Will a Promissory Note Hold Up in Court? Discover the Truth

Yes, a promissory note can be upheld in court as it is a legally binding document that establishes a borrower’s promise to repay a loan, including the terms and conditions. In legal proceedings, a promissory note serves as evidence of the debt and can be used to pursue repayment.

It is essential to ensure that the note is properly drafted, signed by both parties, and includes all relevant details to make it enforceable. A promissory note can provide a strong legal foundation when seeking repayment of a debt through the court system.

The Nature Of A Promissory Note

When it comes to legal matters, it is essential to understand the nature of a promissory note. A promissory note is a legal document that serves as a written promise to repay a debt or loan. It outlines the terms and conditions of the repayment, including the amount borrowed, the interest rate (if applicable), and the repayment schedule. In the event of a dispute, it is crucial to know if a promissory note can stand up in court. By examining the legal definition and the key elements of a promissory note, we can gain better insight into its enforceability.

Legal Definition

A promissory note is legally defined as a written instrument that contains an unconditional promise to pay a specified sum of money to a designated person or entity. This definition emphasizes the importance of the unconditional promise, indicating that there should be no conditions or contingencies that would prevent the repayment.

Elements Of A Promissory Note

To ensure the enforceability of a promissory note, certain elements must be present:

1. Parties: The promissory note should clearly identify the parties involved—the lender (also known as the payee) and the borrower (also known as the maker).

2. Amount: The note must state the exact amount borrowed, ensuring clarity and preventing any ambiguity.

3. Interest: If applicable, the interest rate should be clearly stated in the note. This helps establish the repayment terms and the total amount owed.

4. Repayment Terms: The note should specify the repayment schedule, including the installment amounts and due dates. This helps both parties understand when and how the debt should be repaid.

5. Date and Signatures: A promissory note must contain the date of its creation, ensuring that all parties are aware of when the agreement was made. Additionally, the borrower’s signature is necessary to validate the note.

By ensuring these elements are present, a promissory note can have a stronger chance of standing up in court. However, it is important to note that the enforceability of a promissory note can vary depending on jurisdiction and the specific circumstances surrounding the agreement.

Credit: www.dochub.com

Enforceability Of Promissory Notes

One question often asked when it comes to promissory notes is whether they will stand up in court. In other words, are promissory notes legally enforceable? It’s crucial to understand the factors that affect the enforceability of promissory notes, as well as examine real-life case studies to gain a deeper understanding of how courts handle these agreements.

Factors Affecting Enforceability

Several factors come into play when determining the enforceability of promissory notes:

- The presence of legally binding terms and conditions that clearly outline the obligations of both parties involved.

- The consent and understanding of all parties involved, ensuring they fully comprehend the terms and consequences of the promissory note.

- The capacity and legal competence of the individuals signing the promissory note, ensuring they have the legal authority to enter into such agreements.

- The presence of consideration, which refers to something of value exchanged between the parties involved in the agreement.

- The compliance with applicable laws and regulations concerning the creation and execution of promissory notes.

A promissory note must meet these key criteria to increase its chances of being enforceable in court. It’s always wise to consult with legal professionals to ensure your promissory note satisfies these requirements.

Case Studies

Examining real-life case studies provides valuable insights into how courts handle promissory notes:

| Case | Result |

|---|---|

| Smith v. Johnson | The court ruled in favor of the plaintiff as the promissory note contained all necessary elements and the parties involved willingly entered into the agreement. |

| Williams v. Brown | The court deemed the promissory note unenforceable due to the lack of consideration exchanged between the parties. |

| Miller v. Davis | The court declared the promissory note void as one of the signatories lacked the legal capacity to enter into such agreements. |

These case studies emphasize the importance of meeting the necessary criteria for enforceability and highlight the various reasons why promissory notes may or may not stand up in court.

Challenges To Promissory Notes

Promissory notes are legally binding documents that outline a borrower’s promise to repay a specific amount of money to a lender. However, these documents may face challenges in court. Understanding the potential issues and defenses related to promissory notes is essential for both borrowers and lenders. Challenges can arise due to various reasons, including validity concerns and potential defenses against a promissory note.

Validity Challenges

Validity challenges to promissory notes may revolve around factors such as lack of consideration, improper execution, or fraud. If the court determines that the promissory note lacks consideration, meaning there was no exchange of value between the parties, the note may be deemed invalid. Additionally, improper execution, such as missing signatures or failure to meet legal requirements, can also lead to challenges to the validity of the promissory note.

Defenses Against A Promissory Note

Defendants facing a promissory note claim may have various defenses at their disposal, including fraud, duress, and illegality. In cases where the borrower can prove that the lender engaged in fraudulent activities related to the creation or enforcement of the promissory note, the note’s validity may be called into question. Furthermore, if the borrower can demonstrate that they signed the promissory note under duress or that the underlying obligation is illegal, these defenses may impact the enforceability of the note in court.

Credit: www.windwardstudios.com

Litigation And Court Processes

When it comes to enforcing a promissory note, litigation and court processes play a critical role in determining whether the note will stand up in court. If a dispute arises regarding the repayment of the promissory note, the parties involved may need to file a lawsuit and engage in court proceedings to seek a resolution.

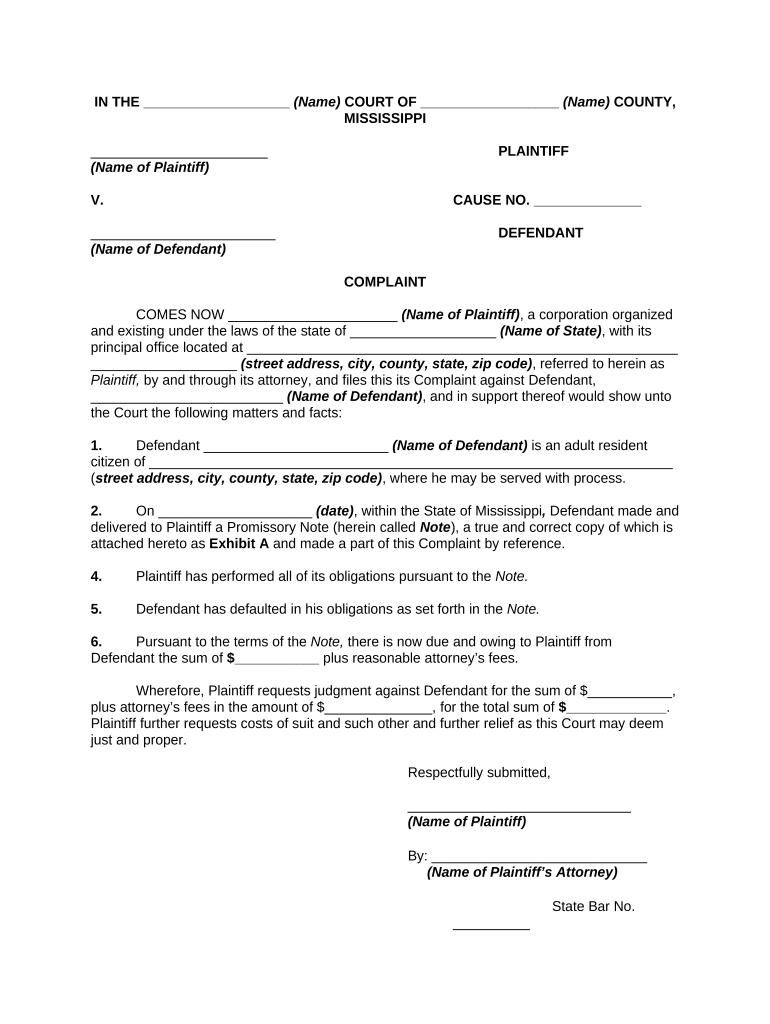

Filing A Lawsuit

To initiate the legal process, the party seeking enforcement of the promissory note must file a lawsuit against the party in default. The plaintiff, which is the party initiating the lawsuit, needs to prepare a complaint stating the reasons for the lawsuit and the relief sought. It is important to be clear and concise in outlining the allegations and claims, providing all relevant details and supporting documentation.

Once the complaint is filed with the appropriate court, the plaintiff needs to serve the defendant, ensuring they receive a copy of the complaint and a summons. Proper service of the lawsuit is crucial to ensure the defendant is aware of the legal action and has an opportunity to respond.

Court Proceedings

Upon receipt of the complaint, the defendant must respond within a specified period, usually by filing an answer. The answer details the defendant’s position, any defenses they may have, and whether they agree or disagree with the claims made in the complaint. Failure to respond adequately may result in a default judgment against the defendant.

Once the lawsuit is underway, both parties may engage in discovery, which allows them to gather evidence and information related to the dispute. This can include requesting documents, interrogatories (written questions), and depositions (sworn testimony).

With the completion of discovery, the court may schedule a pretrial conference to discuss the case’s status and possibly facilitate a settlement. If a resolution cannot be reached, the case will proceed to trial.

During the trial, both parties will present their arguments, evidence, and witnesses before a judge or jury. The judge or jury will then determine the outcome of the case based on the presented information and applicable laws.

If the court finds in favor of the plaintiff, a judgment will be entered against the defendant, establishing the enforceability of the promissory note. The court may order the defaulting party to repay the debt specified in the promissory note, including any accrued interest and legal fees.

However, it is important to note that even if a judgment is obtained, the challenging part could lie in the actual collection of the amount owed. The court’s decision does not guarantee immediate payment, and additional legal steps may be necessary to enforce the judgment.

Strategies For Protecting Promissory Notes

To ensure the enforceability of a promissory note in court, it is essential to carefully draft the document, clearly outlining the terms of the agreement. Additionally, it’s important to obtain signatures from both parties and consider notarizing the document. Maintaining detailed records and adhering to state laws can further bolster the note’s legitimacy.

Protecting your promissory notes is crucial to safeguarding your financial interests in case of disputes or non-payment. By implementing effective strategies, you can enhance the enforceability of your promissory notes and minimize the risks associated with legal proceedings. In this section, we will discuss two key strategies that can help you protect your promissory notes:

Effective Documentation

Creating comprehensive and well-drafted documentation is the foundation for protecting your promissory notes. When it comes to promissory notes, detailed and precise documentation plays a pivotal role in establishing the borrower’s obligations and your rights as the lender. Here are some essential elements you should include in your promissory note documentation:

- Clear Terms: Clearly outline the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any other relevant factors.

- Specific Parties: Identify both the lender and the borrower with their full legal names and contact information to ensure clarity and avoid confusion.

- Explicit Repayment Terms: Clearly state the repayment terms, such as the due date for principal and interest payments, any penalties or late fees, and the consequences for default.

- Collateral Information: If applicable, describe any collateral provided by the borrower to secure the loan, specifying the details of the collateral and its value.

- Witnesses and Signatures: Include spaces for the borrower’s and lender’s signatures as well as a section for witnesses to sign, ensuring the legal validity and enforceability of the promissory note.

By following these guidelines, you can ensure that your promissory note documentation is comprehensive, legally sound, and provides a strong foundation for a potential legal dispute.

Legal Counsel

Seeking legal counsel is a crucial step in protecting your promissory notes. An experienced attorney can review your promissory note documentation, offer valuable guidance, and ensure compliance with applicable laws. Here are some ways legal counsel can assist you:

- Review and Drafting: A skilled attorney can review your existing promissory notes and make necessary revisions to ensure enforceability. They can also help you draft new promissory notes that are tailored to your specific requirements and comply with relevant laws.

- Legal Advice and Compliance: An attorney can provide expert advice on legal matters related to promissory notes, such as interest rate caps, usury laws, and other legal provisions that may impact your loan agreement.

- Dispute Resolution: In the event of a dispute, an attorney can guide you through the legal process, represent your interests, and help you pursue the best possible outcome.

Hiring legal counsel can provide you with the expertise and guidance needed to ensure your promissory notes stand up in court and protect your financial interests effectively.

Credit: www.facebook.com

Frequently Asked Questions Of Will A Promissory Note Stand Up In Court?

Can A Promissory Note Be Enforced In Court?

Yes, a promissory note can be enforced in court if it meets all the legal requirements. It should be properly written, signed by both parties, and contain all the necessary details. However, the court will only enforce the note if it is deemed valid and there is evidence of non-payment.

How Important Is It To Draft A Promissory Note?

Drafting a promissory note is crucial when lending or borrowing money. It serves as a legal document that outlines the terms of the loan, such as repayment schedule, interest rate, and consequences for non-payment. It provides both parties with a clear understanding of their rights and responsibilities, helping to avoid potential disputes.

What Happens If Someone Defaults On A Promissory Note?

If someone fails to make payments as outlined in a promissory note, they are considered in default. The lender can take legal action to recover the owed amount. This can involve going to court, obtaining a judgment against the debtor, and using various methods to collect the debt, such as wage garnishment or seizing assets.

Are Promissory Notes Legally Binding?

Promissory notes are legally binding documents when they meet all the necessary legal requirements. To be enforceable, they should include specific terms, be signed by both parties, and provide clear evidence of an agreement to repay a debt. Courts generally enforce promissory notes as long as they comply with the law.

Conclusion

A well-drafted promissory note can serve as strong evidence in court. By clearly outlining the terms of the agreement, including payment schedules and interest rates, parties can protect their rights in case of default. However, it’s crucial to ensure legality and enforceability when creating such financial instruments.

Take proactive measures to safeguard your interests and seek legal guidance if needed.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Can a Promissory Note be Enforced in Court?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, a promissory note can be enforced in court if it meets all the legal requirements. It should be properly written, signed by both parties, and contain all the necessary details. However, the court will only enforce the note if it is deemed valid and there is evidence of non-payment.” } } , { “@type”: “Question”, “name”: “How Important is it to Draft a Promissory Note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Drafting a promissory note is crucial when lending or borrowing money. It serves as a legal document that outlines the terms of the loan, such as repayment schedule, interest rate, and consequences for non-payment. It provides both parties with a clear understanding of their rights and responsibilities, helping to avoid potential disputes.” } } , { “@type”: “Question”, “name”: “What Happens If Someone Defaults on a Promissory Note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “If someone fails to make payments as outlined in a promissory note, they are considered in default. The lender can take legal action to recover the owed amount. This can involve going to court, obtaining a judgment against the debtor, and using various methods to collect the debt, such as wage garnishment or seizing assets.” } } , { “@type”: “Question”, “name”: “Are Promissory Notes Legally Binding?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Promissory notes are legally binding documents when they meet all the necessary legal requirements. To be enforceable, they should include specific terms, be signed by both parties, and provide clear evidence of an agreement to repay a debt. Courts generally enforce promissory notes as long as they comply with the law.” } } ] }