Why is Debt Cheaper Than Equity? The Financial Advantage Explained

Debt is cheaper than equity because interest payments on debt are tax deductible, resulting in lower overall costs for the borrower. In addition, equity holders have a higher risk and return expectation than debt holders, making equity financing more expensive for companies.

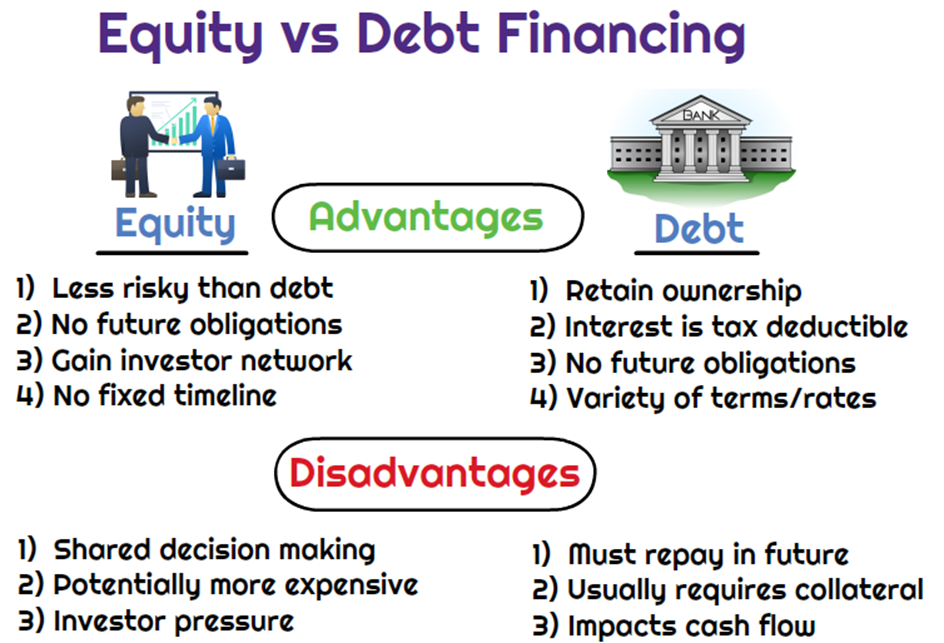

When a company needs to raise funds for various purposes such as expansion or working capital, it has two primary options – debt and equity financing. Debt financing involves borrowing money from lenders, such as banks or bondholders, and promising to repay the principal amount plus interest within a specified timeframe.

On the other hand, equity financing involves selling ownership stakes in the company through the issuance of stocks or shares. Debt financing is considered cheaper than equity financing for a few reasons. Firstly, interest payments on debt are tax deductible, meaning the company can reduce its taxable income by deducting the interest expense from its earnings. This tax advantage lowers the effective cost of borrowing for the company. Secondly, debt holders have a more limited claim on the company’s assets and earnings compared to equity holders. In case of bankruptcy or liquidation, debt holders have priority in receiving their payments before equity holders. This lower risk profile leads to lower return expectations by debt holders, resulting in lower interest rates compared to the return expectations of equity investors. Therefore, companies often choose debt financing over equity financing when feasible to take advantage of the tax benefits and lower costs associated with borrowing. However, it is important for companies to maintain an appropriate balance between debt and equity to ensure optimal capital structure and financial stability.

:max_bytes(150000):strip_icc()/Optimal-capital-structure_final-e29733f0e93846748c9d8662f1b247bb.png)

Credit: www.investopedia.com

Debt Vs. Equity

Debt is generally cheaper than equity due to fixed interest rates, making it an attractive financing option for businesses. Unlike equity, which requires sharing ownership and future profits, debt allows companies to retain control and repay lenders at a lower overall cost.

Debt vs. Equity In any financial decision, whether it’s for a personal investment or a business venture, choosing between debt and equity is a crucial consideration. Both options have their advantages and disadvantages, but today we’re going to delve into one key aspect: why debt is often the cheaper option compared to equity. By taking a closer look at the cost of capital and the risk-return tradeoff, we can gain a better understanding of why debt can be a more cost-effective choice in certain scenarios. Cost of Capital The cost of capital refers to the overall cost that a company incurs to finance its operations. When it comes to debt, this cost is usually in the form of interest payments made to lenders. On the other hand, equity financing involves giving up ownership and sharing profits with shareholders. The cost of equity is often more expensive than debt since shareholders expect to earn higher returns to compensate for the associated risks. By opting for debt financing, companies can benefit from fixed interest rates, which are often lower compared to the potential returns demanded by equity investors. This lower cost of debt allows businesses to allocate their resources more efficiently, making it an attractive option when seeking funds for projects or expansion. Risk and Return There’s an inherent risk associated with every investment, and it’s no different for debt and equity. However, the risk profile of debt is fundamentally different from equity. As a lender, the risk for debt holders is limited to the principal borrowed and the interest payments. In the event of bankruptcy or insolvency, debt holders have a higher priority for repayment compared to equity holders. Equity investors, on the other hand, face greater uncertainty and risk. Their returns are contingent on the company’s profitability and success, making their investment inherently riskier than debt. With higher risks comes the expectation of higher returns, which drives up the cost of equity financing. Moreover, when a company takes on too much equity financing, it may dilute the ownership stake of existing shareholders, potentially reducing the overall value of those shares. By balancing debt and equity, a company can maintain control over its operations while enjoying the cost advantages that debt financing offers. In conclusion, debt is often the more affordable option when compared to equity financing due to its lower cost of capital and lower risk profile. By carefully considering the advantages and disadvantages of each option, businesses can make informed decisions that align with their financial goals and the needs of their stakeholders. With a balanced and strategic mix of debt and equity, companies can optimize their capital structure and drive growth in a cost-effective manner.:max_bytes(150000):strip_icc()/Mezzanine_Financing_Final-6293dcdc9ade49c2a546d328a1732030.png)

Credit: www.investopedia.com

Why Debt Is Cheaper

Debt is often cheaper than equity due to lower interest rates and tax benefits. Lenders have a priority claim on business assets, reducing risk. Additionally, the interest payments on debt are tax-deductible, making it a cost-effective financing option for companies.

Interest Payments

Debt is often considered cheaper than equity due to interest payments. When a company raises capital through debt, it borrows money from lenders or investors and agrees to pay them interest over a specific period. This interest rate is typically lower than the return expected by equity investors. As a result, the cost of debt, which is the interest paid on the borrowed amount, is generally lower than the cost of equity. Let’s dive deeper into why interest payments make debt cheaper.

Fixed Interest Rates

One reason why debt is cost-effective is because of the predictability of interest payments. When a company decides to take on debt, it usually locks in a fixed interest rate for the loan duration. This means that regardless of how well or poorly the company performs, the interest payments remain the same. The fixed nature of interest rates offers stability, making it easier for companies to plan and manage their cash flows. As a result, they can calculate and factor in these interest payments when making financial decisions. This predictability contributes to the perception of debt as a cheaper financing option.

Tax Benefits

Aside from interest payments, another factor that makes debt cheaper than equity is the tax benefits associated with debt financing. Interest payments are considered tax-deductible expenses for companies. This means that the interest paid on debt can be deducted from the company’s taxable income, reducing the amount of tax they owe. As a result, the after-tax cost of debt decreases, making it a more attractive financing option when compared to equity, which does not provide the same tax advantages.

Table: Debt vs Equity Comparison

| Factors | Debt | Equity |

|---|---|---|

| Interest Payments | Lower cost | No interest payments |

| Tax Benefits | Interest payments are tax-deductible | No tax benefits |

| Risk | Higher risk for lenders/investors | Share in profit and losses |

| Control | No dilution of ownership/control | Potential dilution of ownership/control |

In conclusion, debt is often considered cheaper than equity due to its lower cost and associated tax benefits. The predictability of fixed interest rates and the ability to deduct interest payments from taxable income make debt financing an attractive option for companies. However, it is important to note that the decision between debt and equity financing should be based on various factors such as the company’s financial situation, risk tolerance, and growth prospects. Companies should carefully evaluate their options to determine which financing method aligns best with their goals and objectives.

Financial Advantage

Debt is often considered cheaper than equity due to various financial advantages. This section will delve into the leverage effect and business control to further understand why debt is a more cost-effective financing option for businesses.

Leverage Effect

The leverage effect of debt can lead to higher returns for shareholders. By utilizing debt to finance a portion of the company’s assets, a company can amplify its returns on equity when the return on assets exceeds the cost of borrowing.

Business Control

While equity financing dilutes the ownership of existing shareholders, debt financing allows the business owners to retain full control of the company. This can be particularly attractive for entrepreneurs and business owners who want to maintain control over key decisions.

Credit: www.linkedin.com

Considerations

Debt is often cheaper than equity due to lower interest rates and tax advantages. Borrowing money through debt allows businesses to access capital at a lower cost, making it a more cost-effective financing option.

When considering whether to finance your business through debt or equity, there are several important factors to take into account. Financial flexibility and bankruptcy risk are two crucial considerations that can greatly impact your decision.

Financial Flexibility

Debt offers a valuable advantage in terms of financial flexibility. By utilizing debt financing, businesses can retain complete ownership and control over operations. This means that decisions can be made quickly and independently, allowing for greater flexibility in adapting to market changes and pursuing growth opportunities. In addition, debt payments are predictable and fixed, making it easier to plan for and manage cash flow.

Equity financing, on the other hand, involves selling a portion of your business to investors in exchange for capital. While this can provide a significant injection of funds, it also means sharing the decision-making power and potential profits with those investors. The loss of control and autonomy can hinder swift decision-making and lead to a slower response to market changes.

Bankruptcy Risk

Another crucial consideration when comparing debt and equity is the risk of bankruptcy. When a business takes on debt, it has an obligation to repay the borrowed funds, along with any interest. However, even if the business fails to generate sufficient revenue to cover these payments, the assets of the business are typically the only collateral that can be seized by creditors.

In contrast, equity investors become partial owners of the business, meaning they assume a share of both the profits and the losses. In the event of bankruptcy, equity investors may lose their entire investment. This can provide a safety net for the business, as it limits the financial liability of the company and its owners.

However, it’s important to note that excessive debt can also increase the risk of bankruptcy. If a business becomes burdened by excessive debt payments, it may struggle to meet its financial obligations and face insolvency.

In conclusion, while debt may be cheaper than equity in terms of interest rates, it’s crucial to carefully consider the financial flexibility and bankruptcy risk associated with each option. By evaluating these factors in relation to your business goals and financial circumstances, you can make an informed decision that sets your business on the path to success.

Frequently Asked Questions For Why Is Debt Cheaper Than Equity?

Faq 1: Why Is Debt Cheaper Than Equity?

Debt is often cheaper than equity because interest rates on loans are usually lower than the returns on equity investments. Additionally, debt financing allows businesses to deduct interest expenses from their taxable income, further reducing the overall cost of borrowing.

However, it’s important to note that debt comes with the risk of default and the obligation to make regular interest payments.

Faq 2: What Are The Advantages Of Using Debt Instead Of Equity?

Using debt instead of equity offers several advantages. Firstly, interest payments on debt are tax-deductible, lowering the overall cost of borrowing. Secondly, taking on debt doesn’t dilute ownership and control of the business. Lastly, debt can provide a fixed payment schedule, making it easier for businesses to plan and manage cash flow.

However, excessive debt can increase financial risk and limit flexibility.

Faq 3: Are There Any Disadvantages To Relying On Debt For Financing?

While debt financing has its advantages, it also comes with disadvantages. One downside is the obligation to make regular interest payments, which can strain cash flow, especially during economic downturns. Additionally, failure to repay debt can lead to legal consequences and damage a company’s credit rating.

Too much debt can also limit a company’s ability to secure additional financing in the future. It’s important to strike a balance between debt and equity financing.

Conclusion

Understanding why debt is cheaper than equity is essential for making informed financial decisions. While both options have their advantages, the lower cost of debt financing can provide businesses with a competitive edge. By leveraging this knowledge, companies can effectively utilize debt to maximize their returns and overall financial performance.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “FAQ 1: Why is debt cheaper than equity?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Debt is often cheaper than equity because interest rates on loans are usually lower than the returns on equity investments. Additionally, debt financing allows businesses to deduct interest expenses from their taxable income, further reducing the overall cost of borrowing. However, it’s important to note that debt comes with the risk of default and the obligation to make regular interest payments.” } } , { “@type”: “Question”, “name”: “FAQ 2: What are the advantages of using debt instead of equity?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Using debt instead of equity offers several advantages. Firstly, interest payments on debt are tax-deductible, lowering the overall cost of borrowing. Secondly, taking on debt doesn’t dilute ownership and control of the business. Lastly, debt can provide a fixed payment schedule, making it easier for businesses to plan and manage cash flow. However, excessive debt can increase financial risk and limit flexibility.” } } , { “@type”: “Question”, “name”: “FAQ 3: Are there any disadvantages to relying on debt for financing?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “While debt financing has its advantages, it also comes with disadvantages. One downside is the obligation to make regular interest payments, which can strain cash flow, especially during economic downturns. Additionally, failure to repay debt can lead to legal consequences and damage a company’s credit rating. Too much debt can also limit a company’s ability to secure additional financing in the future. It’s important to strike a balance between debt and equity financing.” } } ] }