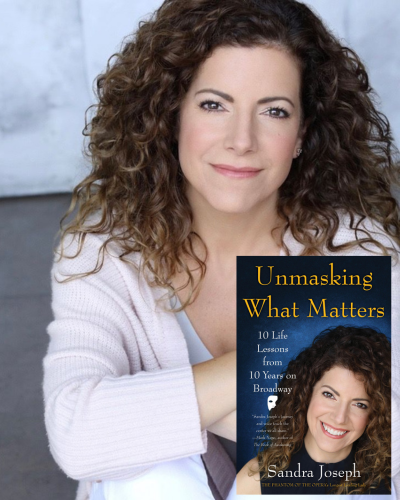

Is Mortgage Field Services Legit: Unmasking the Truth

Mortgage Field Services is a legitimate industry that provides property inspection and preservation services. These services are essential for lenders and loan servicers to ensure the protection and maintenance of their collateral properties.

As a part of the mortgage industry, mortgage field services play a crucial role in safeguarding the lender’s investment and maintaining the overall property value. By conducting inspections, property maintenance, and repairs, these services help mitigate potential risks and loss for mortgage companies.

They also assist in ensuring compliance with regulations and preserving the overall market value of properties. Mortgage field services have emerged as a reputable and integral part of the real estate and mortgage industry, providing valuable services to lenders, loan servicers, and property owners.

Credit: fee.org

The Basics Of Mortgage Field Services

In the world of real estate, mortgage field services play a crucial role in ensuring the smooth functioning of the housing industry. From inspecting properties to providing preservation services, these professionals are key players in maintaining the integrity of mortgage portfolios for lenders and investors.

What Are Mortgage Field Services?

Mortgage field services refer to a range of tasks and responsibilities that are carried out by professionals in order to assess the condition and value of properties that are part of mortgage portfolios. These services are typically outsourced by lenders and investors to third-party providers who specialize in property inspections, preservation, and maintenance.

The Role Of Mortgage Field Services Providers

The role of mortgage field services providers is to act as the eyes and ears of lenders and investors. They visit properties to conduct inspections, assess their physical condition, and identify any potential issues or risks. These professionals are responsible for providing accurate and detailed reports, including photographs and documentation, to help lenders make informed decisions about their mortgage portfolios.

Mortgage field services providers also play a crucial role in preserving the value of properties. They perform tasks such as property maintenance, repairs, and securing vacant properties to prevent vandalism and theft. Additionally, they may handle tasks related to property preservation, including landscaping, snow removal, and cleaning.

Evaluating The Legitimacy Of Mortgage Field Services

In today’s real estate industry, mortgage field services play a crucial role in maintaining and safeguarding properties. However, it is essential to evaluate the legitimacy of these services to ensure that homeowners and lenders can trust the professionals they hire. Let’s delve into some common misconceptions and skepticism surrounding mortgage field services, understand the regulatory landscape they operate within, and learn how to identify red flags that may indicate untrustworthiness.

Common Misconceptions And Skepticism

When it comes to mortgage field services, many people hold misconceptions and skepticism. Let’s address some of these concerns:

- Myth: Mortgage field services only benefit lenders.

- Fact: While lenders do benefit from these services, they also protect the interests of homeowners by ensuring properties are maintained and secure.

- Myth: Mortgage field service providers lack transparency.

- Fact: Reputable companies uphold a high level of transparency, providing detailed reports and documentation to clients.

- Myth: Mortgage field services are unnecessary expenses for homeowners.

- Fact: Timely inspections and proper maintenance can prevent costly repairs in the long run, saving homeowners money.

Understanding The Regulatory Landscape

Mortgage field services operate in a regulated environment to ensure professionalism, ethics, and adherence to industry standards. Here are some aspects of the regulatory landscape:

- Licensing: Field service providers typically require licenses to operate legally, which ensures their competency and compliance with regulations.

- Industry Associations: Reputable companies often hold membership in industry associations, such as the National Association of Mortgage Field Services (NAMFS), which further validates their legitimacy.

- Insurance and Bonding: Trustworthy field service providers carry appropriate insurance and bonding to protect their clients and provide financial security.

Identifying Red Flags

While most mortgage field service providers are legitimate, it’s crucial to be vigilant and identify any potential red flags. Here are some signs to watch out for:

| Red Flag | Explanation |

|---|---|

| Unsolicited Communications | Be cautious of companies that contact you unexpectedly, as legitimate providers generally rely on referrals or are contracted by lenders. |

| Poor Online Presence | Reputable companies invest in their online presence, including a professional website, client testimonials, and active social media profiles. |

| Lack of Documentation | A reliable field service provider will provide detailed reports, photos, and documentation of property inspections and maintenance. |

| Inconsistent Pricing | Be wary of significantly lower prices than the industry average, as this may indicate subpar service or hidden costs later on. |

By familiarizing yourself with these red flags, you can confidently evaluate the legitimacy of mortgage field services and make informed decisions when hiring a provider. Remember, reputable companies prioritize transparency, adhere to industry regulations, and provide top-notch service to protect both lenders and homeowners alike.

The Pros And Cons Of Mortgage Field Services

Mortgage field services play a crucial role in the real estate and financial industry, providing a range of services that help lenders and mortgage servicers manage their properties. These services can include property inspections, occupancy checks, lawn maintenance, and more. While mortgage field services offer several advantages, it’s essential to weigh these benefits against the potential disadvantages and risks involved. In this section, we will explore both the advantages and disadvantages of hiring mortgage field services, giving you a comprehensive understanding of whether this option is the right fit for your needs.

Advantages Of Hiring Mortgage Field Services

Hiring mortgage field services brings forth numerous advantages that may significantly benefit lenders, servicers, and property owners. Let’s delve into some of these key advantages:

- Timely and Efficient Property Inspections

- Ensure Property Preservation and Maintenance

- Flexibility and Scalability

- Industry Expertise and Compliance

- Cost Savings and Increased Profitability

One of the primary advantages of mortgage field services is the ability to conduct timely and efficient property inspections. These services have trained and experienced professionals who can quickly assess the condition of a property, providing accurate reports that are essential for decision-making processes.

Additionally, mortgage field services help ensure property preservation and maintenance. From lawn care to repairs, these services take care of all necessary tasks to prevent the property from deteriorating, protecting its value in the long run.

Another notable advantage is the flexibility and scalability that mortgage field services offer. Whether you have one property or a portfolio of hundreds, these services can accommodate your needs, adapting to fluctuations in demand seamlessly.

Mortgage field service providers possess specialized industry expertise and stay updated with the latest compliance regulations. This ensures that all necessary standards are met and mitigates possible risks associated with non-compliance.

Finally, hiring mortgage field services can result in significant cost savings and increased profitability for lenders and servicers. Instead of hiring and managing an in-house team, outsourcing these tasks to experts can lead to more efficient operations and reduced overhead costs.

Disadvantages And Risks To Consider

While mortgage field services offer several advantages, it’s crucial to consider the potential disadvantages and risks before making a decision. Let’s explore a few key areas where challenges may arise:

- Limited Control and Quality Assurance

- Security and Privacy Concerns

- Dependency on Third-Party Providers

One of the main disadvantages is the limited control and quality assurance that comes with outsourcing mortgage field services. Since you’re relying on a third-party provider, you may have less control over the processes and the quality of work delivered. It’s essential to thoroughly research and vet potential service providers to minimize this risk.

Additionally, security and privacy concerns are important factors to consider. Working with mortgage field service providers involves sharing sensitive property and client information. Ensuring that the provider has robust data protection measures in place is crucial to safeguarding your business and your clients’ interests.

Lastly, it’s important to recognize that by hiring mortgage field services, you become dependent on a third party to perform essential tasks. This reliance introduces an element of risk and requires a level of trust in the provider’s capabilities and reliability.

Credit: www.linkedin.com

Finding Reputable Mortgage Field Services Providers

When it comes to securing property and mortgage field services, it’s important to partner with legitimate providers who adhere to industry standards and offer reliable services. In this article, we will discuss three crucial factors to consider when looking for reputable mortgage field services providers: researching credentials and reviews, understanding pricing and contracts, and screening for compliance and professionalism.

Researching Credentials And Reviews

Prior to engaging with any mortgage field services provider, it is essential to conduct thorough research on their credentials and reviews. This helps provide confidence in their legitimacy and reliability. Here are a few steps you can take in your research process:

- Check if the company is licensed and registered with appropriate regulatory bodies. This is an important indicator of their professionalism and adherence to industry guidelines.

- Look for certifications or accreditations that demonstrate the provider’s commitment to quality and expertise. These credentials can include designations from industry associations or specialized training programs.

- Read online reviews and testimonials from previous clients. These reviews can give insight into the provider’s level of customer satisfaction and overall performance. Pay attention to any patterns or recurring issues mentioned by multiple clients.

Understanding Pricing And Contracts

When entering into an agreement with a mortgage field services provider, it is crucial to have a clear understanding of their pricing structure and contract terms. This ensures transparency and prevents any unexpected surprises. Consider the following:

- Request a detailed breakdown of the pricing structure, including any additional fees or charges that may apply. This helps you evaluate whether the provider’s rates align with your budget and expectations.

- Examine the contract thoroughly and pay attention to key clauses such as scope of work, turnaround times, and liability provisions. Ensure the agreement covers your specific needs and includes provisions for dispute resolution.

- If any terms or conditions are unclear, don’t hesitate to ask for clarification before signing the contract. It is essential to have a complete understanding of your obligations and the services you will receive.

Screening For Compliance And Professionalism

Another important aspect of selecting a reputable mortgage field services provider is screening them for compliance and professionalism. You want to ensure the company operates ethically and maintains high standards. Here are a few steps you can take:

- Verify their insurance coverage to confirm that they have adequate protection in case of any mishaps or accidents during the field services. This protects your interests and minimizes potential liabilities.

- Inquire about their quality control processes and how they ensure accuracy and reliability in their reports and documentation. A provider that emphasizes quality control demonstrates a commitment to delivering accurate and trustworthy services.

- Research their track record for regulatory compliance and any disciplinary actions or complaints lodged against them. This information can be found through government agencies or industry databases.

By following these steps and conducting thorough due diligence, you can find reputable mortgage field services providers who will meet your property management needs effectively and professionally.

Best Practices For Working With Mortgage Field Services

When it comes to working with mortgage field services, it is important to establish clear expectations, maintain open communication and collaboration, and regularly evaluate performance and results. By following these best practices, you can ensure a successful partnership and maximize the benefits of working with a mortgage field service provider.

Establishing Clear Expectations

Clear expectations are the foundation of any successful working relationship. When working with a mortgage field service provider, it is crucial to define and communicate your expectations clearly and concisely. This includes outlining the scope of work, turnaround times, specific requirements, and any other relevant details.

To establish clear expectations, consider the following:

- Clearly define the scope of work and any specific requirements.

- Set realistic deadlines and turnaround times.

- Provide detailed instructions and guidelines.

- Discuss any potential challenges or constraints.

By establishing clear expectations from the start, you can minimize misunderstandings and ensure that both parties are aligned on the goals and objectives of the project.

Communication And Collaboration

Effective communication and collaboration are essential for a successful partnership with a mortgage field service provider. Regularly keeping in touch and exchanging relevant information will help keep the project on track and address any issues or concerns in a timely manner.

Here are some key points to consider for better communication and collaboration:

- Maintain open lines of communication through phone, email, or project management tools.

- Respond promptly to queries and requests for information.

- Share updates, progress reports, and any changes in requirements.

- Address any issues or concerns as soon as they arise.

- Keep the lines of communication open for feedback and suggestions.

By fostering a culture of open communication and collaboration, you can ensure that everyone involved in the project is on the same page and working towards a common goal.

Evaluating Performance And Results

Regularly evaluating the performance and results of your mortgage field service provider is crucial for maintaining quality and efficiency. By assessing their performance, you can identify areas for improvement and make necessary adjustments to ensure the success of your project.

Consider the following points when evaluating performance and results:

- Establish clear performance metrics and goals.

- Regularly review and analyze data and reports.

- Provide constructive feedback and suggestions for improvement.

- Address any performance issues or concerns promptly.

- Recognize and appreciate good performance.

Regular evaluation will enable you to identify any gaps or inefficiencies in the workflow and take appropriate measures to improve the overall performance and results.

Credit: www.wnycstudios.org

Frequently Asked Questions Of Is Mortgage Field Services Legit

What Is A Mortgage Field Service?

A mortgage field service involves inspections and maintenance of properties for lenders and mortgage companies. It includes tasks like property inspections, repairs, and securing properties to protect their value. Mortgage field services ensure that properties are well-maintained during the mortgage process.

Is Town Tasks Legit?

Yes, town tasks is a legitimate platform for completing tasks and finding local services. It offers a safe and secure environment for users to connect and get tasks done efficiently.

What Is Mortgage Field Services?

Mortgage Field Services are companies that provide third-party services to mortgage lenders and servicers. They handle tasks such as property inspections, maintenance, and repairs. These services help lenders protect their investments and ensure that properties are in good condition.

How Does Mortgage Field Services Work?

Mortgage Field Services work by assigning tasks to qualified professionals called field inspectors. These inspectors visit properties to perform inspections, maintenance, and repairs as needed. They provide detailed reports and photos to the mortgage lender or servicer. This helps the lender make informed decisions about the property and ensure compliance with regulations.

Conclusion

To conclude, the legitimacy of mortgage field services depends on various factors such as the credibility of the company, their track record, and the level of transparency in their operations. It is vital to conduct thorough research and ensure that you work with reputable and licensed companies.

Remember to review customer testimonials and seek professional advice to make informed decisions. By following these guidelines, you can navigate the mortgage field services industry with confidence.