What is Mortgage Acquisition Date : Your Guide to Understanding the Key Aspect

The mortgage acquisition date refers to the date when a mortgage is officially obtained. The mortgage acquisition date is the specific day the borrower receives the loan proceeds.

Acquiring a mortgage is a significant milestone for individuals looking to purchase property. This date marks the point at which the borrower has access to the funds required to complete the real estate transaction. Understanding the mortgage acquisition date is crucial as it sets in motion various obligations, such as the start of mortgage payments and the initiation of interest accrual.

Additionally, this date enables both the borrower and lender to establish the time frame for loan repayment. By having a clear understanding of the mortgage acquisition date, borrowers can effectively plan their financial obligations while navigating the homebuying process.

What Is Mortgage Acquisition Date?

Are you curious about the concept of Mortgage Acquisition Date? In this blog post, we will decipher the meaning and significance of Mortgage Acquisition Date. To begin our journey, let’s first understand the definition of Mortgage Acquisition Date.

Definition Of Mortgage Acquisition Date

The Mortgage Acquisition Date is the specific date on which a mortgage loan is acquired by the borrower. It marks the beginning of the loan repayment period and sets the timeline for various key events related to the mortgage.

Importance Of Mortgage Acquisition Date

The Mortgage Acquisition Date holds considerable importance for both borrowers and lenders. Let’s explore why this date matters for each party involved:

- For Borrowers:

- Loan Repayment Planning: The Mortgage Acquisition Date acts as a starting point for borrowers to plan their loan repayment strategies and budget effectively.

- Understanding Interest Accrual: By knowing the Mortgage Acquisition Date, borrowers can calculate the interest accrued on their loan amount during the repayment period and plan their finances accordingly.

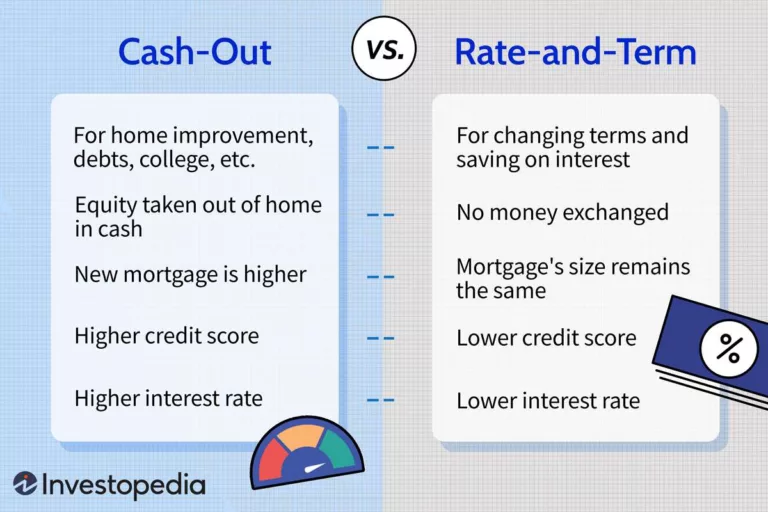

- Opportunity for Refinancing: This date also signifies the eligibility of borrowers to consider refinancing options, allowing them to take advantage of lower interest rates or other favorable conditions in the market.

- For Lenders:

- Loan Monitoring: The Mortgage Acquisition Date helps lenders keep track of the loan progress and ensures timely repayments are made by borrowers.

- Interest Calculation: Lenders utilize this date to calculate and accumulate interest on the loan amount over the repayment period.

- Risk Assessment: By establishing the Mortgage Acquisition Date, lenders can assess the risk associated with the mortgage and make informed decisions regarding the loan.

Now that we have delved into the definition and importance of Mortgage Acquisition Date, you have gained valuable insights into this significant aspect of mortgage loans. Stay tuned for more informative content related to mortgages and real estate.

Factors Affecting Mortgage Acquisition Date

Mortgage acquisition date is influenced by a range of factors like credit score, down payment amount, and interest rates. These factors play a crucial role in determining when individuals can acquire a mortgage.

Factors Affecting Mortgage Acquisition Date When it comes to obtaining a mortgage, the acquisition date can be influenced by a variety of factors that both borrowers and lenders should consider. These factors play a vital role in determining the success of a mortgage application and the terms that are ultimately offered. In this section, we will explore three key factors that can significantly impact the mortgage acquisition date: interest rates, property market conditions, and the borrower’s financial situation.Interest Rates

Interest rates are a crucial determinant in the timing of mortgage acquisition. When rates are low, borrowers are more inclined to secure a mortgage, as it can result in significant savings over the loan term. On the other hand, high interest rates may prompt borrowers to delay their mortgage acquisition until rates start to decrease. Additionally, fluctuating interest rates can affect the overall affordability of a mortgage, impacting the borrower’s decision-making process.Property Market Conditions

The state of the property market is another influential factor that can affect the mortgage acquisition date. In a seller’s market where property prices are rising, borrowers may feel inclined to expedite their mortgage acquisition to avoid potential cost increases. Conversely, in a buyer’s market where property prices are declining or stagnant, borrowers may opt to delay their mortgage application to benefit from potentially lower property prices. Monitoring the state of the property market is essential when determining the ideal time for mortgage acquisition.Borrower’s Financial Situation

The financial situation of the borrower plays a vital role in determining the mortgage acquisition date. Lenders assess the borrower’s credit score, income stability, employment history, and debt-to-income ratio during the mortgage application process. These factors help lenders determine the borrower’s creditworthiness and ability to repay the loan. A favorable financial situation, including a good credit score and stable income, increases the likelihood of a smooth mortgage acquisition process and may result in better loan terms. Borrowers facing financial challenges or significant debts may need to improve their financial situation before proceeding with mortgage acquisition. In conclusion, various factors can influence the mortgage acquisition date, including interest rates, property market conditions, and the borrower’s financial situation. Borrowers and lenders must carefully consider these factors to ensure a successful mortgage application and secure favorable loan terms. By staying informed and conscientious of these factors, borrowers can optimize their mortgage acquisition process and confidently move forward in their home ownership journey.How To Determine Mortgage Acquisition Date

Understanding the mortgage acquisition date is crucial for homeowners and lenders alike. It marks the official date on which a mortgage loan is acquired, providing a reference point for various legal and financial transactions. In this article, we will explore the key components of determining the mortgage acquisition date, including the loan approval date, closing date, and recording date. Let’s delve into each of these factors to gain a comprehensive understanding of mortgage acquisition dates.

Loan Approval Date

The loan approval date is an important milestone in the mortgage acquisition process. It is the date when the lender grants approval for the borrower’s loan application. This date acts as the starting point for calculating various timelines related to the loan. Typically, the loan approval date is documented in the loan approval letter provided to the borrower by the lender. It signifies that the borrower has met the necessary criteria and has been approved for the requested loan amount. Bold phrases are “loan approval date,” “important milestone,” “starting point,” “calculating various timelines,” and “loan approval letter.”

Closing Date

The closing date is another essential aspect of determining the mortgage acquisition date. This date marks the completion of the mortgage transaction, with the buyer and seller signing the necessary legal documents. It is also the date when the funds are disbursed from the lender to the borrower. The closing date is typically agreed upon during the negotiation process and is documented in the purchase agreement or the closing disclosure statement. It is crucial to adhere to the closing date as it finalizes the transfer of ownership and signals the beginning of the borrower’s responsibility to repay the mortgage loan. Key phrases include “closing date,” “completion of the mortgage transaction,” “signing the necessary legal documents,” “funds disbursed,” and “transfer of ownership.”

Recording Date

The recording date is the final piece of the puzzle when determining the mortgage acquisition date. It is the date when the mortgage documents are officially recorded in the public land records, establishing a legal record of the transaction. This recording provides notice to other parties about the existence of the mortgage and ensures the priority of the lender’s lien over other potential claims. The recording date acts as evidence of the mortgage’s validity and serves as an important reference point for future legal transactions, such as refinancing or home equity loans. To maintain accuracy and accessibility, the recording date is typically handled by a county office responsible for maintaining property records. Crucial phrases include “recording date,” “officially recorded,” “establishing a legal record,” “priority of the lender’s lien,” and “future legal transactions.”

In conclusion, determining the mortgage acquisition date involves considering the loan approval date, closing date, and recording date. These factors collectively provide a comprehensive understanding of when a mortgage loan is acquired. By keeping track of these important dates, borrowers can ensure a smooth and accurate mortgage process, while lenders can maintain proper documentation and protect their financial interests. Whether you are a homeowner or a lender, understanding the nuances of mortgage acquisition dates is essential for a successful mortgage journey.

Credit: www.keyinteriors.us

Key Considerations For Mortgage Acquisition

When acquiring a mortgage, there are several key considerations that borrowers should keep in mind. These factors can greatly impact the affordability and overall success of the home buying process. By understanding and addressing these considerations, borrowers can make informed decisions and secure a mortgage that aligns with their financial goals and capabilities.

Loan Terms And Conditions

The loan terms and conditions play a crucial role in determining the affordability of a mortgage. Borrowers should carefully review and analyze the terms offered by lenders to ensure they are favorable and manageable. This includes examining the interest rate, loan duration, and any associated fees or penalties. Bold

Down Payment

The down payment, a lump sum paid upfront, can significantly impact the overall cost of a mortgage. Borrowers should aim to save for a substantial down payment, as it can help lower monthly payments, reduce interest charges, and even eliminate the need for private mortgage insurance (PMI). Bold

Closing Costs

Closing costs are the fees and expenses incurred during the final stages of the mortgage acquisition process. These costs can vary and include items such as appraisal fees, title search fees, and attorney fees. Borrowers should be aware of the closing costs associated with their mortgage and budget accordingly. Bold

Implications Of Mortgage Acquisition Date

When it comes to getting a mortgage, the mortgage acquisition date plays a crucial role in determining various aspects of your loan. Understanding the implications of this date can help you make informed decisions about your mortgage. In this article, we will explore three key implications of the mortgage acquisition date: the interest rate lock, the repayment schedule, and the tax implications.

Interest Rate Lock

One of the significant implications of the mortgage acquisition date is the interest rate lock. The interest rate you are offered at the time of acquiring the mortgage can be locked in for a specific period. This means that even if the interest rates fluctuate during this period, your rate will remain the same. Locking in an interest rate can provide peace of mind and protect you from potential rate increases.

It is important to note that the duration for which you can lock in the interest rate varies depending on the lender and the specific terms of your mortgage agreement. Typically, you can lock in the rate for 30, 45, or 60 days. Make sure to discuss this with your lender before finalizing your mortgage acquisition.

Repayment Schedule

The mortgage acquisition date also impacts the repayment schedule of your loan. When you acquire the mortgage, the repayment schedule will be determined based on the number of years you have agreed to pay back the loan. For example, if you have a 30-year mortgage, your repayment schedule will spread the total loan amount over these 30 years.

It is important to consider your financial situation and long-term goals when deciding on the length of your mortgage. A shorter repayment schedule may result in higher monthly payments but can save you significant interest over time. On the other hand, a longer repayment schedule can provide more manageable monthly payments but may cost you more in interest in the long run. Choose a repayment schedule that aligns with your financial goals and capabilities.

Tax Implications

Lastly, the mortgage acquisition date can have tax implications. In most countries, homeowners are eligible for tax deductions on mortgage interest and property taxes. These deductions can help reduce your taxable income and potentially save you money during tax season.

To claim these deductions, it is essential to know when you acquired your mortgage. Typically, you can deduct the mortgage interest and property taxes paid during the year if they exceed a certain threshold. Keep track of your mortgage payments and consult with a tax professional or use tax software to ensure you are taking advantage of all available deductions.

| Implication | Mortgage Acquisition Date |

|---|---|

| Interest Rate Lock | Lock in the interest rate for a specific period. |

| Repayment Schedule | Determine the length of time for loan repayment. |

| Tax Implications | Eligibility for mortgage interest and property tax deductions. |

:max_bytes(150000):strip_icc()/Key-Performance-Indicators-e2cedcbe530c4440bb21a22bdf7dc63f.png)

Credit: www.investopedia.com

Credit: www.amazon.com

Frequently Asked Questions Of What Is Mortgage Acquisition Date

Is Mortgage Acquisition Date Same As Closing Date?

The mortgage acquisition date and the closing date are not always the same. The mortgage acquisition date refers to when the lender approves the loan application, while the closing date is when the buyer takes possession of the property.

What Does Acquisition Date Mean In Mortgage?

The acquisition date in mortgage refers to the date when a property is officially transferred from the seller to the buyer. It is an important milestone in the mortgage process.

What Is Acquisition Mortgage?

An acquisition mortgage is a type of loan used to purchase a property for investment purposes. It allows investors to acquire properties and build their real estate portfolio.

What Is The Acquisition Date Of A House?

The acquisition date of a house refers to the specific day when ownership of the property is transferred to the buyer. It signifies the date when the purchase process is completed and the new owner takes legal possession of the house.

Conclusion

Understanding the mortgage acquisition date is crucial for homeowners and potential buyers. It determines the start of your loan and affects various aspects of your mortgage, including interest rates and payment schedules. By calculating this important date, you can plan your finances and make informed decisions.

Stay on top of the mortgage acquisition date to ensure a smooth and transparent homebuying or refinancing process. Take charge of your mortgage journey and secure a stable financial future.