Why is Student Loan Interest So High? Find Out the Truth.

Student loan interest is typically high due to factors such as the extended repayment period and the risk associated with lending to individuals with limited credit history or income. As a result, lenders charge high interest rates to compensate for potential losses and to account for inflation over time.

This high interest rate helps ensure that lenders can recoup the principal loan amount while also accounting for the risk and costs associated with providing loans to students. With the increasing cost of higher education and limited repayment options, understanding the reasons behind high student loan interest can provide valuable insights into the financial burden faced by many students and graduates today.

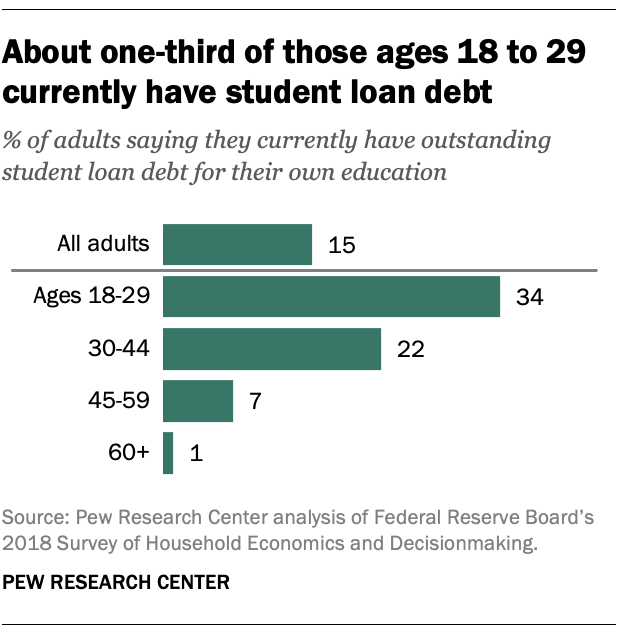

Credit: www.pewresearch.org

The Cost Of Higher Education

Student loan interest rates are often high due to various factors. Lenders charge higher interest to mitigate the risk of default on these loans, as they are unsecured. Furthermore, the length of the loan term can also impact the interest rate, resulting in higher overall borrowing costs for students.

Tuition And Fees

The skyrocketing cost of higher education is a major factor contributing to the high interest rates on student loans. The Tuition and Fees associated with pursuing a college degree have been increasing at an alarming rate in recent years. With universities grappling with budget cuts and rising operating costs, it is often the students who bear the brunt of these financial pressures.

Here are some key reasons why tuition and fees have been increasing:

- Inflation: Just like any other goods or services, the cost of education has not been immune to inflation. The price of textbooks, classroom materials, and other educational resources has been steadily rising, pushing overall costs higher.

- Administrative Expenses: Universities must allocate a significant portion of their budget to administrative expenses. This includes salaries for faculty and staff, building maintenance, utilities, and other day-to-day operations. As these expenses increase, universities often pass the burden onto students through increased tuition fees.

- State Funding Cuts: In the past years, several states have slashed their funding for higher education. These funding cuts have put additional financial strain on universities, compelling them to raise tuition to make up for the shortfall.

Living Expenses

The cost of attending college extends beyond tuition and fees. Students also have to contend with the high expenses of living away from home. These living expenses can include housing, meals, transportation, and personal necessities, all of which contribute to the overall financial burden on students.

Some of the factors that contribute to high living expenses for students are:

- Housing: Rent prices in college towns and cities can be significantly higher than in other areas. The limited availability of affordable housing can lead to rental rates that stretch students’ budgets.

- Food: The cost of food can vary depending on the location and whether students choose to cook or eat out. Dormitory meal plans and eating on-campus can also add to the overall expenses.

- Transportation: Students may need to commute to and from campus, adding to their transportation costs. Public transportation, gas, and parking fees can quickly add up, further burdening students financially.

- Personal Expenses: Students also have personal expenses such as clothing, toiletries, and entertainment. These may seem like small costs individually, but when combined, they can significantly impact a student’s overall budget.

Credit: www.cfr.org

The Business Of Student Loans

The high interest rates associated with student loans can often leave borrowers puzzled. Why are student loan interest rates so high? To answer this question, it is crucial to understand the business side of student loans. From the perspective of banks and lenders, there are several factors that contribute to the high interest rates.

Banks And Lenders

Banks and lenders play a significant role in the student loan industry. They provide the funds that allow students to finance their education. However, lending money to students comes with its own set of risks and costs, which are ultimately reflected in the interest rates.

Risk and Return

Student loans carry a higher risk compared to other types of loans. Unlike mortgages or car loans, student loans typically have no collateral. This means that if borrowers default on their loans, there is no physical asset for the lender to seize and sell to recover the money. As a result, banks and lenders charge higher interest rates to compensate for the increased risk.

Moreover, student loans are often available to borrowers with limited credit histories and income. Lenders consider these borrowers to be higher-risk, which further justifies the higher interest rates. Students who have recently graduated or are still studying may not have a steady income or significant assets, making them a less secure investment for lenders.

Administrative Costs

Issuing and managing student loans involve administrative costs for banks and lenders. These costs include processing loan applications, reviewing borrowers’ eligibility, and servicing the loans throughout their repayment period. These additional expenses also contribute to the overall interest rates.

Rewarding Responsible Borrowers

While the high interest rates may seem burdensome, it is important to note that not all borrowers pay the same rates. Many lenders offer interest rate discounts and incentives to borrowers with a strong credit history or those who make consistent on-time payments. Responsible borrowers are rewarded with better interest rates, reducing the overall cost of their loans.

In conclusion, the businesses of student loans must consider the risks and costs associated with lending money to students, leading to higher interest rates. However, it is crucial to explore all available options and understand the terms and conditions of student loans to make informed decisions about higher education financing.

Government Involvement

When it comes to understanding why student loan interest rates are so high, it’s essential to examine the substantial role that government involvement plays in shaping the landscape. Federal policies, regulations, and oversight have a significant impact on the interest rates charged to students, making it a crucial factor to consider.

Federal Policies

Federal policies play a pivotal role in the determination of student loan interest rates. The government sets the interest rates for federal student loans, taking into account various economic factors and the cost of funds. These rates are often influenced by market conditions and the general economic environment. For instance, during times of economic instability, the government may adjust interest rates to mitigate financial risks.

Regulations And Oversight

Regulations and oversight enforced by the government impact the administration of student loans, including interest rates. Regulatory measures are implemented to ensure fair lending practices and protect borrowers’ interests. The oversight of the student loan industry by government agencies such as the Consumer Financial Protection Bureau and the Department of Education aims to monitor lenders and servicers, ensuring compliance with laws and regulations.

Government involvement in the student loan sector significantly influences the determination of interest rates. By examining federal policies, regulations, and oversight, it becomes clear that the government plays a pivotal role in shaping the interest rate landscape for student borrowers.

Impact On Borrowers

Student loan interest is often high due to several factors, including the risk associated with lending to borrowers with limited credit history, the cost of managing loans, and the need to provide a return on investment for lenders. The impact on borrowers is significant, as it can result in increased overall loan costs and longer repayment periods.

Student loans are a significant financial burden on borrowers, affecting their lives long after graduation. The high interest rates associated with these loans only exacerbate the situation, making it even more challenging for borrowers to manage their finances effectively.

Long-term Financial Burden

The long-term financial burden of student loan interest is a stark reality for many borrowers. As interest accrues over the life of the loan, the total amount owed can increase substantially, often making it difficult to pay off the principal balance. This can lead to a never-ending cycle of debt, with borrowers struggling to make ends meet while making loan payments.

Moreover, high-interest rates can extend the repayment period, resulting in more interest being paid overall. This means that borrowers end up paying much more than the initial loan amount, further exacerbating their financial strain.

Notably, the long-term financial burden of student loan interest extends beyond the individual borrower. It can also impact their ability to contribute to the economy and achieve other financial milestones, such as purchasing a home or starting a family. Additionally, the stress and anxiety caused by the constant burden of debt can have detrimental effects on borrowers’ mental well-being and overall quality of life.

Alternative Repayment Options

Fortunately, there are alternative repayment options available for borrowers struggling with high student loan interest rates. These options provide some relief and flexibility, allowing borrowers to better manage their finances.

One such option is income-driven repayment plans. These plans calculate loan payments based on a percentage of the borrower’s income, ensuring that payments remain affordable, even with high-interest rates. These plans also offer the possibility of loan forgiveness after a certain period, providing borrowers with the opportunity to finally be free from the burden of student loan debt.

| Income | Repayment Percentage | Monthly Payment |

|---|---|---|

| $20,000 | 10% | $166.67 |

| $40,000 | 15% | $333.33 |

| $60,000 | 20% | $500 |

Another option is loan refinancing. This involves obtaining a new loan with lower interest rates to pay off the existing student loan. By doing so, borrowers can reduce their monthly payments, save money on interest, and potentially pay off the loan faster.

It is essential for borrowers to explore these alternative repayment options and consider which one is best suited to their individual circumstances. By doing so, they can take proactive steps towards managing their student loan debt and alleviating the long-term financial burden caused by high-interest rates.

The Future Of Student Loan Interest

As the cost of higher education continues to rise, the issue of student loan interest becomes more pressing. Many students and graduates find themselves burdened with high interest rates that make it difficult to repay their loans. Understanding the reasons behind these high interest rates is crucial in finding solutions for the future.

Potential Reforms

One potential reform that has gained attention is the idea of reducing student loan interest rates. By lowering these rates, borrowers would have a better chance of repaying their loans in a timely manner. This reform is often discussed in the context of the federal government’s role in student lending. Advocates argue that the government should use its power to negotiate lower interest rates on behalf of borrowers.

Another proposed reform is the establishment of income-driven repayment plans. These plans base loan payments on the borrower’s income, ensuring that repayment remains affordable even with high interest rates. This approach can provide relief to borrowers who are struggling to make ends meet and reduce the overall burden of student loan interest.

Public Discourse And Advocacy

In recent years, there has been a significant increase in public discourse surrounding student loan interest. Advocacy groups, think tanks, and policymakers have joined the conversation, highlighting the need for change. This increased attention has spurred action and put pressure on lawmakers to address the issue.

Public discourse and advocacy have also led to increased transparency regarding student loan interest rates. As more information becomes available, borrowers are better equipped to make informed decisions about their loans and advocate for fairer terms.

/codeconclusion/code

The high interest rates on student loans have created a financial burden for many borrowers. However, with potential reforms and increased public discourse, there is hope for a future where student loan interest rates are more reasonable. By addressing this issue head-on, we can create a system that allows students to pursue higher education without being trapped in a cycle of debt.

:max_bytes(150000):strip_icc()/payday-loans.asp-final-882c60fabb124a519dada443015c2eb2.png)

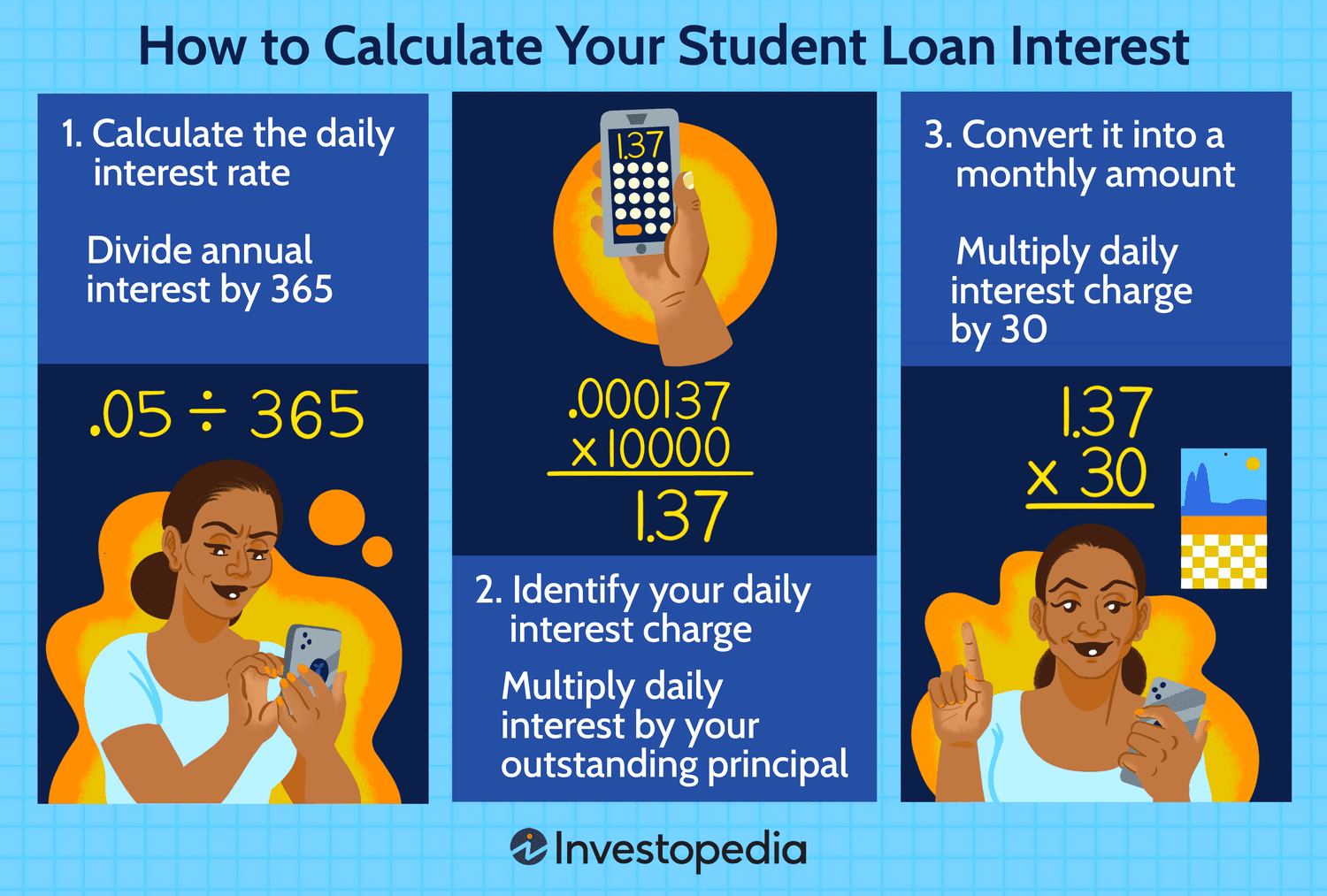

Credit: www.investopedia.com

Frequently Asked Questions On Why Is Student Loan Interest So High?

Q1: How Is Student Loan Interest Calculated?

A1: Student loan interest is typically calculated based on the interest rate set by the lender and the amount borrowed. It is important to consider factors such as the loan term, repayment plan, and any applicable fees or charges that may affect the total interest you will pay over time.

Q2: Why Do Student Loans Have High Interest Rates?

A2: Student loans tend to have higher interest rates due to several factors. Lenders consider the risk associated with lending a large amount of money to individuals with limited credit history, as well as the potential for delayed repayment or default.

Additionally, student loans often come with longer repayment terms, which can increase the overall interest paid over time.

Q3: Can I Lower The Interest Rate On My Student Loans?

A3: In some cases, it may be possible to lower the interest rate on your student loans. Options such as refinancing or consolidating your loans, enrolling in autopay, or qualifying for certain forgiveness programs can help you secure a lower interest rate.

However, it is important to carefully review the terms and conditions before making any changes to your existing loans.

Q4: Are There Any Alternatives To Student Loans With High Interest Rates?

A4: Yes, there are alternatives to student loans with high interest rates. Scholarships, grants, and work-study programs are options that can help reduce the need for loans altogether. Additionally, exploring other sources of funding like crowdfunding, employer-sponsored tuition assistance, or attending community college before transferring to a four-year institution can also help lower the overall cost of education.

Conclusion

To sum up, understanding the factors influencing high student loan interest rates is essential. By comprehending the complexities of loan repayment, borrowers can make informed decisions. With awareness, students can navigate the loan process more effectively and take proactive steps to manage their debt.

It’s crucial to stay informed.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Q1: How is student loan interest calculated?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A1: Student loan interest is typically calculated based on the interest rate set by the lender and the amount borrowed. It is important to consider factors such as the loan term, repayment plan, and any applicable fees or charges that may affect the total interest you will pay over time.” } } , { “@type”: “Question”, “name”: “Q2: Why do student loans have high interest rates?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A2: Student loans tend to have higher interest rates due to several factors. Lenders consider the risk associated with lending a large amount of money to individuals with limited credit history, as well as the potential for delayed repayment or default. Additionally, student loans often come with longer repayment terms, which can increase the overall interest paid over time.” } } , { “@type”: “Question”, “name”: “Q3: Can I lower the interest rate on my student loans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A3: In some cases, it may be possible to lower the interest rate on your student loans. Options such as refinancing or consolidating your loans, enrolling in autopay, or qualifying for certain forgiveness programs can help you secure a lower interest rate. However, it is important to carefully review the terms and conditions before making any changes to your existing loans.” } } , { “@type”: “Question”, “name”: “Q4: Are there any alternatives to student loans with high interest rates?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A4: Yes, there are alternatives to student loans with high interest rates. Scholarships, grants, and work-study programs are options that can help reduce the need for loans altogether. Additionally, exploring other sources of funding like crowdfunding, employer-sponsored tuition assistance, or attending community college before transferring to a four-year institution can also help lower the overall cost of education.” } } ] }