Can Anyone Issue a Promissory Note? Discover the Power within Accountability

Yes, anyone can issue a promissory note as long as they possess the legal capacity to enter into a contract. A promissory note can be issued by anyone who has the legal authority and capability to enter into a contract.

It is not limited to specific individuals or entities. A promissory note is a legal document that binds the issuer to repay a specific amount of money to the recipient, usually with interest, within a specified timeframe. It serves as a written promise to pay and can be used in various situations such as loans, business transactions, or personal agreements.

However, it is crucial to ensure that the terms and conditions of the promissory note comply with applicable laws and regulations to ensure its validity and enforceability.

The Basics Of Promissory Note

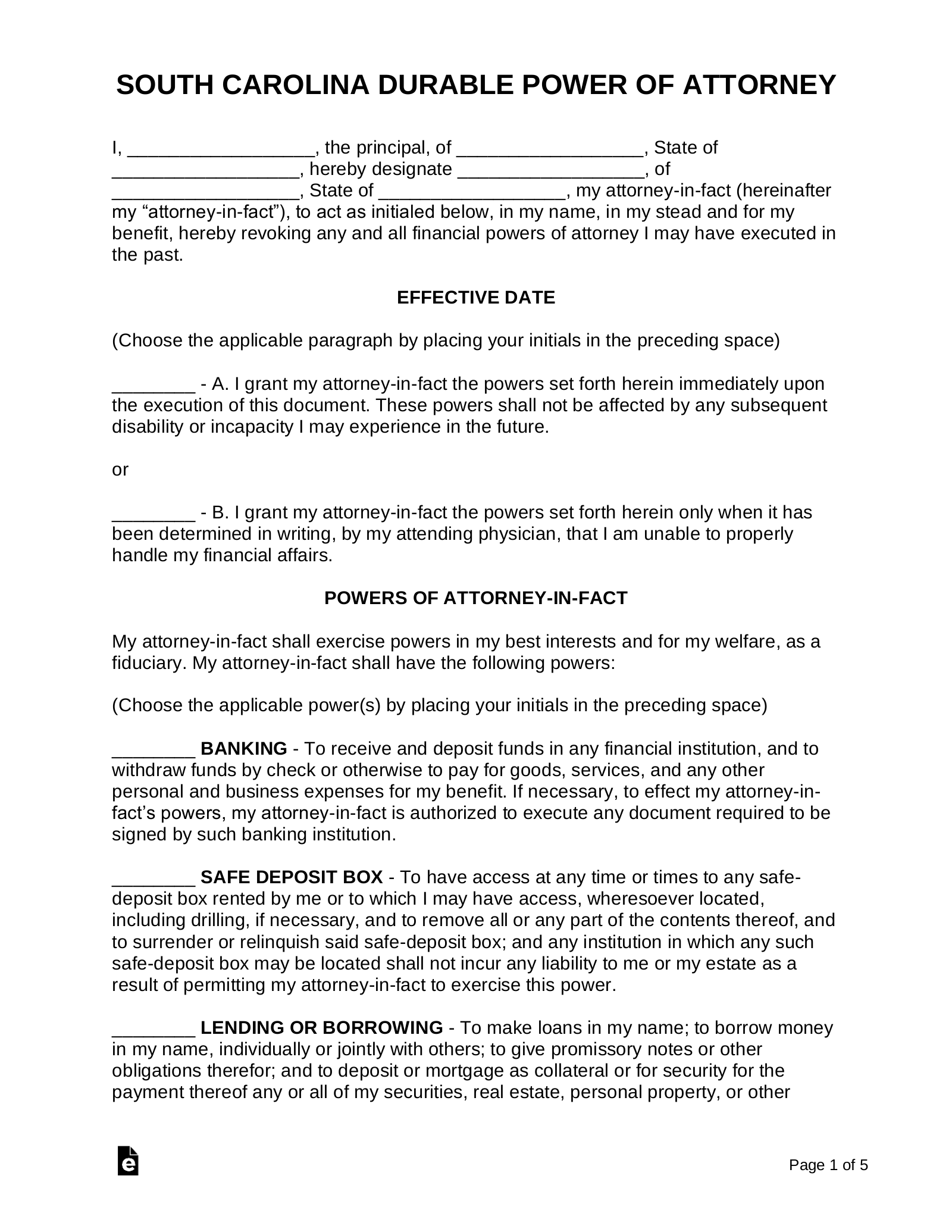

Promissory notes can be issued by individuals, businesses, or financial institutions to formalize agreements and promises to pay a specific amount to the holder. However, there are legal requirements for issuing promissory notes, and they must be signed by the debtor.

What Is A Promissory Note?

A promissory note is a legal document that outlines the details of a loan transaction between a lender and a borrower. It contains a written promise from the borrower to repay a specific amount of money to the lender within a specified timeframe. Promissory notes are commonly used in personal and business transactions as a way to formalize loans and provide a clear record of the agreement.

Legal Requirements For Issuing A Promissory Note

Issuing a promissory note involves certain legal requirements that must be followed to ensure the document is legally valid and enforceable. While the specific requirements may vary depending on the jurisdiction, here are some common legal elements that should be included:

- Names and Contact Information: The promissory note should include the full names and contact information of both the lender and the borrower. This helps to identify the parties involved in the loan agreement.

- Amount of Loan: The exact amount of money being loaned must be clearly stated in the promissory note. This includes both the principal amount and any accrued interest.

- Repayment Terms: The promissory note should outline the repayment terms, including the date on which the loan must be repaid in full. It should also specify the frequency and amount of any installment payments, if applicable.

- Interest Rate: If the loan carries an interest rate, it must be clearly stated in the promissory note. This ensures that both parties are aware of the agreed-upon interest rate and can calculate the interest due.

- Collateral: In some cases, the promissory note may include details about any collateral pledged to secure the loan. This provides the lender with recourse in case the borrower fails to repay the loan.

- Date and Signatures: The promissory note must be dated and signed by both the lender and the borrower. This signifies their agreement to the terms and conditions stated in the document, as well as their commitment to fulfilling their obligations.

It is important to note that the legal requirements for issuing a promissory note may vary depending on the jurisdiction. Consulting with a legal professional can help ensure compliance with local laws and regulations.

Who Can Issue A Promissory Note?

A promissory note is a legally binding document that establishes a borrower’s obligation to repay a loan. It outlines the terms and conditions of the loan, including repayment schedule, interest rate, and consequences of default. When it comes to issuing a promissory note, it is essential to understand who can issue one. This article will explore the different entities that have the authority to issue a promissory note.

Individuals

An individual, whether they are a student, homeowner, or entrepreneur, has the ability to issue a promissory note. If someone borrows money from a family member or friend, the lender may ask for a promissory note as a formal acknowledgment of the debt. The individual issuing the note will specify the amount borrowed, the timeline for repayment, and any applicable interest rates. This safeguards both parties’ interests and ensures clear communication and understanding of the loan agreement.

Businesses And Organizations

Businesses and organizations also have the authority to issue promissory notes. This includes small businesses, corporations, nonprofit organizations, and government entities. When a business borrows money from a financial institution or obtains financing from investors, they may be required to issue a promissory note to document the loan. This serves as proof of the debt and provides the lender with legal recourse in case of default. Additionally, businesses may issue promissory notes to suppliers or other parties to ensure timely payment for goods or services rendered.

Code:

Who Can Issue a Promissory Note?

A promissory note is a legally binding document that establishes a borrower's obligation to repay a loan. It outlines the terms and conditions of the loan, including repayment schedule, interest rate, and consequences of default. When it comes to issuing a promissory note, it is essential to understand who can issue one. This article will explore the different entities that have the authority to issue a promissory note.

Individuals

An individual, whether they are a student, homeowner, or entrepreneur, has the ability to issue a promissory note. If someone borrows money from a family member or friend, the lender may ask for a promissory note as a formal acknowledgment of the debt. The individual issuing the note will specify the amount borrowed, the timeline for repayment, and any applicable interest rates. This safeguards both parties' interests and ensures clear communication and understanding of the loan agreement.

Businesses and Organizations

Businesses and organizations also have the authority to issue promissory notes. This includes small businesses, corporations, nonprofit organizations, and government entities. When a business borrows money from a financial institution or obtains financing from investors, they may be required to issue a promissory note to document the loan. This serves as proof of the debt and provides the lender with legal recourse in case of default. Additionally, businesses may issue promissory notes to suppliers or other parties to ensure timely payment for goods or services rendered.

Understanding The Accountability Of Issuing A Promissory Note

Issuing a promissory note is a serious financial and legal commitment. Understanding the accountability of issuing a promissory note is crucial for anyone considering entering into this type of financial agreement.

Legal And Financial Responsibility

When issuing a promissory note, it’s important to understand the legal and financial responsibilities that come with it. As the issuer, you are legally bound to fulfill the promise to repay the borrowed amount. This creates a legal obligation that can be enforced through the legal system if the terms are not met.

The financial responsibility includes the commitment to repay the principal amount as well as any interest agreed upon in the note. Defaulting on this responsibility can lead to financial repercussions, making it imperative to commit to the terms of the note.

Default Consequences

Defaulting on a promissory note can have serious consequences. Failure to make timely payments can result in legal action from the creditor, leading to potential judgments and damage to your credit score.

Additionally, defaulting may lead to high interest penalties and additional fees, further worsening the financial situation for the issuer. Understanding these consequences is essential for anyone considering the issuance of a promissory note.

Credit: www.facebook.com

The Power And Risks Of Holding A Promissory Note

Understanding the power and risks associated with holding a promissory note is crucial, especially if you are the beneficiary or considering becoming one. Promissory notes are legal instruments that formalize a borrower’s promise to repay a debt to the lender, typically with interest. While promissory notes offer numerous benefits to both parties involved, they also carry certain risks. In this section, we will explore the rights and options that beneficiaries have, as well as some strategies to mitigate potential risks.

Beneficiary Rights And Options

Being the beneficiary of a promissory note provides you with certain rights and options that can influence your financial position. These rights include:

- Receiving Regular Payments: As the beneficiary, you have the right to receive regular payments as outlined in the promissory note. These payments can be structured to meet your needs, whether it’s monthly, quarterly, or annually.

- Enforcing Payment: If the borrower fails to make the required payments, you have the option to enforce payment through legal means. This may involve legal steps such as filing a lawsuit or seeking arbitration to recover the owed amount.

- Transferring Ownership: In some cases, beneficiaries have the option to transfer their ownership rights to another party. This can be beneficial if you wish to sell or assign your interest in the promissory note to someone else.

- Modifying Terms: Depending on the terms agreed upon, beneficiaries may have the option to negotiate and modify the terms of the promissory note. This can include adjusting the repayment schedule, interest rate, or even extending the maturity date.

Risk Mitigation Strategies

While holding a promissory note offers potential financial gains, it is essential to be aware of the inherent risks involved. Here are some strategies to mitigate these risks:

- Due Diligence: Before accepting a promissory note, thoroughly evaluate the borrower’s creditworthiness and financial standing. Request documentation such as credit reports, financial statements, and references to assess their ability to repay the debt.

- Security Collateral: One way to mitigate risk is by securing the promissory note with collateral. This can include assets such as real estate, vehicles, or valuable possessions that provide an additional layer of protection in case of default.

- Loan Insurance: Consider obtaining loan insurance to protect against the risk of default. This type of insurance can help cover the outstanding balance or provide payments in case of the borrower’s inability to meet their obligations.

- Regular Monitoring: Stay proactive by regularly monitoring the borrower’s financial situation. Keep track of their credit score, income changes, and any potential red flags that may indicate an increased risk of default.

By understanding your rights and utilizing risk mitigation strategies, you can navigate the terrain of holding a promissory note with confidence. These measures allow you to protect your interests and maximize the potential benefits offered by this financial instrument.

Conclusion And Key Takeaways

Yes, anyone can issue a promissory note as long as they are legally capable of entering into a contract. It is important to understand the terms and conditions of the promissory note and ensure that both parties agree to the agreement.

Importance Of Accountability

Promissory notes provide a clear framework for establishing accountability between parties involved in a financial transaction. The presence of a written agreement creates a record that can be referred to and enforced if necessary. This promotes trust and confidence in business dealings, as all parties know their obligations and the consequences of failing to fulfill them. By holding individuals accountable for their promises, promissory notes contribute to a fair and transparent financial environment.Empowerment Through Promissory Notes

When it comes to financial agreements, clarity and empowerment go hand in hand. Promissory notes empower both the borrower and the lender by clearly outlining the terms and conditions of the loan or debt. For the borrower, it serves as a guide, clearly defining the repayment schedule, interest rates, and any penalties or consequences for default. This allows them to plan and manage their finances effectively. On the other hand, the lender benefits from the assurance that their investment is protected, as the terms of repayment are legally binding. In addition, promissory notes provide the flexibility to customize the terms of the agreement to meet the needs and circumstances of both parties. For example, they can include provisions for early repayment, collateral, or any other specific conditions that may be agreed upon. This flexibility allows borrowers to negotiate better terms and lenders to secure their investment. By creating a fair and transparent system, promissory notes empower individuals and businesses to participate in financial transactions with confidence. They provide a structure that ensures accountability and protects the interests of all parties involved. Whether you are borrowing or lending money, promissory notes offer a reliable and legally enforceable mechanism that promotes trust and empowers both parties to fulfill their obligations. So, next time you are entering into a financial agreement, consider utilizing a promissory note to ensure a smooth and accountable transaction.

Credit: legaltemplates.net

Credit: www.doyourownwill.com

Frequently Asked Questions Of Can Anyone Issue A Promissory Note?

Can Anyone Issue A Promissory Note?

Yes, anyone who is of legal age and has the capacity to enter into a contract can issue a promissory note. This includes individuals, businesses, and organizations who need to record a promise to pay a specific amount of money on a specified date.

Conclusion

Issuing a promissory note is an accessible way for individuals and businesses to formalize financial agreements. Understanding the legal and financial implications is crucial in creating a valid and enforceable promissory note. With careful consideration and adherence to legal requirements, anyone can issue a promissory note with confidence and clarity.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Can anyone issue a promissory note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, anyone who is of legal age and has the capacity to enter into a contract can issue a promissory note. This includes individuals, businesses, and organizations who need to record a promise to pay a specific amount of money on a specified date.” } } ] }