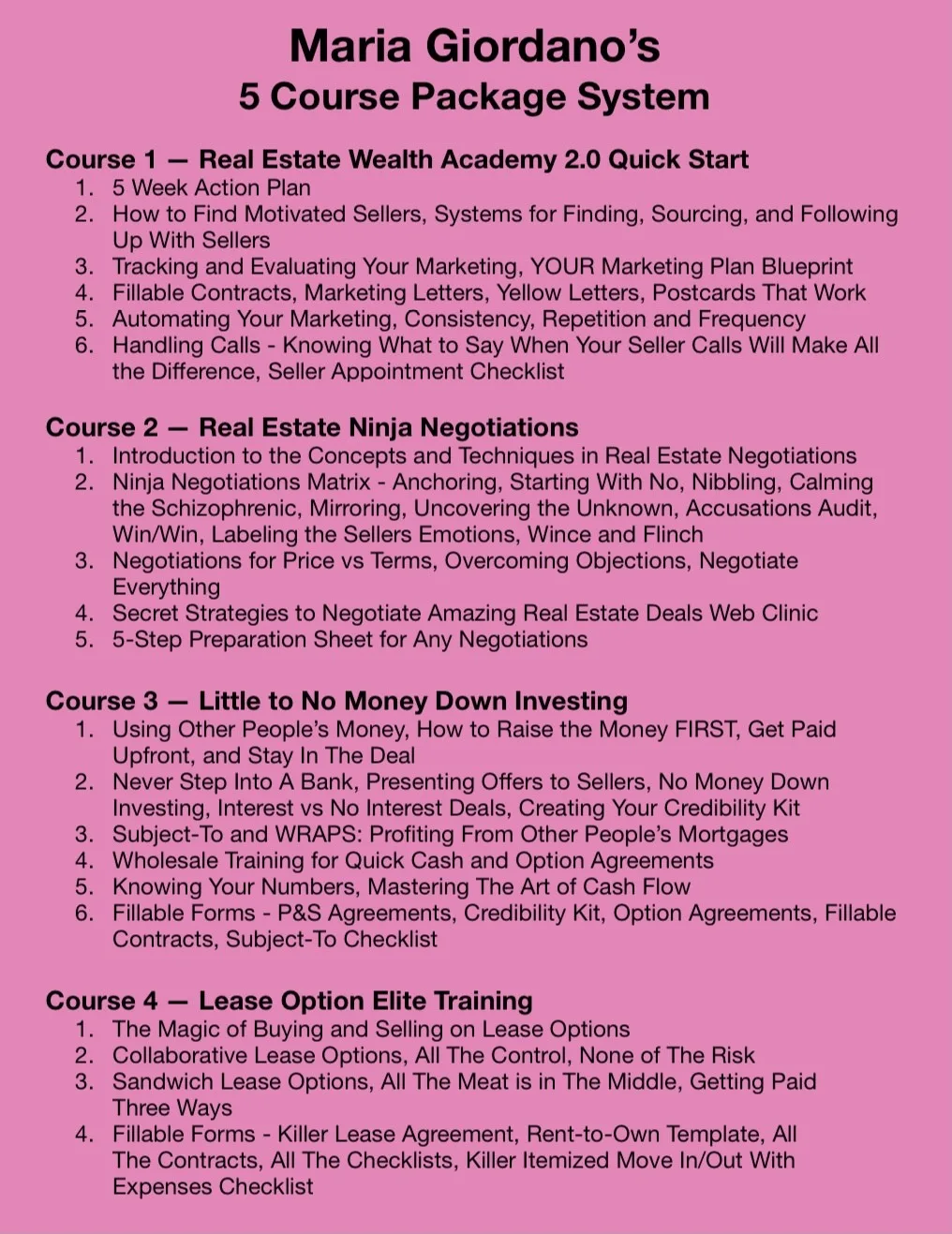

One such strategy is the sandwich lease, which involves subleasing a property that is already being leased. This unique approach allows tenants to become landlords themselves, generating rental income while still fulfilling their obligations to the original landlord. We will explore the concept of the sandwich lease in more detail, including its benefits, considerations, and potential risks. By understanding this real estate strategy, you can make informed decisions and optimize the use of your leased property.

Credit: www.amazon.com

What Is A Sandwich Lease

Are you familiar with the concept of a sandwich lease? If not, don’t worry! In this article, we will dive into the definition and workings of a sandwich lease. Whether you’re a real estate investor or simply curious about this intriguing method, this post will help you understand the ins and outs of a sandwich lease.

Definition

A sandwich lease, also known as a sublease or an assignment of lease, is a unique arrangement in the real estate world. It involves three parties: the original tenant (the sandwich leaseholder), the landlord, and the subtenant.

In a sandwich lease, the original tenant subleases the property they are renting from the landlord to another person, known as the subtenant. The sandwich leaseholder acts as the middleman, essentially sandwiched between the landlord and the subtenant.

How It Works

Now that we have a basic understanding of what a sandwich lease is, let’s explore how it works in practice:

- The original tenant finds a property they wish to rent and signs a lease agreement with the landlord. They become the sandwich leaseholder.

- Next, the sandwich leaseholder subleases the property to a subtenant, who will be responsible for paying the rent and occupying the property.

- The sandwich leaseholder collects rent from the subtenant and pays the agreed rent to the landlord. This arrangement allows the original tenant to generate income from the property without directly occupying it.

- In some cases, the sandwich leaseholder may also negotiate additional terms and conditions with the subtenant, such as maintenance responsibilities or lease extensions.

It’s important to note that the original lease agreement between the landlord and the sandwich leaseholder remains in effect. The sublease between the sandwich leaseholder and the subtenant is a separate contractual arrangement.

One of the advantages of a sandwich lease is the potential for generating passive income as the sandwich leaseholder. By charging a higher rent to the subtenant than what they pay to the landlord, the sandwich leaseholder can create a profitable margin. However, it’s crucial to carefully consider all legal and financial obligations involved before entering into a sandwich lease.

Now that you have a better understanding of a sandwich lease, you can explore its potential benefits and drawbacks for your real estate ventures. Keep in mind that local laws and regulations may vary, so it’s wise to seek professional advice before engaging in this type of lease arrangement.

Credit: www.amazon.com

Benefits Of Sandwich Leases

When it comes to real estate investing, sandwich leases offer a unique and advantageous strategy. This type of lease arrangement involves two leases being stacked, with the investor acting as the middleman between the property owner and the tenant. By taking on this intermediary role, investors can benefit in numerous ways. Let’s dive into the specific advantages of sandwich leases:

Low Entry Cost

One of the primary benefits of sandwich leases is the low entry cost involved. Unlike traditional real estate investing where you need to put down a substantial amount of money to purchase a property, sandwich leases allow you to leverage someone else’s property and generate income without the need for a significant upfront investment. This makes it an attractive option for those looking to enter the real estate market with limited financial resources.

Minimal Risk

Sandwich leases also come with minimal risk for the investor. Since you don’t actually own the property, you are not responsible for its maintenance, repairs, or any unforeseen expenses that may arise. The burden of property ownership falls on the property owner, while you simply collect rent from the tenant. This reduces your exposure to potential financial risks and allows you to focus on generating income from the lease agreement.

Key Players In A Sandwich Lease

A sandwich lease, also known as a lease option or a lease-purchase agreement, involves three key players: the optionor, the optionee, and the tenant-buyer. Each of these individuals has a distinct role in the transaction. Understanding the responsibilities and rights of these parties is crucial to navigate a sandwich lease successfully.

Optionor

The optionor is the property owner or the landlord who initiates the sandwich lease agreement. They hold the legal rights to the property and have the option to sell it to the tenant-buyer at a predetermined price and within a specified timeframe. A responsible optionor should ensure that the property is well-maintained and adhere to all local regulations and laws.

Optionee

The optionee, also known as the middle person, is an individual who enters into a sandwich lease agreement with the optionor. The optionee acts as both the tenant and the landlord simultaneously. They have the right to lease the property from the optionor and sublease it to the tenant-buyer. The optionee’s goal is to create a profit margin by charging a higher rent to the tenant-buyer compared to the rent they pay to the optionor.

Tenant-buyer

The tenant-buyer is the individual who desires to own the property eventually. They enter into a lease agreement with the optionee and have the right to occupy and enjoy the property as a tenant. However, the tenant-buyer also has the option to purchase the property at a pre-agreed price within a designated period, usually at the end of the lease term. This arrangement allows the tenant-buyer to test the property and ensure it meets their requirements before committing to the purchase.

Once these key players understand their roles and responsibilities, they can proceed with a sandwich lease with confidence. The optionor provides the property, the optionee facilitates the agreement, and the tenant-buyer gains the opportunity to become a homeowner. With clarity on each role, a sandwich lease can be a win-win situation for all parties involved.

Steps To Execute A Sandwich Lease

In this section, we will discuss the essential steps to successfully execute a sandwich lease. By following these steps, you can navigate the process with ease and increase your chances of a profitable sandwich lease agreement.

Finding A Motivated Seller

The first step in executing a sandwich lease is finding a motivated seller who is open to the idea of a lease option. This involves searching for property owners who may be facing financial difficulties or are eager to sell quickly. Some effective strategies to find motivated sellers include:

- Scouring online real estate platforms

- Attending local real estate networking events

- Building relationships with real estate agents who can connect you with potential sellers

- Marketing your services to distressed property owners

By employing these strategies, you can narrow down your search to find sellers who are willing to consider a sandwich lease arrangement.

Negotiating Lease Terms

Once you have identified a motivated seller, the next step is to negotiate lease terms that are beneficial to both parties involved. Some essential aspects to consider during the negotiation process include:

- Rent amount and payment schedule

- Lease duration and renewal options

- Maintenance and repair responsibilities

- Option fee and purchase price

During negotiations, it’s crucial to maintain open communication and be flexible, ensuring that the agreement meets the seller’s needs while providing favorable terms for yourself as the lessee.

Finding A Tenant-buyer

After finalizing the lease terms with the seller, the next step is to find a tenant-buyer who will eventually purchase the property. This involves marketing the property effectively and screening potential candidates to ensure they are financially capable and motivated to buy. Some strategies for finding a tenant-buyer include:

- Advertising through various channels, such as online listings, social media, and local classifieds

- Conducting thorough background and credit checks

- Verifying the tenant-buyer’s employment and income stability

- Evaluating their commitment to the lease option agreement and their ability to meet the future purchase requirements

By taking these steps to find a tenant-buyer, you can secure a reliable individual who is willing and able to exercise the purchase option at the end of the lease term.

Pitfalls To Avoid In Sandwich Leases

When considering Sandwich Leases, it is crucial to be aware of the potential pitfalls that can arise. By understanding and avoiding these common mistakes, you can increase your chances of success and profitability in the long run.

Unrealistic Profit Expectations

One of the major pitfalls in Sandwich Leases is having unrealistic profit expectations. It is important to remember that while Sandwich Leases can be a lucrative investment strategy, they require careful planning and realistic expectations.

Many individuals are attracted to Sandwich Leases for the potential to earn passive income and generate sizable profits. However, it is essential to conduct thorough research and analysis to ensure that your profit expectations align with the current market conditions and rental rates.

Keep in mind that there are costs involved in managing and maintaining the property, including repairs, marketing, and potential vacancies. Therefore, it is vital to crunch the numbers and calculate your expected returns accurately.

Lack Of Due Diligence

Lack of due diligence is another common pitfall to avoid in Sandwich Leases. When entering into a Sandwich Lease agreement, it is crucial to conduct a comprehensive assessment of the property, the existing lease, and the financials.

By performing due diligence, you can uncover any hidden issues or potential risks associated with the property. This may include outstanding liens or judgments, maintenance issues, or legal disputes. Identifying these factors beforehand can help you make an informed decision and protect your investment.

Furthermore, it is important to review the terms and conditions of the existing lease. Understanding the rights and responsibilities of the various parties involved is essential to ensure a smooth and successful Sandwich Lease arrangement.

Lastly, conducting a financial analysis is crucial. Evaluate the current and potential rental income, expenses, and cash flow to determine if the Sandwich Lease is a financially viable option. This includes considering factors such as market demand, location, and rental rates to estimate the potential returns on your investment.

Credit: www.amazon.com

Frequently Asked Questions For Sandwich Lease

What Is A Sandwich Lease?

A sandwich lease is a real estate arrangement where a tenant subleases a property they are renting to another tenant. The original tenant acts as a middleman, leasing the property to a third party while still being responsible for rent payments to the landlord.

How Does A Sandwich Lease Work?

In a sandwich lease, the tenant who holds the original lease becomes the landlord to a subtenant. The subtenant pays rent to the middleman tenant, who in turn pays rent to the actual landlord. The middleman tenant is responsible for any damages or lease violations by the subtenant.

What Are The Benefits Of A Sandwich Lease?

A sandwich lease can provide several benefits, such as generating additional income for the middleman tenant, allowing flexibility in renting the property, and potentially avoiding eviction if the subtenant fails to pay rent. It can also be a way to invest in real estate without the need for a large down payment.

Can Anyone Enter Into A Sandwich Lease?

Not everyone can enter into a sandwich lease. It requires the consent of both the original landlord and the original tenant, who must have the right to sublease the property. Additionally, the subtenant must agree to the terms of the sublease and be approved by the original landlord.

Conclusion

To sum it up, a sandwich lease can be a valuable tool for both tenants and landlords. By acting as a middleman, the sandwich lease allows for the subletting of a property, providing an opportunity for profit while minimizing risks.

However, it is important to thoroughly understand the legal implications and obligations involved before entering into such an agreement. With careful consideration and proper documentation, a sandwich lease can be a win-win situation for all parties involved.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a sandwich lease?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A sandwich lease is a real estate arrangement where a tenant subleases a property they are renting to another tenant. The original tenant acts as a middleman, leasing the property to a third party while still being responsible for rent payments to the landlord.” } } , { “@type”: “Question”, “name”: “How does a sandwich lease work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “In a sandwich lease, the tenant who holds the original lease becomes the landlord to a subtenant. The subtenant pays rent to the middleman tenant, who in turn pays rent to the actual landlord. The middleman tenant is responsible for any damages or lease violations by the subtenant.” } } , { “@type”: “Question”, “name”: “What are the benefits of a sandwich lease?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A sandwich lease can provide several benefits, such as generating additional income for the middleman tenant, allowing flexibility in renting the property, and potentially avoiding eviction if the subtenant fails to pay rent. It can also be a way to invest in real estate without the need for a large down payment.” } } , { “@type”: “Question”, “name”: “Can anyone enter into a sandwich lease?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Not everyone can enter into a sandwich lease. It requires the consent of both the original landlord and the original tenant, who must have the right to sublease the property. Additionally, the subtenant must agree to the terms of the sublease and be approved by the original landlord.” } } ] }