How to Master Excel for Calculating Adjustable Rate Mortgages

To calculate an adjustable rate mortgage in Excel, use the PMT function with the appropriate interest rate, loan term, and loan amount. In Excel, input the formula “=PMT(rate, nper, pv)” where rate is the interest rate, nper is the number of periods, and pv is the present value or loan amount.

Are you planning to finance your dream home with an adjustable rate mortgage? As you crunch the numbers to determine your monthly payments, having a handy tool like Excel can make the process a breeze. By utilizing the PMT function, you can easily calculate how much you need to set aside every month.

By following a few simple steps, you’ll be able to estimate your adjustable rate mortgage payments accurately. Read on to learn how to calculate an adjustable rate mortgage using Excel, saving you time and effort as you plan for your future home.

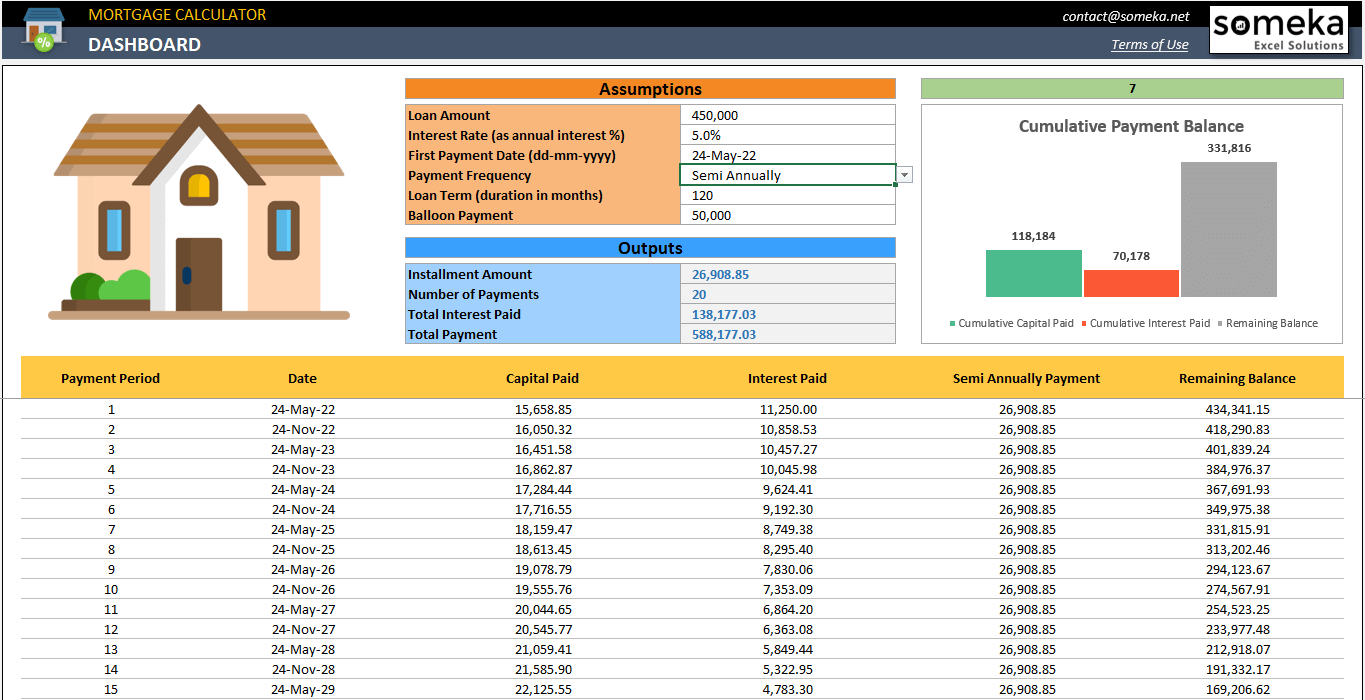

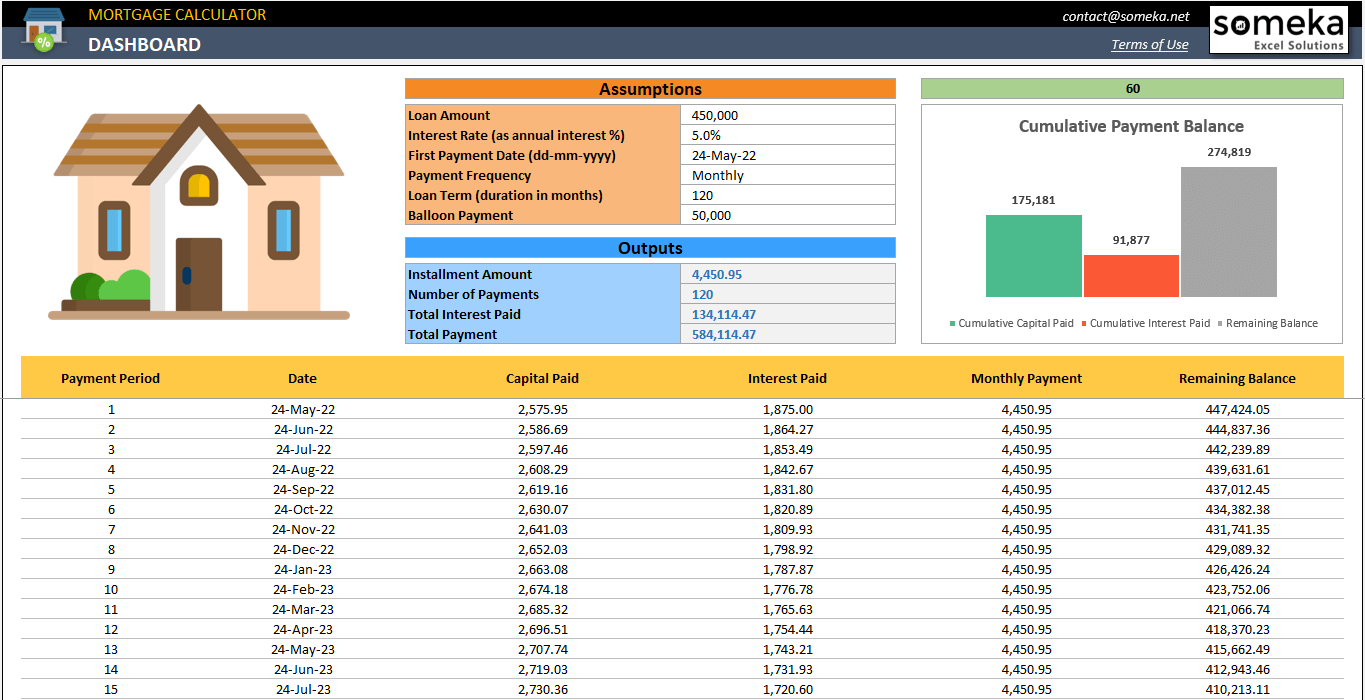

Credit: www.someka.net

Understanding Adjustable Rate Mortgages

Adjustable rate mortgages, commonly referred to as ARMs, can be calculated using Excel. By inputting the necessary data, such as the initial interest rate, adjustment frequency, and loan balance, you can effectively analyze the impact of rate changes on your monthly mortgage payments.

Get a clear understanding of how to calculate ARMs in Excel with our step-by-step guide.

Definition And Features Of Adjustable Rate Mortgages

Adjustable Rate Mortgages (ARMs) are home loans with interest rates that can change over time. Unlike fixed-rate mortgages, which have a set interest rate for the duration of the loan, ARMs have adjustable rates that can fluctuate periodically. These changes are typically based on an index, such as the Treasury Bill rate or the London Interbank Offered Rate (LIBOR). ARMs usually offer an initial fixed-rate period, during which the interest rate remains constant. After this fixed-rate period, the interest rate may adjust annually or on a predetermined schedule.

One key feature of adjustable rate mortgages is the use of an index to determine the interest rate adjustments. The index reflects changes in the broader market conditions, ensuring that your mortgage rates align with prevailing interest rates. Lenders typically add a margin to the index rate to calculate the final interest rate for your ARM. This margin accounts for the lender’s costs and profits.

Advantages And Disadvantages Of Adjustable Rate Mortgages

Adjustable rate mortgages offer both advantages and disadvantages for borrowers.

Advantages

1. Lower initial rates: One of the main benefits of ARMs is that they often start with lower interest rates than fixed-rate mortgages. This means lower monthly payments at the beginning of your loan term.

2. Flexibility: ARMs provide flexibility for borrowers who plan to sell their homes or refinance before the interest rate adjustments occur. This can be beneficial if you anticipate a significant change in your financial situation or if you plan to move within a few years.

3. Potential savings: If interest rates decline after the initial fixed-rate period, borrowers with ARMs may benefit from lower monthly payments compared to those with fixed-rate mortgages. This potential for savings is one of the reasons why some homeowners choose ARMs.

Disadvantages

1. Future rate uncertainty: The main disadvantage of adjustable rate mortgages is the uncertainty of future interest rate adjustments. Your monthly payments can increase significantly if interest rates rise. This can put a strain on your budget, especially if you are not prepared for higher payments.

2. Risk of payment shock: If your ARM has an interest rate cap, there is a risk of payment shock when rates rise above this cap. Payment shock refers to a sudden and substantial increase in monthly mortgage payments, which can be challenging for homeowners to manage.

3. Complexity: ARMs are more complex than fixed-rate mortgages, and understanding the terms, calculations, and potential risks requires careful attention. It is crucial to review all documentation and consult with a financial advisor before choosing an ARM.

In conclusion, adjustable rate mortgages offer flexibility and potential savings in the short term, but carry the risk of future rate increases and payment shock. Borrowers considering an ARM should carefully evaluate their financial situation and future plans before making a decision. Understanding the definition, features, and pros and cons of ARMs is essential to make informed choices about mortgage options.

Credit: www.someka.net

Excel Functions For Mortgage Calculations

Are you in the process of calculating an Adjustable Rate Mortgage (ARM) using Excel? Look no further – we’ve got you covered! In this section, we will explore the Excel functions that will simplify your mortgage calculations and save you valuable time. By using these functions, you can accurately determine your monthly mortgage payments and track the changes in interest rates over time.

Basic Arithmetic Formulas In Excel

When you’re calculating an ARM in Excel, it’s essential to have a good grasp of the basic arithmetic formulas. These formulas allow you to perform simple calculations, such as addition, subtraction, multiplication, and division, right within your spreadsheet. Here are a few key arithmetic formulas that you’ll find useful:

- Addition (+): Use this formula to sum up the values in multiple cells. For example, to calculate the total loan amount, you can enter “=A1+B1” in a specific cell, where A1 contains the principal balance and B1 has the down payment.

- Subtraction (-): This formula helps in subtracting one value from another. To determine the loan balance after making a payment, you can use the formula “=A1-B1,” where A1 represents the initial loan balance, and B1 denotes the payment made.

- Multiplication (): Use this formula to multiply numbers together. For instance, if you want to calculate the total interest paid over the life of the loan, you can enter “=A1B1,” where A1 represents the monthly payment, and B1 indicates the number of months in the loan term.

- Division (/): This formula allows you to divide one number by another. To find the monthly interest rate for your ARM, you can use the formula “=A1/B1,” where A1 represents the annual interest rate, and B1 denotes the number of months in a year.

Financial Functions For Mortgage Calculations

In addition to basic arithmetic formulas, Excel also provides a range of powerful financial functions that can take your mortgage calculations to the next level. These built-in functions allow you to effortlessly determine monthly payments, calculate total interest paid, and assess the impact of interest rate changes. Here are a few key financial functions you should be aware of:

| Function | Description |

|---|---|

| PMT | Calculates the monthly payment for a loan based on constant payments and a fixed interest rate. |

| IPMT | Calculates the amount representing the interest portion of a loan payment for a given period. |

| PPMT | Calculates the amount representing the principal portion of a loan payment for a given period. |

| IRR | Calculates the internal rate of return for a series of cash flows, such as the returns on an investment. |

| EFFRATE | Calculates the effective annual interest rate from the nominal interest rate and the number of compounding periods per year. |

These financial functions can be easily accessed in Excel by typing “=PMT,” “=IPMT,” “=PPMT,” “=IRR,” or “=EFFRATE” followed by opening parentheses and entering the required arguments. Excel will then provide you with the calculated value, eliminating the need for manual calculations.

Creating An Adjustable Rate Mortgage Calculator In Excel

Learn how to calculate adjustable rate mortgages in Excel by creating your own adjustable rate mortgage calculator. This step-by-step guide will help you accurately calculate your mortgage payments and stay informed about potential interest rate changes.

Creating an adjustable rate mortgage calculator in Excel is a useful and efficient way to determine monthly payments based on different interest rates. Excel allows you to input and calculate complex formulas, making it an ideal tool for creating personalized mortgage calculators. In this guide, we will walk you through the process of setting up the worksheet, using Excel functions to calculate monthly payments, and incorporating adjustable interest rates.

Setting Up The Worksheet

To begin, open a new Excel worksheet and label the necessary columns. Create headers for Loan Amount, Loan Term, Annual Interest Rate, Monthly Interest Rate, and Monthly Payment.

Next, input the corresponding values for the Loan Amount, Loan Term, and Annual Interest Rate. For example, in the Loan Amount column, you can enter the loan value you are looking to calculate the monthly payment for. Similarly, in the Loan Term column, input the number of years or months for which the mortgage will be repaid. Finally, fill in the Annual Interest Rate column with the interest rate applicable to your mortgage.

Once the values are entered, we will use Excel functions to calculate the Monthly Interest Rate and Monthly Payment.

Using Excel Functions To Calculate Monthly Payments

Excel offers the PMT function, which allows us to calculate the monthly payment based on the loan amount, loan term, and interest rate.

In the Monthly Interest Rate column, input the following formula:

=Annual Interest Rate/12

This formula divides the annual interest rate by 12 to calculate the monthly interest rate. Ensure the cell references are absolute (using dollar signs) so that when you copy the formula down the column, it references the correct cells.

In the Monthly Payment column, input the PMT formula:

=PMT(Monthly Interest Rate, Loan Term, -Loan Amount)

Make sure to use the appropriate cell references in the formula. The negative sign before the Loan Amount is essential to indicate cash outflow (payment) rather than cash inflow (deposit).

Once entered, Excel will automatically calculate the monthly payment based on the provided loan amount, loan term, and interest rate.

Incorporating Adjustable Interest Rates

If you want to incorporate adjustable interest rates, you can replace the fixed interest rate in the Annual Interest Rate column with a cell reference that contains the adjustable rate. This will allow you to easily update the interest rate and see the corresponding monthly payment.

Simply input the cell reference, such as =C2, where C2 is the cell containing the adjustable interest rate. When the interest rate changes, update the value in the referenced cell, and Excel will automatically recalculate the monthly payment.

By following these steps, you can create an adjustable rate mortgage calculator in Excel that enables you to calculate monthly payments based on changing interest rates. This spreadsheet can be a valuable tool for homeowners and prospective buyers alike.

Credit: www.youtube.com

Customizing Excel For Mortgage Analysis

Customizing Excel for Mortgage Analysis is an essential step in accurately calculating adjustable rate mortgages. By formatting and organizing data effectively, creating visually appealing charts and graphs, you can easily analyze mortgage trends. In this section, we will explore how to customize Excel for mortgage analysis using the following headings:

Formatting And Organizing Data Effectively

When it comes to mortgage analysis, it’s crucial to have well-formatted and organized data in Excel. By following these simple steps, you can ensure that your data is easily accessible and comprehensible:

- Start by creating designated columns for each relevant piece of information such as interest rate, loan term, payment frequency, and loan amount.

- Format the cells appropriately by applying the desired number format to each column. For example, use the percentage format for interest rates and the currency format for loan amounts.

- Use formulas to automatically calculate values based on the given inputs. For instance, the PMT function can calculate the monthly payment amount.

- To make your data more visually appealing and easier to navigate, consider using conditional formatting. Apply different colors to highlight specific values or create data bars to represent the magnitude of each data point.

- Filter and sort your data to focus on specific criteria or identify patterns easily. Excel offers various filtering and sorting options that can streamline your analysis process.

Creating Charts And Graphs To Visualize Mortgage Trends

Visual representations of mortgage data can significantly enhance your analysis and make it easier to identify trends and patterns. Here’s how you can create charts and graphs in Excel:

- Select the data range you want to include in the chart.

- Go to the “Insert” tab and choose the chart type that best suits your needs, such as a line chart, bar chart, or scatter plot.

- Customize the chart elements, such as titles, axes, and legends, to ensure clarity and understanding.

- Use formatting options to enhance the visual appeal of your chart, such as adjusting colors, font sizes, and applying chart styles.

- Consider adding trendlines or secondary axes to illustrate additional insights.

By following these steps and customizing Excel for mortgage analysis, you can efficiently calculate and analyze adjustable rate mortgages. Formatting and organizing data effectively and creating visually appealing charts and graphs are vital elements of this process. Now that you have a solid foundation, you can dive deeper into mortgage analysis using Excel.

Frequently Asked Questions For How To Calculate Adjustable Rate Mortgage In Excel

How Do You Calculate An Adjustable Rate Mortgage?

To calculate an adjustable rate mortgage (ARM), take the initial interest rate and add the index rate. This combined rate will determine the interest you’ll pay. Keep in mind that the index rate can fluctuate over time, impacting your monthly mortgage payment.

ARMs are generally recalculated annually.

How Do I Calculate Mortgage Rate In Excel?

To calculate mortgage rates in Excel, use the PMT function. Enter the loan amount, interest rate, and loan term to calculate the monthly payment. The formula is “=PMT(rate, nper, pv)”. Replace “rate” with the annual interest rate, “nper” with the number of months, and “pv” with the loan amount.

Does Excel Have A Mortgage Calculator Function?

Yes, Excel has a mortgage calculator function. It can help you calculate your monthly mortgage payments based on variables such as loan amount, interest rate, and loan term.

What Is The Formula For The Mortgage Spreadsheet?

The formula for the mortgage spreadsheet calculates the monthly payment based on the loan amount, interest rate, and loan term. It helps determine how much you need to pay each month to repay your mortgage.

Conclusion

After following these simple steps, you can easily calculate adjustable rate mortgage in Excel. By understanding the formulas and functions involved, you can effectively analyze your mortgage payments and plan for your financial future. Remember to regularly update your Excel spreadsheet with adjusted interest rates to stay on top of any changes in your mortgage payments.

With this newfound knowledge, you can confidently navigate the world of adjustable rate mortgages and make informed decisions. Happy calculating!