How Much Money Can You Borrow in Federal Student Loans? Find Out Now!

You can borrow a maximum amount determined by the federal government in federal student loans. Federal student loans have set limits on how much money you can borrow.

These loans are designed to help students cover the cost of education and have specific loan limits depending on factors such as your year in school and dependency status. The maximum loan amount also varies between undergraduate and graduate students.

It is important to understand and plan for these limits when considering federal student loans as a source of funding for your education.

Credit: www.edvisors.com

Federal Student Loans

Federal student loans offer students the opportunity to borrow up to a certain amount based on their academic year and dependency status. The maximum yearly loan amount varies depending on factors such as the student’s grade level and status.

One of the most popular ways for students to fund their higher education is through federal student loans. These loans are offered by the U.S. Department of Education and come with certain advantages such as fixed interest rates, flexible repayment options, and the possibility of loan forgiveness.Loan Limits

When it comes to borrowing money through federal student loans, there are limits in place to ensure that students do not take on excessive debt. The loan limits vary depending on the type of federal loan and whether the student is considered a dependent or independent. Here are the loan limits for the different types of federal student loans: 1. Direct Subsidized Loans: These loans are available to undergraduate students with demonstrated financial need. The loan amount is determined by the student’s school and cannot exceed a specific annual limit. The maximum loan limits for dependent undergraduate students range from $5,500 for first-year students to $7,500 for third-year and beyond. Independent undergraduate students have higher annual loan limits, ranging from $9,500 for first-year students to $12,500 for third-year and beyond. 2. Direct Unsubsidized Loans: These loans are available to undergraduate and graduate students regardless of financial need. The annual loan limits for dependent undergraduate students are the same as those for Direct Subsidized Loans. However, independent undergraduate students have higher annual loan limits, ranging from $9,500 to $12,500. Graduate and professional students have a higher annual loan limit of $20,500. 3. Direct PLUS Loans: These loans are available to graduate or professional students, as well as to parents of dependent undergraduate students. There is no specific annual loan limit, but the borrowing amount cannot exceed the student’s cost of attendance minus any other financial aid received.Interest Rates

Interest rates for federal student loans are set each year by the U.S. Department of Education and are fixed for the life of the loan. The interest rates may vary depending on the type of loan and whether the loan is taken out by an undergraduate or graduate student. Here are the current interest rates for federal student loans: 1. Direct Subsidized Loans and Direct Unsubsidized Loans for undergraduate students: The current interest rate is 2.75%. 2. Direct Unsubsidized Loans for graduate and professional students: The current interest rate is 4.30%. 3. Direct PLUS Loans: The current interest rate is 5.30%. It is important to note that these interest rates are subject to change each year, so it is essential to check the current rates before applying for a federal student loan. In conclusion, federal student loans offer students an opportunity to finance their education with reasonable loan limits and fixed interest rates. By understanding the loan limits and interest rates, students can make informed decisions regarding their borrowing options.Determining Your Loan Amount

Determining your loan amount for federal student loans depends on various factors such as your financial need, cost of attendance, and the types of loans available. Understanding the maximum loan amount you can borrow helps you plan your education financing effectively.

Cost Of Attendance

Determining your loan amount starts with understanding the cost of attendance. The cost of attendance refers to the total amount you’ll need to cover your education expenses for the academic year. These expenses typically include tuition and fees, room and board, textbooks, transportation, and personal expenses.Other Financial Aid

In addition to the cost of attendance, you also need to consider any other financial aid you may be receiving. This could include scholarships, grants, work-study programs, or other forms of assistance. The amount of other financial aid you receive will directly impact the amount you can borrow in federal student loans. When calculating your loan amount, it’s important to subtract any other financial aid from the cost of attendance to determine the remaining amount that you’ll need to borrow. Keep in mind that it’s generally recommended to maximize any free aid options, such as scholarships and grants, before relying heavily on student loans. To determine your loan amount, you’ll need to subtract your other financial aid from the cost of attendance. The remaining amount is typically the maximum you can borrow in federal student loans. However, it’s important to note that there are annual and aggregate loan limits set by the federal government. For dependent undergraduate students, the annual loan limits are as follows: – $5,500 for first-year students – $6,500 for second-year students – $7,500 for third-year and beyond students The total aggregate loan limit for dependent undergraduate students is $31,000. Graduate students have higher limits, with an annual limit of $20,500 and an aggregate limit of $138,500, including undergraduate loans. It’s crucial to understand and consider these limits when determining your loan amount. Borrowing responsibly and only taking out what you need can help prevent excessive student loan debt in the future. In conclusion, determining your loan amount involves considering the cost of attendance and any other financial aid you may receive. Subtracting your other financial aid from the cost of attendance will give you a better idea of how much you can borrow in federal student loans. But remember, always borrow responsibly and keep in mind the loan limits set by the federal government.Repayment Options

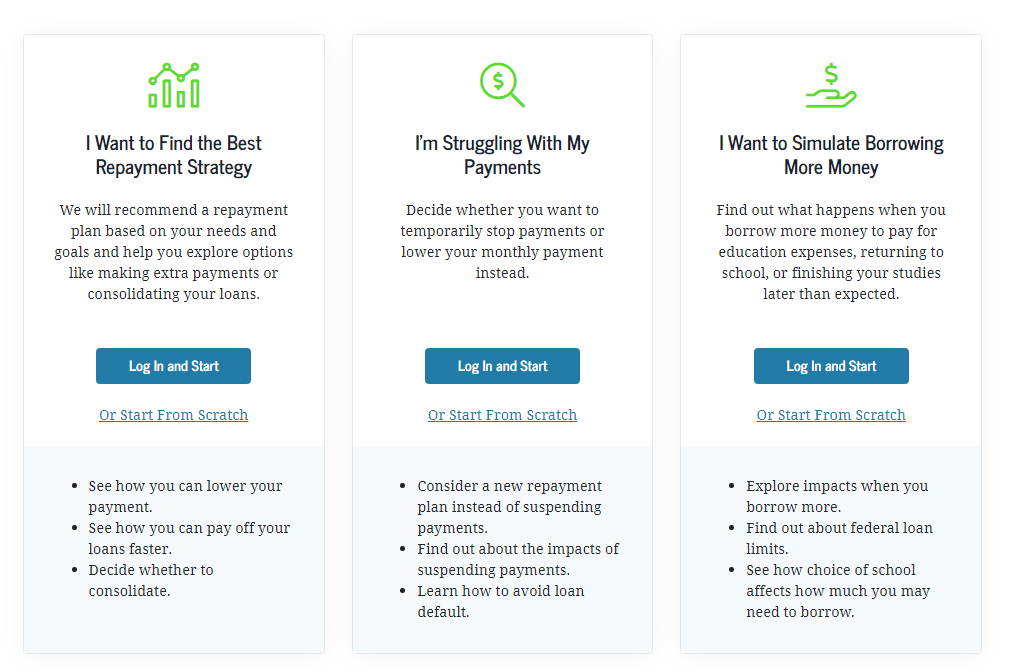

When it comes to repaying federal student loans, borrowers have several repayment options to choose from. Understanding these options is crucial for managing debt effectively and making informed decisions about the best approach for individual financial circumstances.

Standard Repayment Plan

Under the standard repayment plan, borrowers make fixed monthly payments over a period of 10 years. This plan is the default option for federal student loans and typically results in the lowest overall interest paid over the life of the loan.

Income-driven Repayment Plans

Income-driven repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), determine monthly payments based on a borrower’s income and family size. These plans offer flexibility for those facing financial challenges and may lead to loan forgiveness after 20 or 25 years of qualifying payments.

Credit: studentaid.gov

Loan Forgiveness Programs

When it comes to repaying student loans, one option that can provide significant financial relief is loan forgiveness programs. These programs offer borrowers the opportunity to have a portion or all of their federal student loans forgiven, meaning they are no longer responsible for repaying that debt. Two such loan forgiveness programs are the Public Service Loan Forgiveness and the Teacher Loan Forgiveness programs.

Public Service Loan Forgiveness

Under the Public Service Loan Forgiveness (PSLF) program, individuals who work full-time in a qualifying public service job can have their remaining loan balance forgiven after making 120 qualifying payments. This program is specifically designed for those working in government, non-profit organizations, and other public service sectors.

To be eligible for PSLF, borrowers must have made 120 monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. It’s important to note that only direct loans, such as Federal Direct Stafford Loans and Federal Direct PLUS Loans, are eligible for forgiveness under the PSLF program.

Furthermore, borrowers must be enrolled in a qualifying repayment plan, such as the income-driven repayment plans, which can make repayment more manageable based on their income and family size. It’s recommended that borrowers submit an annual Employment Certification Form to track their progress toward loan forgiveness under the PSLF program.

Teacher Loan Forgiveness

The Teacher Loan Forgiveness program is aimed specifically at teachers who work in low-income schools or educational service agencies. Under this program, eligible teachers can have a portion of their federal student loans forgiven after completing five consecutive years of teaching full-time in a qualifying school or agency.

To qualify for Teacher Loan Forgiveness, borrowers must have taken out their loan prior to the end of their five-year teaching period. Additionally, they should not have had an outstanding balance on their student loan as of October 1, 1998.

The amount of loan forgiveness available under the Teacher Loan Forgiveness program varies based on the subject area taught and the qualifications of the teacher. For highly qualified mathematics or science teachers, the maximum loan forgiveness amount is $17,500. For other qualified teachers, the maximum amount is set at $5,000.

It’s important for borrowers to keep in mind that these loan forgiveness programs are only available for federal student loans. Private loans do not typically offer forgiveness options. If you’re unsure about the type of loan you have, you can check with your loan servicer or refer to your loan documents.

Tips For Managing Student Loan Debt

Looking for tips to manage student loan debt? Find out how much money you can borrow in federal student loans and take control of your finances with these helpful strategies.

Budgeting

One of the most effective ways to manage your student loan debt is to create a budget. With a budget in place, you’ll have a clear picture of your income and expenses, allowing you to make informed financial decisions.

Here are a few steps to help you create a budget:

- Start by calculating your monthly income. Include any wages, scholarships, or grants you receive.

- List all of your monthly expenses, such as rent, utilities, groceries, transportation, and entertainment.

- Subtract your total expenses from your income to determine your disposable income.

- Allocate a portion of your disposable income towards your student loan payments. Consider setting aside a little extra each month.

- Track your spending and adjust your budget as needed.

Extra Payments

If your financial situation allows, consider making extra payments towards your student loans. By paying more than your minimum monthly payment, you can accelerate your debt repayment and potentially save on interest charges.

Here are some strategies to help you manage extra payments:

- Review your budget to identify areas where you can cut back on expenses and allocate those savings towards your additional loan payments.

- Consider using windfall money, such as tax refunds or work bonuses, to make larger lump sum payments.

- Contact your loan servicer to ensure that any extra payments you make are applied towards the principal balance of your loan.

- Set up automatic payments to avoid missing any extra payment opportunities.

Credit: www.cbsnews.com

Frequently Asked Questions Of How Much Money Can | Borrow In Federal Student Loans?

How Much Money Can I Borrow In Federal Student Loans?

You can borrow up to $12,500 a year in federal student loans for undergraduate study, depending on your year in school and dependency status. The total amount you can borrow for your entire undergraduate education is typically $57,500. Graduate and professional students have higher borrowing limits.

Can I Borrow More Than The Maximum Amount In Federal Student Loans?

If you need to borrow more money for your education, you may consider seeking additional options like private student loans, scholarships, grants, or work-study programs. It’s important to weigh the pros and cons of each option and make an informed decision based on your personal financial situation and goals.

How Do I Apply For Federal Student Loans?

To apply for federal student loans, you must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online and requires information about your family’s financial situation. Once you submit the FAFSA, the information is used to determine your eligibility for various forms of financial aid, including federal student loans.

Conclusion

Federal student loans offer various options for borrowing money for education. Understanding the borrowing limits and available programs is crucial for making informed decisions. By evaluating your financial needs and considering the maximum loan amounts, you can effectively manage your college expenses and pursue your academic goals without financial stress.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “How much money can I borrow in federal student loans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You can borrow up to $12,500 a year in federal student loans for undergraduate study, depending on your year in school and dependency status. The total amount you can borrow for your entire undergraduate education is typically $57,500. Graduate and professional students have higher borrowing limits.” } } , { “@type”: “Question”, “name”: “Can I borrow more than the maximum amount in federal student loans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “If you need to borrow more money for your education, you may consider seeking additional options like private student loans, scholarships, grants, or work-study programs. It’s important to weigh the pros and cons of each option and make an informed decision based on your personal financial situation and goals.” } } , { “@type”: “Question”, “name”: “How do I apply for federal student loans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To apply for federal student loans, you must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online and requires information about your family’s financial situation. Once you submit the FAFSA, the information is used to determine your eligibility for various forms of financial aid, including federal student loans.” } } ] }