What is the Difference between Loan Term And Amortization? Explained

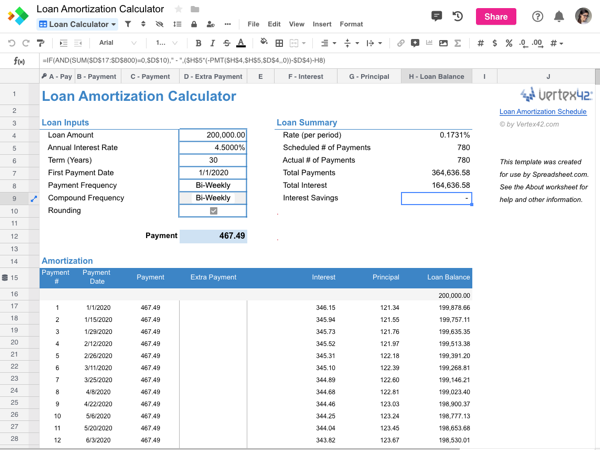

The loan term refers to the length of time in which a loan must be repaid, while amortization refers to the process of gradually paying off a loan over time through regular payments that cover both the principal and interest. The loan term specifies the duration of the loan, such as 5 years or 30…