Is It Illegal to Be Denied Credit? Protect Your Rights with These Legal Strategies!

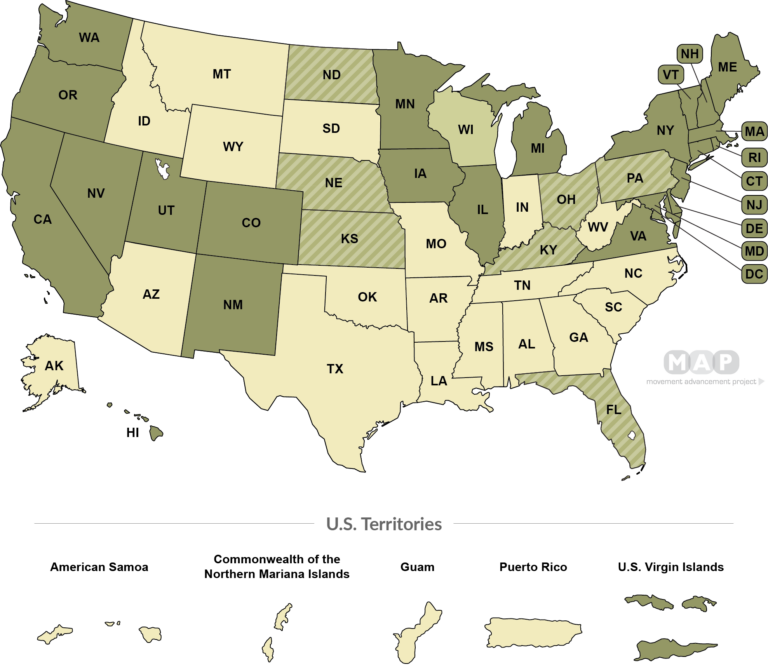

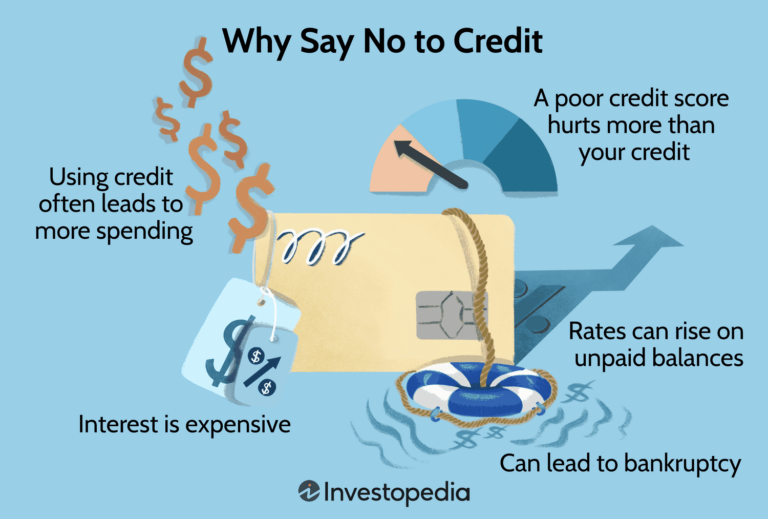

It is not illegal to be denied credit, as lenders have the right to reject credit applications based on their own criteria. However, it is illegal for lenders to deny credit based on discriminatory factors such as race, religion, or gender. In the United States, the Equal Credit Opportunity Act (ECOA) and the Fair Credit…