What is the Difference: Promissory Note vs. Loan Agreement?

A promissory note is a legal document that details a promise to repay a specific amount of money, while a loan agreement is a contract that outlines the terms and conditions of a loan, including repayment terms, interest rates, and collateral requirements. A promissory note is a binding agreement between a borrower and a lender and serves as evidence of the debt, whereas a loan agreement is a comprehensive document that covers all aspects of the loan, ensuring both parties are aware of their rights and obligations.

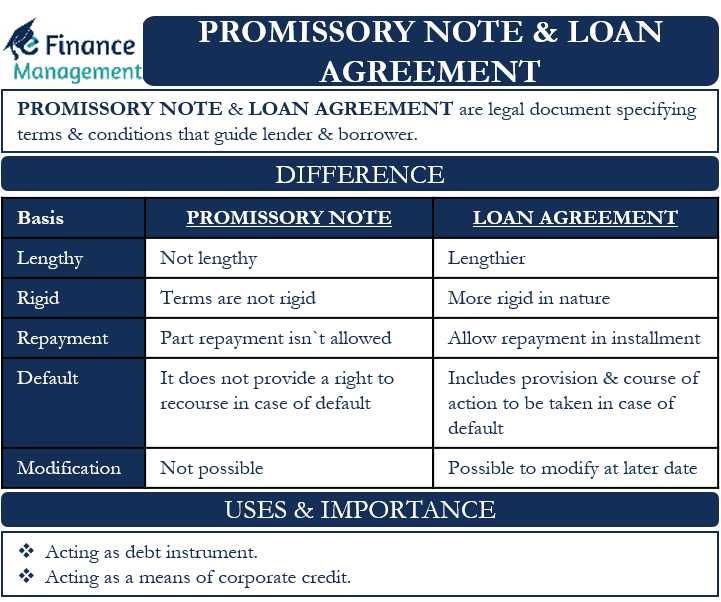

Credit: efinancemanagement.com

Key Differences

A promissory note and a loan agreement differ in their legal nature and purpose. While a promissory note is a written promise to repay a specific amount of money, a loan agreement outlines the terms and conditions of a loan, including interest rates and repayment schedules.

Legal Definition

Before diving into the key differences between a promissory note and a loan agreement, it is important to understand their legal definitions. Both documents are legally binding contracts that outline the terms and conditions of a loan. However, they serve different purposes and have distinct functions.

Purpose And Function

A promissory note is a simpler document compared to a loan agreement. It is a written promise to pay a specific amount of money to a lender at a designated time or upon demand. Essentially, it establishes a borrower’s commitment to repay the loan.

On the other hand, a loan agreement is a more comprehensive contract that governs the entire lending relationship. It encompasses not only the borrower’s promise to repay, but also the lender’s terms and conditions, such as interest rates, repayment schedule, collateral, and any penalties or fees. A loan agreement provides more protection to both parties involved and clarifies their rights and obligations.

While a promissory note is a standalone document, a loan agreement may incorporate a promissory note as part of its terms. In such cases, the promissory note serves as evidence of the borrower’s commitment and is attached to the loan agreement.

Let’s simplify these differences further:

| Promissory Note | Loan Agreement |

|---|---|

| A simple document that outlines the borrower’s promise to repay. | A more comprehensive contract that covers all terms and conditions of the loan. |

| Single party commitment – borrower’s promise to repay. | Mutual agreement between the lender and borrower, clarifying each party’s rights and obligations. |

| Generally used for smaller, straightforward loans. | Typically used for complex loans involving larger amounts and multiple conditions. |

Understanding these key differences between a promissory note and a loan agreement is crucial when entering into any lending arrangement. Whether you’re the borrower or the lender, having the appropriate document in place ensures clarity, protection, and legal enforceability.

Credit: legaltemplates.net

Promissory Note

A promissory note and a loan agreement differ in their legal aspects: a promissory note is a written promise to repay a debt, while a loan agreement outlines the terms and conditions of a loan.

A promissory note is a legal document that outlines the terms of a loan or repayment agreement between two parties. It serves as a written promise to repay a specific amount of money, usually with interest, by a specified date. This document is commonly used in various lending situations, such as personal loans, business loans, or real estate transactions.Definition

A promissory note is a legally binding document that clearly defines the terms and conditions of a loan or debt. It acts as a written contract between the lender and the borrower, detailing the amount borrowed, the interest rate, the repayment schedule, and any other specific terms agreed upon by both parties.Elements

A promissory note typically includes several key elements, which are essential to its validity and enforceability. These elements include:- Parties: The names and contact information of the lender (also known as the payee) and the borrower (also known as the maker or payor) must be clearly identified in the promissory note.

- Principal Amount: This refers to the initial amount borrowed, which must be stated in the promissory note. The principal amount may also be referred to as the loan amount or face value.

- Interest Rate: The promissory note should state the applicable interest rate, which is the cost of borrowing the money. The interest rate can be fixed or variable, depending on the terms agreed upon.

- Repayment Terms: The promissory note must specify the repayment terms, including the total repayment period, the number and frequency of installments, and the due dates for each payment.

- Collateral: If the loan is secured by collateral, such as real estate or a vehicle, the details of the collateral should be mentioned in the promissory note.

Enforceability

A promissory note is a legally enforceable document, meaning that the lender can take legal action to collect the outstanding debt if the borrower fails to repay as agreed. However, to ensure enforceability, certain conditions must be met. These conditions include:- Proper Execution: The promissory note must be properly executed, signed, and dated by both the lender and the borrower. Each party should have a copy of the fully executed document.

- Specific Language: The terms stated in the promissory note should be clear, unambiguous, and easily understood by both parties. Ambiguity or uncertainty may lead to disputes regarding the repayment obligations.

- Legally Competent Parties: Both the lender and the borrower must have the legal capacity to enter into a binding agreement. This means they must be of legal age, mentally competent, and not under any legal disability.

- Compliance with Applicable Laws: The promissory note must comply with the relevant laws and regulations of the jurisdiction in which it is being executed. This includes adhering to usury laws, consumer protection laws, and any other applicable legal requirements.

Loan Agreement

A loan agreement is a legal contract between a borrower and a lender, outlining the terms and conditions of a loan. This agreement specifies the amount borrowed, the interest rate, repayment schedule, and any additional fees or penalties. It serves as a formal record of the loan transaction, protecting the rights of both parties involved.

Definition

A loan agreement is a formal document that outlines the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and any additional fees or penalties. It serves as a legal record of the loan transaction, protecting the rights of both the borrower and the lender.

Terms And Conditions

The loan agreement specifies the specific terms and conditions of the loan, including the repayment schedule, interest rate, late payment penalties, and any other relevant details. This document ensures that both parties are aware of their responsibilities and obligations regarding the loan.

Collateral

Many loan agreements require the borrower to provide collateral as security for the loan. Collateral can be in the form of real estate, vehicles, or other valuable assets. In the event that the borrower defaults on the loan, the lender has the right to seize the collateral to cover the outstanding debt.

:max_bytes(150000):strip_icc()/Term-Definitions_Template_promissorynote.asp-76c1a84d9d5344abb8f3c4110233207e.jpg)

Credit: www.investopedia.com

Frequently Asked Questions Of What Is The Difference Between A Promissory Note And A Loan Agreement?

What Is A Promissory Note And How Does It Differ From A Loan Agreement?

A promissory note is a legal document that outlines a borrower’s promise to repay a specific amount to a lender. On the other hand, a loan agreement is a contract that specifies the terms and conditions of a loan. While both serve as evidence of debt, a promissory note is more straightforward, while a loan agreement provides more comprehensive details of the loan terms.

Conclusion

Understanding the difference between promissory notes and loan agreements is crucial for any financial transaction. While both documents involve lending and repayment, they serve distinct legal purposes. A promissory note is a written promise to repay a specific amount, while a loan agreement outlines the terms and conditions of the loan.

Clear comprehension of these documents will ensure clarity and transparency in any financial arrangement.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a promissory note and how does it differ from a loan agreement?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A promissory note is a legal document that outlines a borrower’s promise to repay a specific amount to a lender. On the other hand, a loan agreement is a contract that specifies the terms and conditions of a loan. While both serve as evidence of debt, a promissory note is more straightforward, while a loan agreement provides more comprehensive details of the loan terms.” } } ] }