No Closing Cost Refinance Mortgage Options: Save Big Now!

Buying a home often involves lots of extra fees. Did you know that there are ways to refinance your mortgage without paying these fees? It’s true! In this article, we will explain how you can do this.

What is a No Closing Cost Refinance?

A no closing cost refinance lets you change your home loan without paying fees up front. That sounds pretty good, right? Let’s learn more about it.

How Does It Work?

When you get a new loan for your house, there are usually costs. These are called closing costs. Banks sometimes offer to let you skip these fees. Instead, they add them to your loan, or they charge a higher interest rate.

Benefits of No Closing Cost Refinance

- Save Money Now: You don’t have to pay these fees today.

- Simple Process: It’s easier since you skip some steps.

- Quicker: You can change your mortgage faster.

Credit: www.bankrate.com

How Much Can You Save?

| Without No Closing Cost Refinance | With No Closing Cost Refinance |

|---|---|

| $3000 Up Front | $0 Up Front |

You see? The table shows how much you can save right away.

What’s The Catch?

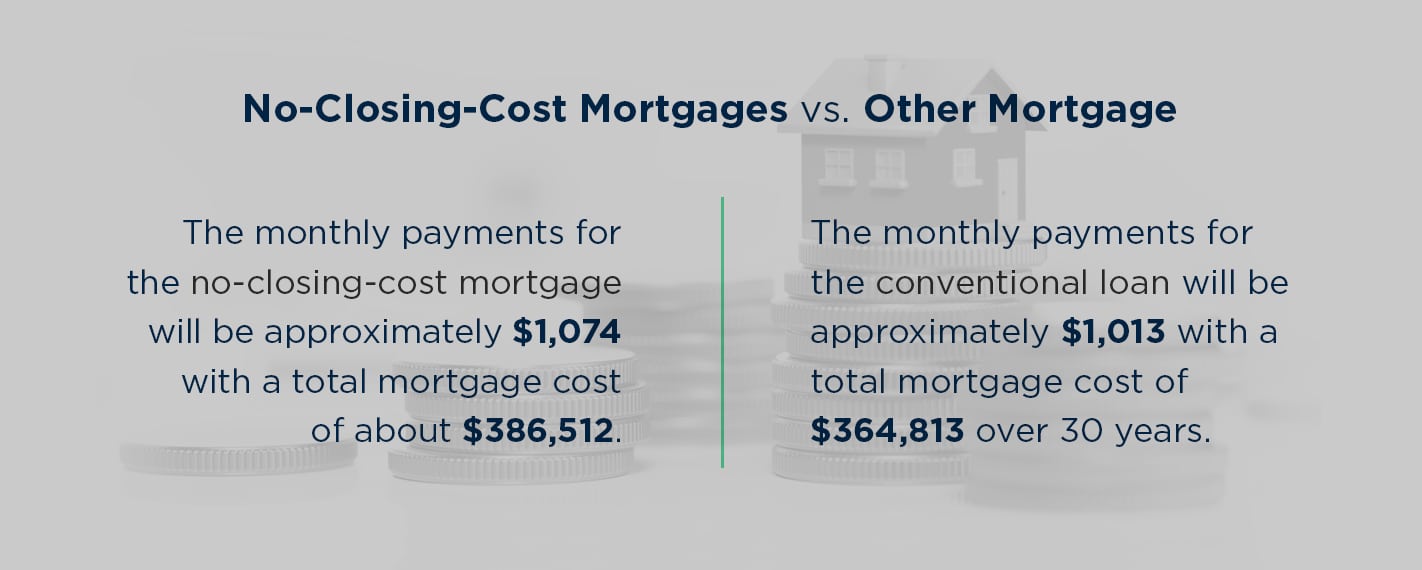

Even though it looks like you save money, it’s not all perfect. Sometimes, if you choose to not pay now, you may pay more in total over time. This is especially true if you pay a higher interest rate.

Should You Choose a No Closing Cost Refinance?

To decide, ask yourself:

- How long will you live in your home?

- Can you afford to pay more each month?

- Do you need to save money right now?

Other Options to Consider:

You might choose to pay the fees now to have a lower monthly payment. Or you can even negotiate with the lender for a better deal.

Steps to Take When Refinancing

- Research: Find out what different lenders offer.

- Compare: Look at the costs and benefits of each choice.

- Decide: Pick the option that works best for your family.

Why Lenders Offer No Closing Cost Options

Lenders do this to help people get loans. They want to make it easy for you to refinance.

Finding the Best No Closing Cost Refinance Option for You

Talking to different banks and lenders can help you choose the best path. Look for those who explain things clearly and honestly. Trust is important with money matters.

Questions to Ask Lenders:

- How much will I pay in the long run?

- Can I pay off my loan early without a penalty?

- Is my interest rate fixed or can it change?

Credit: assurancemortgage.com

Frequently Asked Questions On No Closing Cost Refinance Mortgage Options: Save Big Now!

What Are No Closing Cost Refinance Options?

Refinancing without closing costs involves lenders covering these fees in exchange for a slightly higher interest rate.

How Can I Refinance With No Closing Costs?

Lenders may offer no closing cost options; it’s crucial to compare offers and understand the trade-off in interest rates.

Do No Closing Cost Mortgages Save Money?

They can save money upfront, but typically result in higher interest payments over the loan’s life compared to paying closing costs upfront.

Who Offers No Closing Cost Refinance Mortgages?

Many lenders, including banks, credit unions, and online mortgage brokers, offer no closing cost refinancing options.

Conclusion

Now you know that no closing cost options can help you save money quickly. But, remember to think about how it will affect your payments over time. Be smart and shop around. Ask good questions and find the best deal for your family.

Recap:

- No Closing Cost means less to pay right now.

- Make sure you understand the long-term costs.

- Shop around and choose a trustworthy lender.

Refinancing your home can be a smart move. With the right no closing cost option, you can save money and make the best choice for your family’s future.