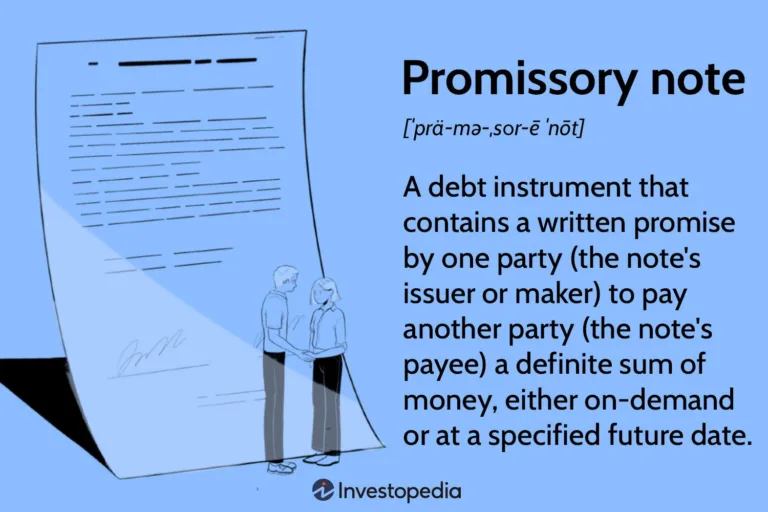

How Long is a Promissory Note Valid? : Unveiling the Time Limit

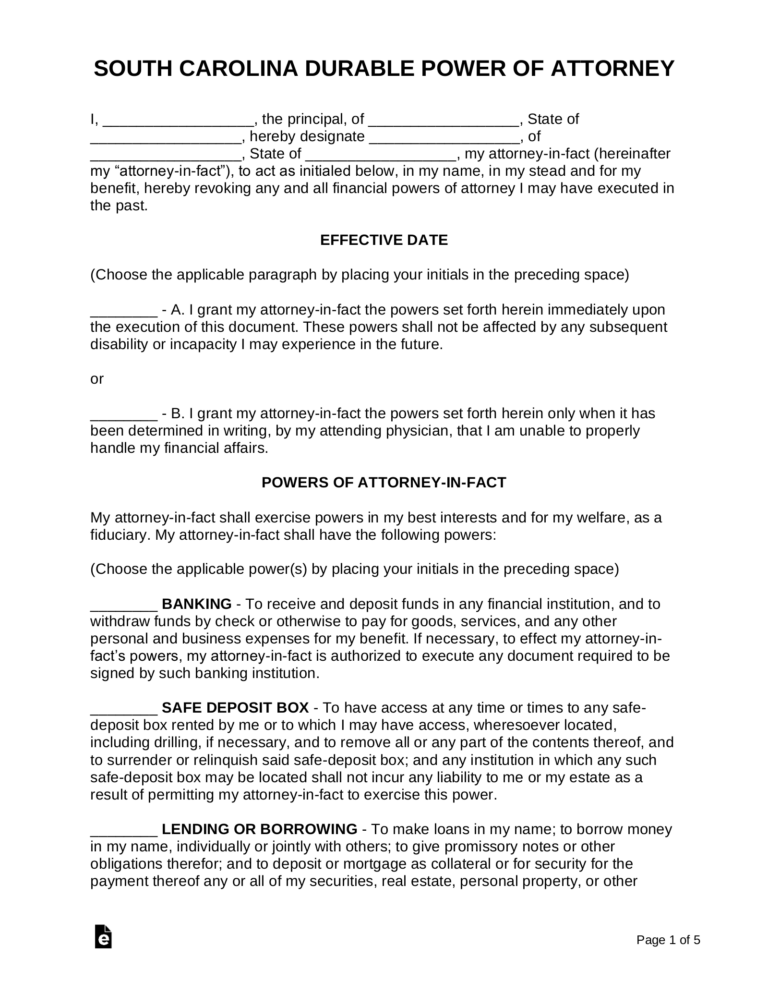

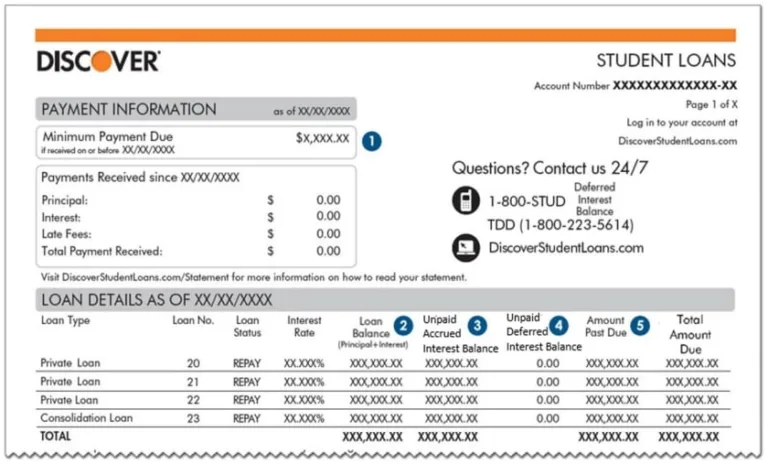

A promissory note is typically valid for a specified period agreed upon by the parties involved. Credit: fastercapital.com The Basics Of Promissory Notes A promissory note is a legally binding document that outlines the terms and conditions of a loan or debt agreement. It is a written promise from one party to another, guaranteeing the…