Understanding the Treatment of Pik in Cash Flow Statement

Pik is not specifically treated in the cash flow statement as it is a non-cash item. However, it is important to note that any cash flows related to Pik, such as interest payments, should be disclosed separately in the cash flow statement.

These cash flows can be classified either as operating activities or financing activities, depending on the nature of the Pik transaction. Nowadays, understanding the information provided by financial statements is essential for both investors and analysts. One such statement is the cash flow statement, which showcases the inflow and outflow of cash in a business during a specific period.

It is crucial in assessing a company’s liquidity, financial performance, and overall financial health. However, when it comes to the treatment of Pik (Payment in Kind) in the cash flow statement, it is important to note that Pik is typically not explicitly addressed. Hence, this article will delve into how Pik is generally handled and disclosed in the cash flow statement.

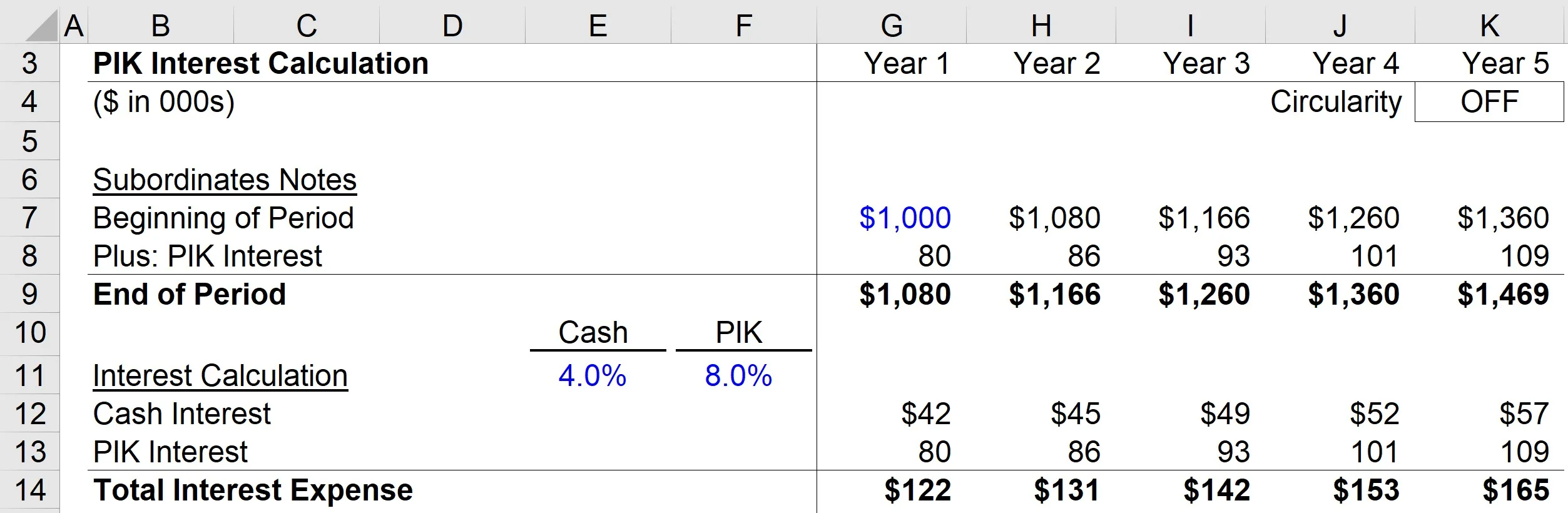

Credit: breakingintowallstreet.com

Importance Of Pik In Cash Flow Statement

A Pik, also known as a Payment-in-Kind, is a feature found in some financial instruments that provides the issuer with a choice to pay interest or dividends in the form of additional securities or other non-cash forms, instead of making cash payments. Piks have gained popularity as they offer flexibility to both issuers and investors.

Significance Of Pik

Piks have a significant impact on cash flow statements as they can affect the timing and amount of cash flows. By allowing the issuer to defer cash payments for interest or dividends, Piks can have a significant impact on the company’s cash flow situation. It is important to understand the significance of Pik in cash flow statements to accurately analyze a company’s financial health.

Impact On Cash Flow Analysis

Piks can have both positive and negative impacts on cash flow analysis. Let’s take a look at some key points to consider:

- Deferral of Cash Payments: Piks allow issuers to defer cash payments for interest or dividends, which can improve cash flow in the short term. However, it is important to remember that the payments will have to be made eventually, which could potentially create cash flow challenges in the future.

- Effect on Operating Activities: Piks can impact the operating activities section of the cash flow statement. When Piks are used as a means to pay interest or dividends, they are classified as non-cash items. This classification can affect the accuracy of operating cash flow calculations.

- Investor Perception: Piks can also influence how investors perceive a company’s financial stability and future prospects. Investors may scrutinize companies with Piks more closely to assess the potential risks associated with deferred cash payments.

Overall, the treatment of Pik in the cash flow statement is essential for accurate cash flow analysis and understanding a company’s financial position.

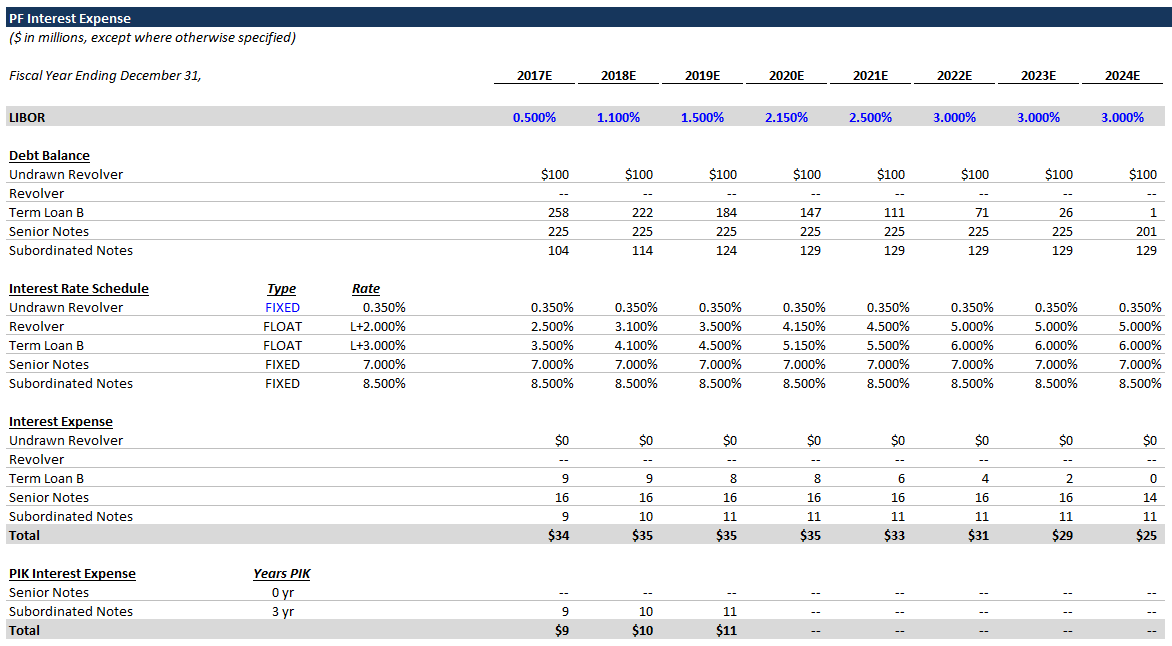

Credit: www.wallstreetprep.com

Calculation And Presentation Of Pik

When it comes to analyzing a company’s financial health, the cash flow statement plays a crucial role. One important aspect of the cash flow statement is the calculation and presentation of Pik, which stands for Principal and Interest on Borrowing in Cash (Pik). Understanding how Pik is treated in the cash flow statement is essential for investors and financial analysts to assess a company’s ability to manage its borrowing costs and generate sufficient cash inflows to cover its debt obligations.

Methods Of Calculation

Calculation of Pik in the cash flow statement involves considering the principal and interest paid on borrowings during a specific period. Typically, Pik is calculated by adding up the principal repayment and interest expense on borrowings. The principal repayment refers to the amount of borrowed money that is being paid back, while the interest expense represents the cost of borrowing money.

Where And How Pik Is Presented

Pik can be presented in the cash flow statement under the financing activities section. The financing activities section provides information about the company’s capital structure, including its borrowing activities. Pik is usually presented as a separate line item in the financing activities section, allowing stakeholders to easily identify the amount of principal repayment and interest expense incurred by the company during the reporting period.

Interpretation And Analysis Of Pik

The interpretation and analysis of PIK (Payment-in-Kind) in the cash flow statement are essential for understanding the financial health of a company. It provides valuable insights into how a company manages its cash flow and its ability to generate sustainable revenue. When analyzing PIK, investors should consider its implications and compare it with traditional cash flow metrics to make informed investment decisions.

Implications For Investors

Investors should carefully assess the implications of PIK in the cash flow statement. A high proportion of PIK could indicate that a company is relying heavily on non-cash sources to fund its operations. This may raise concerns about the company’s ability to generate sufficient cash flow from its core business activities. On the other hand, a low or decreasing PIK could signal efficient cash management and a stronger financial position.

Comparative Analysis With Traditional Cash Flow Metrics

Comparing PIK with traditional cash flow metrics such as operating cash flow and free cash flow provides a broader perspective on a company’s financial performance. By analyzing these metrics in conjunction, investors can gain a comprehensive understanding of the company’s cash flow dynamics. This comparative analysis can help identify trends and anomalies that may not be apparent when looking at PIK in isolation.

Challenges In Addressing Pik In Cash Flow Statement

When preparing a cash flow statement, businesses face several challenges in accurately addressing the concept of Pik (payment-in-kind). Pik, also known as payment-in-kind interest, refers to an arrangement where the interest on a loan is paid with additional debt rather than cash. This method can present unique difficulties when it comes to its treatment in the cash flow statement. Let’s explore two specific challenges: Complexity of Pik Calculation and Potential Misinterpretation.

Complexity Of Pik Calculation

The calculation of Pik in a cash flow statement can be a complex task due to its non-cash nature. Unlike regular interest payments, Pik involves the issuance of additional debt as a means of settling interest obligations. This unconventional approach to interest payment adds a layer of intricacy to the cash flow statement.

Businesses must accurately determine the fair value of the additional debt issued for Pik to incorporate it into the cash flow statement. This fair value calculation requires careful evaluation and assessment, involving considerations such as the interest rate, maturity date, and market conditions.

Furthermore, the timing of Pik transactions can vary, adding to the complexity. Depending on the terms of the arrangement, additional debt may be issued periodically or upon certain triggers. These variations in timing can make it challenging to determine the appropriate period in which Pik transactions should be recognized in the cash flow statement.

Potential Misinterpretation

Another challenge in addressing Pik in the cash flow statement is the potential for misinterpretation. Due to its non-cash nature, Pik transactions may be misunderstood or overlooked, leading to inaccurate financial analysis and decision-making.

Investors and stakeholders relying on the cash flow statement for assessing a company’s financial health may not fully grasp the implications of Pik on its cash flow position. This lack of understanding can result in misinterpretations of the company’s liquidity, profitability, and overall financial performance.

Proper disclosure and clear communication are crucial in mitigating the risk of misinterpretation. Businesses should provide detailed explanations and supplementary information in the cash flow statement notes to ensure stakeholders have a complete understanding of the impact of Pik transactions on the company’s cash flow.

Best Practices For Reporting Pik In Cash Flow Statements

When preparing cash flow statements, it’s important to carefully consider the treatment of Pik. This requires proper documentation of the interest portion as an operating activity, and the principal component as a financing activity. Reporting Pik in cash flow statements should be based on standard accounting practices and accurately reflect the company’s financial position.

In order to ensure transparency and accuracy in financial reporting, it is crucial to adhere to best practices when reporting Pik (Payment in Kind) in cash flow statements. By following these guidelines, companies can provide clear and standardized information about the interest payments made with additional debt instead of cash. This not only promotes transparency but also helps investors and stakeholders make informed decisions. Two key best practices for reporting Pik in cash flow statements are discussed below:Transparency And Disclosure

Transparency is the foundation of any financial reporting process. When it comes to reporting Pik in cash flow statements, providing clear and comprehensive information is essential. Companies should disclose the amount of Pik used, the nature of the obligation, and any related terms and conditions. This ensures that investors have a complete understanding of the financial impact of Pik on the company’s cash flow. To ensure transparency, it is recommended to include a breakdown of the Pik interest payments in a separate line item within the cash flow statement. This allows for easy identification and analysis of the impact of Pik on the company’s cash flow position. Additionally, any significant changes or events related to Pik should be clearly disclosed in the accompanying notes to the financial statements.Standardization And Consistency

Standardization and consistency are crucial for effective financial reporting. When reporting Pik in cash flow statements, it is important to adopt a standardized approach across all reporting periods. This enables comparability and facilitates analysis over time. To achieve this, companies should follow a consistent methodology for calculating and presenting Pik interest payments in the cash flow statement. This includes using the same accounting principles and measurement techniques for all reporting periods. By doing so, companies can eliminate discrepancies and ensure the accuracy and reliability of the reported Pik amounts. Moreover, it is advisable to provide a clear explanation of the methodology used to calculate Pik interest payments in the financial statement disclosures. This helps users of the financial statements understand the basis of the reported figures and allows for meaningful analysis and comparisons across different companies or industries. By adhering to these best practices for reporting Pik in cash flow statements, companies can enhance transparency, provide relevant information, and promote consistency in financial reporting. This, in turn, assists investors and stakeholders in making well-informed decisions based on accurate and standardized financial information.

Credit: multipleexpansion.com

Frequently Asked Questions For How Is Pik Treated In Cash Flow Statement?

Q: What Does The Acronym Pik Stand For?

A: PIK stands for “Payment In Kind,” which refers to the practice of paying interest on a loan with additional debt rather than cash.

Q: How Is Pik Interest Reported In A Cash Flow Statement?

A: PIK interest is typically classified as a non-cash financing activity in a cash flow statement, as it does not involve the actual outflow of cash.

Q: Does Pik Interest Affect A Company’s Cash Flow?

A: PIK interest does not directly affect a company’s cash flow, as it does not involve the movement of cash in or out of the business. However, it may have an impact on a company’s overall financial health and obligations.

Q: Why Do Companies Use Pik Interest?

A: Companies may use PIK interest to manage their cash flow by delaying cash outflows for interest payments. It can also be a way to raise additional financing without immediate cash obligations.

Conclusion

Understanding how Pik is treated in the cash flow statement is crucial for accurate financial reporting. By recognizing the impact of Pik on operating cash flow and financing activities, businesses can make informed decisions. It’s essential to consult with financial experts to ensure Pik treatment aligns with accounting standards and provides a clear reflection of the company’s financial health.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Q: What does the acronym PIK stand for?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A: PIK stands for \”Payment In Kind,\” which refers to the practice of paying interest on a loan with additional debt rather than cash.” } } , { “@type”: “Question”, “name”: “Q: How is PIK interest reported in a cash flow statement?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A: PIK interest is typically classified as a non-cash financing activity in a cash flow statement, as it does not involve the actual outflow of cash.” } } , { “@type”: “Question”, “name”: “Q: Does PIK interest affect a company’s cash flow?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A: PIK interest does not directly affect a company’s cash flow, as it does not involve the movement of cash in or out of the business. However, it may have an impact on a company’s overall financial health and obligations.” } } , { “@type”: “Question”, “name”: “Q: Why do companies use PIK interest?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A: Companies may use PIK interest to manage their cash flow by delaying cash outflows for interest payments. It can also be a way to raise additional financing without immediate cash obligations.” } } ] }