Are Promissory Notes Legally Binding? : Uncover the Power of Legal Promissory Notes

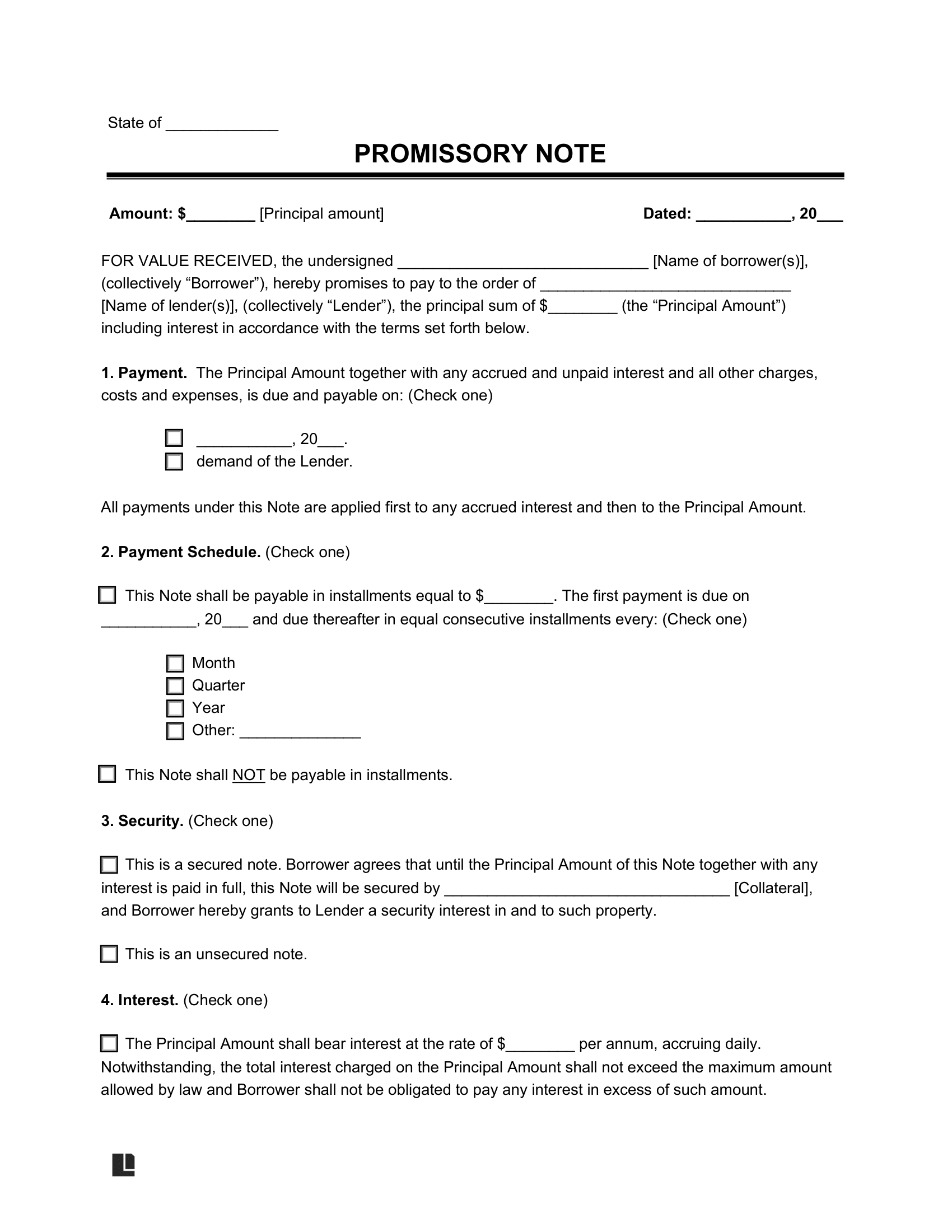

Promissory notes are legally binding documents that outline a borrower’s promise to repay a loan to a lender, providing assurance of financial obligation.

Credit: www.officedepot.com

The Basics Of Promissory Notes

In the world of finance and legal documents, promissory notes play a significant role in formalizing agreements between parties involved in a loan transaction. These legally binding contracts provide assurance that borrowers will repay the borrowed amount to lenders while establishing clear terms and conditions that both parties must adhere to. Understanding the basics of promissory notes is essential for anyone involved in financial transactions or seeking loan agreements. In this article, we will explore what promissory notes are, their key elements, and why they hold legal validity.

What Are Promissory Notes?

A promissory note is a written promise made by one party, known as the borrower or the debtor, to repay a specific sum of money to another party, known as the lender or the creditor, within a specified timeframe. It outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral or security provided. Promissory notes can be used in various lending scenarios, whether between individuals, businesses, or even financial institutions.

Key Elements Of A Promissory Note

A promissory note typically contains several key elements that make it legally binding and enforceable:

- Parties Involved: The names and contact information of both the lender and the borrower should be clearly stated in the promissory note.

- Loan Amount: The specific amount of money borrowed by the borrower must be stated, whether it is a fixed amount or a variable amount.

- Interest Rate: The agreed-upon interest rate, whether it is a fixed percentage or variable, must be clearly mentioned, along with any additional fees or charges associated with the loan.

- Repayment Terms: The promissory note should outline the repayment schedule, including the frequency of payments, the due dates, and the duration of the loan.

- Collateral or Security: If the borrower has provided collateral or security to secure the loan, such as property or assets, it should be detailed in the promissory note.

These elements, combined with the signatures of both parties, create a legally binding agreement that ensures the borrower’s commitment to repay the loan and protects the lender’s rights in case of default or breach of contract.

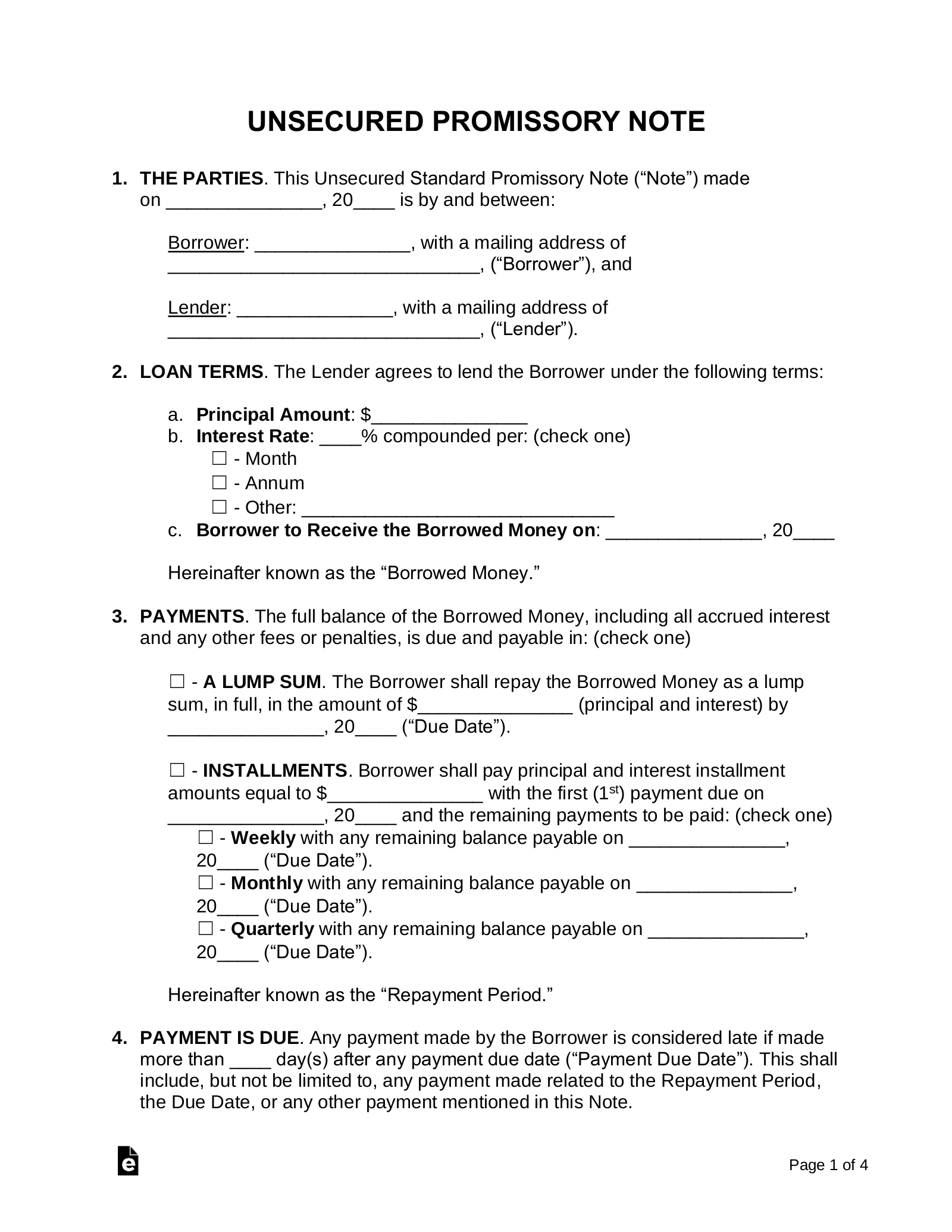

Credit: eforms.com

Enforceability Of Promissory Notes

In the realm of contractual agreements, promissory notes hold a significant place due to their widespread use in various financial transactions. These legally binding documents serve as a written promise to repay a specific amount of money, outlining the terms and conditions of the loan. But are promissory notes legally binding? Understanding the enforceability of promissory notes requires a closer look at the legal requirements and factors that come into play.

Legal Requirements For Enforceability

Promissory notes must adhere to specific legal requirements to be considered enforceable in a court of law. These requirements typically include:

- Written Document: A promissory note must be in writing, clearly stating the terms and conditions of the loan agreement.

- Promise to Pay: The note must contain an unequivocal promise by the borrower to repay the borrowed amount.

- Principal Amount: The note should specify the principal amount borrowed, ensuring clarity on the exact sum to be repaid.

- Interest Terms: If applicable, the note should outline the interest rate, payment schedule, and any other relevant interest-related details.

- Signatures: Both the borrower and lender must sign the promissory note to demonstrate their consent to the agreement.

Factors Affecting Enforceability

While promissory notes generally adhere to the legal requirements discussed above, several factors can impact their enforceability:

| Factor | Explanation |

|---|---|

| Proper Execution: | A promissory note executed improperly or without the necessary legal formalities may be deemed unenforceable. |

| Illegal Terms: | If the terms outlined in the promissory note involve illegal activities or violate public policy, the note may not be legally enforceable. |

| Lack of Consideration: | A promissory note must be supported by valid consideration (something of value), such as money lent or goods/services provided, to ensure enforceability. |

| Statute of Limitations: | The expiry of the prescribed statute of limitations can impact the enforceability of a promissory note, as legal action may no longer be possible after a certain period. |

Understanding the legal requirements and factors affecting the enforceability of promissory notes is crucial for both borrowers and lenders. By ensuring compliance with the necessary elements and avoiding potential pitfalls, parties involved can safeguard their interests in loan agreements.

Challenges And Limitations

When it comes to promissory notes, there are certain challenges and limitations that individuals and businesses need to be aware of. Understanding the potential obstacles and boundaries associated with these financial instruments is crucial for ensuring that they are legally binding and effectively enforceable.

Common Challenges In Enforcing Promissory Notes

Enforcing promissory notes can sometimes be challenging, as it involves legal processes and potential disputes. Some common challenges in enforcing promissory notes include:

- Poor documentation and record-keeping, leading to ambiguity in the terms and conditions of the note

- Disputes over the validity of the promissory note, such as allegations of fraud or coercion

- Difficulties in locating the debtor or enforcing collection in case of default

Limitations On Promissory Notes

Promissory notes also have certain limitations that can impact their legal binding. These limitations include:

- Statute of limitations on enforcing promissory notes, which varies by jurisdiction and can restrict the time frame for legal action

- Restrictions on the types of transactions that can be documented with promissory notes, such as certain consumer lending laws

- The requirement for consideration, meaning that the promise must be supported by something of value

Legal Remedies For Non-payment

If a promissory note is legally binding, the lender can seek legal remedies if the borrower fails to make payments as agreed. Legal remedies for non-payment may include filing a lawsuit, obtaining a judgment, and enforcing the judgment to recover the owed amounts.

It’s essential to understand the legal implications of promissory notes to ensure enforcement in case of non-payment.

Options For Seeking Repayment

A promissory note is a legally binding document that outlines the terms and conditions of a loan agreement between two parties. However, there are instances when the borrower fails to fulfill their repayment obligations. In such cases, the lender has several options to seek repayment:

- Filing a Lawsuit: If the borrower is consistently non-compliant with the terms of the promissory note, the lender can file a lawsuit in a court of law. This legal action enables the lender to seek a judgment against the borrower, which often results in the court ordering the borrower to pay back the outstanding amount.

- Enforcement of Collateral: In situations where the promissory note is secured by collateral, such as property or vehicles, the lender can enforce the collateral. This means that the lender can take possession of the collateral and sell it to recover the outstanding debt.

- Debt Collection Agency: Lenders can also hire a debt collection agency to recover the outstanding amount on their behalf. These agencies specialize in collecting debts and often employ various strategies to prompt the borrower to make repayment, such as phone calls, letters, and negotiation.

- Garnishment: Another option available to lenders is garnishment, which involves obtaining a court order to deduct a portion of the borrower’s wages or bank account directly. This ensures that the lender receives regular payments towards the outstanding debt until it is fully repaid.

Implications Of Defaulting On A Promissory Note

Defaulting on a promissory note can have significant legal and financial implications. When a borrower fails to make timely payments or fulfill other terms of the promissory note, they may face the following consequences:

- Damage to Credit Score: Defaulting on a promissory note can severely damage the borrower’s credit score. This can make it challenging for them to obtain future loans, secure favorable interest rates, or even impact their ability to rent an apartment or get a job.

- Legal Proceedings: As previously mentioned, lenders have legal remedies available to them when a borrower defaults on a promissory note. This can result in costly legal proceedings, including court fees and potential judgments against the borrower.

- Loss of Collateral: If the promissory note includes collateral, such as a home or car, defaulting on the loan may lead to the loss of those assets. The lender may seize and sell the collateral to recover the outstanding debt.

- Additional Fees and Interest: Defaulting on a promissory note often leads to additional fees, penalties, and interest charges. This increases the overall amount owed, making it even more challenging for the borrower to settle their debt.

Maximizing The Power Of Promissory Notes

Promissory notes are a powerful legal tool that can be used in various situations to establish legally binding agreements. Understanding how to maximize the power of promissory notes can help protect your interests and ensure that agreements are upheld.

Best Practices For Creating A Strong Promissory Note

A strong promissory note is essential to ensure that your agreement is legally binding and enforceable. By following these best practices, you can create a promissory note that maximizes its power:

- Clearly state the terms: Be sure to clearly outline the terms of the agreement, including the amount borrowed, interest rate, payment schedule, and any penalties for late payments.

- Include recourse provisions: Consider including recourse provisions that outline the actions that can be taken in the event of default, such as pursuing legal action or placing a lien on the borrower’s assets.

- Specify governing law: It’s essential to specify the jurisdiction and governing law that will apply to the promissory note. This helps ensure consistency and can simplify the legal process if any disputes arise.

- Include signatures: Both the borrower and lender should sign the promissory note to indicate their agreement and acceptance of the terms. This helps establish the document’s authenticity.

Utilizing Promissory Notes In Various Legal Situations

Promissory notes are versatile legal instruments that can be used in various legal situations. Understanding how to utilize them effectively can provide you with added protection and help you establish clear agreements.

Business transactions:

Promissory notes can be a valuable tool in business transactions, such as loans between partners, vendors, or suppliers. By creating a promissory note, you ensure that both parties are clear on the terms of the agreement and can seek legal remedies if necessary.

Real estate transactions:

When buying or selling property, promissory notes can be used to establish the terms of financing arrangements. By detailing the loan amount, interest rate, and repayment schedule, a promissory note can help protect both the buyer and seller’s interests.

Personal loans:

Whether lending money to a friend or family member or borrowing from someone you trust, a promissory note can formalize the agreement and ensure clarity. This can help maintain healthy relationships and prevent misunderstandings.

Credit: www.rocketlawyer.com

Frequently Asked Questions On Are Promissory Notes Legally Binding?

Are Promissory Notes Legally Binding?

Yes, promissory notes are legally binding contracts that outline the terms of a loan or payment agreement between two parties. They serve as evidence of the borrower’s promise to repay the money borrowed and can be enforced through legal channels if necessary.

Do Promissory Notes Expire?

Promissory notes typically do not have an expiration date unless stated otherwise in the agreement. The repayment terms and due dates specified in the promissory note are binding until the loan is fully repaid or otherwise settled by both parties involved.

What Happens If A Promissory Note Is Not Paid?

If a promissory note is not paid according to the terms stipulated, the lender has the right to take legal action to recover the owed amount. This can include filing a lawsuit, seeking judgment, garnishing wages, or pursuing other means of debt collection as specified by local laws and regulations.

Can Promissory Notes Be Modified?

Yes, promissory notes can be modified, but any changes must be agreed upon by both the lender and the borrower. It is recommended to document any modifications in writing and have both parties sign and date the amended promissory note to ensure clarity and prevent potential disputes in the future.

Conclusion

Promissory notes are indeed legally binding documents that serve as evidence of a debt agreement between two parties. It’s crucial to properly draft and execute these documents to ensure enforceability in a court of law. Understanding the legalities and requirements is key for both lenders and borrowers to protect their interests.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Are promissory notes legally binding?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, promissory notes are legally binding contracts that outline the terms of a loan or payment agreement between two parties. They serve as evidence of the borrower’s promise to repay the money borrowed and can be enforced through legal channels if necessary.” } } , { “@type”: “Question”, “name”: “Do promissory notes expire?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Promissory notes typically do not have an expiration date unless stated otherwise in the agreement. The repayment terms and due dates specified in the promissory note are binding until the loan is fully repaid or otherwise settled by both parties involved.” } } , { “@type”: “Question”, “name”: “What happens if a promissory note is not paid?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “If a promissory note is not paid according to the terms stipulated, the lender has the right to take legal action to recover the owed amount. This can include filing a lawsuit, seeking judgment, garnishing wages, or pursuing other means of debt collection as specified by local laws and regulations.” } } , { “@type”: “Question”, “name”: “Can promissory notes be modified?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, promissory notes can be modified, but any changes must be agreed upon by both the lender and the borrower. It is recommended to document any modifications in writing and have both parties sign and date the amended promissory note to ensure clarity and prevent potential disputes in the future.” } } ] }