Who is Liable on the Promissory Note? Find Out the Legal Responsibilities Now

The person who signs the promissory note is liable for the debt. A promissory note is a legal document that outlines the terms and conditions of a loan or debt repayment.

It serves as a binding agreement between the borrower and the lender. While it is commonly used in personal loans, it can also be utilized in business transactions. Understanding who is liable on the promissory note is crucial for both parties involved.

This liability falls on the person who signs the note, also known as the borrower or debtor. They are legally obligated to repay the debt as agreed upon in the note. This clear and concise answer will provide a solid foundation for exploring further aspects of promissory notes and their implications.

Credit: www.sec.gov

Understanding Promissory Notes

What Is A Promissory Note?

A promissory note is a legally binding document that contains a promise made by one party to pay a specific amount of money to another party. It serves as a written agreement between the borrower and the lender, outlining the terms and conditions of the loan.

Types Of Promissory Notes

There are various types of promissory notes, each designed to meet different financial needs and situations. Some common types include:

- Simple promissory notes: These are basic promissory notes that state the borrower’s promise to repay the debt.

- Secured promissory notes: These notes are backed by collateral, such as real estate or vehicles, which the lender can claim if the borrower fails to repay the loan.

- Unsecured promissory notes: Unlike secured notes, unsecured promissory notes do not have any collateral attached to them. The lender relies solely on the borrower’s creditworthiness.

- Installment promissory notes: These notes outline a series of payments over a specific period, allowing borrowers to repay the loan in smaller, manageable installments.

Promissory notes play a crucial role in documenting loan agreements and ensuring that both parties understand their rights and obligations. It is important to consult a legal professional when drafting or entering into a promissory note to ensure compliance with relevant laws and regulations.

Credit: www.jotform.com

Parties Involved In A Promissory Note

A promissory note is a legally binding document that outlines the terms and conditions of a loan. It serves as evidence of a promise to repay a specific amount of money within a specified timeframe. Several parties are involved in a promissory note, each with distinct responsibilities and liabilities. Understanding the roles of these parties is essential to ensure a smooth loan transaction and avoid any potential legal issues. The primary parties involved in a promissory note are the Maker and the Payee.

Maker

The Maker is the individual or entity who is borrowing money and making the promise to repay. In other words, the maker is the debtor or borrower in the loan agreement. They are responsible for fulfilling the terms and conditions outlined in the promissory note, including making timely payments and complying with any other agreed-upon obligations.

Payee

The Payee is the individual or entity to whom the money is owed. They are typically the lender or creditor in the loan agreement. The payee holds the legal right to receive the amount specified in the promissory note from the maker. As the recipient of the funds, the payee has the authority to enforce the terms of the promissory note, including taking legal action if the maker fails to fulfill their obligations.

Liability On A Promissory Note

A promissory note is a legal document that outlines the terms of a loan agreement, including the amount of the loan, the repayment schedule, and the consequences for default. It establishes the liability of the parties involved. Understanding the different types of liability on a promissory note is essential for both lenders and borrowers.

Primary Liability

Primary liability on a promissory note refers to the direct obligation of the borrower to repay the loan according to the terms specified in the document. The borrower is primarily responsible for fulfilling the terms of the promissory note, including making timely payments and repaying the principal amount.

Secondary Liability

Secondary liability arises when a party other than the borrower becomes liable for the repayment of the promissory note. This could occur when a co-signer or guarantor is involved in the loan agreement. In such cases, the co-signer or guarantor assumes secondary liability and becomes responsible for the debt if the borrower defaults. However, it’s important for all parties to clearly understand their level of liability before entering into a promissory note agreement.

Factors Affecting Liability

When it comes to the liability on a promissory note, there are various factors that can affect who is responsible for its repayment. Understanding these factors is crucial for both lenders and borrowers in order to have a clear understanding of their obligations and rights. In this section, we will explore the conditions of the note and the potential involvement of third parties as key factors influencing liability.

Conditions Of The Note

Before delving into the specifics of liability, it is important to understand the conditions set forth in the promissory note. These conditions typically outline the terms of the loan, including the principal amount, the interest rate, and the repayment schedule. It is essential for both parties involved to carefully review and agree upon these conditions before signing the note.

Moreover, any additional terms or clauses specified in the note can also impact liability. For example, the note may include provisions for late payment penalties or acceleration clauses that allow the lender to demand immediate repayment under certain circumstances.

Third-party Involvement

In some cases, third parties may become involved with the promissory note, affecting liability. One such scenario is when an individual co-signs the note with the borrower. This means that the co-signer becomes equally responsible for the repayment of the loan if the borrower fails to fulfill their obligations.

Another situation arises when the note is assigned or sold to a different party. This can occur when a lender transfers their rights to another entity, such as a collection agency. The new assignee then assumes the role of the lender and becomes the party to whom the borrower is liable.

- Co-signing the note can increase liability for an individual other than the borrower.

- Assigning or selling the note transfers the lender’s role and liabilities to a new party.

It is important to note that the terms and conditions of the note generally remain the same even with third-party involvement. Therefore, both the borrower and any third parties should carefully review the note to ensure clarity and avoid any potential disputes regarding liability.

Legal Recourse For Non-payment

When someone defaults on a promissory note, it raises the question of who is liable for the unpaid amount. This is an important issue to address, as it determines the course of action that can be taken to recover the outstanding debt. To understand the options available, it is necessary to explore enforcement options and the potential legal implications.

Enforcement Options

When a borrower fails to make the required payments outlined in a promissory note, the lender has several enforcement options at their disposal. These options depend on the terms stipulated in the note itself and the applicable laws of the jurisdiction in which the note was made. Some common enforcement options include:

- Initiating a legal action: The lender can file a lawsuit against the borrower, seeking a court order to enforce payment of the debt. This can result in a judgment against the borrower and potential consequences such as wage garnishment, property liens, or bank account seizures.

- Engaging a collection agency: Lenders may choose to hire a collection agency to pursue repayment on their behalf. Collection agencies have various tools and techniques at their disposal to locate the borrower, negotiate payment arrangements, or take legal action if necessary.

- Negotiating a settlement: In some cases, lenders may be open to negotiating a settlement with the borrower, particularly if they believe that recovering a portion of the debt is better than no recovery at all. This can involve reducing the outstanding balance or agreeing to a suitable repayment plan.

Legal Implications

Non-payment of a promissory note can have significant legal implications for both parties involved. If the lender decides to pursue legal action, the borrower may face consequences such as:

- Damage to credit rating: A judgment against the borrower can negatively impact their credit score. This can make it difficult for them to secure future loans or credit.

- Legal expenses: The borrower may be responsible for paying the legal fees incurred by the lender in pursuing the debt. This can add to their financial burden.

- Seizure of assets: Depending on the jurisdiction, the lender may have the right to seize the borrower’s assets to satisfy the unpaid debt.

It is crucial for both lenders and borrowers to understand the legal recourse available in case of non-payment. By being aware of the enforcement options and potential legal implications, individuals can make informed decisions and take appropriate actions to address defaulted promissory notes.

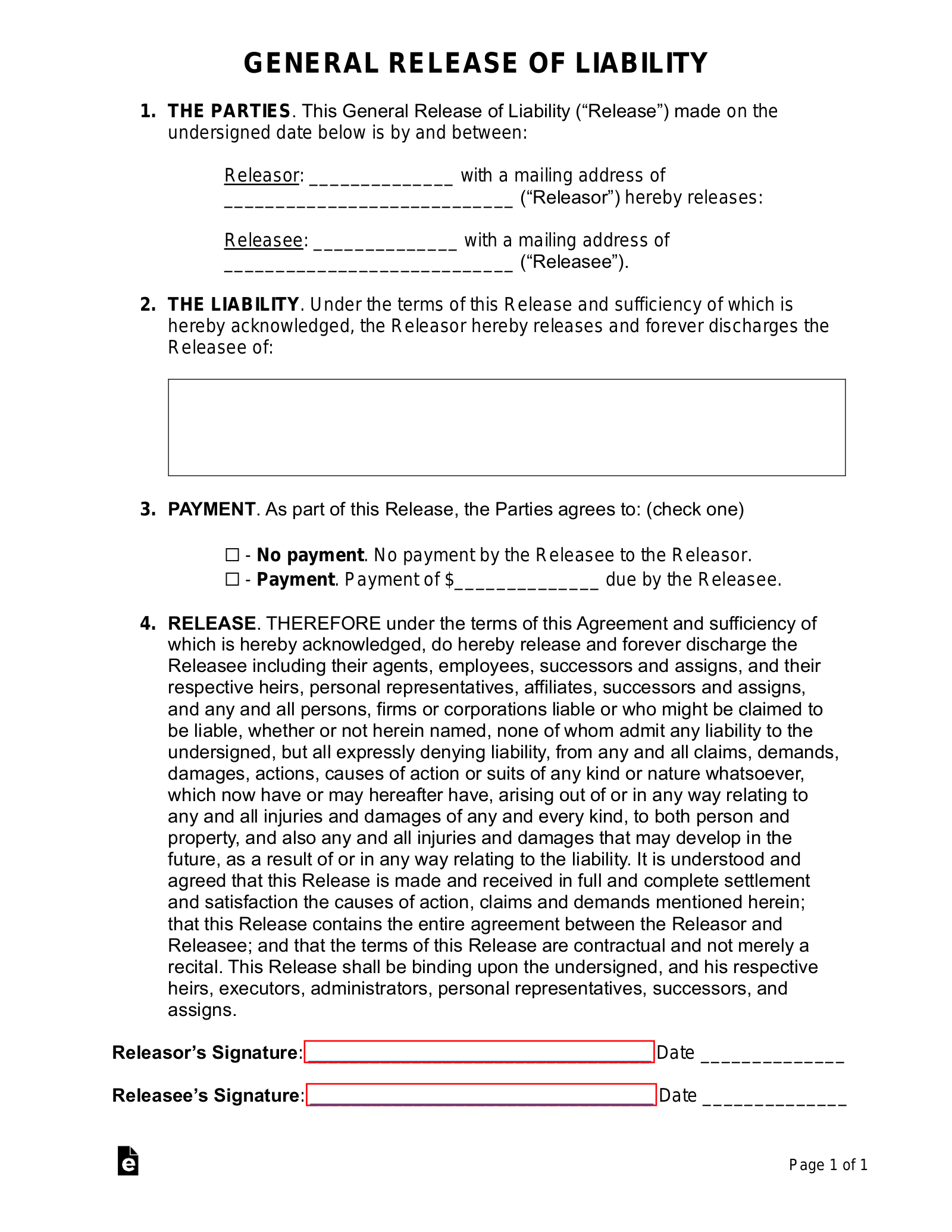

Credit: eforms.com

Frequently Asked Questions On Who Is Liable On The Promissory Note?

What Is A Promissory Note?

A promissory note is a legal document that outlines the terms and conditions of a loan, including the amount borrowed, interest rate, and repayment schedule.

Who Is The Maker Of A Promissory Note?

The maker of a promissory note is the person or entity who signs the note and promises to repay the borrowed amount according to the specified terms.

Who Is The Payee On A Promissory Note?

The payee on a promissory note is the person or entity who is entitled to receive the borrowed funds from the maker of the note.

Can The Payee Transfer A Promissory Note To Someone Else?

Yes, the payee can transfer a promissory note to another person or entity by endorsing the note and delivering it to the new holder.

Conclusion

Understanding the liability on a promissory note is essential for all parties involved. Whether you’re the borrower or the lender, knowing the legal responsibilities is crucial. It’s important to seek legal advice, carefully read and understand the terms on the promissory note to avoid any future conflicts.

Always stay informed and protect your rights.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a promissory note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A promissory note is a legal document that outlines the terms and conditions of a loan, including the amount borrowed, interest rate, and repayment schedule.” } } , { “@type”: “Question”, “name”: “Who is the maker of a promissory note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The maker of a promissory note is the person or entity who signs the note and promises to repay the borrowed amount according to the specified terms.” } } , { “@type”: “Question”, “name”: “Who is the payee on a promissory note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The payee on a promissory note is the person or entity who is entitled to receive the borrowed funds from the maker of the note.” } } , { “@type”: “Question”, “name”: “Can the payee transfer a promissory note to someone else?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, the payee can transfer a promissory note to another person or entity by endorsing the note and delivering it to the new holder.” } } ] }