What is a Successor in Interest Mortgage: How to Unlock Homeownership Potential

A successor in interest mortgage refers to a mortgage loan that is transferred to a new borrower. This occurs when the original borrower of the mortgage passes away or chooses to transfer the mortgage to someone else.

When a borrower obtains a mortgage, they may choose to name a successor in interest, who will assume responsibility for the mortgage in the event of their death or if they decide to transfer ownership. The successor in interest becomes the new borrower and is legally responsible for making mortgage payments and complying with the terms of the loan.

The successor in interest mortgage allows for a smooth transition of ownership and ensures that the mortgage debt is transferred to the appropriate party. This type of arrangement provides security for both the original borrower and the successor in interest, as the mortgage becomes a binding obligation for the new borrower. It is important for all parties involved to understand the terms and responsibilities of a successor in interest mortgage before entering into such an agreement.

Credit: www.tcaregs.com

Understanding Successor In Interest Mortgage

A Successor in Interest Mortgage refers to a situation where a new borrower assumes the existing mortgage of a previous homeowner. This commonly occurs in cases of inheritance or property transfer. The successor takes on the responsibility of making mortgage payments and fulfills the obligations of the original mortgage agreement.

This transfer can happen smoothly with the lender’s approval and proper legal documentation.

Definition

A successor in interest mortgage is a unique type of mortgage that allows a person to assume the existing mortgage loan of a property, even if they are not the original borrower. This occurs when a property owner transfers their interest in the property to another individual or entity. The new person or entity then assumes responsibility for the mortgage payments and other terms of the loan agreement.Benefits

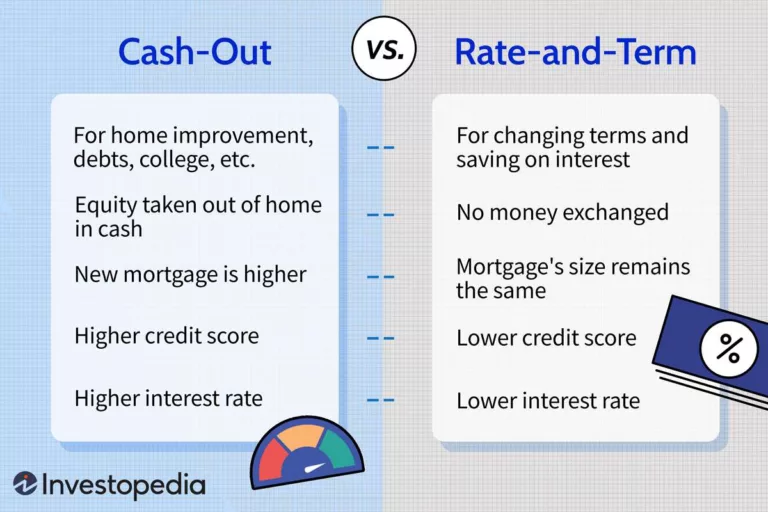

There are several benefits to a successor in interest mortgage that make it an attractive option for both the seller and the buyer. Firstly, it can be a smoother and quicker process than applying for a new mortgage loan, as the buyer does not need to go through the entire loan application process. This can save both time and money for the buyer. Secondly, assuming an existing mortgage can often result in more favorable loan terms for the buyer. This is especially true if the original mortgage had a lower interest rate or more favorable repayment terms than what is currently available in the market. By assuming the existing mortgage, the buyer can take advantage of these favorable terms and potentially save money over the life of the loan. Another benefit of a successor in interest mortgage is that it allows the buyer to avoid certain costs associated with obtaining a new mortgage. This can include appraisal fees, closing costs, and origination fees that are typically incurred when applying for a new mortgage loan. By assuming the existing mortgage, the buyer can bypass these costs and save money. Additionally, assuming an existing mortgage can be an attractive option for borrowers who may have difficulty qualifying for a new mortgage. This can include individuals with less-than-perfect credit or those who may not meet the income requirements for a new loan. By assuming an existing mortgage, these borrowers can still become homeowners without the hurdles of obtaining a new mortgage loan. Overall, a successor in interest mortgage provides an alternative path to homeownership for both buyers and sellers. It offers a seamless transition of mortgage ownership while potentially saving time, money, and paperwork for all parties involved.:max_bytes(150000):strip_icc()/real-estate-short-sale_sourcefile-5029c549f7c249ebb831e3f0e61fcab2.jpg)

Credit: www.investopedia.com

Qualifications For Successor In Interest Mortgage

If you’re considering becoming a successor in interest for a mortgage, it’s important to understand the qualifications and requirements involved. Whether you’re inheriting the property, assuming the mortgage after a divorced, or taking over the loan after the death of the original borrower, meeting the necessary criteria will ensure a smooth transition. In this post, we’ll dive into the legal requirements and documentation needed to become a successor in interest for a mortgage.

Legal Requirements

When it comes to qualifying as a successor in interest for a mortgage, there are several legal requirements that must be met. These criteria are put in place to protect the interests of both the lender and the successor borrower. Below are some essential legal requirements you need to be aware of:

- The successor in interest must have a legitimate claim to the property, either through inheritance, divorce decree, or a transfer due to the death of the original borrower.

- The successor must intend to live in the property as their primary residence, or use it for approved rental purposes.

- The successor must be able to demonstrate their ability to make mortgage payments based on their income and financial stability.

- The successor must not have a history of bankruptcy or foreclosure, which can negatively impact their chances of being approved as a successor in interest.

- The lender may require the successor to assume the mortgage under the existing terms and conditions, or offer a modification if agreed upon.

Documentation Needed

Now that you are aware of the legal requirements, let’s move on to the documentation needed to support your eligibility as a successor in interest for a mortgage:

- A copy of the legal document establishing your claim to the property, such as a will, trust, divorce decree, or death certificate of the original borrower.

- Proof of your residency or intended use of the property, such as your driver’s license, utility bills, or rental agreements.

- Documentation showcasing your financial stability, including income verification, tax returns, and bank statements.

- A credit report to demonstrate your repayment history and creditworthiness.

- Any additional supporting documentation that the lender may request to assess your application, such as character references or employment verification.

By gathering and submitting the necessary documentation, you can streamline the process of becoming a successor in interest for a mortgage and increase your chances of approval.

Unlocking Homeownership Potential

A successor in interest mortgage can be a game-changer for those aspiring to become homeowners. This innovative mortgage model opens up new doors by providing access to preferential mortgage terms, increasing affordability, and offering a streamlined application process. Let’s delve deeper into the benefits it offers.

Access To Preferential Mortgage Terms

Successor in interest mortgages provide borrowers with access to preferential mortgage terms, making homeownership more affordable and achievable. These terms often include lower interest rates, longer repayment periods, and reduced down payment requirements. By taking advantage of these benefits, aspiring homeowners are presented with more favorable financial terms, making their dream of owning a home a reality.

Increasing Affordability

One of the key advantages of a successor in interest mortgage is the increased affordability it presents. This type of mortgage allows individuals to assume the existing mortgage of a deceased family member or previous homeowner. By assuming an existing mortgage, borrowers can avoid the costs associated with traditional mortgage applications, such as origination fees and appraisal costs. This can lead to significant savings and make homeownership more accessible to a broader range of individuals.

Streamlined Application Process

The successor in interest mortgage also offers a streamlined application process, removing some of the barriers that often hinder homeownership. Compared to traditional mortgages, the application process is simplified and more efficient. Borrowers are not required to provide extensive financial documentation or go through lengthy approval procedures. This accelerated process allows individuals to secure a mortgage more quickly, enabling them to seize homeownership opportunities without unnecessary delays.

Success Stories

Real-life experiences of individuals who have benefited from a successor in interest mortgage provide valuable insights into the tangible benefits of this financing option. Here are some success stories that highlight how this mortgage can positively transform homeownership.

Real-life Experiences

Success stories shared by homeowners who have utilized a successor in interest mortgage shed light on the practicality and effectiveness of this loan option. Let’s take a look at a couple of individuals who achieved their homeownership dreams through this innovative financing solution.

Case Study 1:

Mark, a widower, inherited his childhood home after his parents passed away. However, the mortgage on the property posed a significant burden on his finances. Mark discovered the option of a successor in interest mortgage, which allowed him to take over the existing mortgage without triggering a loan due-on-sale clause. This meant he could avoid the hassle of refinancing and maintain the favorable terms of the original loan. As a result, Mark was able to retain the family home without incurring any additional financial strain.

Case Study 2:

Lisa, a divorced parent, found herself in a difficult situation after her ex-husband moved out of their jointly-owned property. She wanted to continue living in the home to provide stability for her children, but the mortgage was solely in her ex-husband’s name. Fortunately, Lisa learned about the successor in interest mortgage, which enabled her to assume the mortgage and keep the property. This not only allowed her to secure a stable living environment for her children but also saved her from the hassle and expense of seeking alternative housing.

Tangible Benefits

These success stories highlight the tangible benefits that can be obtained through a successor in interest mortgage. Let’s explore some of these advantages in more detail:

| Benefits | Explanation |

|---|---|

| Preserving Favorable Loan Terms | A successor in interest mortgage allows borrowers to maintain the existing favorable terms of the original loan, such as low interest rates or fixed repayment periods. This can lead to significant long-term savings. |

| Avoiding Loan Due-on-Sale Clauses | By assuming the existing mortgage through a successor in interest arrangement, homeowners can circumvent loan due-on-sale clauses that may otherwise trigger loan acceleration or the need for expensive refinancing. |

| Minimizing Financial Strain | For individuals who have inherited a property or experienced a change in ownership circumstances, a successor in interest mortgage can provide a more affordable and manageable solution, reducing the financial burden while maintaining homeownership. |

| Streamlining Home Transfers | Successor in interest mortgages simplify the transfer of property ownership between family members or related parties, allowing homeowners to navigate these transitions smoothly and efficiently. |

These real-life success stories and tangible benefits of a successor in interest mortgage illustrate the value and flexibility it can offer to homeowners in various situations. Understanding these possibilities can empower individuals to explore this mortgage option and make informed decisions for their unique homeownership needs.

Credit: www.smithdebnamlaw.com

Frequently Asked Questions Of What Is A Successor In Interest Mortgage

What Does Successor Of Interest Mean On A Mortgage Loan?

A successor of interest on a mortgage loan refers to a person or entity who assumes the rights and obligations of the original borrower. They take over the loan and become responsible for making the mortgage payments and complying with the terms of the loan agreement.

What Does It Mean To Be Confirmed As The Successor In Interest?

Being confirmed as the successor in interest means you have legally inherited the rights, responsibilities, and ownership of a property or asset from the previous owner.

How Do You Prove You Are A Successor In Interest?

To prove you are a successor in interest, provide legal documents such as a will, trust, or court order that designates you as the heir. Additionally, you can present documentation showing your relationship to the previous owner, like a birth certificate or marriage record.

What Is A Successor In Interest On A Mortgage Assumption?

A successor in interest on a mortgage assumption is someone who takes over the mortgage from the original borrower. They assume all rights and responsibilities related to the loan. It is commonly done in the case of a sale or transfer of property ownership.

Conclusion

To sum up, a successor in interest mortgage is a legal arrangement where the rights and obligations of a borrower are transferred to a new party. This can occur due to various circumstances, such as a change in ownership or the death of the original borrower.

Understanding the concept of a successor in interest mortgage is crucial for both lenders and borrowers, as it affects the rights and responsibilities associated with the loan. By familiarizing yourself with this concept, you can make informed decisions regarding your mortgage and ensure a smooth transition in such situations.