Why is Debt Cheaper Than Equity? The Financial Advantage Explained

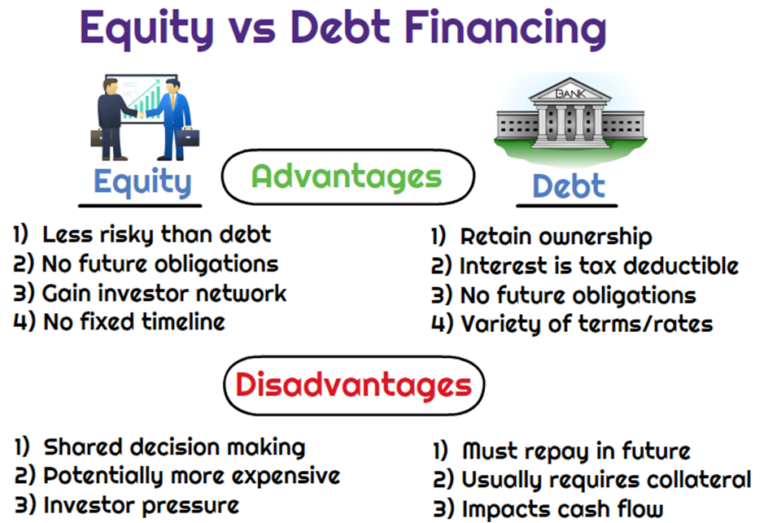

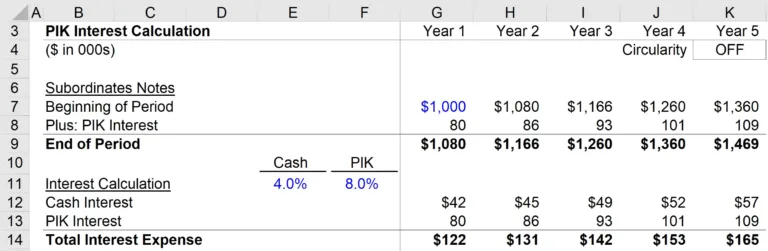

Debt is cheaper than equity because interest payments on debt are tax deductible, resulting in lower overall costs for the borrower. In addition, equity holders have a higher risk and return expectation than debt holders, making equity financing more expensive for companies. When a company needs to raise funds for various purposes such as expansion…