Does a Release of Promissory Note Need to Be Notarized? Simplified Explanation!

No, a release of promissory note does not need to be notarized. A release of promissory note is a legal document used to show that a borrower has repaid a loan, and it typically includes details such as the borrower’s name, the lender’s name, the loan amount, and the date of repayment.

While it is not required to have the release notarized, it is advisable to have it signed by both parties and witnessed by a third party to ensure its validity and authenticity. By following these steps, you can effectively release a promissory note without the need for notarization.

:max_bytes(150000):strip_icc()/Term-Definitions_Template_promissorynote.asp-76c1a84d9d5344abb8f3c4110233207e.jpg)

Credit: www.investopedia.com

What Is A Promissory Note?

A promissory note is a legal document that outlines the terms and conditions of a loan or financial agreement between two parties. It serves as a written promise to repay a specific amount of money, along with any applicable interest, within a specified timeframe. Essentially, it is a binding contract that documents the borrower’s obligation to repay the lender according to the agreed-upon terms.

Definition And Purpose

A promissory note can be defined as a written agreement that establishes a borrower’s legal obligation to repay a specific amount of money to a lender. It serves as a vital financial instrument for both parties involved, ensuring that the terms of the loan are clearly stated and legally enforceable.

Key Components

A promissory note typically includes several key components:

- Principal Amount: This is the initial amount of money borrowed.

- Interest Rate: It specifies the rate at which interest will accrue on the outstanding balance.

- Repayment Terms: This outlines the schedule and method of repayment, including the frequency and amount of each payment.

- Due Date: It specifies the date by which the borrower must repay the loan in full.

- Collateral: In some cases, the promissory note may include details about collateral, which serves as security for the loan.

- Default and Remedies: It outlines the consequences for the borrower if they fail to repay the loan as agreed, including potential legal remedies for the lender.

These components ensure that both parties have a clear understanding of their rights and responsibilities, minimizing the potential for misunderstanding or disputes.

Importance Of Notarization

A release of a promissory note does not necessarily need to be notarized. However, the importance of notarization lies in providing legal authenticity and proof of the document’s legitimacy. It adds an extra layer of protection and credibility in case of any future disputes.

Legal Validity

Notarization plays a crucial role in establishing the legal validity of a release of promissory note. When a promissory note is notarized, it means that a notary public, an impartial third party, has verified the authenticity of the signatures and the identity of the parties involved. This provides an extra layer of assurance that the release of the promissory note is legitimate and binding.

Preventing Disputes

Notarization helps in preventing disputes that may arise in relation to the release of a promissory note. By having the release notarized, it becomes harder for any party to claim that they did not sign the document or that they were not aware of its terms and conditions. Notarization ensures that all parties are fully aware of their obligations and have willingly entered into the release agreement.

In addition, notarization creates a date-stamped record of the release, which can be helpful in case of any future disputes regarding the terms or timing of the release. This record can serve as concrete evidence of the parties’ intentions and help resolve any disagreements more efficiently.

Overall, notarization adds an extra layer of protection and credibility to a release of promissory note. It helps establish its legal validity and reduces the chances of disputes, providing peace of mind to all parties involved.

Release Of Promissory Note

When a borrower repays a loan, it is crucial to have an official record of the repayment. A promissory note, a legal document outlining the terms of the loan, is often used to keep track of the debt. However, when the borrower fulfills their obligations and repays the full amount, a release of the promissory note is issued to acknowledge the debt has been satisfied.

Meaning And Process

A release of promissory note is a legal document acknowledging that a promissory note has been fully repaid, and the terms of the note have been satisfied. The process involves drafting the release, signing it, and providing it to the borrower as official documentation that the debt has been cleared.

Notarization Requirements

Notarization of a release of promissory note depends on the laws of the jurisdiction where the transaction took place. In some regions, notarization is mandatory to validate the release, while in others, it may not be required. It’s essential to consult legal counsel or local authorities to determine the specific notarization requirements for a release of promissory note in a particular area.

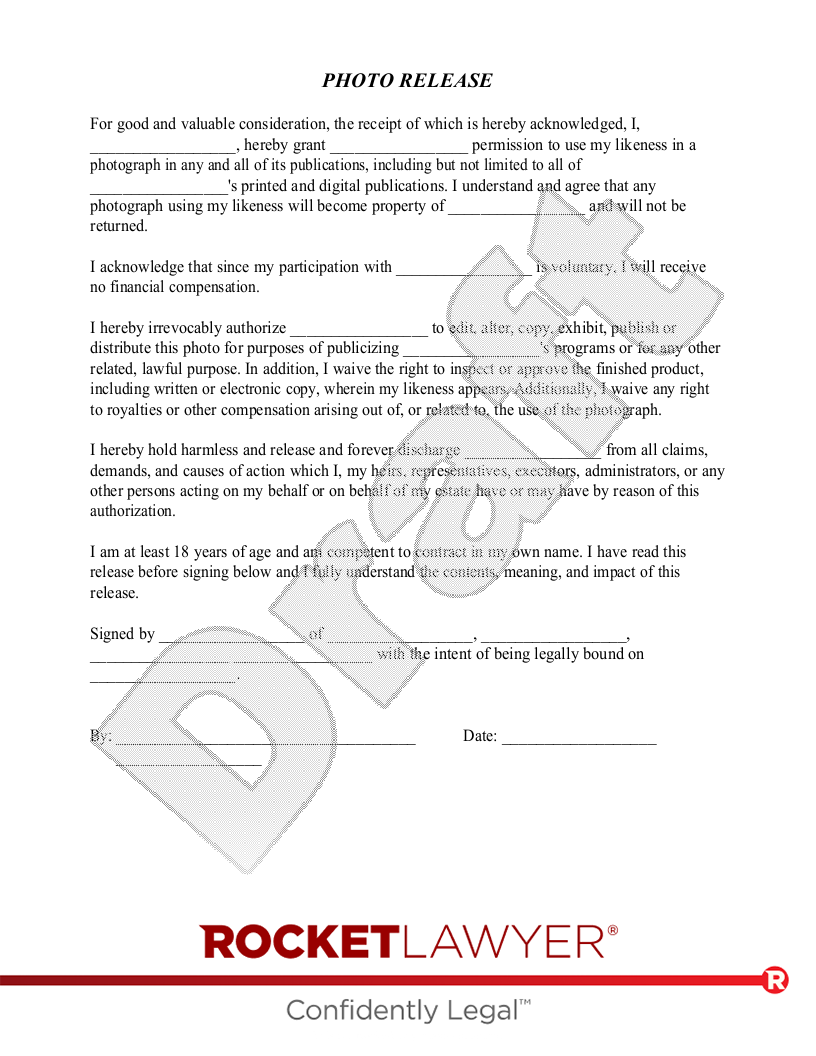

Credit: www.rocketlawyer.com

Exceptions To Notarization

A promissory note is a legally binding contract that outlines the terms and conditions of a loan or debt repayment. In many cases, a release of promissory note also needs to be notarized to ensure its validity and authenticity. However, there are certain circumstances where notarization may not be required. Let’s explore these exceptions to notarization:

1. Trust Between the Parties:

In some cases, notarization may be waived if there is a high level of trust and understanding between the parties involved. This typically occurs when the lender and borrower have a long-standing relationship and have already built a strong level of trust. The absence of notarization in such cases does not negate the legal validity of the release of promissory note.

2. State Laws:

State laws can vary when it comes to notarization requirements for promissory notes. Some states may have specific provisions that exempt certain types of promissory notes from the need for notarization. It is essential to consult the relevant state laws or seek legal advice to determine if notarization is mandatory in your particular state.

3. Unsecured Promissory Notes:

Notarization may not be necessary for unsecured promissory notes where the lender does not have any collateral securing the loan. Since the lender does not have any security interest, notarization may be deemed unnecessary. However, it is crucial to review the laws in your jurisdiction to ascertain if notarization is indeed exempted for unsecured promissory notes.

4. Private Agreements:

In certain cases, the contracting parties may agree to waive the notarization requirement in private agreements. However, it is essential to note that notarization adds an extra layer of security and can be beneficial in case of any dispute or legal issue in the future.

5. Context and Purpose:

Depending on the context and purpose of the release of promissory note, notarization may be unnecessary. For example, if the release is between family members or friends for a small amount, notarization may be considered excessive.

6. Online Platforms:

With the rise of online platforms that facilitate digital transactions, some platforms provide electronic signatures and authentication methods that replace traditional notarization. These platforms utilize encryption and other security measures to ensure the integrity and authenticity of the release of promissory notes.

In conclusion, while notarization is typically required for the release of promissory notes, there are exceptions to this rule. Trust between parties, state laws, unsecured notes, private agreements, context, and purpose, as well as online platforms, are factors that may exempt notarization. It is essential to review the specific circumstances and applicable laws to determine if notarization is necessary or if alternate methods of authentication can be utilized.

Credit: cocosign.com

Frequently Asked Questions Of Does A Release Of Promissory Note Need To Be Notarized?

Does A Release Of Promissory Note Need To Be Notarized?

A release of promissory note doesn’t necessarily need to be notarized. However, notarizing the document adds an extra layer of authenticity and credibility. Whether or not to notarize depends on the parties involved and state laws. It’s advisable to consult a legal expert to ensure compliance with the specific requirements in your jurisdiction.

What Is A Promissory Note Release?

A promissory note release is a legal document that signifies the borrower’s fulfillment of their financial obligation to the lender. It releases the borrower from any further liability and acknowledges the loan has been fully repaid. The release should include important details such as the names of the parties involved, the loan amount, and the date of repayment.

How Does A Notarized Release Of Promissory Note Protect Parties?

A notarized release of promissory note offers an additional level of protection for both the lender and the borrower. It provides evidence that the borrower has fulfilled their financial obligation, which can be useful in case of any future disputes or legal issues.

Notarization adds an official seal of authenticity and helps to deter fraudulent activity.

Are There Any Legal Requirements For A Release Of Promissory Note?

The legal requirements for a release of promissory note vary based on jurisdiction. However, common elements include the names of the parties involved, the loan amount, the date of release, and a statement that confirms the borrower has satisfied their repayment obligations.

It’s essential to consult with a legal professional to ensure compliance with local laws.

Conclusion

Notarizing a release of promissory note adds an extra layer of authenticity and legality to the document. While not always required, it can provide additional assurance of the parties’ intent to release the debt. However, consulting legal counsel is crucial to ensure compliance with relevant state laws and individual circumstances.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Does a release of promissory note need to be notarized?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A release of promissory note doesn’t necessarily need to be notarized. However, notarizing the document adds an extra layer of authenticity and credibility. Whether or not to notarize depends on the parties involved and state laws. It’s advisable to consult a legal expert to ensure compliance with the specific requirements in your jurisdiction.” } } , { “@type”: “Question”, “name”: “What is a promissory note release?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A promissory note release is a legal document that signifies the borrower’s fulfillment of their financial obligation to the lender. It releases the borrower from any further liability and acknowledges the loan has been fully repaid. The release should include important details such as the names of the parties involved, the loan amount, and the date of repayment.” } } , { “@type”: “Question”, “name”: “How does a notarized release of promissory note protect parties?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A notarized release of promissory note offers an additional level of protection for both the lender and the borrower. It provides evidence that the borrower has fulfilled their financial obligation, which can be useful in case of any future disputes or legal issues. Notarization adds an official seal of authenticity and helps to deter fraudulent activity.” } } , { “@type”: “Question”, “name”: “Are there any legal requirements for a release of promissory note?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The legal requirements for a release of promissory note vary based on jurisdiction. However, common elements include the names of the parties involved, the loan amount, the date of release, and a statement that confirms the borrower has satisfied their repayment obligations. It’s essential to consult with a legal professional to ensure compliance with local laws.” } } ] }