How Do I Write a Simple Promissory Note? : An Easy Step-by-Step Guide

To write a simple promissory note, include the borrower’s and lender’s names, the loan amount, repayment terms, and signatures of both parties. This document serves as a legally binding agreement between the borrower and lender for the repayment of a loan.

A promissory note is a straightforward way to formalize a loan, ensuring clarity and avoiding potential conflicts or misunderstandings in the future.

Understanding Promissory Notes

When it comes to legal documentation, one important agreement that people often encounter is a promissory note. Whether you are lending money to a friend or family member or borrowing from a financial institution, understanding the basics of a promissory note is crucial. In this section, we will delve into what a promissory note is, why it is important, and how you can write a simple one.

What Is A Promissory Note?

A promissory note is a legally binding document that outlines a written promise or obligation to pay a specific amount of money. It serves as a record of the terms of a loan or debt, including the amount borrowed, the interest rate (if applicable), the repayment schedule, and any other relevant details. Essentially, it is a written contract between a borrower and a lender, ensuring that both parties are aware of their responsibilities and obligations.

Importance Of Promissory Notes

Promissory notes play a vital role in financial transactions, providing legal protection and clarity for both lenders and borrowers. Here are some reasons why they are crucial:

- Clear Terms: By clearly stating the terms of the loan, promissory notes minimize misunderstandings and disputes between the parties involved. They ensure that everyone is on the same page regarding repayment amounts, due dates, and any additional conditions.

- Legal Enforceability: Promissory notes serve as evidence of a loan agreement and can be used as legal documentation if a borrower fails to repay the borrowed amount. In case of a dispute or loan default, a promissory note can be presented in court as proof of the borrower’s commitment to repay.

- Peace of Mind: For both parties, having a promissory note in place provides peace of mind. It offers security to lenders, assuring them that they have a legal recourse if the borrower defaults. Similarly, borrowers can rely on the note to clarify their obligations and ensure they fulfill their repayment responsibilities.

To safeguard your interests and ensure a smooth loan process, it is essential to create a well-drafted promissory note. Next, we will explore how you can write a simple, effective promissory note that complies with legal requirements.

Key Components

When it comes to writing a simple promissory note, it’s important to include key components that outline the terms of the agreement between the parties involved. These components provide clarity and legal protection, ensuring that both the lender and borrower are on the same page. In this article, we will explore the key components of a promissory note, including the parties involved, loan details, and repayment terms.

Parties Involved

The first component of a promissory note is identifying the parties involved. This includes the lender, who is the individual or entity providing the loan, and the borrower, who is the individual or entity receiving the loan. Clearly stating the full legal names and addresses of both parties is essential for proper identification and documentation. Additionally, it’s important to mention the relationship between the parties, such as family, friends, or business associates.

Loan Details

The next component to include in a promissory note is the loan details. This section outlines the amount of money being borrowed and the purpose of the loan. It’s important to be specific and provide clear details regarding the loan, including any interest rate, if applicable. By clearly outlining the loan amount and purpose, both parties can refer back to the promissory note for clarification if needed.

Repayment Terms

Lastly, the repayment terms must be clearly defined in the promissory note. This includes the date the loan will be repaid in full and any specified installments or intervals for payments. It’s essential to include the method of payment, whether it’s through cash, check, bank transfer, or any other agreed-upon method. By clearly outlining the repayment terms, both parties can avoid misunderstandings and ensure a smooth repayment process.

Writing The Promissory Note

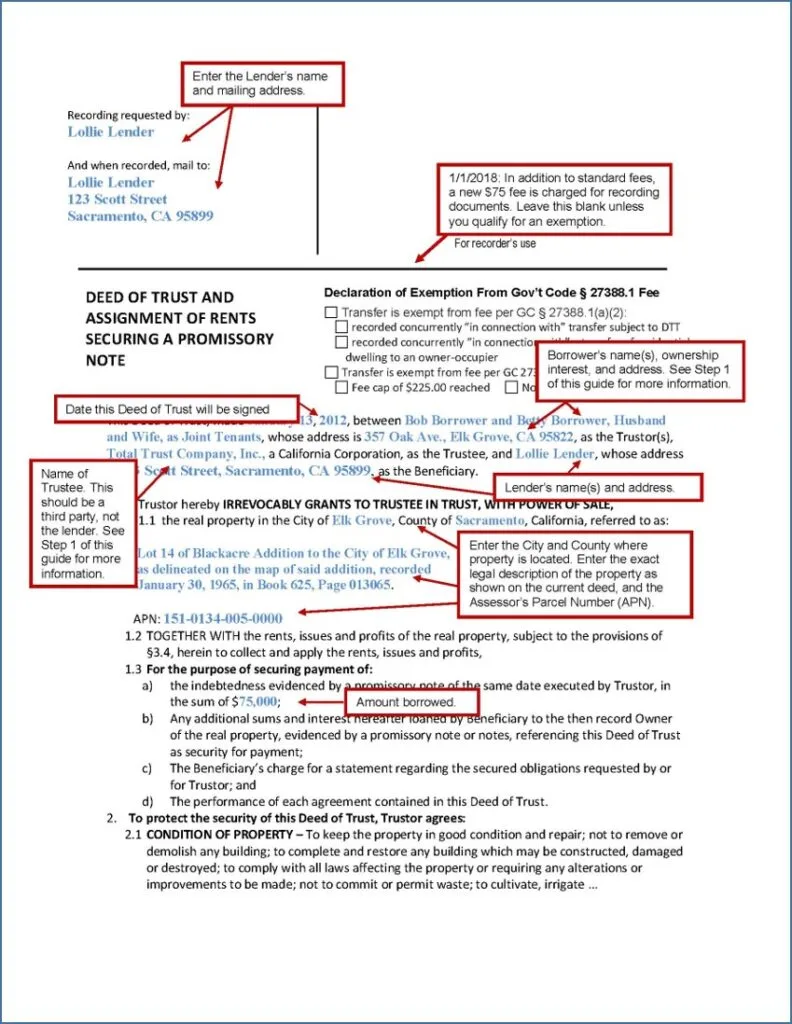

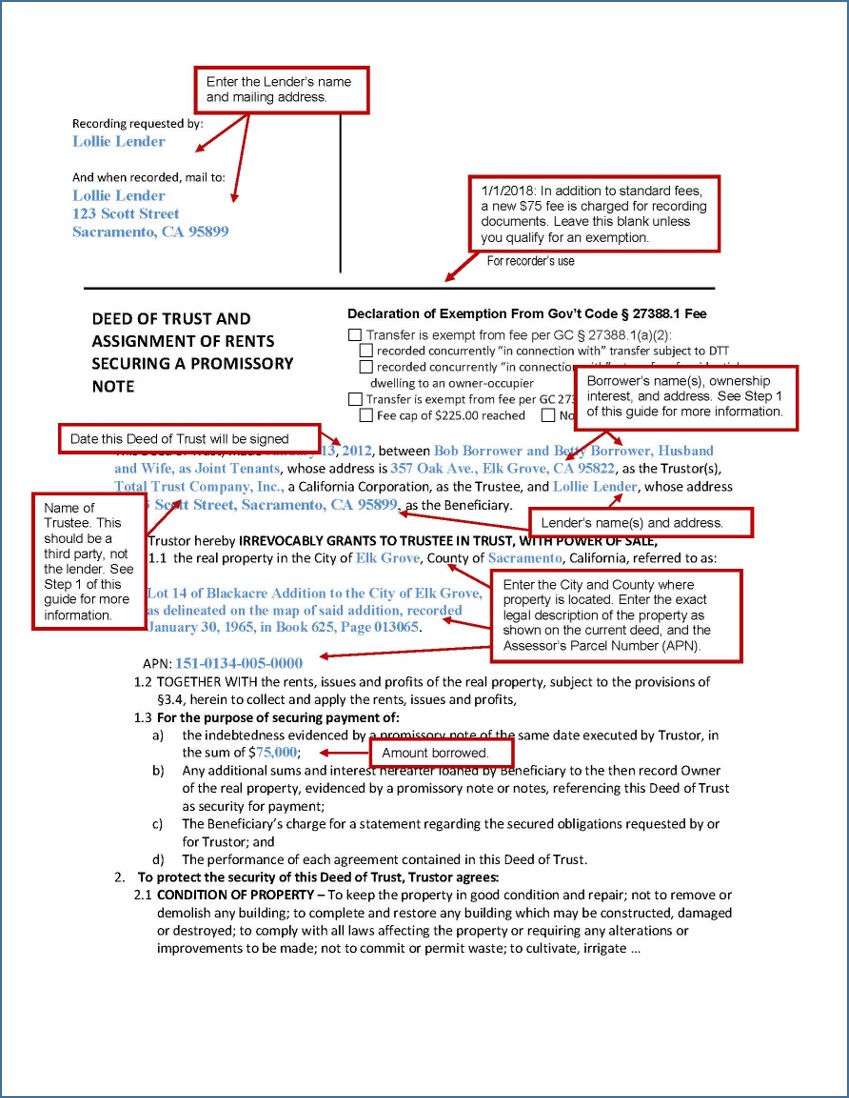

When writing a promissory note, it’s important to follow a clear and structured format to ensure the document is legally binding and serves its purpose effectively. Here’s a step-by-step guide on how to write a simple promissory note:

Choose A Template Or Format

When creating a promissory note, you have the option to either use a pre-designed template or craft your own format. Utilizing a template can streamline the process and provide a professional layout. Choose a format that best suits your needs, whether it’s a secured or unsecured promissory note, and tailor it accordingly to encompass all the necessary details.

Fill In The Details

Once you have selected your template or format, it’s time to fill in the important details. While doing so, make sure to include the date of the promissory note, the names of the parties involved, the principal amount being borrowed, the interest rate (if applicable), and the repayment terms. Detailing these elements in a clear and concise manner will contribute to the effectiveness and enforceability of the promissory note.

Credit: saclaw.org

Legal Considerations

When dealing with legal considerations, it’s important to understand how to write a simple promissory note. Begin by outlining the complete terms of the agreement, including the amount borrowed, interest rate, repayment schedule, and consequences for default. Be sure to use clear and concise language, and consider seeking legal advice to ensure the note complies with the law.

Writing a simple promissory note can be a straightforward process; however, it is essential to consider the legal aspects involved. By following certain legal guidelines, you can ensure that your promissory note is valid and enforceable. This section highlights two crucial legal considerations when creating a promissory note: consulting with a legal advisor and adhering to state-specific requirements.

Consultation With Legal Advisor

Consulting with a legal advisor is highly recommended when creating a promissory note. While it is possible to draft a simple promissory note on your own, a legal expert can provide valuable insights and ensure that the note meets all necessary legal requirements. Their knowledge and experience can help you avoid potential pitfalls and ensure that your promissory note is legally binding and enforceable.

State-specific Requirements

Each state has its own set of laws and regulations regarding promissory notes. It is crucial to familiarize yourself with the specific requirements of your state before drafting a promissory note. This will help you comply with the legal standards set forth by your state and increase the likelihood of the note being upheld in court, should the need arise.

To determine the state-specific requirements for your promissory note, consider factors such as the format, language, and specific clauses that may be required. Some states may also have specific interest rate limits or other restrictions that need to be taken into account. By understanding and incorporating these state-specific requirements, you can ensure that your promissory note is legally valid and enforceable.

Execution And Follow-up

Execution and Follow-up are key steps in creating a simple promissory note. To ensure the validity and enforceability of the note, you need to focus on signing the promissory note and maintaining proper record-keeping and follow-up.

Signing The Promissory Note

Signing the promissory note is essential to establish the borrower’s commitment to repay the debt. It is crucial to follow these steps and guidelines:

- Choose a suitable time and place to sign the promissory note.

- Ensure all parties involved are present and ready to sign.

- Clearly identify the borrower and lender, incorporating their legal names.

- Include the date of signing to indicate when the agreement becomes effective.

- Specify the amount borrowed and the agreed-upon interest, if applicable.

- State the repayment terms, including the schedule and method of payment.

- Include any additional terms or conditions agreed upon.

Remember, it is crucial that all parties carefully review and understand the terms of the promissory note before signing. Consultation with legal professionals can also ensure compliance with applicable laws.

Record-keeping And Follow-up

Proper record-keeping and follow-up are necessary to protect both the borrower and the lender and maintain the transparency and legality of the promissory note. Here are some key aspects to consider:

- Create multiple copies of the signed promissory note; one copy for the lender, one for the borrower, and potentially one for a trusted third party.

- Keep the original promissory note in a secure location to prevent loss or damage.

- Use a tracking system to record each payment received from the borrower.

- Send timely payment reminders to the borrower to ensure adherence to the repayment schedule.

- If any modifications or amendments are made to the promissory note, ensure all parties involved sign and date the changes accordingly.

- Maintain detailed records of all communication and transactions related to the promissory note.

By maintaining proper documentation and follow-up, both parties can protect their interests and ensure the smooth execution of the promissory note.

Credit: www.wikihow.com

:max_bytes(150000):strip_icc()/Term-Definitions_Template_promissorynote.asp-76c1a84d9d5344abb8f3c4110233207e.jpg)

Credit: www.investopedia.com

Frequently Asked Questions For How Do I Write A Simple Promissory Note?

What Is A Promissory Note Used For?

A promissory note is a legal document used to record a promise to repay a loan. It outlines terms such as the amount borrowed, interest rate, repayment schedule, and consequences for defaulting. It provides a sense of security for lenders and borrowers by establishing clear expectations and consequences.

How Do I Create A Simple Promissory Note?

To create a simple promissory note, start by including the borrower and lender names, the amount borrowed, and the repayment terms. Include details such as the interest rate, due date, and late payment penalties. Clearly state the consequences of defaulting and ensure both parties sign and date the document.

Consider consulting a legal professional for additional guidance.

What Should Be Included In A Promissory Note?

A promissory note should include essential elements such as the borrower and lender names, the loan amount, repayment terms, interest rate, and due date. Additionally, include details on late payment penalties, default consequences, and a provision for changes or modifications.

It is crucial to ensure all parties involved understand and agree to the terms outlined in the note.

Can A Promissory Note Be Legally Binding Without Interest?

Yes, a promissory note can legally be binding without interest. The interest rate can be negotiated or waived by both parties. However, it is important to ensure all other terms and conditions of the promissory note are clearly stated and agreed upon by both the borrower and the lender.

Conclusion

Thank you for taking the time to learn about how to write a simple promissory note. By following the steps and guidelines provided you can create a legally binding document that outlines the terms of a loan or debt agreement.

With a clear understanding of the key elements and the importance of clarity and specificity, you can confidently draft a promissory note that protects the interests of all parties involved. Writing a promissory note doesn’t have to be complicated, and with the right information at your fingertips, you can ensure that your financial agreements are documented accurately and professionally.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a promissory note used for?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A promissory note is a legal document used to record a promise to repay a loan. It outlines terms such as the amount borrowed, interest rate, repayment schedule, and consequences for defaulting. It provides a sense of security for lenders and borrowers by establishing clear expectations and consequences.” } } , { “@type”: “Question”, “name”: “How do I create a simple promissory note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To create a simple promissory note, start by including the borrower and lender names, the amount borrowed, and the repayment terms. Include details such as the interest rate, due date, and late payment penalties. Clearly state the consequences of defaulting and ensure both parties sign and date the document. Consider consulting a legal professional for additional guidance.” } } , { “@type”: “Question”, “name”: “What should be included in a promissory note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A promissory note should include essential elements such as the borrower and lender names, the loan amount, repayment terms, interest rate, and due date. Additionally, include details on late payment penalties, default consequences, and a provision for changes or modifications. It is crucial to ensure all parties involved understand and agree to the terms outlined in the note.” } } , { “@type”: “Question”, “name”: “Can a promissory note be legally binding without interest?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, a promissory note can legally be binding without interest. The interest rate can be negotiated or waived by both parties. However, it is important to ensure all other terms and conditions of the promissory note are clearly stated and agreed upon by both the borrower and the lender.” } } ] }