How to Become a Mortgage Broker With No Experience: Insider Secrets Revealed

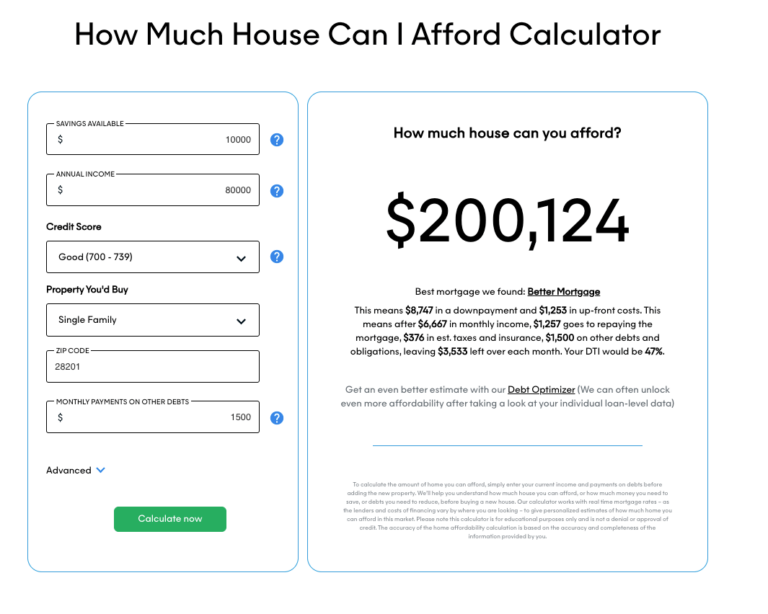

To become a mortgage broker with no experience, get licensed by completing pre-licensing and continuing education courses, gain hands-on experience through an internship or a job in the mortgage industry, and build a strong network of contacts in the field. In addition, stay updated on industry regulations and trends to improve your knowledge and credibility…