Refinance Mortgage With Home Improvement Loan: Boost Equity!

Do you want to make your home better? Or maybe save some money on your home loan?

You can do both! Refinancing your mortgage with a home improvement loan is smart.

Let’s talk about what this means and how you can do it.

What Is a Home Improvement Loan?

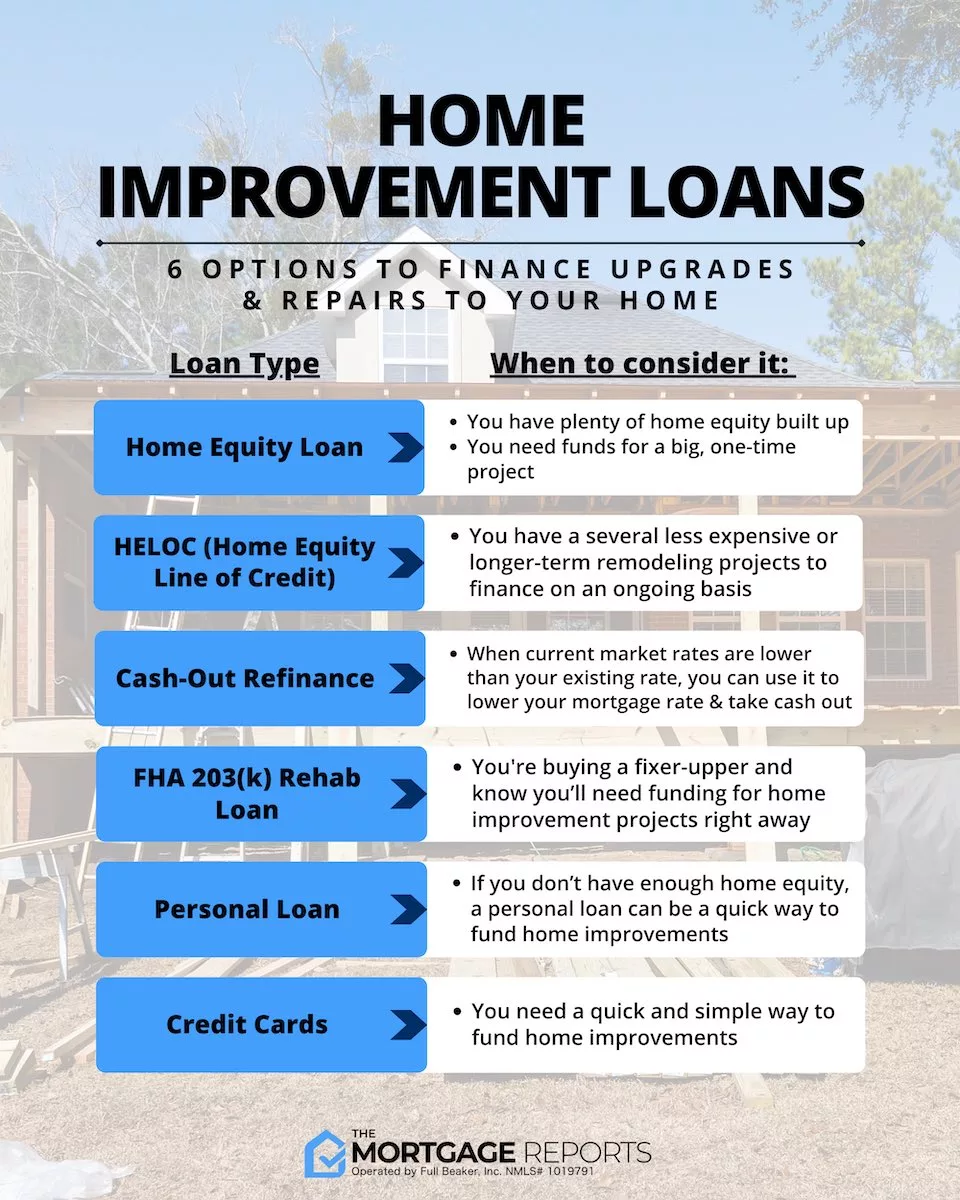

A home improvement loan is money you borrow to fix or make your home nicer. Like getting a new kitchen or a room for toys.

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Credit: www.investopedia.com

What Does Refinance Mean?

Refinancing is when you get a new home loan to replace the old one. This can lower your payments or give you money for your house.

How Can You Combine Them?

You can combine them by getting a new loan that includes extra money for your house fixes.

Credit: www.citizensbank.com

Why Should You Refinance for Home Improvements?

| Reason | How It Helps You |

|---|---|

| Save Money | Lower monthly payments or interest can save a lot. |

| Add Value | Improvements can make your house worth more later. |

| One Loan | One loan is easier to manage than two different loans. |

Steps to Refinance Your Mortgage with a Home Improvement Loan

- Check How Much Your Home Is Worth

- Decide What Improvements You Want to Make

- Talk to a Lender About Refinancing

- See If You Qualify for the New Loan

- Get the Refinance and Home Improvement Loan

- Start Your Home Improvements

Important Things to Remember

- Your credit score needs to be good to get a good loan.

- Improvements should add real value to your home.

- You should still be able to pay the loan each month.

Tips to Make the Process Easier

Here are some tips to help you along the way.

- Know your budget: Don’t spend more money than you have.

- Choose smart improvements: Some fixes add more value than others.

- Shop around for rates: Get the best loan terms for your money.

Finishing Thoughts

Refinancing with a home improvement loan can be a big help. You can save money and have a nicer home.

Just make sure to plan well and choose smart. Good luck!

Frequently Asked Questions Of Refinance Mortgage With Home Improvement Loan: Boost Equity!

What Is A Refinance Mortgage?

A refinance mortgage involves replacing an existing loan with a new one, typically to secure better terms or rates.

Can I Combine Home Improvement Loans?

Yes, some lenders offer refinancing options that let you combine a mortgage with funds for home improvements.

How Does Home Improvement Affect Refinance?

Home improvements can increase property value and potentially qualify you for better refinance loan terms.

What’s The Benefit Of Refinancing?

Refinancing can lower monthly payments, reduce interest rates, or change loan terms to better suit your financial goals.