What is an Open Ended Mortgage : Your Key to Financial Flexibility

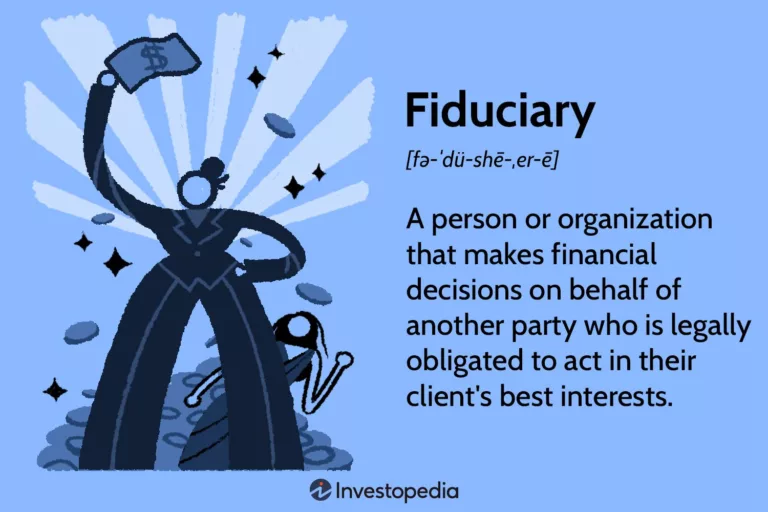

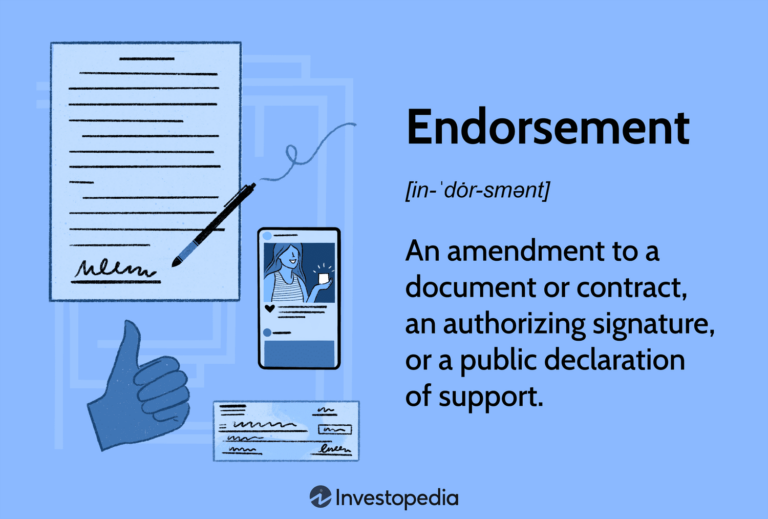

An open-ended mortgage allows borrowers to access additional funds as needed, without the need to renegotiate the loan terms. This type of mortgage provides flexibility and ongoing access to equity. Owning a home is a dream for many, and getting the right mortgage is an essential part of making that dream a reality. Among the…