What are Examples of Amortized Assets? Discover the Power of Effective Capital Management

Examples of amortized assets include intangible assets such as patents, copyrights, and trademarks. These assets are gradually expensed over their useful life.

Amortized assets are assets that gradually lose their value or are expensed over a specific period of time. Examples of such assets include intangible assets like patents, copyrights, and trademarks. These assets are acquired by a company and are considered valuable, but their value decreases over time.

Instead of recording the entire cost of acquiring the asset as an expense in one go, it is spread out over the course of its useful life. This gradual expensing is known as amortization. By spreading the cost out over time, it allows companies to accurately reflect the diminishing value of these assets and allocate expenses more evenly. This approach helps in matching expenses with the revenue generated by the assets and providing a more accurate representation of a company’s financial health.

:max_bytes(150000):strip_icc()/terminalvalue-Final-12edef62cff74d4c9e2e62c82ac1b606.jpg)

Credit: www.investopedia.com

Amortized Assets

Amortized assets are those with a finite useful life that are expensed over time. Examples include intangible assets like patents, trademarks, and goodwill. These assets are gradually written off on a company’s balance sheet, reflecting their decreasing value over time.

Definition

An amortized asset refers to a type of long-term asset that is systematically allocated or spread out over its useful lifespan for accounting and tax purposes. This means that the cost of the asset is gradually reduced over time to reflect its decreasing value or usefulness. Amortization, in accounting, is the process of spreading out the cost of an intangible asset over its useful life. It is similar to depreciation but applies to intangible assets such as patents, copyrights, and licenses.

Examples

Amortized assets are commonly found in various industries where businesses rely on long-term tangible or intangible assets. Let’s take a look at some common examples:

- 1. Patents: Companies that hold patents, which grant exclusive rights to use or sell an invention, amortize the cost of acquiring the patent over its legal life.

- 2. Trademarks: Similar to patents, trademarks are also considered amortized assets. Businesses allocate the cost of registering and protecting a trademark over its useful life.

- 3. Film Rights: In the entertainment industry, companies acquire rights to produce, distribute, or exhibit films. These rights are amortized over the expected lifespan of the film or the licensing agreement.

- 4. Franchise Agreements: Franchise businesses often enter into franchise agreements that grant them the right to operate under a well-known brand. The costs associated with these agreements are typically amortized over the term of the agreement.

It’s important for businesses to properly account for amortized assets as it allows for more accurate financial reporting and enables them to align costs with the expected benefits derived from these assets.

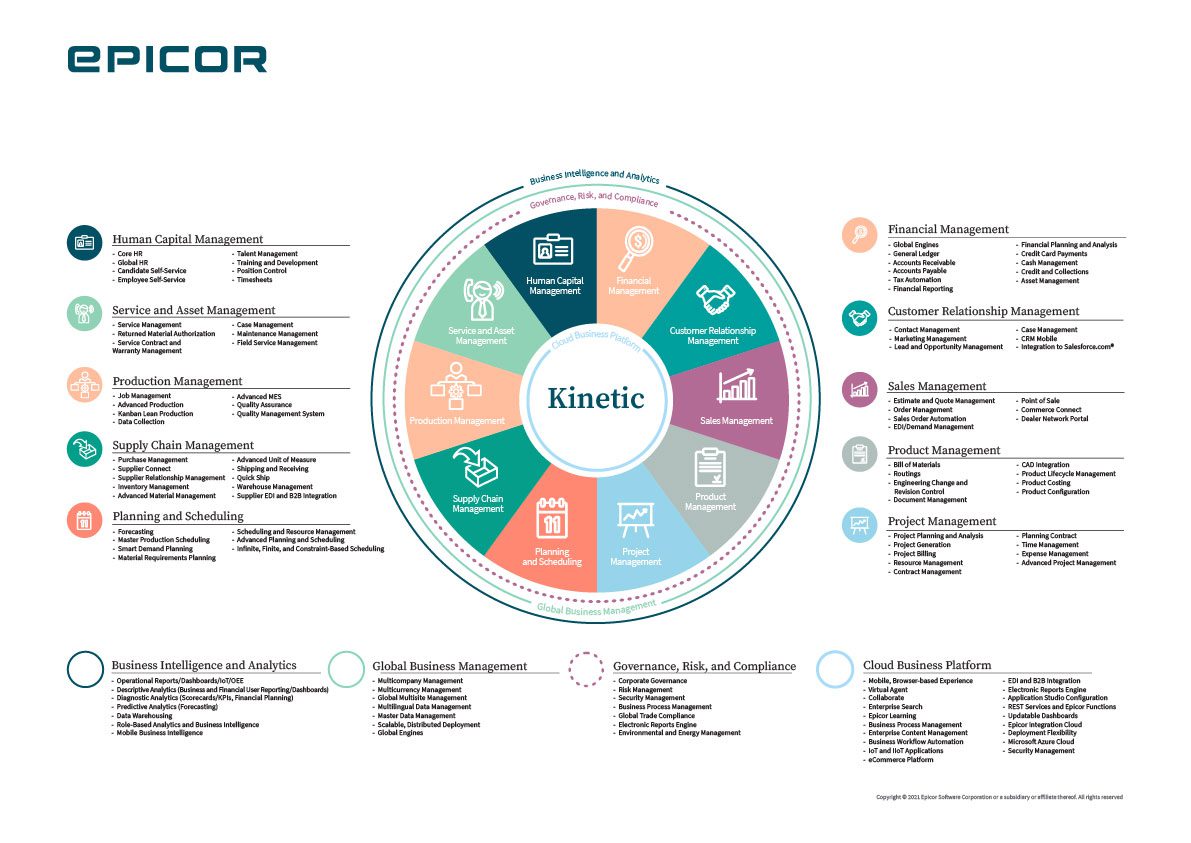

Credit: encompass-inc.com

The Power Of Effective Capital Management

Amortized assets are a powerful example of effective capital management, ensuring even distribution of costs and expenses over time. This approach helps companies maintain financial stability and make informed investment decisions for long-term success.

Benefits

In the realm of effective capital management, understanding the benefits of amortized assets is crucial. By incorporating amortized assets into your financial strategy, you can reap several advantages:

- Reduced financial burden: Amortization allows you to spread out the cost of an asset over time, easing the strain on your finances.

- Improved cash flow: Amortized assets provide consistent, predictable payments, enabling you to better plan and manage your cash flow.

- Accurate asset valuation: By accounting for the gradual reduction of an asset’s value over time, amortization helps present a more accurate representation of your business’s net worth.

- Tax benefits: Amortized assets often offer tax advantages, as you can deduct the annual amortization expense from your taxable income.

Strategies

Implementing effective strategies when dealing with amortized assets can optimize your financial performance and ensure long-term success. Below are some strategies to consider:

- Create a clear amortization plan: Develop a comprehensive plan that outlines the depreciation and amortization schedules for your assets. This will help you stay organized and maintain control over your capital.

- Regularly review and update: Revisit your amortization plan periodically to reflect any changes in asset value or usage. This ensures your amortization expenses remain accurate and up-to-date.

- Maximize tax benefits: Work closely with your tax advisor to identify and leverage any available tax benefits associated with amortized assets. This can help minimize your tax liability and maximize savings.

- Consider accelerated amortization: In certain cases, it may be advantageous to accelerate the amortization of an asset. This approach can be utilized when an asset is expected to lose value more rapidly in the early years of its life cycle.

- Utilize software tools: Explore using specialized software or accounting tools to streamline the management of your amortized assets. These tools can automate calculations and reporting, saving you time and reducing potential errors.

By implementing these strategies, you can effectively manage your amortized assets and harness their full potential for your business’s financial health.

Credit: www.facebook.com

Frequently Asked Questions For What Are Examples Of Amortized Assets?

What Are Amortized Assets?

Amortized assets are tangible or intangible assets that are systematically allocated and expensed over their useful life, rather than being recorded as a one-time expense. This helps to reflect the asset’s gradual consumption or decline in value over time, providing a more accurate representation of its economic benefits.

Why Are Amortized Assets Important?

Amortized assets are important because they allow businesses to match the cost of an asset with the revenue it generates over its useful life. By spreading the cost over time, businesses can better determine the true financial impact of the asset and make more informed decisions regarding budgeting, pricing, and profitability.

What Are Some Examples Of Amortized Assets?

Examples of amortized assets include intangible assets such as patents, copyrights, trademarks, and licenses. Additionally, tangible assets like equipment, machinery, and vehicles can also be amortized. These assets have a finite lifespan and their costs are spread out over time to accurately represent their value and usage.

How Are Amortized Assets Calculated?

The calculation of amortized assets involves determining the asset’s cost, its estimated useful life, and any salvage value it may have. The cost of the asset is divided by the number of periods in its useful life to determine the annual amortization expense.

The resulting expense is then recorded on the income statement as an expense for that period.

Conclusion

Amortized assets are common in businesses and can include intangible assets like patents and trademarks, as well as tangible assets such as equipment and property. Understanding how these assets are amortized is crucial for accurate financial reporting and decision making.

By recognizing and accounting for these assets, businesses can better manage their resources and make informed financial decisions for future growth.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What are amortized assets?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Amortized assets are tangible or intangible assets that are systematically allocated and expensed over their useful life, rather than being recorded as a one-time expense. This helps to reflect the asset’s gradual consumption or decline in value over time, providing a more accurate representation of its economic benefits.” } } , { “@type”: “Question”, “name”: “Why are amortized assets important?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Amortized assets are important because they allow businesses to match the cost of an asset with the revenue it generates over its useful life. By spreading the cost over time, businesses can better determine the true financial impact of the asset and make more informed decisions regarding budgeting, pricing, and profitability.” } } , { “@type”: “Question”, “name”: “What are some examples of amortized assets?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Examples of amortized assets include intangible assets such as patents, copyrights, trademarks, and licenses. Additionally, tangible assets like equipment, machinery, and vehicles can also be amortized. These assets have a finite lifespan and their costs are spread out over time to accurately represent their value and usage.” } } , { “@type”: “Question”, “name”: “How are amortized assets calculated?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The calculation of amortized assets involves determining the asset’s cost, its estimated useful life, and any salvage value it may have. The cost of the asset is divided by the number of periods in its useful life to determine the annual amortization expense. The resulting expense is then recorded on the income statement as an expense for that period.” } } ] }