How to Write a Powerful Legal Letter to Recover Debts

To write a legal letter to someone who owes you money, provide a clear and concise statement of the debt owed and request payment within a specific time frame. Be sure to include all relevant details, such as the amount owed, the date of the debt, and any supporting documentation.

In addition, clearly state the consequences if payment is not made, such as legal action or reporting to credit agencies. Promptness, accuracy, and professionalism are key in this communication. Owing money can often lead to strained relationships and unresolved financial disputes.

In such situations, a legal letter serves as a formal and effective way to demand payment from someone who owes you money. By clearly outlining the debt and setting a deadline for payment, a legal letter communicates the seriousness of the situation and compels the debtor to take appropriate action. We will provide a step-by-step guide on how to write a persuasive legal letter that effectively conveys your demand for payment. Let’s delve into the details.

Credit: www.typecalendar.com

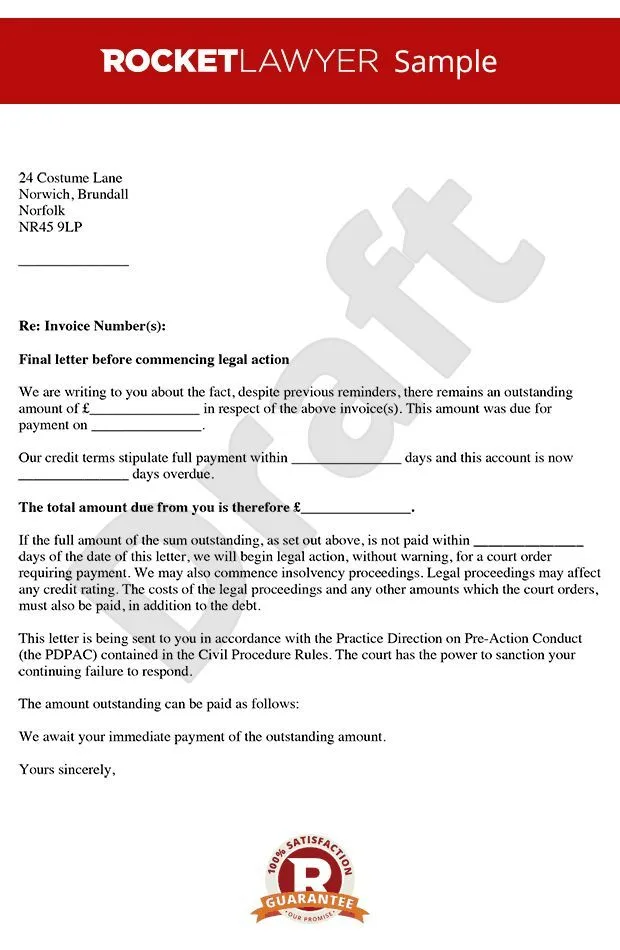

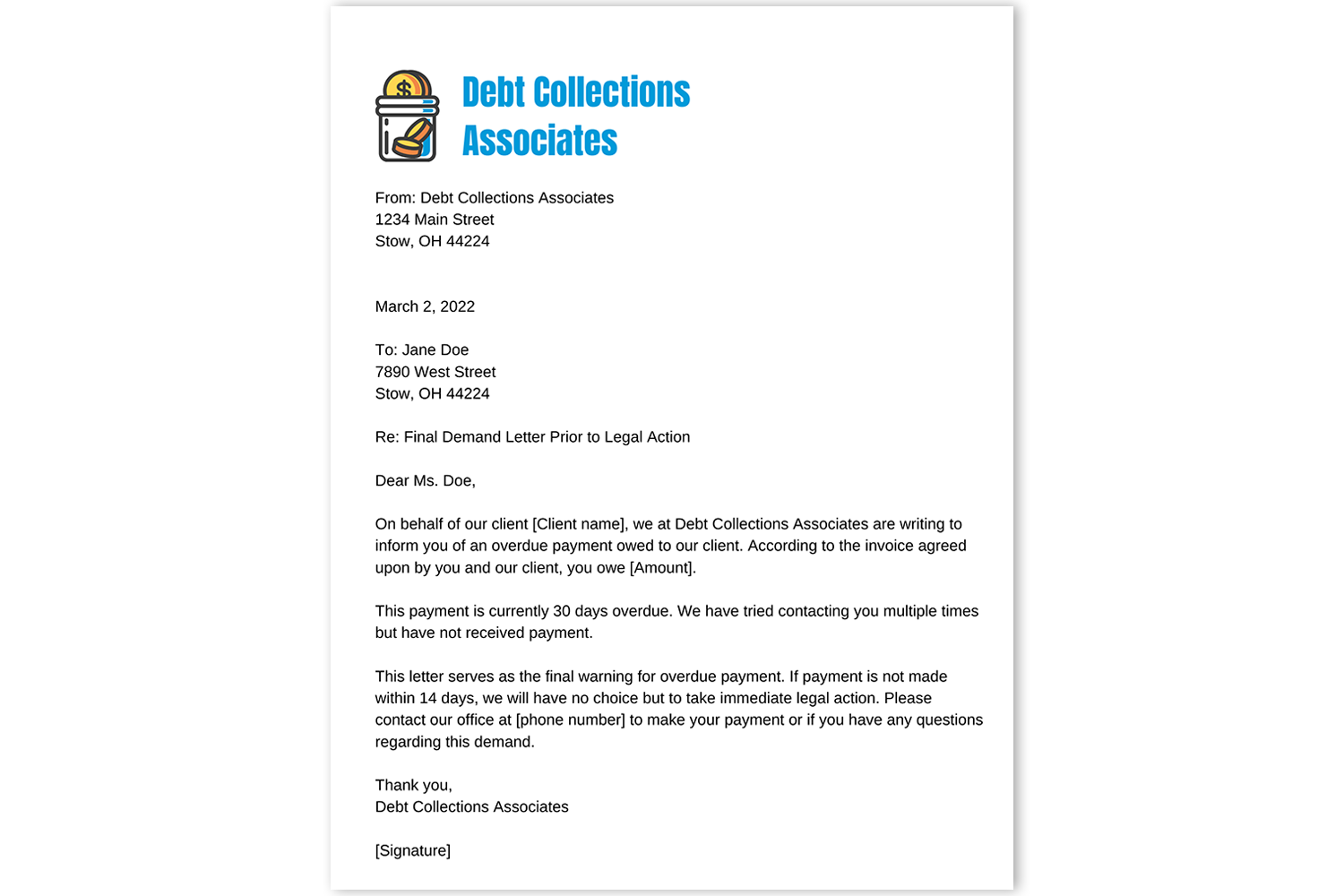

Choosing The Right Format

When writing a legal letter to someone who owes you money, it’s crucial to choose the right format. Begin with a formal header including your address and contact information, followed by the recipient’s details. Clearly articulate the purpose of the letter, your expectations, and any potential consequences if the debt is not addressed.

Selecting The Appropriate Template

When it comes to writing a legal letter to someone who owes you money, choosing the right format is crucial. Using a well-designed template can make your letter appear more professional and organized, increasing the chances of receiving a positive response. There are different templates available depending on the nature of the debt, such as unpaid invoices, promissory notes, or loans. Selecting the appropriate template ensures that you include all the necessary details and follow the standard format for clarity.Structuring And Formatting The Letter

Structuring and formatting your legal letter properly is equally important. This not only helps in presenting the information clearly but also conveys your seriousness and professionalism in pursuing the unpaid debt. Consider the following points when structuring and formatting your letter: 1. Use a Clear and Concise Language: Keep your language simple and straightforward, making it easier for the recipient to understand your message. Avoid legal jargon or complex terminology. 2. Include Relevant Information: Provide all relevant details regarding the debt, such as the amount owed, specific dates or deadlines, and any accompanying documents. Be sure to mention the nature of the debt and how it originated. 3. State Your Intentions: Clearly state your intentions in the letter, whether it is a request for payment, a warning of legal action, or an offer to negotiate a settlement. This eliminates any confusion and sets the tone for further communication. 4. Follow a Professional Tone: Maintain a polite and professional tone throughout the letter. It is essential to remain calm and composed, even if the situation becomes frustrating. This helps to build credibility and may encourage the recipient to take your claim seriously. 5. Provide Contact Information: Include your contact information, such as your name, address, phone number, and email, at both the beginning and end of the letter. This enables the recipient to easily reach out to you for any further discussions or clarifications. 6. Proofread and Edit: Before sending the letter, proofread it thoroughly to ensure there are no grammatical or typographical errors. Editing your letter improves its overall quality and professionalism. Remember, while adhering to the appropriate format and structure is essential, the content of your legal letter should always be tailored to your specific situation. It is important to consult with a legal professional to ensure the accuracy and effectiveness of your letter. By carefully selecting the appropriate template and structuring and formatting your legal letter, you increase the likelihood of resolving the issue smoothly and obtaining the payment owed to you.Understanding Legal Requirements

When writing a legal letter to someone who owes you money, it is crucial to understand the legal requirements involved. Take into account the specific guidelines and formalities needed to effectively communicate your claim and protect your rights in a professional manner.

Researching Applicable Laws And Regulations

Before writing a legal letter to someone who owes you money, it is essential to understand the legal requirements surrounding debt collection in your specific jurisdiction. Researching applicable laws and regulations will help ensure that your letter is accurate, effective, and legally compliant.

Here are some steps you can take to research and understand the applicable laws and regulations:

- Consult a legal professional: It is a good idea to seek advice from a lawyer or legal expert who specializes in debt collection. They can provide valuable insights into relevant laws and regulations that apply to your situation.

- Review local statutes and regulations: Take the time to read and familiarize yourself with the specific statutes and regulations governing debt collection in your jurisdiction. These laws may include specific provisions on how to communicate with debtors, what information should be included in debt collection letters, and what actions are prohibited.

- Check for any recent updates or changes: Laws and regulations surrounding debt collection can change over time. Make sure you check for any recent updates or amendments that may impact your case.

Including Necessary Legal Language

When writing a legal letter to someone who owes you money, it is crucial to include necessary legal language to convey your rights and intentions clearly. This will help ensure that your letter is taken seriously and communicates the seriousness of the matter at hand.

Here are some key elements of legal language you should consider including in your letter:

- Clear and concise language: Use simple and straightforward language that is easy to understand. Avoid complex legal jargon that may confuse the recipient.

- Identification of parties involved: Clearly identify yourself and the recipient in the letter to establish the legal relationship between both parties.

- Description of the debt: Provide a detailed description of the debt owed, including the amount, date of the debt, and any relevant supporting documentation, such as invoices or contracts.

- Consequences of non-payment: Clearly state the consequences of non-payment, such as legal action or credit reporting. This emphasizes the seriousness of the matter and may serve as a strong incentive for the debtor to address the outstanding debt.

- Compliance with applicable laws: Ensure that your letter complies with all relevant laws and regulations governing debt collection. This includes adhering to any specific requirements regarding communication with debtors, debt validation, or dispute resolution.

Crafting A Compelling Opening

When writing a legal letter to someone who owes you money, the opening plays a crucial role in setting the tone and clearly expressing the purpose of the communication. A well-crafted opening can express professionalism and assertiveness, setting the groundwork for a successful resolution of the matter at hand. Here are some essential steps to create a strong opening for your legal letter:

Setting A Professional Tone

Begin your letter by addressing the recipient with a formal salutation. Use their full name and title, if applicable. A courteous and respectful tone reflects professionalism and sets the stage for a constructive exchange. Avoid using informal language and maintain a focused, business-like approach throughout the letter.

Clearly Stating The Purpose

Immediately convey the purpose of the letter in the opening sentences. Clearly and concisely state that the letter pertains to a debt owed to you, avoiding ambiguity or unnecessary details in the initial statement. This sets the tone for a clear and straightforward communication, demonstrating your intent and providing the recipient with a clear understanding of the matter at hand.

Presenting The Facts Clearly

Looking for guidance on writing a legal letter to recover owed money? Learn how to effectively communicate your case and present the facts clearly in this informative article.

Detailing The Outstanding Debt

When it comes to writing a legal letter to someone who owes you money, presenting the facts clearly is crucial. One of the first steps in this process is detailing the outstanding debt. This includes providing accurate information about the total amount owed.

Start by stating the exact amount owed in a clear and concise manner. For example, if the debtor owes you $1000, state it as, “You currently owe a total of $1000.”

Next, provide a breakdown of how the debt accumulated, if applicable. This could include the date the debt was incurred, any agreed-upon terms or payment plans, and details about missed payments. It’s important to be specific and provide a timeline of events, ensuring everything is clearly stated.

Providing Evidence Of The Debtor’s Obligations

In order to strengthen your case, it’s crucial to provide evidence of the debtor’s obligations. This can be done by gathering any relevant documents that support your claim. These might include:

- Contracts or agreements that outline the debtor’s responsibilities

- Invoices or receipts for goods or services provided

- Bank statements or payment records that demonstrate the debtor’s failure to fulfill their payment obligations

Ensure that all evidence provided is accurate and verifiable. It is essential to organize and present these documents clearly. You can consider creating a table that lists each document, the date it was issued, and a brief description of its relevance to the debt. By doing so, you make it easier for the recipient of your letter to review the evidence without confusion.

Conveying Consequences And Next Steps

When dealing with a legal letter to someone who owes you money, it’s crucial to clearly convey the consequences of non-payment and outline the next steps. The letter should clearly state the amount owed, the deadline for payment, and the consequences of non-compliance, while also offering options for resolving the debt amicably.

Articulating Potential Legal Actions

When dealing with someone who owes you money, it is vital to clearly convey the potential legal actions that could be taken. This not only shows your seriousness but also helps the debtor understand the consequences of their actions. By articulating the potential legal actions, you can establish a sense of urgency and emphasize the importance of resolving the matter promptly.

Outline the specific legal actions you can take in a concise and straightforward manner. These may include filing a lawsuit, obtaining a judgment, or seeking a garnishment of wages or assets. By explaining these potential consequences, you are providing an opportunity for the debtor to comprehend the gravity of the situation and hopefully motivate them to take action.

Remember to avoid using excessive legal jargon in your letter. Instead, use language that is understandable to a layperson. This ensures that your message is clear and easily comprehended by the recipient.

Establishing A Deadline For Response

To maintain control of the situation and encourage a prompt response, it is crucial to establish a deadline for the debtor to reply to your legal letter. Clearly specify the date by which the debtor should respond, allowing them adequate time to review the matter and seek legal counsel if necessary.

Ensure the deadline you set is reasonable and considerate, taking into account any extenuating circumstances that may affect the debtor’s ability to respond promptly. Setting a clear deadline not only demonstrates your firmness but also allows you to take further action if the debtor fails to comply.

Clearly state the consequences that will follow if the debtor does not respond within the given timeframe. This may include pursuing legal action or reporting the debt to credit agencies. By providing a deadline and outlining the consequences, you are signaling your intention to take further steps if the matter remains unresolved.

Credit: www.pinterest.com

Credit: etactics.com

Frequently Asked Questions For How Do You Write A Legal Letter To Someone Who Owes You Money?

How Do You Write A Legal Letter To Someone Who Owes You Money?

Writing a legal letter to someone who owes you money can be done by following these steps:

1. Start by addressing the recipient and stating your purpose for writing the letter. 2. Clearly explain the details of the debt, including the amount owed, the date it was due, and any payment agreements made. 3. Include any supporting documents, like invoices or receipts, that prove the debt. 4. Clearly state your expectation for payment and provide a deadline for response. 5. Close the letter by thanking the recipient for their attention and providing your contact information for further communication. Remember to consult a legal professional if needed to ensure all legal requirements are met.

Conclusion

Writing a legal letter to someone who owes you money requires a clear and professional approach. Remember to keep the letter concise and to the point, outlining the details of the debt and requesting prompt payment. By following these steps, you can protect your rights and increase the likelihood of receiving the money owed to you.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “How do you write a legal letter to someone who owes you money?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Writing a legal letter to someone who owes you money can be done by following these steps:1. Start by addressing the recipient and stating your purpose for writing the letter. 2. Clearly explain the details of the debt, including the amount owed, the date it was due, and any payment agreements made. 3. Include any supporting documents, like invoices or receipts, that prove the debt. 4. Clearly state your expectation for payment and provide a deadline for response. 5. Close the letter by thanking the recipient for their attention and providing your contact information for further communication. Remember to consult a legal professional if needed to ensure all legal requirements are met.” } } ] }