What is a Discharge of Mortgage? Learn the Power Behind Liberating Your Property

A discharge of mortgage is the legal process of releasing a property from the lien or mortgage loan that was previously registered against it by the lender. This process removes the lender’s claim on the property and confirms that the loan has been fully paid or otherwise satisfied.

A discharge of mortgage is typically issued by the lender or financial institution and is registered with the appropriate government authority to update the property title. It provides evidence that the mortgage has been discharged and the property is no longer encumbered by the loan.

This is an important step for property owners as it allows them to have full ownership rights and sell or transfer the property without any restrictions or liabilities tied to the mortgage.

Understanding The Discharge Of Mortgage

A Discharge of Mortgage is the process of releasing a property from a mortgage debt after the loan has been fully repaid. This legal documentation confirms that the borrower no longer owes any money to the lender and grants them full ownership of the property.

Understanding the Discharge of Mortgage The discharge of mortgage is an essential step in the process of home ownership. It is important to grasp the concept and purpose of a discharge of mortgage, as it plays a significant role in ensuring a property’s title is clear and free from any encumbrances. In this section, we will delve into the details of what a discharge of mortgage is, why it is necessary, and how it relates to the overall mortgage process.What Is A Discharge Of Mortgage?

A discharge of mortgage, also known as a release of mortgage, is a legal document that officially releases a property from the mortgage debt. It is issued by the lender or the mortgagee once the borrower or the mortgagor has fully paid off the mortgage loan. This document serves as proof that the mortgage has been satisfied and that the property is no longer collateral for the loan. In simpler terms, it is like a certificate of freedom for the property, freeing it from any outstanding mortgage obligations.Why Is A Discharge Of Mortgage Necessary?

A discharge of mortgage is a necessary step in the mortgage process for several reasons. Firstly, it ensures that the mortgage lender no longer has a legal claim on the property. Without a discharge of mortgage, the lender could potentially retain rights to the property, even if the mortgage has been fully paid off. By obtaining and registering the discharge, the borrower can establish complete ownership and control over their property. Another reason a discharge of mortgage is essential is for future property transactions. When selling or refinancing a property, the existence of a discharged mortgage can significantly impact the process. Prospective buyers or new lenders will want assurance that the property’s title is clear and free of any outstanding mortgage obligations. The discharge of mortgage serves as proof of full repayment and guarantees a smooth transaction. Finally, obtaining a discharge of mortgage ensures that the property owner receives all the associated benefits of owning a mortgage-free property. This includes the removal of any restrictions on the property’s title and the ability to fully utilize the property’s equity. Additionally, it gives the property owner peace of mind, knowing that they are no longer indebted to the mortgage lender. In conclusion, understanding the discharge of mortgage is crucial to any homeowner. It represents the final step in the mortgage repayment journey and is necessary to clear the property from any mortgage debts. By obtaining this document, homeowners can establish complete ownership and enjoy the benefits of a mortgage-free property. So let’s dive deeper into the discharge of mortgage process and uncover its intricacies.

Credit: www.yumpu.com

The Process Of Discharging A Mortgage

When it comes to homeownership, one of the most important events is paying off your mortgage. Once you’ve made your final payment, you’ll want to complete the process of discharging your mortgage. This process involves removing the legal claim that the lender has on your property. By discharging your mortgage, you gain full ownership of your home, free and clear of any encumbrances. To help you understand the steps involved, let’s take a closer look at the process of discharging a mortgage.

Step 1: Requesting A Discharge Of Mortgage

The first step in the process is to request a discharge of mortgage from your lender. This can typically be done by contacting the mortgage servicing department or the customer service division of your lender. It’s important to provide accurate information such as your loan number, the property address, and your contact details to ensure a smooth process.

Step 2: Completing The Necessary Documentation

Once you’ve made the request, your lender will provide you with the necessary documentation to complete the discharge process. This may include a discharge form or a mortgage satisfaction document. You’ll need to carefully review and fill out these documents, ensuring all required fields are completed accurately.

Step 3: Submitting The Documents To The Mortgage Lender

After completing the necessary documentation, you’ll need to submit the forms to the mortgage lender for review. It’s important to keep copies of all documents for your records. You may also be required to provide additional documentation such as a copy of the final mortgage payment confirmation, a government-issued ID, or any other supporting documents requested by the lender.

Step 4: Verification And Approval Process

Once the lender receives your documents, they will begin the verification and approval process. This involves reviewing the submitted forms, cross-checking the information provided, and conducting any necessary background checks. The lender will then determine whether you have met all the requirements for a discharge of mortgage. If everything is in order, they will proceed with approving your request.

Overall, discharging a mortgage is a crucial step towards gaining full ownership and control over your property. By following these steps, you can successfully complete the process and enjoy the peace of mind that comes with a mortgage-free home.

The Power Behind Liberating Your Property

When it comes to owning a property, there is nothing more satisfying than having complete freedom over it. However, if you have ever had a mortgage on your property, you may be familiar with the lingering feeling of being tied down. That is where a discharge of mortgage comes in, offering you the power to liberate your property and take control of your financial future. In this article, we will explore the benefits of a discharge of mortgage and how it can give you the freedom to sell, refinance, or transfer ownership.

Benefits Of A Discharge Of Mortgage

A discharge of mortgage carries numerous benefits that can have a profound impact on your property ownership experience. Let’s take a closer look at these advantages:

Freedom To Sell

One of the primary benefits of a discharge of mortgage is the freedom it provides when you decide to sell your property. Once the discharge is in effect, you become the sole owner of your property, with no mortgage lien lingering over it. This means that you have the authority to execute a sale without any legal obstacles, allowing you to negotiate the best deal and reap the rewards of your investment.

Refinance Your Property

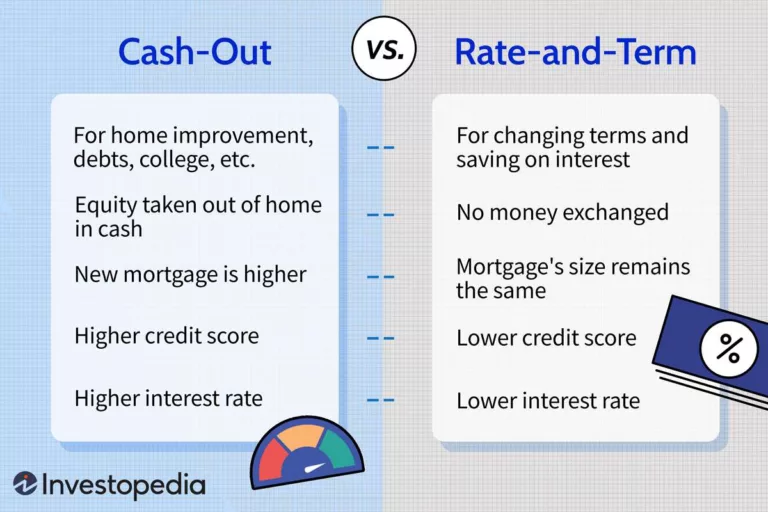

Another significant advantage of a discharge of mortgage is the ability to refinance your property. When you refinance, you essentially replace your existing mortgage with a new one, usually with better terms and interest rates. However, to proceed with refinancing, you will need to discharge your current mortgage. By doing so, you regain control over your property’s equity, making it easier to secure a more favorable loan and potentially save thousands of dollars in the long run.

Transfer Ownership

Occasionally, situations arise where you may need to transfer the ownership of your property. Whether you are gifting it to a family member, adding a partner to the title, or incorporating it into a trust, a discharge of mortgage is necessary. By discharging the existing mortgage, you eliminate any complications or legal concerns surrounding the property’s transfer. This enables a smooth and hassle-free process, ensuring that the property’s ownership is properly documented and protected.

In conclusion, a discharge of mortgage has the power to liberate your property, providing you with unrivaled freedom and control. Whether you plan to sell, refinance, or transfer ownership, freeing yourself from the burden of a mortgage enables you to navigate these transactions smoothly, confidently, and without restriction. Take charge of your property, seize your financial opportunities, and unlock the full potential of your investment with a discharge of mortgage.

Credit: www.pbs.org

Common Misconceptions About Discharge Of Mortgage

A discharge of mortgage is the legal process that releases a borrower from their loan obligations, indicating the mortgage has been fully paid. Common misconceptions about this process include thinking it happens automatically or that it immediately clears the property’s title.

However, it requires proper documentation and may take time to complete.

Discharge Of Mortgage Vs. Release Of Mortgage

One common misconception about the discharge of mortgage is that it is the same as the release of mortgage. While these terms may sound similar, they refer to slightly different processes in the world of real estate. Understanding the distinction between a discharge of mortgage and a release of mortgage is crucial for homeowners, lenders, and anyone else involved in a property transaction.

When a mortgage is discharged, it means that the legal obligation to repay the loan has been officially removed from the property. This typically occurs when the mortgage has been paid off in full or when the property has been sold. The discharge of mortgage is a formal legal process that effectively releases the property from the lien placed on it by the lender.

In contrast, a release of mortgage refers to the act of releasing the lien on the property without necessarily requiring the full repayment of the loan. This can happen when a portion of the mortgage has been paid off or when the property is being transferred to another owner. A release of mortgage essentially allows the property to be transferred or refinanced while still leaving an outstanding balance on the loan.

Discharge Of Mortgage Vs. Satisfaction Of Mortgage

Another misconception is the confusion between the discharge of mortgage and the satisfaction of mortgage. While these terms may seem interchangeable, they actually refer to different stages in the life of a mortgage.

The discharge of mortgage, as mentioned earlier, refers to the removal of the lien on the property once the mortgage has been paid off or the property has been sold. It is an important step in ensuring that the property titles can be transferred without any encumbrances.

On the other hand, the satisfaction of mortgage signifies the completion of the mortgage payments and the fulfillment of the borrower’s obligations. When a mortgage is satisfied, it means that the borrower has repaid the loan in full and no further payments are required. This is often accompanied by the discharge of mortgage, as the lender acknowledges that the debt has been settled.

It is essential to understand these distinctions to avoid any confusion or misconceptions when dealing with mortgages and real estate transactions. Whether you’re a homeowner trying to clear a property title or a lender finalizing a loan, knowing the differences between discharge of mortgage and release of mortgage, as well as satisfaction of mortgage, will ensure that you navigate the process correctly.

Tips For A Smooth Discharge Of Mortgage Process

When it comes to finalizing your mortgage process, obtaining a discharge of mortgage is an important step. A discharge of mortgage is a legal document that releases the property owner from any obligation to the lender once the mortgage is fully paid off. Ensuring a smooth discharge process will help streamline the completion of your mortgage and provide you with peace of mind.

Keep Track Of Important Dates And Deadlines

To ensure a smooth discharge of mortgage process, it is essential to stay organized and keep track of important dates and deadlines. This will help you avoid delays and potential issues that can arise. Mark the date of your final mortgage payment and make a note of when you expect the discharge to be processed. Double-check with your lender to confirm the expected date of completion.

Double-check All Documentation

Double-checking all the documentation is crucial to a seamless discharge of mortgage process. Ensure all the necessary paperwork is completed accurately and signed correctly. Review the discharge document carefully to validate that the information matches the details of your mortgage. Any mistakes or discrepancies in the documentation can cause delays and unnecessary complications. It is always a good idea to seek legal advice if you have any doubts or uncertainties.

Communicate With The Mortgage Lender

Effective communication with your mortgage lender is key to a successful discharge of mortgage process. Stay in touch with your lender throughout the process to address any concerns or questions promptly. Keep a record of all communications, including emails, phone calls, and documents exchanged. This will help you provide any necessary evidence or clarification in case of any disputes or discrepancies.

By adhering to these tips, you can ensure a smooth discharge of mortgage process and complete the finalization of your mortgage successfully. Remember to keep track of important dates and deadlines, double-check all documentation, and maintain open communication with your mortgage lender. Taking these steps will help minimize any potential roadblocks and provide you with a hassle-free discharge process.

Credit: www.facebook.com

Frequently Asked Questions Of What Is A Discharge Of Mortgage

What Does It Mean When A Mortgage Is Discharged?

When a mortgage is discharged, it means that the borrower has paid off their loan in full, and the lender has released their claim to the property. This typically happens after the final mortgage payment is made and all obligations are met.

What Happens To A Discharged Mortgage?

Once a mortgage is discharged, it is officially paid off and removed as a lien on the property. The borrower is no longer obligated to make mortgage payments, and the property is free from any mortgage-related restrictions.

What Is Difference Between Discharge And Release Of Mortgage?

Discharge is the legal process of removing a mortgage lien from a property title after the loan is fully repaid. Release, on the other hand, is when a lender gives up their rights to the property after the mortgage is satisfied.

Both processes indicate the mortgage is no longer binding.

What Does Full Discharge Of Mortgage Mean?

A full discharge of mortgage means the complete payment and release of a mortgage, indicating that the debt has been fully repaid and the property is no longer held as collateral.

Conclusion

To sum up, understanding what a discharge of mortgage means is crucial for homeowners. This process signifies the release of the mortgage debt on a property, providing the homeowner with full ownership. By obtaining a discharge of mortgage, individuals can enjoy financial freedom, flexibility, and the ability to sell or transfer their property without any encumbrances.

Remember, seeking professional assistance and maintaining proper documentation is essential throughout this procedure.