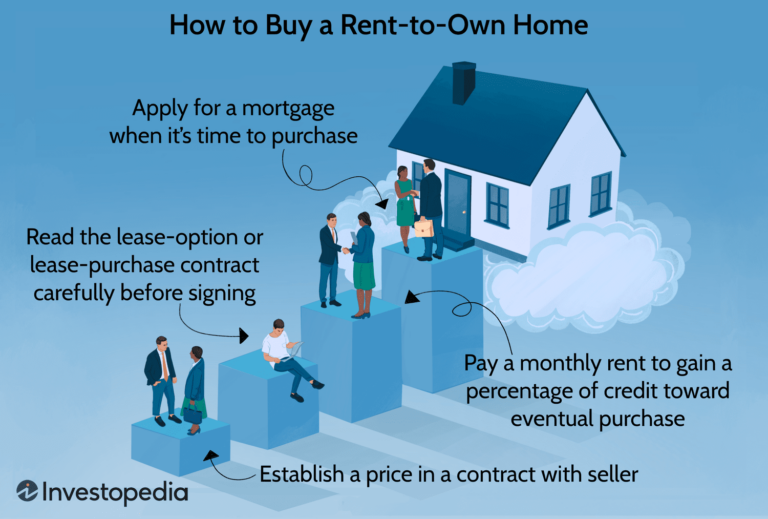

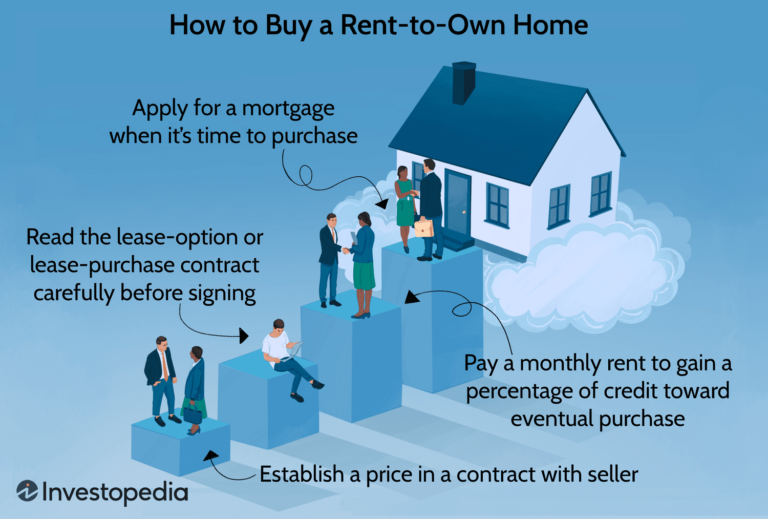

When Could Women Get a Mortgage? Unveiling the Empowering Timeline!

Women were allowed to get a mortgage starting in the early 1970s. Before this time, they faced significant limitations in obtaining home loans, but as gender equality progressed, these restrictions were gradually lifted. 1. Early Restrictions On Women’s Access To Mortgages Throughout history, women have faced numerous hurdles and restrictions when it came to accessing…